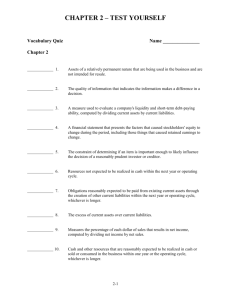

Fair Value as the Measurement

advertisement