Krzys’ Ostaszewski, http://math.illinoisstate.edu/krzysio/krzys.html

http://smartURL.it/krzysioFM (paper) or http://smartURL.it/krzysioFMe (electronic)

Instructor for online seminar for exam FM: http://smartURL.it/onlineactuary

If you find these exercises valuable, please consider buying the manual or attending our

seminar, and if you can’t, please consider making a donation to the Actuarial Program at

Illinois State University: http://smartURL.it/ISUactuarydonate. Donations will be used

for scholarships for actuarial students. Donations are tax-deductible to the extent allowed

by law. Questions about these exercises or the FM Manual written by Dr. Ostaszewski?

E-mail: krzysio@krzysio.net

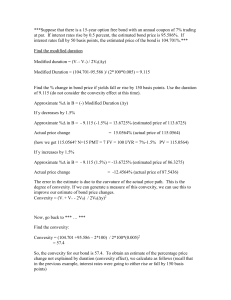

Spring 2000 SOA Course 6 Examination, Multiple Choice, Problem No. 3, also Dr.

Ostaszewski’s online exercise No. 4 posted June 11, 2005

You are given the following with respect to a bond with semi-annual coupon payments

priced to yield 8% nominal annual compounded semi-annually:

Semi-Annual

Payment

Present Value of

Period (t)

Payment at Yield

1

3.00

2.89

2

3.00

2.78

3

3.00

2.67

4

3.00

2.57

5

3.00

2.47

6

103.00

81.76

(2)

Calculate the convexity of the bond with respect to i , the nominal annual interest rate

compounded semiannually.

A. 1.29

B. 1.58

C. 8.78

D. 9.50

E. 17.56

Solution.

The actual exam question just asked for the convexity. But this author finds the approach

of the problem and its solution problematic, although valuable for learning. Let us study

this exam question a bit. It is unclear from the wording of the problem whether the yield

of 8% is the effective annual interest rate or the nominal annual interest rate compounded

semiannual interest rate (which is suggested by the semi-annual bond coupons). Let us

examine the effective annual interest rate implied by the present values of cash flows

given (note that we count time in years):

0.50

3

⎛ 3.00 ⎞

− 1 ≈ 7.76%. But also note that

• For cash flow at time 0.5, i = ⎜

≈ 2.89,

⎟

⎝ 2.89 ⎠

1.08 0.50

so that the discrepancy between 7.76% and 8.00% can be due to rounding error.

3

3.00

• For cash flow at time 1, i =

− 1 ≈ 7.91%. But also note that

≈ 2.78, so that the

1.08

2.78

discrepancy between 7.91% and 8.00% can be due to rounding error.

2

3

⎛ 3.00 ⎞ 3

− 1 ≈ 8.08%. But also note that

• For cash flow at time 1.5, i = ⎜

≈ 2.67, so

⎟

⎝ 2.67 ⎠

1.081.5

that the discrepancy between 8.08% and 8.00% can be due to rounding error.

1

3

⎛ 3.00 ⎞ 2

− 1 ≈ 8.04%. But also note that

• For cash flow at time 2, i = ⎜

≈ 2.57, so

⎟

⎝ 2.57 ⎠

1.08 2

that the discrepancy between 8.04% and 8.00% can be due to rounding error.

2

3

⎛ 3.00 ⎞ 5

− 1 ≈ 8.09%. But also note that

• For cash flow at time 2.5, i = ⎜

≈ 2.47, so

⎟

⎝ 2.47 ⎠

1.08 2.5

that the discrepancy between 8.09% and 8.00% can be due to rounding error.

1

⎛ 103.00 ⎞ 3

− 1 ≈ 8.00%. This one gives us exactly the yield.

• For cash flow at time 2, i = ⎜

⎝ 81.76 ⎟⎠

Given this, we will proceed under the assumption that 8% is the effective annual interest

rate. Note first that the sum of present values is 95.14. The convexity with respect to the

force of interest is:

2.89

2.78

2.67

2.57

2.47

81.76

0.5 2 ⋅

+ 12 ⋅

+ 1.5 2 ⋅

+ 22 ⋅

+ 2.5 2 ⋅

+ 32 ⋅

≈

95.14

95.14

95.14

95.14

95.14

95.14

≈ 8.10455644.

