Personnel Committee Meeting

advertisement

CAL POLY POMONA FOUNDATION, INC.

CALIFORNIA STATE POLYTECHNIC UNIVERSITY, POMONA

PERSONNEL COMMITTEE

Thursday, May 07, 2015

1:00 pm – 2:00 pm

Building #55 – Executive Conference Room

AGENDA

PAGE

CONSENSUS ACTION ITEMS

Consensus Action Items: Items in this section are considered to be routine and acted on by the

committee in one motion. Each item of the Consent agenda approved by the committee shall be

deemed to have been considered in full and adopted as recommended. Any committee member may

request that a consent item be removed from the consent agenda to be considered as a separate

action item. If no additional information is requested, the approval vote will be taken without

discussion.

1.

Minutes February 3, 2015 Meeting

ACTION: Approval

Steven Garcia

1-2

ACTION ITEMS

2.

2015-16 Compensation and Benefits Budget

ACTION: Approval

Dennis Miller

3-7

3.

457 Plan Employee Contributions

ACTION: Approval

Dennis Miller

8 - 13

4.

Foundation Employee Handbook Update

ACTION: Approval

Dennis Miller

14

DISUCSSION ITEMS

None Presented

INFORMATION ITEMS

5.

2015-16 Budget Resolution

G. Paul Storey

15

6.

Foundation Summer 4/10 Schedule Update

Dennis Miller

16

7.

Executive Director’s Report

G. Paul Storey

CAL POLY POMONA FOUNDATION, INC.

PERSONNEL COMMITTEE MEETING MINUTES

Tuesday, February 3, 2015

Present:

Mahyar Amouzegar, Susie Diaz, Winny Dong, Steven Garcia, Devon Graves, Rosie Pasos, James Priest,

and Sharon Reiter

Absent:

Samir Anz and Mei Lien Chang

Visitors:

Anne McLoughlin, Dennis Miller, Debra Poe, David Prenovost and Paul Storey

CALL TO ORDER

The meeting was called to order at 2:30pm by Personnel Committee Chair, Steven Garcia.

CONSENSUS ACTION ITEMS

Approval of Minutes

1.

November 11, 2014 Meeting Minutes

Steven Garcia stated the minutes were approved by consent.

ACTION ITEMS

2.

Comparability Study for Pay, Benefits, and Working Conditions

The Foundation as an Auxiliary of the CSU has an obligation to provide wages and salaries for positions that are

competitive with comparable jobs in other educational institutions or in commercial operations of like nature. The

Foundation maintains a comparability analysis which is required to be conducted at least every 5 years with the

last analysis in May 2010.

Dennis Miller presented the comparison analysis and stated the outcome confirms Foundation provides

comparable salaries and benefits for its full time employees as it relates to positions providing similar services

within the CSU.

A motion was made by Susie Diaz to accept the Foundation's Comparability Analysis and to be presented at the

next Board meeting for approval. The motion was seconded by Winny Dong and unanimously approved.

3.

Anti-Discrimination/Affirmative Action Policy and Plan

Dennis Miller presented the Foundation's Affirmative Action Plan, Policy #209 titled "Nondiscrimination and

Affirmative Action in Employment".

This plan requires the Foundation and each of its departments, offices, and operations to treat all employees

equally without regard to race, color, ancestry, religion, national origin, sex, gender, sexual preference, marital

status, pregnancy, age, mental or physical handicap, medical condition, veteran, disabled veteran or Vietnam

era veteran's status, or any other protected status as defined by current laws. The Foundation will make

positive efforts to increase the employment and advancement opportunities for women, members of minority

groups, the disabled, disabled veterans and veterans of the Vietnam era, by establishing policies and

procedures that works toward the employment of a workforce that reflects the diverse society served by the

organization. The objectives of this plan and goals for 2015 have been reviewed and updated.

A motion was made by Devon Graves to accept the reviewed and updated Affirmative Action Plan and

recommends the resolution be forwarded to the full Board of Directors for approval. The motion was seconded

by James Priest and unanimously approved.

DISCUSSION ITEMS

None Presented

1

Personnel Committee Minutes

2/3/15

Page 2

INFORMATION ITEMS

4.

CalPERS Valuation Reports for Foundation Pension Plan

Paul Storey presented the California Public Employee Retirement System reports for each of the three

Foundation pension plan tiers with the 2015-16 fiscal year employer contribution rates.

1.) Miscellaneous First Tier Plan (2% at 55) is funded at 87.4%, a positive growth of 3.1% over June 30, 2013.

The projected employer contribution rate for FY 2015-16 is 10.03%,

2.) Miscellaneous Second Tier Plan (2% at 60) is funded at 84.3%, a positive growth of 4.5% over June 30, 2013.

The projected employer contribution rate for FY 2015-16 is 6.709%,

3.) A Newly established Miscellaneous Tier (2% at 62) did not report the funded portion. The projected employer

contribution rate for FY 2015-16 is 6.237%

5.

Executive Director's Report

1.

At the last Board meeting the Foundation asked for and received approval for a VEBA trust fund withdrawal

estimated at $275,000 to cover Medicare eligible retires and spouses. Upon further review the amount is

actually $372,834.

2.

The next Board of Directors meeting is February19, 2015, 2:00pm at KW. A meet and greet lunch will take

place at 1:00 with the new president.

3.

Innovation Brew Works grand opening and ribbon cutting is February 20, 2015, 4:00 to 8:00pm.

OPEN FORUM

Meeting adjourned at 3:10.

Respectfully submitted,

°II

Steven N. Garcia, Chair

Personnel Committee

2

.',.j,

t.-

AA/

^e-

<f,-

Memorandum

€-

a

I

Cal Poly

[d

hlr Pomona

Poron

Date:

20'15

May 1.

1, 2015

To:

Personnel

Personnel Committee

Committee

Inc.

Cal Poly Pomona Foundation, Inc.

r,

.,> ,/'

From:

Dennis Mill

Millel

Employment Officer

Chief Employment

Foundation

FO

unt ali0n

l/)tllt

z-

Expenses

Related Budget

Budget Expenses

of Employment

Employment Related

Subject:

Subject: Request for Approval of

overall

associated with the overall

During the budget year there

there will be several

expenses associated

several key expenses

year.

201 5-2016 budget

budget year.

for the

the 2015-2016

expenses for

cost of labor.

theestimated

esllmatedexpenses

labor.Below

Below are

are the

Educational Reimbursement:

1. EducationalReimbursement:

1

2.

