Practice set

advertisement

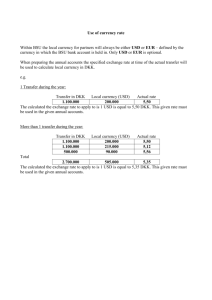

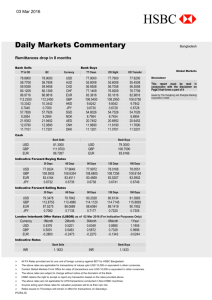

Bo Sjö 2012-10-03 Practice Set and Solutions #1 What to do with this practice set?1 Practice sets are handed out to help students master the material of the course and prepare for the final exam. These sets contain worked-out problems in corporate finance. This set is not graded, and there is no need to hand-in the solutions. Students are strongly encouraged to solve them, discuss the solutions with other course participants, and use the teacher's (e-mail) to discuss any problems they might encounter. Question 1 You read the following quotes USD /DEM 0.4565 -0.4580 a) What is the quote for buying and selling DEMs? b) What is the quote for buying and selling USD? Question 2 You are given the following quotations May 13, 2009 from the web of the Swedish news paper Dagens Industri, at 1800h GMT +2 SEK 7.85/USD SEK 10.69/USD a) What is the EUR /USD rate? b) The Financial Times web quotes the USD /EUR to 1.36 (the same day and time) Is it correct? (What is the cross-rate here?) Question 3 Suppose that a Canadian firm is delivering CAD 1.25m to an U.S. firm in exchange for USD 1m. Their views will differ. Who is purchasing foreign exchange, who is selling and what is the (foreign) rate of exchange? Question 4 You are given the following spot rates against the GBP (Foreign over pound)2 1 These question and solutions are still a bit preliminary. 2 From Feb 2, 2007. 1 Country _Code _Midpoint _Change _Spread _Czech Rep CZJ 42.7945 +0.1868 616–273 _Denmark DKK 11.30929 +0.0289 065–119 _Euro EUR 1.5172 +0.0039 168–175 _Norway NOK 12.3321 +0.0394 263–379 _Russia RUB 52.1528 – 0.0368 376–679 _Switzerland CHF 2.4531 +0.0040 522–540 _Turkey YTL 2.7656 –0.0050 614–698 The spreads are the three last decimals in the quotation. If the ask price seems to be lower than the bid add +1000 to the outright ask quote to establish the “rip-off rule”. a) From the perspective of the British are these quotations given as direct or indirect quotations? b) For a Dane is this quotation against the krone direct or indirect? c) What are the outright bid-ask quotations for (conform that they corresponds to the midpoint prices above) CZJ/GBP DKK/GBP EUR/GBP NOK/GBP d) What are the outright mid-point quotations for the GBP/DKK and the GBP/RUB? e) What are the outright bid-ask quotes for the GBP/DKK and the GBP/RUB? Question 5 You are given the following table of foreign exchange rates (2012-10-03) Currency Last Day High Day Low % Change Bid Ask EUR/USD 1.2916 1.2933 1.2881 +0.00% 1.2916 1.2918 GBP/USD 1.6117 1.6140 1.6090 -0.07% 1.6117 1.6119 USD/JPY 78.260 78.290 78.140 +0.12% 78.260 78.270 USD/CHF 0.93700 0.93940 0.93590 +0.10% 0.93700 0.93710 USD/CAD 0.98610 0.98740 0.98410 +0.21% 0.98610 0.98640 AUD/USD 1.0223 1.0264 1.0203 -0.38% 1.0223 1.022 a) What are the spreads for the currencies above? b) What are the mid-point quotations for these currencies? c) Which currencies are given according to American and European quotation, respectively? d) What is the mid-point quote for Canadian dollar over the US dollar? e) What is the cross-rate(midpoint) for the Australian dollar over the Swiss franc in European quotation? Is that the correct way to quote the rate for an Australian? 2 f) How many euros do you need to by one Australian dollar? g) Are these quotes from London, Frankfurt or New York? Question 6 Look at Bank A's quotation ABC/EUR 20.50 - 20.55, compare with Bank B’s quotation ABC/EUR 20.60-20.65. a) Is there an arbitrage opportunity? b) What will happen in the future? Question 7 Given that the 3-month Danish interest rate is 4.41%, the U.S. rate of interest is 4.96, and the spot rate in European terms is 6.44, what is the (approximate) 3-month forward rate of DKR per USD? Question 8 Both France and US are producing wines such as Cabernet Sauvignon. Suppose a bottle of Cabernet Sauvignon sells for USD 18, in the U.S. An equivalent bottle, according to market experts, sells in France for EUR 