How to manage currency risk

advertisement

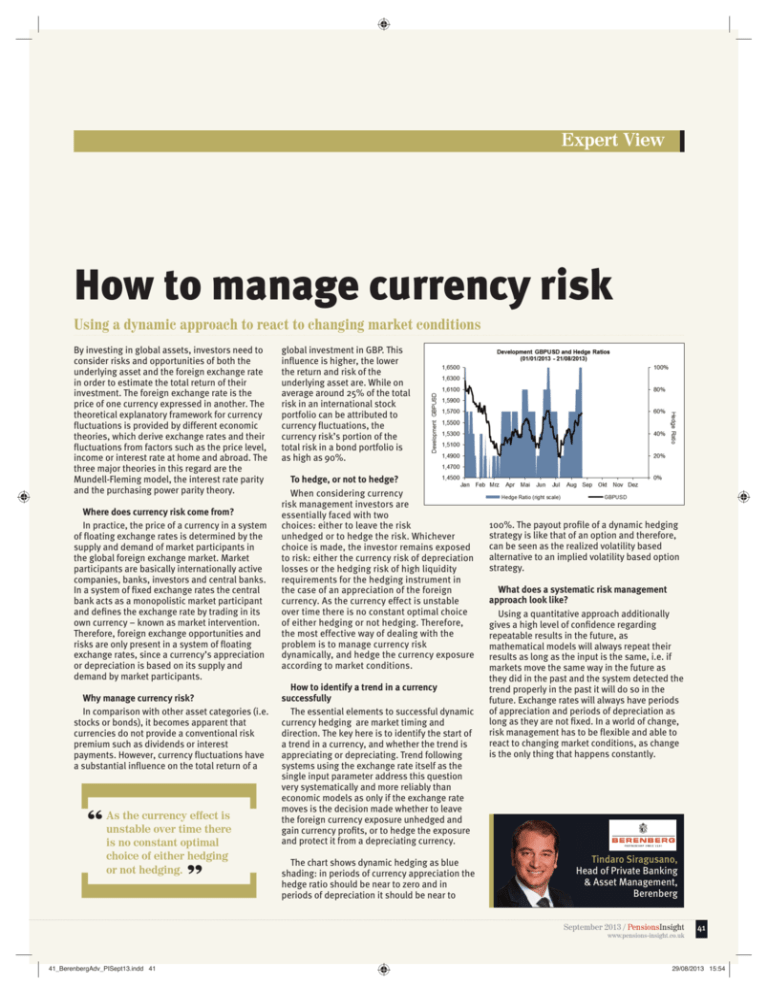

Expert View How to manage currency risk Using a dynamic approach to react to changing market conditions By investing in global assets, investors need to consider risks and opportunities of both the underlying asset and the foreign exchange rate in order to estimate the total return of their investment. The foreign exchange rate is the price of one currency expressed in another. The theoretical explanatory framework for currency fluctuations is provided by different economic theories, which derive exchange rates and their fluctuations from factors such as the price level, income or interest rate at home and abroad. The three major theories in this regard are the Mundell-Fleming model, the interest rate parity and the purchasing power parity theory. Where does currency risk come from? In practice, the price of a currency in a system of floating exchange rates is determined by the supply and demand of market participants in the global foreign exchange market. Market participants are basically internationally active companies, banks, investors and central banks. In a system of fixed exchange rates the central bank acts as a monopolistic market participant and defines the exchange rate by trading in its own currency – known as market intervention. Therefore, foreign exchange opportunities and risks are only present in a system of floating exchange rates, since a currency’s appreciation or depreciation is based on its supply and demand by market participants. Why manage currency risk? In comparison with other asset categories (i.e. stocks or bonds), it becomes apparent that currencies do not provide a conventional risk premium such as dividends or interest payments. However, currency fluctuations have a substantial influence on the total return of a [] the currency effect is “ As unstable over time there is no constant optimal choice of either hedging or not hedging. ” global investment in GBP. This influence is higher, the lower the return and risk of the underlying asset are. While on average around 25% of the total risk in an international stock portfolio can be attributed to currency fluctuations, the currency risk’s portion of the total risk in a bond portfolio is as high as 90%. To hedge, or not to hedge? When considering currency risk management investors are essentially faced with two choices: either to leave the risk unhedged or to hedge the risk. Whichever choice is made, the investor remains exposed to risk: either the currency risk of depreciation losses or the hedging risk of high liquidity requirements for the hedging instrument in the case of an appreciation of the foreign currency. As the currency effect is unstable over time there is no constant optimal choice of either hedging or not hedging. Therefore, the most effective way of dealing with the problem is to manage currency risk dynamically, and hedge the currency exposure according to market conditions. How to identify a trend in a currency successfully The essential elements to successful dynamic currency hedging are market timing and direction. The key here is to identify the start of a trend in a currency, and whether the trend is appreciating or depreciating. Trend following systems using the exchange rate itself as the single input parameter address this question very systematically and more reliably than economic models as only if the exchange rate moves is the decision made whether to leave the foreign currency exposure unhedged and gain currency profits, or to hedge the exposure and protect it from a depreciating currency. The chart shows dynamic hedging as blue shading: in periods of currency appreciation the hedge ratio should be near to zero and in periods of depreciation it should be near to 100%. The payout profile of a dynamic hedging strategy is like that of an option and therefore, can be seen as the realized volatility based alternative to an implied volatility based option strategy. Expert View What does a systematic risk management approach look like? Using a quantitative approach additionally gives a high level of confidence regarding repeatable results in the future, as mathematical models will always repeat their results as long as the input is the same, i.e. if markets move the same way in the future as they did in the past and the system detected the trend properly in the past it will do so in the future. Exchange rates will always have periods of appreciation and periods of depreciation as long as they are not fixed. In a world of change, risk management has to be flexible and able to react to changing market conditions, as change is the only thing that happens constantly. Tindaro Siragusano, Head of Private Banking & Asset Management, Berenberg September 2013 / PensionsInsight 41 www.pensions-insight.co.uk 41_BerenbergAdv_PISept13.indd 41 29/08/2013 15:54