2.

857,000

$57,000

Conversion: $78.000

PARS Sick Leave Conversion:

PARS

$78,000

3.

3. Wage Adjustments:

(covering 115

115 employees)

employees)

$180,000 (covering

Pension Plan:

Plan:

4.

4. CalPERS

CaIPERS Pension

$1.040,500 (inclusive of all benefit formulas)

$1,040,500

5 VEBA Contribution:

5.

Contribution:

$1,000,000 (Actual amount)

$1,000,000

Proposed

Prooosed Action:

Committee'ss

the Personnel

Personnel Committee

WHEREAS, the

is requesting

requesting the

management is

Foundation management

the Foundation

of Director's

Director's

to

the

Board

action to approve all of the above noted expenses

forward

expenses and forward

1,2015,

for final approval,

2015, unless otherwise noted.

effective date of July 1.

approval, with an effective

reviewed the

NOW, THEREFORE, BE IT

Committee has reviewed

lT RESOLVED,

RESOLVED, the Personnel Committee

NOW,

Board of

of Directors.

Directors.

the Board

approval to

to the

recommends approval

above request and recommends

PASSED AND ADOPTED THIS

DAY OF MAY 2015.

7Ih DAY

THIS 7th

PASSED

(.Fn'

By:

)

lr^,.(.-- V

\

{,t_a<^.-/

Dr. Steven N. Garcia,

Garcia, Chair

Dr.

Personnel Committee

Personnel

Committee

CAL POLY POMONA FOUNDATION, INC.

PROPOSED BUDGET

SUMMARY STATEMENT OF ACTIVITY

REVENUE

EXPENSES

NET SURPLUS/(DEFICIT)

Revised

Budget

Current

Forecast

Proposed

Budget

Revised

Budget

Current

Forecast

Proposed

Budget

Revised

Budget

Current

Forecast

Proposed

Budget

2014-2015

2014-2015

2015-2016

2014-2015

2014-2015

2015-2016

2014-2015

2014-2015

2015-2016

4,218,404

2,807,587

1,226,246

4,421,615

3,267,192

9,139

4,528,054

3,282,739

1,181,071

5,028,874

2,404,200

78,555

5,125,917

2,878,270

89,649

5,539,943

3,570,820

96,488

(810,470)

403,387

1,147,691

(704,302)

388,922

(80,510)

(1,011,889)

(288,081)

1,084,583

8,252,237

7,697,946

8,991,864

7,511,629

8,093,836

9,207,251

740,608

(395,890)

(215,387)

Bookstore

BRONCO BOOKSTORE

9,488,000

9,828,276

9,763,780

9,202,119

9,435,839

9,446,381

285,881

392,437

317,399

Total Bookstore

9,488,000

9,828,276

9,763,780

9,202,119

9,435,839

9,446,381

285,881

392,437

317,399

Dining Services

FOUNDATION MAINTENANCE

POLY TROLLEY

FRESH ESCAPES

CARL'S JR.

PONY EXPRESS - CCMP

PONY EXPRESS - CLA

INNOVATION BREW WORKS

POLY FRESH

PONY EXPRESS - ENV

ENG COFFEE SHOP

STARBUCKS COFFEE

PANDA EXPRESS

KIKKA SUSHI

LOS OLIVOS

VISTA CAFÉ

DENNYS

VENDING

QDOBA

JAMBA JUICE

SUBWAY

ROUND TABLE

DINING ADMINISTRATION

EINSTEIN'S BAGELS

PONY EXPRESS AT CBA

FRESHENS/PURA VIDA

TACO BELL

BRONCO BUCKS CARD OFFICE

SCE LOBBY SHOP

KW - CATERING/CONF. FOODS

0

293,000

94,454

477,962

633,075

200,425

340,454

410,002

57,460

74,859

925,800

114,999

67,299

5,142,797

1,423,767

884,255

217,197

645,050

300,000

870,000

374,951

0

386,500

980,000

185,002

260,000

167,903

84,085

1,941,994

0

320,000

162,725

512,440

775,000

194,200

430,000

461,560

59,500

16,700

1,090,000

111,000

124,018

5,292,885

1,397,521

883,580

123,500

820,000

201,950

940,000

455,000

0

419,000

1,032,000

205,000

276,330

161,159

80,000

2,270,389

0

323,500

173,224

537,127

785,501

196,115

546,400

441,401

60,700

45,100

1,147,501

118,438

94,860

5,562,607

1,403,402

884,286

134,100

829,000

290,000

948,000

491,000

0

427,000

1,046,000

193,501

302,672

178,154

84,426

2,336,254

6

308,106

85,214

404,102

515,758

176,728

337,256

350,010

50,013

75,008

877,962

7,848

29,282

4,699,041

1,354,897

855,903

189,587

566,627

302,953

758,702

317,633

1,033,169

381,203

764,021

182,908

231,575

165,800

73,025

1,992,033

(1,634)

363,118

131,498

407,931

626,592

173,144

496,394

398,509

52,998

17,094

972,922

8,088

148,964

4,643,985

1,348,158

955,195

103,560

673,304

257,011

808,641

397,276

1,020,863

410,583

826,728

199,053

249,386

161,274

67,950

2,111,261

2

326,990

141,247

448,518

644,489

178,752

538,494

376,571

56,056

41,418

1,036,909

8,071

32,593

4,863,847

1,350,524

951,239

112,951

694,398

284,614

832,277

429,650

1,051,993

414,826

842,136

190,385

264,835

178,579

71,821

2,188,922

17,553,290

18,815,457

19,580,269

17,086,370

18,029,846

18,553,107

K.W. Conference Ctr. & Lodge

1,452,619

1,626,969

1,542,709

1,428,670

1,558,365

1,530,360

23,949

68,604

12,349

University Village

9,603,211

9,021,729

9,540,576

8,021,611

8,187,423

8,209,366

1,581,600

834,306

1,331,210

38,097,120

39,292,431

40,427,334

35,738,770

37,211,473

37,739,214

2,358,350

2,080,958

2,688,120

46,349,357

46,990,377

49,419,198

43,250,399

45,305,309

46,946,465

3,098,958

1,685,068

2,472,733

FISCAL YEAR

GENERAL ACTIVITIES:

ADMINISTRATION

REAL ESTATE

INVESTMENTS

TOTAL GENERAL ACTIVITIES

ENTERPRISE ACTIVITIES:

