CHAPTER 4

advertisement

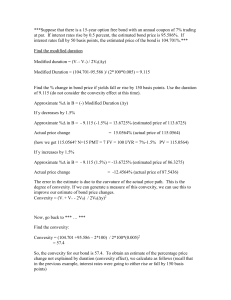

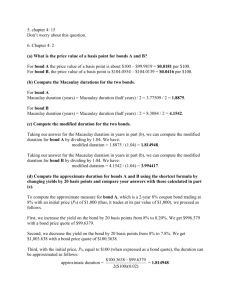

4. Answer the following questions for bonds A and B. Coupon Yield to maturity Maturity (years) Par Price Bond A 8% 8% 2 $1000.00 $1000.00 Bond B 9% 8% 5 $1000.00 $1040.55 (a) Calculate the actual price of the bonds for a 100-basis-point increase in interest rates. To price the bonds, recognize we have 8% yields. If we increase the bond yields by 100 basis points, then the new yield is 9%. At a YTM of 9% the prices of bonds A and B are: 1 1 1 + r n P=C r 1 1 1 .045 4 PA = $40 0.045 1 1 1 .045 10 PB = 45 0.045 M + 1 r n $1,000 + = $982.062 4 (1.045) $1, 000 + = $1,000.00 10 (1.045) (b) Using duration, estimate the price of the bonds for a 100-basis-point increase in interest rates. The first step is to compute modified duration: MD = MDA = 40 0.042 C y2 1 nM C / y 1 n n 1 1 y 1 y P 1 4 1000 40 / 0.04 1 1.04 4 1.04 5 3.6299 1000 $45 1 1 10 2 0.04 (1.04) MDB = 10 $1000 $45 / 0.04 (1.04 )11 = 7.9888 $1040.55 56 These are both modified durations based on semiannual cash flows. To “annualize” them we divide each by 2: Modified duration for Bond A is 1.8149. Modified duration for Bond B is 3.9944. Now we estimate the percentage price change of bonds A and B assuming a 100 bp yield increase (i.e., dy = 0.01). For bond A, we get: For bond B: dP = –modified duration (dy) = –1.8149(0.01) = –0.018149. P dP = –modified duration (dy) = –3.9944(0.01) = –0.039944 P This means that duration estimates that bonds A and B will decline by 1.8149% and 3.9944%, respectively, when interest rates increase by 100 bps. Therefore, the new bond price predicted by duration is: Bond A: 1000(1 – 0.018149) = $981.851. Bond B: 1040.55(1 – 0.039944) = $998.986. (c) Using both duration and convexity measure, estimate the price of the bonds for a 100basis-point increase in interest rates. Now we need to calculate convexity for bonds A and B. We have: convexity measure (half years) = 2 d P 1 = 2 dy P 2C n(n 1) M C / y 1 1 2Cn 3 1 . n n 1 n2 y 1 y y 2 1 y P 1 y For Bonds A and B, we get: 2(40) 4(5) 1000 $40 / 0.04 1 1 2(40)4 1 CMA = = 17.1093 3 4 5 6 (0.04) 1.04 (0.04) 2 1.04 1000 1.04 2(45) 10(11) 1000 $45 / 0.04 1 1 2(45)10 1 CMB = = 79.0547 3 10 11 12 (0.04) 1.04 (0.04) 2 1.04 1040.55 1.04 57 To “annualize” these convexity measures, we divide by 4: Convexity measure for Bond A is 4.2773. Convexity measure for Bond B is 19.7637. Now we estimate the percentage price change using both modified duration and convexity, assuming a 100 bp yield increase (i.e., dy = 0.01). dP 1 = –modified duration(dy) + convexity measure(dy)2 P 2 For bond A: dP 1 = –1.8149(0.01) + (4.2773)(0.01)2 = –0.01794 P 2 For bond B: dP 1 = –3.9944(0.01) + (19.7637)(0.01)2 = –0.03896 P 2 This means that duration and convexity together predict that bonds A and B will decline by 1.794% and 3.896%, respectively, when interest rates increase by 100 bps. Therefore, the new bond prices estimated are: Bond A: 1000(1 – 0.01794) = $982.064. Bond B: 1040.55(1 – 0.03896) = $1000.014. (d) Comment on the accuracy of your results in parts b and c, and state why one approximation is closer to the actual price than the other. The following table summarizes the results: Actual new price Price predicted by duration Price predicted by duration and convexity Bond A Bond B 982.063 1,000.00 981.851 998.986 982.062 1,000.014 It is clear that the new price estimated by duration and convexity together is closer to the actual new price estimated by duration alone. This occurs because duration is based on a linear approximation of a relationship that is inherently convex. Thus, providing an adjustment” for convexity improves the estimate. However, even with the convexity adjustment, the new price is still an estimate. We can see this when we look at the Taylor Series expansion of the percentage price change in a bond as a function of changes in y: 58 dP dP 1 1 d 2P error 2 . dy dy 2 P dy P 2 dy P The first term on the RHS of the above equation is modified duration and the second term is the convexity measure. Notice the third term. It contains higher order derivatives (order 3). The number of derivatives in this term is infinite (although each diminishes in importance). The more terms on the RHS we include in our estimate of bond price changes, the better our estimate will be. Since we use only the first two terms means our result will not be exact. 59