Esame di Microeconomia avanzata (16 aprile 2004)

advertisement

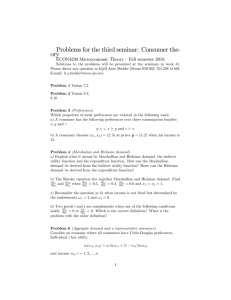

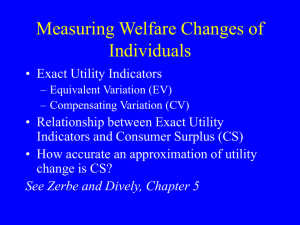

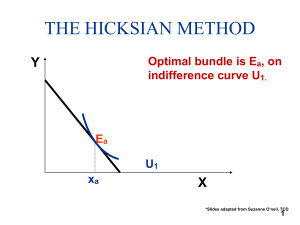

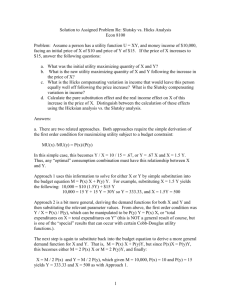

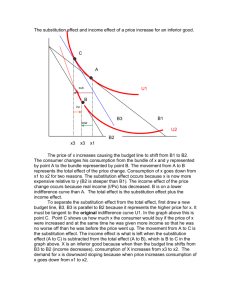

Advanced Microeconomics I Examination Set (June 12th, 2009) (Paolo Bertoletti) Time: 75 minutes. I. The conditional input demand function is totally analogous to the Hicksian compensated demand. Yet, if the price of an input changes, a profit maximizer will react by changing is “optimal” technique and the level of output she produces in such a way that no “Giffen” input exists in production theory. Discuss. Show that the “output effect” which corresponds to the change in the supply function will always have the same sign that the “substitution effect” (hint: use x(p,w) = ~ x (w,y(p,w))). II. Discuss briefly the convexity of the profit function, providing an economic intuition for it. III. A consumer has a direct utility function of the form U(x1,x2) = lnx1 + x2: assume that consumption choice is interior. Derive the system of Marshallian and Hicksian demands. Advanced Microeconomics I - Examination Set (June 12th, 2009) - SOLUTIONS (Paolo Bertoletti) I) The conditional input demand function is totally analogous to the Hicksian compensated demand. Yet, if the price of an input changes, a profit maximizer will react by changing is “optimal” technique and the level of output she produces in such a way that no “Giffen” input exists in production theory. Discuss. Show that the “output effect” which corresponds to the change in the supply function will always have the same sign that the “substitution effect” (hint: use x(p,w) = ~ x (w,y(p,w))) It must be that x(p,w) = ~ x (w,y(p,w)) holds as an identity: by differentiation one then gets: xi ~ x ~ x y i i , wi wi y wi where the right-hand-side can be interpreted as the addition of a “substitution” and an “output effect”. By Shephard’s lemma, ~ x i/y = cy/wi, where cy is marginal cost. Now consider the FOC for profit maximization, p = cy(w,y): it implies that y/wi = -(cy/wi)/(cy/y) (SOC implies that cy/y > 0). Indeed, then: c y 2 ) ~ xi y wi 0. c y y wi y ( Thus the “output effect” will always be “negative” as the substitution effect, since both for an inferior input and a normal input an increase in its price will reduce its use (either by increasing or decreasing respectively the level of output). In other words, an input is inferior ( ~ x i/y < 0) if and only if is regressive (y/ wi > 0). III) Discuss briefly the convexity of the profit function, providing an economic intuition for it. Convexity follows directly from profit maximization. An economic intuition comes from the fact that the profit expression is linear wrt the prices. Thus, if the producer were not to adjust her choice after a price change, then her “passive” profit would change linearly, while clearly she will be in generally able to do better than that by using a profit maximizing behavior. IV) A consumer has a direct utility function of the form U(x1,x2) = lnx1 + x2: assume that consumption choice is interior. Derive the system of Marshallian and Hicksian demands. The MRS is given by 1/x1. Notice that the MRS does not depend on the amount of x2: thus the indifferences curves are “vertically” parallel, and their distance is constant, since they are given by equations alike x2 = u - lnx1. By using MRS = - p1/p2 and the budget constraint one gets easily the Marshallian demand system x1(p,m) = p2/p1 and x2(p,m) = m/p2 – 1, and then the indirect utility function v(p,m)= ln(p2/p1) + m/p2 – 1. By inverting v(p,m) wrt m one derive the expenditure function e(p,u) = p2(u + 1) - p2ln(p2/p1) and eventually, by using Shephard’s lemma, the Hicksian demand system h1(p,u) = p2/p1 and h2(p,u) = u - ln(p2/p1) (notice that x1(p,m) = h1(p,u)).