Total Dining Services

TOTAL ENTERPRISE ACTIVITIES

TOTAL GENERAL & ENTERPRISE ACTIVITIES

4

(6)

(15,106)

9,240

73,860

117,317

23,697

3,198

59,992

7,447

(149)

47,838

107,151

38,017

443,756

68,870

28,352

27,610

78,423

(2,953)

111,298

57,318

(1,033,169)

5,297

215,979

2,094

28,425

2,103

11,060

(50,039)

466,920

1,634

(43,118)

31,227

104,509

148,408

21,056

(66,394)

63,051

6,502

(394)

117,078

102,912

(24,946)

648,900

49,363

(71,615)

19,940

146,696

(55,061)

131,359

57,724

(1,020,863)

8,417

205,272

5,947

26,944

(115)

12,050

159,128

785,611

(2)

(3,490)

31,977

88,609

141,012

17,363

7,906

64,830

4,644

3,682

110,592

110,367

62,267

698,760

52,878

(66,953)

21,149

134,602

5,386

115,723

61,350

(1,051,993)

12,174

203,864

3,116

37,837

(425)

12,605

147,332

1,027,162

CAL POLY POMONA FOUNDATION, INC.

PROPOSED BUDGET

SUMMARY STATEMENT OF ACTIVITY

REVENUE

EXPENSES

NET SURPLUS/(DEFICIT)

Revised

Budget

Current

Forecast

Proposed

Budget

Revised

Budget

Current

Forecast

Proposed

Budget

Revised

Budget

Current

Forecast

Proposed

Budget

2014-2015

2014-2015

2015-2016

2014-2015

2014-2015

2015-2016

2014-2015

2014-2015

2015-2016

0

0

0

2,086,608

2,079,000

1,355,338

(2,086,608)

(2,079,000)

(1,355,338)

SURPLUS (DEFICIT) AFTER DESIGNATED GIFT 46,349,357

46,990,377

49,419,198

45,337,007

47,384,309

48,301,803

1,012,350

FISCAL YEAR

DESIGNATED GIFTS - University

(393,932)

1,117,395

SUPPLEMENTAL PROGRAMS

RESEARCH OFFICE

1,288,575

1,250,000

1,250,000

1,243,571

1,204,398

1,204,546

45,004

45,602

45,454

AGRICULTURE UNITS

3,470,211

3,508,172

3,455,800

3,408,219

3,263,246

3,413,124

61,992

244,926

42,676

CONTINUING EDUCATION

4,389,641

4,258,069

5,768,481

3,911,086

4,103,982

5,522,538

478,555

154,087

245,943

794,856

575,000

575,004

794,856

575,000

574,992

0

0

12

9,943,283

9,591,241

11,049,285

9,357,732

9,146,626

10,715,200

585,551

444,615

334,085

56,292,640

56,581,618

60,468,483

54,694,739

56,530,935

59,017,003

1,597,901

50,683

1,451,480

14,355,493

9,306,254

6,267,196

4,983,766

4,951,935

2,221,042

9,371,727

4,354,319

4,046,154

8,794,236

11,452,901

8,567,959

6,312,936

8,221,465

6,150,507

2,481,300

3,231,436

2,417,452

23,149,729

20,759,155

14,835,155

11,296,702

13,173,400

8,371,549

11,853,027

7,585,755

6,463,606

79,442,369

77,340,773

75,303,638

65,991,441

69,704,335

67,388,552

13,450,928

7,636,438

7,915,086

UNRESTRICTED FOUNDATION PROGRAMS

TOTAL SUPPLEMENTAL

TOTAL SURPLUS (DEFICIT) UNRESTRICTED

RESTRICTED:

ENDOWMENT/INVESTMENTS

RESTRICTED FOUNDATION PROGRAMS

TOTAL RESTRICTED

TOTAL

5

CAPITAL REQUESTS

NET CASH GENERATED

CAL POLY POMONA FOUNDATION, INC.

PROPOSED BUDGET

SUMMARY STATEMENT OF ACTIVITY

DEPRECIATION & AMORTIZATION

Revised

Budget

Current

Forecast

Proposed

Budget

Carryover

Revised

Budget

Current

Forecast

Prior

Years

Proposed

Budget

Revised

Budget

Current

Forecast

Proposed

Budget

FISCAL YEAR

2014-2015

2014-2015

2015-2016

2014-2015

2014-2015

Carryover

2015-2016

2014-2015

2014-2015

2015-2016

150,672

945,312

154,407

936,601

203,976

894,069

277,000

570,000

194,485

331,686

74,500

180,000

231,000

400,000

(936,798)

778,699

1,147,691

(744,380)

993,837

(80,510)

1,095,984

1,091,008

1,098,045

847,000

526,171

254,500

631,000

989,592

168,947

Bookstore

BRONCO BOOKSTORE

150,672

142,176

162,000

110,000

10,000

100,000

25,000

326,553

524,613

354,399

Total Bookstore

150,672

142,176

162,000

110,000

10,000

100,000

25,000

326,553

524,613

354,399

Dining Services

FOUNDATION MAINTENANCE

POLY TROLLEY

FRESH ESCAPES

CARL'S JR.

PONY EXPRESS - CCMP

PONY EXPRESS - CLA

INNOVATION BREW WORKS

POLY FRESH

PONY EXPRESS - ENV

ENG COFFEE SHOP

STARBUCKS COFFEE

PANDA EXPRESS

KIKKA SUSHI

LOS OLIVOS

VISTA CAFÉ

DENNYS

VENDING

QDOBA

JAMBA JUICE

SUBWAY

ROUND TABLE

DINING ADMINISTRATION

EINSTEIN'S BAGELS

PONY EXPRESS AT CBA

FRESHENS/PURA VIDA

TACO BELL

BRONCO BUCKS CARD OFFICE

SCE LOBBY SHOP

KW - CATERING/CONF. FOODS

3,600

33,072

4,452

20,244

5,400

3,936

12,000

17,160

360

5,000

11,304

372

15,672

100,968

4,020

7,800

3,996

47,232

12,580

21,012

9,612

113,004

43,692

19,284

16,440

15,804

0

2,280

61,200

3,000

32,500

5,288

18,600

5,400

4,000

8,200

17,155

400

2,500

8,100

370

16,000

100,910

4,018

7,800

0

40,932

8,820

18,000

9,300

84,921

39,340

19,370

16,440

13,092

0

2,280

45,555

3,000

33,072

5,292

15,744

5,400

3,936

12,000

17,160

360

5,004

10,104

372

15,672

100,968

4,020

7,800

0

47,208

10,236

18,000

11,304

82,392

43,680

20,208

16,440

15,804

0

2,280

45,996

Total Dining Services

611,496

532,291

553,452

1,186,036

925,901

65,173

601,500

(107,620)