This is closest to answer C. But the original question asked for convexity. The Macaulay

duration is

2.89

2.78

2.67

2.57

2.47

81.76

0.5 ⋅

+ 1⋅

+ 1.5 ⋅

+ 2⋅

+ 2.5 ⋅

+ 3⋅

≈

95.14

95.14

95.14

95.14

95.14

95.14

≈ 2.78352954.

Convexity with respect to the interest rate i is:

1

1

C=

⋅D ≈

2 ⋅C M +

(1+ i )

(1+ i )2 M

1

1

⋅ 8.10455644 +

⋅ 2.78352954 ≈ 9.33477879.

2

1.08

1.08 2

This is closest to answer D. This is, of course, very confusing. The solution published by

the SOA did the following. It treated fractional times as whole numbers, i.e., counted

time in half years, and used the basic formula for convexity for fixed cash flows

1

C=

∑ w ⋅t (t + 1),

(1+ i )2 t≥0 t

as well as 4% as the effective semi-annual interest rate, so that it calculated convexity in

half-years squared as

1⋅ 2 2.89

2 ⋅ 3 2.78

3⋅ 4 2.67

4 ⋅ 5 2.57

⋅

+

⋅

+

⋅

+

⋅

+

2

2

2

1.04 95.14 1.04 95.14 1.04 95.14 1.04 2 95.14

5 ⋅ 6 2.47

6 ⋅ 7 81.76

+

⋅

+

⋅

≈ 35.1195311.

2

1.04 95.14 1.04 2 95.14

35.1195311

The convexity measure in years squared is therefore

≈ 8.77988278. Division

4

by four is caused by the fact that there are four half-years squared in one year squared.

Or, you can simply observe that the calculation produces convexity with respect to

≈

j=

i(2)

d 2P

1 d 2P

, assuming j = 4%, and that

=

. This gives answer C. There is a

2

2

4 dj 2

d i(2)

( )

problem with this approach. First, the convexity so calculated is with respect to the

nominal annual interest rate i ( 2 ) , and it is not the regular convexity calculated with

respect to the annual effective interest rate i. Moreover, the semiannual effective interest

3.00

rate implied by the cash flow at time 0.5 years is

− 1 ≈ 3.81%, not 4%. Also,

2.89

3

≈ 2.88 ≠ 2.89, so that the discrepancy cannot be explained by rounding error. The

1.04

1

⎛ 103.00 ⎞ 6

− 1 ≈ 3.92%, and

semiannual rate implied by the cash flow at time 3 years is ⎜

⎝ 81.76 ⎟⎠

103.00

≈ 81.40 ≠ 81.76. The values given in the problem are inconsistent with the

1.04 6

interest rate used in the published SOA solution. Let us ask ourselves one more question:

what is the value of convexity with respect to i ( 2 ) ? Convexity with respect to nominal

annual interest rate i ( m ) is

1

1

1

C (m) =

DM .

2 CM +

2

⎛

⎛

i(m) ⎞

i(m) ⎞ m

⎜⎝ 1 + m ⎟⎠

⎜⎝ 1 + m ⎟⎠

Therefore,

C (2) =

1

⎛

i(2) ⎞

1

+

⎜⎝

2 ⎟⎠

2

⋅ CM +

1

1

⋅ ⋅ DM =

⎛

i(2) ⎞ 2

1

+

⎜⎝

2 ⎟⎠

2

1

1 1

⋅ 8.10455644 +

⋅ ⋅ 2.78352954 ≈ 8.79289001.

1.08

1.08 2

This is closest to answer C.

Answer C.

=

© Copyright 2005 by Krzysztof Ostaszewski.

All rights reserved. Reproduction in whole or in part without express written

permission from the author is strictly prohibited. Past Society of Actuaries

examinations are intellectual property of the Society of Actuaries and are used here

with permission.