Short Sales Title and Escrow

Title & Escrow for Short Sales

Multicultural Marketing Division

Caridad Stuart

Bay Area Multicultural Marketing Manager

Fidelity National Title Group

Today’s Objectives

1. Background

2. The Process

3. Title & Escrow Issues

4.

Do’s & Don’t

5. Q & A

Background

• The subprime mortgage crisis is an ongoing financial crisis triggered by a dramatic rise in mortgage delinquencies and foreclosures in the US, with major adverse consequences for banks and financial markets around the globe.

• The crisis became apparent in 2007 and has exposed pervasive weakness in financial industry regulation and the global financial system.

•

When US prices began to decline in 2006-2007, mortgage delinquencies soared, and securities backed with subprime mortgages, widely held by financial firms, lost most of their value.

• The result has been a large decline in the capital of many banks and USA government sponsored enterprises, tightening credit around the world.

Background Continued…

• Foreclosures accelerated in the US in late 2006 and triggered a global financial crisis through 2007 and 2008.

•

Governments bailed out key financial institutions, such as Freddie Mac and

Fannie Mae.

• 92% of all adjustable rate mortgages will reset next year

• 3.3 million homeowners have adjustable rate mortgages

• Foreclosures in 2007 increased 79% over 2006

• There were 2.2 million foreclosures in 2007

What is a Short Sale?

Why a Short Sale?

A short sale is a sale in which the outstanding obligations

(loans/mortgages) against the real estate are greater than the amount for which the property can be sold.

A short sale is for the homeowners that truly can’t afford to make their mortgage payments. Illness, Death of a Spouse, Divorce, Loss of Job are other reasons for short sales.

For example: A mortgagor has a first Deed of Trust (DT) recorded against his property in the amount of $250,000 and a second Deed of Trust for $80,000 BUT the Property Value is $300,000.

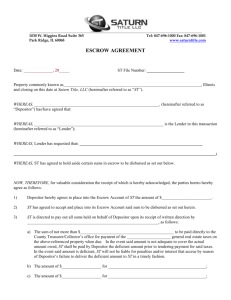

THE PROCESS: Escrow is Opened… Now what?

•

It is customary for a realtor or agent to open a pre-escrow or listing with an Escrow

Officer so that he/she can get the process of a draft HUD-1 statement prepared to forward to the negotiator at the bank.

• The Escrow Officer will revise the HUD1 several times to meet the negotiator’s request to change fees that show on the HUD-1 that may or may not be approved.

• The listing agent will receive several offers all of which are submitted to the bank for review. The Escrow Officer will draw Closing Statements according to all the contracts received.

• If the bank chooses to accept an offer submitted by the listing agent, the short sale process has officially begun. It is imperative that any and all documents forwarded to the principals are executed and that all requests are promptly adhered to.

•

Often times- the preliminary report will request an SI or Statement of Information for either buyer or seller or both.

The Escrow Process Continued…

• Review your preliminary report for HOA (Homeowners Associations

)

Prepare your seller to have to come up with a check payable to the HOA management company so that escrow is able to order the HOA docs in a timely manner.

• Now that the buyer is in contract, Escrow will request an update on the preliminary title report so that it too can be forwarded to the short sale lender.

•

Demands on tax defaults, garbage liens, HOA dues, and any miscellaneous bills will be updated and will be reflected on the HUD-1 statement for short sale lender approval.

•

Real Estate professionals often times do not understand that title companies file their rates with the Department of Insurance; while the short sale lender may not approve a certain fee that shows on the Estimated HUD-1, please note that it is a fee that has been filed and the Escrow Officer must charge it. In some cases, this means that the seller will have to bring in additional funds to close escrow. Please prepare your client to understand this. It will be reiterated at the signing, however, a prepared customer will be a happier customer.

•

The Short Sale Approval Letter is the most important document that is forwarded to

Escrow.

The Escrow Process Continued

…

•

The Short Sale approval letter must be received in its entirety, including any attached promissory notes. Remember, a short sale will be null and void if there is a promissory note attached to the approval that has not been executed by the seller at the time of signing and forwarded along with short sale payoff funds at close of escrow.

• Remember why the client is requesting a short sale. If they cannot afford to make payments on their house, chances of them wanting to make a payment for the balance owed on the property they are no longer living in are very low.

•

Escrow will confirm the legitimacy of the short sale approval letter via phone or email and will verify the instructions stipulated on the approval. (A sample approval letter is provided.)

•

One of the most common scenarios in a short sale that is an area of contention is when there is a 1 st and a 2 nd mortgage on the property. The 1 st will usually allow the

2 nd to receive $1000 and the rest minus fees, commissions and bills are to go to the

1 st .

The Escrow Process Continued…

• The agent to ensure the closing, will propose to the buyer’s agent that the buyer pay the additional funds requested by the second.

THE PROBLEM :

•

Both the 1 st and the 2 nd mortgage lien holders must be in agreement of how much the other gets and it must be fully DISCLOSED and APPROVED by the first. Remember the first lien holder is in 1 st position for a reason!

• The Escrow Officer is obligated to notify the 1 st lien holder of the outside agreement and get an approval in writing that the 2 nd can receive additional funds. If this is not approved, it is likely that the short sale will not close if the 2 nd chooses to not accept the $1000 it is being offered by the 1 st .

Include more process info here

Short Sale Approval Letter

Important items to note on the Short Sale

Approval Letter

1.

“Approved”

2.

Close of Escrow Date (on or before …)

3.

Buyer’ Name (s)

4.

Property Address

5.

Sale Price

6.

Approved Fees

7.

Approved Commissions

8.

Amount due to the 2 nd Lien holder if applicable

9.

Promissory Note if applicable or indication that there is NO

Promissory Note attached or a part of the approval.

10.

Where short payoff funds are to be sent and to whom and how

Short Sale Approval Letter

• Copy & Paste Sample of SSAL here!

The Role of the Escrow Officer in a Short Sale

• Include the list I used for my escrow files given to the agent here… TIPS…

CASE STUDY

#1

• Case study from a recently closed SSA transaction here

Case Study Continued

DO’S & DON’TS

DO

Communicate : Always communicate with your client and your Escrow

Officer

Disclosure:

Understand:

Disclose, Disclose, Disclose- that is our company policy!

the Escrow Officer’s fiduciary duty is to the buyer, seller and new lender

Documentation: It is important that you provide your Escrow Officer handling the transaction, any and all documents forwarded to you for execution by your client in a timely manner. Remember: an

SI can hold up a transaction and even be a deal breaker.

Read: The Preliminary Title Report!

Assume :

Assume:

Assume:

Wait:

DON’T that all documents have been reviewed by your client.

that your client understands what he has been given that your client fully understands the extent of his/her situation until the last minute to COMMUNICATE , DISCLOSE ,

UNDERSTAND , and provide DOCUMENTATION to your

Escrow Officer.

Thank You !

CARIDAD STUART

BAY AREA MULTICULTURAL MARKETING MANAGER

FIDELITY NATIONAL TITLE GROUP

825 BROADWAY

OAKLAND CA 94606

DIRECT: 510-338-1852

CELL : 925- 818-3169