58,105

43,568

55,282

1,150,000

903,000

147,000

1,045,000

(1,067,946)

University Village

2,525,748

2,525,748

2,668,680

965,000

1,086,985

0

229,000

3,142,348

2,273,069

3,770,890

TOTAL ENTERPRISE ACTIVITIES

3,346,021

3,243,783

3,439,414

3,411,036

2,925,886

312,173

1,900,500

2,293,335

2,398,855

3,914,861

TOTAL GENERAL & ENTERPRISE ACTIVITIES 4,442,005

4,334,791

4,537,459

4,258,036

6

3,452,057

566,673

2,531,500

3,282,927

2,567,802

3,912,019

GENERAL ACTIVITIES:

ADMINISTRATION

REAL ESTATE

INVESTMENTS

TOTAL GENERAL ACTIVITIES

(1,113,413)

25,988

1,084,583

(2,842)

ENTERPRISE ACTIVITIES:

K.W. Conference Ctr. & Lodge

6,000

15,000

80,000

80,000

400,000

400,000

5,000

25,000

2,459

25,000

75,000

20,000

96,900

86,928

343,000

230,000

3,204

158,000

38,551

3,932

3,932

71,000

59,031

175,000

3,204

50,000

14,000

15,000

18,500

20,000

195,000

11,969

48,000

3,594

17,966

13,692

94,104

42,717

27,633

(384,802)

77,152

2,807

(20,149)

59,142

107,523

53,689

447,824

72,890

36,152

31,606

125,655

(333,373)

132,310

63,726

(1,078,165)

48,989

235,263

18,534

40,297

2,103

13,340

(59,839)

4,634

(10,618)

36,515

123,109

73,808

25,056

(458,194)

80,206

4,443

(22,894)

125,178

103,282

(8,946)

662,882

53,381

(63,815)

19,940

187,628

(276,241)

149,359

67,024

(974,493)

47,757

224,642

22,387

36,104

(115)

14,330

145,652

392,001

(790,828)

(3,002)

29,582

37,269

89,353

146,412

21,299

(55,094)

81,990

5,004

8,686

100,696

110,739

77,939

624,728

56,898

(59,153)

21,149

167,810

622

115,223

49,450

(1,214,601)

55,854

224,072

19,556

53,641

(425)

14,885

133,359

913,941

(1,124,369)

CAPITAL REQUESTS

NET CASH GENERATED

CAL POLY POMONA FOUNDATION, INC.

PROPOSED BUDGET

SUMMARY STATEMENT OF ACTIVITY

DEPRECIATION & AMORTIZATION

Revised

Budget

Current

Forecast

Proposed

Budget

Carryover

Revised

Budget

Current

Forecast

Prior

Years

Proposed

Budget

Revised

Budget

Current

Forecast

Proposed

Budget

FISCAL YEAR

2014-2015

2014-2015

2015-2016

2014-2015

2014-2015

Carryover

2015-2016

2014-2015

2014-2015

2015-2016

0

0

0

(2,086,608)

(2,079,000)

(1,355,338)

SURPLUS (DEFICIT) AFTER DESIGNATED GIFT 4,442,005

4,334,791

4,537,459

0

0

0

AGRICULTURE UNITS

52,242

35,502

49,302

760,377

CONTINUING EDUCATION

34,224

28,249

34,849

320,000

0

0

0

86,466

63,751

84,151

1,080,377

138,377

480,000

176,750

4,528,471

4,398,542

4,621,610

5,338,413

3,590,434

1,046,673

2,708,250

ENDOWMENT/INVESTMENTS

0

0

RESTRICTED FOUNDATION PROGRAMS

0

0

0

4,528,471

DESIGNATED GIFTS - University

4,258,036

3,452,057

566,673

2,531,500

1,196,319

488,802

2,556,681

45,004

45,602

45,454

166,750

(646,143)

142,051

(554,772)

10,000

192,779

182,336

270,792

0

0

12

SUPPLEMENTAL PROGRAMS

RESEARCH OFFICE

UNRESTRICTED FOUNDATION PROGRAMS

TOTAL SUPPLEMENTAL

TOTAL SURPLUS (DEFICIT) UNRESTRICTED

138,377

480,000

(408,360)

369,989

(238,514)

787,959

858,791

2,318,167

0

9,371,727

4,354,319

4,046,154

0

2,481,300

3,231,436

2,417,452

0

0

11,853,027

7,585,755

6,463,606

4,398,542

4,621,610

12,640,986

8,444,546

8,781,773

RESTRICTED:

TOTAL RESTRICTED

TOTAL

5,338,413

7

3,590,434

1,046,673

2,708,250

Memorandum

Date:

May 1, 2015

To:

Personnel Committee

Cal Poly Pomona Foundation, Inc.

From:

Dennis Miller

Chief Employment Officer

Subject:

PARS Vacation/Sick Leave Conversion Program

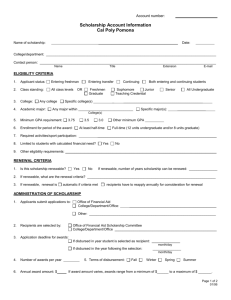

The PARS Vacation/Sick Leave Conversion Program allows the Foundation to provide

eligible employees a supplemental retirement plan to the existing retirement program

(CalPERS) by converting a portion of unused Vacation and Sick Leave balances to

cash, and then contributing those funds directly into the employees PARS 457(b)

individual account on a tax-deferred basis. The percentage of participation is fully

elective by the eligible employees and the option to convert occurs on an annual basis.

Foundation must meet certain financial obligations to convert funds under this Program

and must have approval from the Personnel Committee and final approval from the

Board of Directors. As outlined below, Foundation has met its minimum financial

requirements to allow employees to convert sick time and vacation time under this

Program, and is requesting approval from the Personnel Committee to move this

request to the Board of Directors for final approval.

The Foundation will generate an unrestricted forecasted surplus of $2.1 million

(excluding the Designated Gifts to the University of $2.1 million), has funded its

reserves by $1.3 million, and has met its debt service coverage requirements for the

fiscal year ended June 2015. See attached documents for further details.

