THE JOHNS HOPKINS UNIVERSITY Consolidated Financial

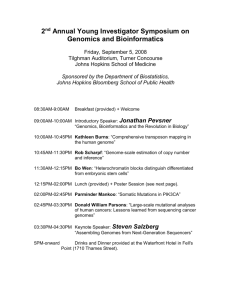

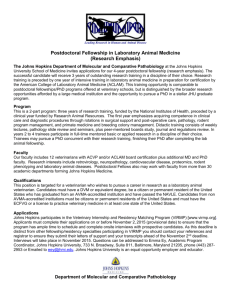

advertisement