Economic Incentives and Wildlife Conservation

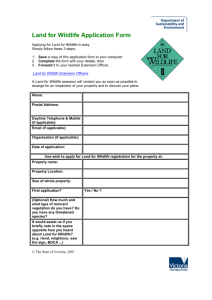

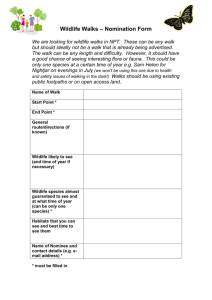

advertisement