As of June 30, 2015, there will be 65 employees eligible to convert sick leave. If all 65

converted their maximum amount of sick time, the amount would be approximately

$144,000. However, based on historical participation and conversion levels, a

reasonable forecast of the expense resulting from sick leave conversions is $78,000.

There are 54 employees eligible to convert a portion of their vacation. If all 54

employees convert 100% of their allowable hours the amount would be approximately

$133,000. However, based on historical participation and conversion levels, a

reasonable forecast of the expense resulting from vacation time conversions is $65,000.

8

Subject:

Subject:

PARS

PARS Vacation/Sick

Vacation/Sick Leave Conversion Program

Program

It is notable

notable that when an employee elects

elects to convert

convert unused

unused vacation

vacation time

time there

there isisno

no

cost

Foundation since vacation amounts have

have already

cost to Foundation

already been

been earned

earned and

and accrued.

accrued.

Eligible

Eligible employees

employees will be invited

invited to a training

training session

session in May

May to learn

learn about

about the

the

advantages and disadvantages

disadvantages of

of converting

converting vacation

vacation and

advantages

and sick

sick leave

leave time

timeinto

into the

the

program, and

retirement program.

and subsequently

subsequently invested

supplemental retirement

Hancock

invested with

with John

John Hancock USA,

USA,

presenting information

who

representative presenting

who will have a representative

information at

at this

this meeting.

meeting.

Proposed Action:

Proposed

Foundation management

management is

is requesting

requesting the

WHEREAS, Foundation

the Personnel

Personnel Committee's

Committee's action

action

to approve

allowing eligible

employees to elect to convert

portion of their

approve allowing

eligible employees

their vacation

vacation and

and

convert a portion

poly

sick leave to the deferred

deferred compensation

compensation supplement retirement

retirement plan of Cal Poly

Pomona

Foundation, Inc.

Inc. effective

30, 2015.

2015, and

Pomona Foundation,

effective June

June 30

and forward

fonlrrard to

to the

the Board

Board of

of Directors

Directors

for final approval.

Now'

lr RESOLVED,

RESOLVED, the Personnel

NOW, THEREFORE,

THEREFORE, BE IT

Personnel Committee

committee has reviewed the

surplus, reserves

pARS

reseryes and

and debt

surplus.

debt service

service coverage

coverage and

and approves the funding for the

the PARS

Vacation/sick

Leave Conversion

conversion Plan

Plan of

Vacation/Sick Leave

of Cal

cal Poly

Poly Pomona

Pomona Foundation,

Foundation, Inc. effective

effectrve

2015.

June 30.

30,2015.

PASSED AND ADOPTED

ADOPTED THIS

PASSED

THIS 7th

7th DAY

DAY OF

OF MAY

MAY 2015.

2015.

By:

Bv:

'ffi

-J-fl

\ t -,1^- h\"- ^;

Dr. Steven N. Garcia, Chair

Personnel

Personnel Committee

Committbe

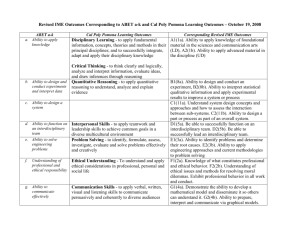

Number of

Employees

Eligible for

Vacation

Fiscal Year Conversion

2001-2002

36

2002-2003

32

2003-2004

39

2004-2005

40

2005-2006

40

2006-2007

46

2007-2008

43

2008-2009

42

2009-2010

49

2010-2011

53

2011-2012

56

2012-2013

69

2013-2014

51

2014-2015

65

Number of

Employees

Electing

Vacation

Conversion

17

13

20

25

26

27

18

23

25

43

28

38

29

37

Percentage

Electing

Vacation

Conversion

47%

41%

51%

63%

65%

59%

42%

55%

51%

81%

50%

55%

57%

57%

$ Amount

$ Amount Vacation

Vacation

Employees

Employees

Eligible

Converted

$65,240

$28,851

$57,528

$27,717

$64,810

$40,256

$68,972

$45,068

$73,817

$38,901

$88,019

$54,480

$79,480

$31,657

$85,640

$48,705

$99,177

$47,224

$112,511

$68,885

$105,500

$61,041

$149,194

$58,778

$117,000

$49,479

$144,000

$65,000

Number of

Number of

Employees

Percentage $ Amount Sick

Eligible for Employees

Electing Sick Electing Sick

Employees

Sick

Fiscal Year Conversion Conversion

Conversion

Eligible

2001-2002

56

20

36%

$51,695

2002-2003

62

25

40%

$51,757

2003-2004

71

32

45%

$61,847

2004-2005

68

45

66%

$68,198

2005-2006

72

40

56%

$72,390

2006-2007

68

36

53%

$66,608

2007-2008

62

27

44%

$70,525

2008-2009

60

34

57%

$65,926

2009-2010

74

41

55%

$84,160

2010-2011

41

29

71%

$96,045

2011-2012

45

30

67%

$91,947

2012-2013

56

31

55%

$111,476

2013-2014

55

42

76%

$114,000

2014-2015

54

30

56%

$133,000

Fiscal Year - Combined Total

2001-2002

$56,137

2002-2003

$63,534

2003-2004

$88,626

2004-2005

$99,993

2005-2006

$80,879

2006-2007

$102,967

2007-2008

$76,197

2008-2009

$89,052

2009-2010

$101,611

2010-2011

$143,027

2011-2012

$129,920

2012-2013

$138,780

2013-2014

$140,070

2014-2015

$143,000

$ Amount Sick

Employees

Converted

$27,286

$35,817

$48,370

$54,924

$41,978

$48,487

$44,540

$40,347

$54,387

$74,142

$68,879

$80,002

$90,591

$78,000

Estimate

Estimate

Estimate

10

Description

Debt Service Coverage

(Fiscal Year Ended June 30)

Actual

Budget

2013-14

Change in unrestricted net assets

$

5,751,184

Add Back:

University Designated Expenses

Surplus (Deficit) before Designated Expenses - see Note

$

7,147,252

$

12,311,018

$

2,162,375

$

3,994,008

$

9,721,196

$

2,162,375

$

2,129,683

$

7,667,404

$

2,162,375

2,806,818

4,621,610

1,034,716

$

1,829,625

332,750

$

1,451,480

1,355,338

4,398,542

1,139,179

1,829,625

332,750

$

50,683

2,079,000

4,528,476

1,198,712

1,829,625

332,750

$

1,907,400

Proposed

Budget

2015-16

Forecast

2014-15

2,086,608

3,867,508

1,296,258

Maximum Annual Debt Service *

2005 Series Bonds

2007 Series Bonds

Total Debt Service

$

1,396,068

Add Back:

Depreciation and amortization

Interest (see detail below)

Available for Debt Service

Revised

Budget

2014-15

8,463,144

1,829,625

332,750

$

2,162,375

Total Debt Service before Designated Expenses - see Note

5.69

4.50

3.55

3.91

Total Debt Service after Designated Expenses

5.05

3.53

2.58

3.29

Note: Bond covenants require the Foundation to not incur a deficit in any two consecutive years after adding back the designated

gifts and a debt coverage ratio of at least 1.25.

* Maximum annual debt service is reported as the total amount of scheduled debt service during the year in which

the debt service is scheduled to be highest during the life of the Bonds

Interest Detail

2005 Series Bonds - Interest (portion advance refunded 2013 & 2

2007 Series Bonds - Interest

Total Interest Expense

1,170,408

125,850

$

11

1,296,258

1,080,528

118,184

$

1,198,712

1,020,995

118,184

$

1,139,179

925,964

108,752

$

1,034,716

CAL POLY POMONA FOUNDATION, INC.

2014-15 PROPOSED BUDGET

SUMMARY OF SOURCES AND USES OF FUNDS

Revised

2014-2015

PROPOSED BUDGET

SOURCES OF CASH

SURPLUS (DEFICIT)

Administration

Real Estate

Investments

Bookstores

Dining Services

Kellogg West Conference Center

University Village

Supplementary Programs

TOTAL OPERATING SURPLUS (DEFICIT)

Designated Gifts

NET OPERATING SURPLUS (DEFICIT)

NON-CASH TRANSACTIONS:

Depreciation and Amortization

Post Retiree Medical Benefits - See Note 1

TOTAL CASH GENERATED BY OPERATIONS

FINANCING

TOTAL SOURCES OF FINANCING

RESERVES

Capital Reserve

Residential Board Meal Program Surplus Reserve

Insurance Reserve

Venture Capital/Real Estate Reserve

Withdraw of funds from Post Retiree Medical Benefit Trust

TOTAL SOURCES FROM RESERVES

TOTAL SOURCES OF CASH

BEGINNING OF THE YEAR WORKING CAPITAL LESS CONTINGENCY

NET WORKING CAPITAL AVAILABLE END OF YEAR - Note 2

Minimal Two Months Working Capital Reserve Required

12

2015-2016

PROPOSED BUDGET

(810,470)

403,387

1,147,691

285,881

466,920

23,949

1,581,600

585,551

3,684,509

(2,086,608)

1,597,901

(704,302)

388,922

(80,510)

392,437

785,611

68,604

834,306

444,615

2,129,683

(2,079,000)

50,683

(1,011,889)

(288,081)

1,084,583

317,399

1,027,162

12,349

1,331,210

334,085

2,806,818

(1,355,338)

1,451,480

4,528,476

614,273

6,740,650

4,398,542

614,273

5,063,498

4,621,610

548,209

6,621,299

-

USES OF CASH

CAPITAL EXPENDITURES

University Village

Bookstore

Dining Services

Kellogg West

Real Estate

Agricultural Units

Continuing Education

Administration

Prior Year Carryover

TOTAL CAPITAL EXPENDITURES

FINANCING

University Village Bond payment - 2005A & B

CTTi Bond payment - 2007

TOTAL USES OF FINANCING

RESERVES

Agriculture Program Reserve @ 55% net Annual Surplus

Cafeteria State Share Reserve

Capital Reserve @ 1.75% of Gross Auxiliary Revenues

Emergency Reserve

Indirect Cost Disallowance Reserve

Innovation Village Demo Reserve

Insurance Reserve

Pine Tree Ranch Reserve @ 50% net Annual Surplus

Post Retiree Medical Benefits Trust - see Note 1

Research & Sponsored Programs

Residential Board Meal Program Surplus Reserve excess 7%

Venture Capital/Real Estate Reserve @ 1.0% of Gross Rev.

TOTAL RESERVE CONTRIBUTIONS

TOTAL USES OF CASH

NET SOURCES & (USES) OF CASH

2014-2015

FORECAST

-

-

1,601,000

96,900

1,354,000

86,928

100,921

372,834

2,070,734

8,811,384

372,834

1,914,683

6,978,181

965,000

110,000

1,186,036

1,150,000

570,000

760,377

320,000

277,000

1,086,985

10,000

925,901

903,000

331,686

138,377

5,338,413

3,590,434

229,000

25,000

595,500

1,045,000

400,000

166,750

10,000

237,000

1,046,673

3,754,923

625,000

195,000

820,000

625,000

195,000

820,000

625,000

205,000

830,000

33,098

21,295

813,948

422,292

864,302

8,221

39,796

998

1,000,000

20,000

135,188

465,113

2,516,362

8,674,775

136,609

8,200

39,796

8,740

62,747

1,000,000

20,000

329,388

469,904

2,310,875

6,721,309

256,872

1,000,000

20,000

365,004

493,887

2,814,680

7,399,603

1,800,499

9,989,677

10,246,549

10,246,549

12,047,048

6,317,408

6,946,467

194,485

1,230,969

175,000

800,000

372,834

2,578,803

9,200,102

CAL POLY POMONA FOUNDATION, INC.

SOURCES/(USES) AND WORKING CAPITAL

Balance as of

6/30/2014

Sources of Funds:

Fund Balance (Unrestricted)

Current & Long term debt

University Village Series 2005

CTTI Bonds Series 2007

Excess of Accounts Receivable over Accounts Payable

Post Retiree Medical Benefits - Note 1

Total Available

Uses of Funds

Investment in fixed assets

Depreciation

Inventory

Reserves :

Board Designated Reserves

Agriculture Program Reserve

Cafeteria State Share Reserve

Capital Reserve

Emergency Reserve

Indirect Cost Dissallowance Reserve

Innovation Village Demo Reserve

Insurance Reserve

Pine Tree Ranch Reserve

Auxiliaries Multiple Employer VEBA Trust - Note 1

Research & Sponsored Programs

Residential Board Meal Program Surplus Res

Venture Capital/Real Estate Reserve

Other

Total Uses

Available for Working Capital

Net Working Capital - Note 2

Minimal Two Months Working Capital Reserve Required

Forecast

Fiscal 14/15

43,193,446

50,683

23,920,000

2,785,000

3,817,394

335,469

74,051,309

(625,000)

(195,000)

614,273

(155,044)

98,042,213

(45,576,534)

1,968,299

3,590,434

(4,398,542)

53,705

182,062

5,577,708

120,152

346,406

54,529

98,378

140,886

Proposed

Budgeted 15/16

1,451,480

(625,000)

(205,000)

548,209

1,169,689

3,754,923

(4,621,610)

21,295

Net End of

6/30/2016

44,695,609

22,670,000

2,385,000

3,817,394

1,497,951

75,065,954

112,258

1,548,176

1,370,037

23,357

64,061,632

9,989,677

9,989,677

(411,916)

256,872

10,246,549

(630,810)

1,800,499

12,047,048

5,336,578

6,317,408

6,946,467

6,946,467

(366,667)

8,200

(61,125)

8,740

62,747

627,166

20,000

242,460

469,904

627,166

20,000

190,004

(306,113)

Note 1 - Forecast and Proposed Budget includes funding of $1.0 million and withdraws of $372,834 each year;

the Post Retirement Med Benefit.

Note 2 - Net Working Capital does not include cash advances for Sponsored Programs per policy # 172

13

1,497,951

105,387,570

(54,596,686)

1,968,299

75,000

182,062

4,279,333

120,152

346,406

71,469

100,000

140,886

1,254,332

152,258

1,980,640

1,533,828

23,357

63,018,906

12,047,048

12,047,048

(931,708)

Goal

75,000

6,000,000

346,406

75,000

6,000,000

,A

Memorandum

Cal Poly

PdT Pomona

ci

hur

Date:

2015

May 1,

1,2015

To.

To:

Personnel Committee

Personnel

Committee

Cal Poly Pomona Foundation.

Foundation, Inc.

Inc.

r,

..t /'

From:

Dennis Mill

Mille/

Chief Employment Officer

Officer

Foundation

FO

unil a[0n

AlFit

/* lftu4tt

Subject:

Employee Handbook Revisions

Subject: EmployeeHandbookRevisions

practice of most organizations.

As is the practice

Foundation maintains

maintains an Employee

Employee Handbook

Handbook

organizations, Foundation

policies, benefits,

to help

help communicate

information to all

all employees

key policies,

benefits, and

and working

communicate information

employees on key

conditions, related

to employment

employment while

while working

working for

for Foundation.

Foundation. Periodically,

related to

Periodically, it is

necessary

to

review,

revise,

and

update

the

Employee

Handbook,

when

necessary

Employee Handbook, especially

especially when

legislative

legislative updates occur

occur to

to California

California labor

labor laws,

laws, which

which isis the

the case

case for

tor 2015.

2015.

Effective July 1, 2015, Foundation

Foundation is required

required to provide

provide paid

paid sick leave

leave for part

part time

time

Effective

employees

employees per the Healthy Workplace/Healthy Families

Families Act of 2014, commonly

commonly referred

"A81522".

to as

"AB1522-.

as

revisions to the handbook are mostly minor language

language changes,

changes, two notable

While the revisions

While

changes

adopting a policy to offer paid sick time to our part time employees in

changes include adopting

policy on

video cameras.

support of AB1522,

A81522, and

and including

including aa policy

on the

the use

use of

of video

cameras.

This is the link to the Foundation

Foundation Employee

Employee Handbook

Handbook online on the Employment

Employment

Services

Services website: http://www.foundation.csupomona.edu/content/es/d/nh/employeehtto://www.foundation.csupomona.edu/contenVes/d/nh/emoloveehandbook. pdf

handbook.pdf

Proposed Action:

WHEREAS, the Foundation

Foundation management

management is

is requesting

requesting the Personnel

Personnel Committee's

Committee's

forward to the Board of Director's for

action to approve

approve the Employee

Employee Handbook

Handbook and forward

final approval,

approval, with

with an

an effective

effective date

date of

of July

July1,

1,2015.

2015.

NOW, THEREFORE,

THEREFORE, BE IT

lT RESOLVED,

RESOLVED, the

the Personnel

Personnel Committee

Committee has

has reviewed

reviewed the

recommends approval

above request and recommends

approval to

to the

the Board

Board of

of Directors.

Directors.

PASSED

THIS 7th

rh DAY

PASSED AND ADOPTED THIS

DAY OF

OF MAY

MAY 2015.

2015.

BY:

By:

(ts

,n

J [,''-''* l^ I o-'-<--"'-

Dr. Steven N.

N. Garcia,'

Garcia.l Chair

Chair

Personnel

Personnel Committee

14

A

Agel

Memorandum

,

Date:

May

4. 2015

May 4,

To:

Board of Directors

Directors

Foundation, Inc.

Inc.

Cal Poly Pomona Foundation,

From:

G. Paul

P aul St

St&jg{a^!t1)L'atc;"'u"

Executive

Executive Director

(

Subject:

Programs,Designated

DesignatedGifts,

Gifts,Reserve

Reserve

General

Enterprise,Supplemental

SupplementalPrograms,

General Activities,

Activities, Enterprise,

Cash Plan/Reserves

Plan/Reserves for

for Fiscal

Fiscal Year

Year 2015-16

2015-16

Budgets and

and Long

Long Range

Range Cash

Cal Poly Pomona

Foundation

HffiillfiflH

ft nAl-Director

!4

provisions of

University

Compliance Guide

Guide for

forCalifornia

CalifomiaState

StateUniversity

WHEREAS, Pursuant to the

the provisions

of the

theCompliance

proposed operating

and

Foundation's proposed

operating budgets

budgets and

Auxiliary Organizations

Cal Poly

Poly Pomona

Pomona Foundation's

Section 11.7.

11.7, the

the Cal

Organizations Section

Activities

(Administration; Real Estate

Investments) Enterprise

Enterprise Activities

Estate &

&Investments)

forecast

forecast include:

include: General Activities (Administration:

(Research Office.

Office,

Programs (Research

(Bookstore/Dining Services/Kellogg

Housing); Supplemental

Supplemental Programs

WesUFoundation Housing):

Services/Kellogg West/Foundation

Foundation Programs):

Programs); Designated

Designated

Unrestricted Foundation

Agriculture Units.

Restricted and

and Unrestricted

Education, Restricted

Agriculture

Units, Continuing Education.

Capital;

andUses

Uses and

and Working

WorkingCapital;

with the

Summary of

of Sources

Sources and

Gifts; Reserves

Budgets; along

along with

the Summary

Reserves and Capital Budgets;

Foundation's

Plan/Reserves.

The

Statement

of

Activities:

Debt

Service

Coverage:

Long

Term

Cash

Plan/Reserves.

The

Foundation's

and

Coverage;

Activities;

Statement

and

operating and

approving the

the annual

annual operating

governing Board accomplishes

these activities

activities by reviewing

reviewing and approving

accomplishes these

approved budgets may be

changes to the

the approved

capital budgets before

before the

the start

start of each

each fiscal

fiscal year.

year. Necessary

Necessary changes

progresses, and

year progresses.

and

fiscal year

made by the governing Board

as the

the fiscal

Board as

provides that

that Foundation

No. 118,

1 18, provides

Policy No.

Budget Process

Process Policy

Foundation Budget

the Foundation

WHEREAS, the

proposed

andsupporting

supporting

budgets, forecasts

forecasts and

present annually the

Administration will present

and capital

capital proposed budgets.

the operating

operating and

Directors, and

detailed

information to the Board of Directors:

schedules and information

detailed schedules

pension Plans

Plans

rate of

WHEREAS.

blended rate

of 9.6% to the three pension

includes contributing

contributing aa blended

WHEREAS, the budget includes

ranges (previously

with CALPERS

approximaiely $1.040.500

a total of approximately

$1,040,500 and changes to salary grade ranges

CALPERS for a

approved in November

November 2014)

2014) and a 3% or approximately

$180,000 wage adjustment

adjustment for

for eligible

eligible

approximately $180,000

approved

who

paid

funds,

employees

("Eligible

employees"

are

regular

benefited

employees

paid

from

non-grant

funds,

who were

were

from

non-grant

employees

regular

benefited

("Eligible

are

employees"

employees

due

to

pay

to

adjustments

year

have

had

any

hired

prior

to

beginning

this

2014-15

fiscal

year

and

have

not

any

adjustments

who

fiscal

and

2014-15

prior

of

this

beginning

to

the

hired

promotions

during the 2014-15

fiscal year,

year, and

and among

among the other

other employees

employees includes the

2014-15 fiscal

promotions or

reitructures during

or job restructures

$372.834 with the VEBA Trust:

Trust; and

and

withdraw $372,834

million and withdraw

two Officers

contribute $1.0

Foundation); and contribute

$1 .0 million

oi Foundation):

Officers of

per

health

care

plan

as

per

actuarial

actuarial

postretirement

as

the

assume

7.5%

$548.209

benefit

cost

for

postretirement

as

the

or

assume 7.5%

$548,209

studies.

proposed operating

presents these

prepared and

these proposed

WHEREAS. the Foundation

and presents

management has prepared

Foundation management

WHEREAS,

and

plan/reserve,

range

gifts,

long

reserves

and

and

capital

budgets

and

forecasts,

designated

gifts,

reserves

and

long

range

plan/reserve.

designated

budgets

and

proposed operating and

and

theseproposed

discussed these

WHEREAS,

reviewed and

anddiscussed

hasreviewed

Directors has

Board of

of Directors

WHEREAS, the Board

pursuant

plan/reserve

reserves

and

long

range

plan/reserve

pursuant

to

gifts, reserves and long range

designated gifts,

forecasts, designated

andforecasts,

capital budgets

budgets and

Foundation Budget Process Policy

No. 118.

1 18, and

and

Policy No.

Foundation

capital

and Capital

Proposed Operating

operating and

NOW, THEREFORE,

THEREFORE,the

the Board

Board of

the Proposed

approves the

of Directors

Directors approves

NOW,

Activities.

Enterprise

Enterprise

year

Activities,

for

General

2014-15

fiscal

Budgets

for

year

2015-16

and

forecasts

for

fiscal

year

2014-15

for

General

forecasts

for

fiscal

Budgets

plan/reserve.

long-range cash plan/reserve.

Activities. Supplemental

Reserves and the long-range

Gifts, Reserves

Programs, Designated

Designated Gifts.

Supplemental Programs.

Actitities,

Passed and

and adopted

adopted this 21st

MAY 2015

201 5.

21 st day of MAY

Passed

By

By:

Rachel Dominguez,

Dominguez. Secretary

Secretary

Rachel

Cal Poly

of Directors

Directors

Foundation Board

Board of

Pomona Foundation

Polv Pomona

15

15

2015 SUMMER 4/10 WORK SCHEDULE FOR FOUNDATION

th

th

Starts June 15 and Ends September 4

Week of:

Monday

Tuesday

Wednesday

Thursday

Friday

15 - 19

10

10

10

10

Off

22 - 26

10

10

10

10

Off

29 – 7/3

8

8

8

8

Holiday

6 - 10

10

10

10

10

Off

13 - 17

10

10

10

10

Off

20 - 24

10

10

10

10

Off

27 – 31

10

10

10

10

Off

3-7

10

10

10

10

Off

10 - 14

10

10

10

10

Off

17 - 21

10

10

10

10

Off

See (F) below.

24 – 28

10

10

10

10

10

Aug/Sep

See (F) below.

31 - 4

10

10

10

10

10

September

7 - 11

Holiday

8

8

8

8

June

July

August

Notes

A. The normal schedule is 7:00AM to 6:00PM. The standard one hour meal period is from noon

until 1:00PM (a minimum 30 minute meal period is required for nonexempt employees).

However, a unit may have different work hours to support their operational commitments as

determined by the respective unit Director, and with prior approval from the Executive Director.

B. Working beyond the 10 hour shift requires a second meal period of at least 30 minutes for

nonexempt employees.

C. When sick or vacation time is used it will be paid on an hour-for-hour basis for nonexempt

employees. I.e.: an employee takes a paid vacation day and will receive 10 hours of paid

vacation.

D. Newly hired employees are subject to this schedule provided they are part of a department that

adopted the alternate workweek schedule.

E. Foundation will make a reasonable effort to find a work schedule which does not exceed eight

hours in a day for employees who are unable to work the 4/10 summer schedule.

F. Employees will work only 4 ten hour days during this week however, department coverage is

needed from 8 – 5 all week. To accommodate the coverage levels, some employees will be off

on Friday and others will be off on Monday, and this will be determined at the unit level.

G. For questions about the above schedule please contact Dennis Miller at extension 2958.

16