10. a) According to PPP, and the law of one price, what should be the USD/EUR spot exchange rate? b) Suppose the Cabernet Sauvignon in the U.S. raises to $20 over the next year, while the price of the French CS is expected to rise to EUR11. What would be the one-year forward rate, USD/EUR? Question 9 On January 1, your American firm is able to obtain a loan from a Swiss Bank at 3% p.a. The loan is CHF 5m, to be fully repaid a year from now. The sum will be invested in the US for one year. The currenct spot rate is CHF 1.4515/USD. During the year you expect 4% inflation in the US and 1% in Switzerland. a) Calculate dollars received from borrowing. b) After borrowing do you have a short or a long position? Show in a pay-off diagram. c) How can you hedge that position? d) Calculate the cost of borrowing in CHF. e) Calculate how much you need to repay in USD. If relative PPP holds? (We can also ask “if the random walk theory holds?) f) Calculate the cost of borrowing in per cent. 3 Question 10 Assume that the 1-month money market rate of interest in Sweden is 1.91% while in Norway it is 2.06%. The spot exchange rate between the Swedish krona (SEK) and the Norwegian krone (NOK) is 0.838 NOK/SEK. a) Calculate potential arbitrage profits (in percentage terms) if the 1-month forward exchange rate is 0.854 NOK/SEK. b) Is it possible that the resulting arbitrage capital movements between the two countries could trigger an international financial crisis? If the NOK/SEK rate is floating or fixed? c) Suppose that the forward rate is unbiased predictor of the future spot rate. What is the expected rate of depreciation? How will this information change your answer in b)? Question 11 What is meant by the real exchange rate. Is it a stationary over time? What does it tell us? Solution 11 The real rate is defined as q = S t Pf Pd , where S = dom/for. Try to discuss what it is in relation to PPP. What is real appreciation? What is real depreciation? Does PPP hold, in absolute or relative form? 4 Solutions Solution 1 You read the following quotes the (USD /DEM) rate: 0.4565 -0.4580 a) What is the quote for buying and selling DEMs? The question you need to answer first is what is the “home” currency here? The answer is that is the USD. Thus, you buy DEM at 0.4580 from the dealer, and sell DEM to the dealer at 0.4565. (Confirm with the rip-off rule) a) Take the inverse of the exchange rates, and remember that bid price < ask price, and the answer is 2.1834 - 2.19058 Solution 2 a) What is the EUR /USD rate? (SEK 7.85/USD) / SEK10.69/EUR) = (SEK 7.85) * EUR/(SEK10.69) = 0.73 EUR/USD b) The Financial Times web quotes the USD /EUR to 1.36 (the same day and time) Is it correct? (What is the cross-rate here?) Take the inverse of EUR/USD and get USD 1.36/EUR, which matches the quotation in Financial Times quite exactly. Solution 3 The US firm will view this as a purchase of CAD 1.25m against a total payment of USD 1m. The unit price of one CAD is USD 1m / CAD 1.25m = USD 0.80/CAD The Canadian would view this as a purchase of USD 1m for CAD 1.25m, implying a unit price of USD CAD 1.25m / USD 1m = CAD 1.25/USD Solution 4 a) For the British these quotes are indirect, since it is number of foreign currency units over one domestic currency unit. b) For the Danes this quote is direct since it is domestic units over one foreign unit c) Outright quotations CZJ/GBP 42.7616 DKK/GBP 11.30065 EUR/GBP 1.5168 NOK/GBP 12.3263 - 42.8273 -11.30119 - 1.5175 - 12.3379 5 d) GBP 0.088423/DKK and GBP 0.0192/RUB e) In this case the bid becomes the ask and the ask becomes the bid when do inverse GBP/DKK: 0.088486 – 0.088490 GBP/RUB: 0.0191689 - 0.0191800 Solution 5 a) Spreads are given as the last three decimals. Thus the spread for the EUR/USD is 960 – 918, the rest follows. b) Mid-point quotation is given as (bid+ask)/2. Thus, the midpoint for EUR/USD is EUR 1.2917/USD. c) American: USD/JPY, USD/CHF, USD/CAD. European: EUR/USD, GBP/USB, AUD/USD. d) CAD 1.0139/USD e) AUD 0.9578/CHF (show the calculations to confirm) No, Aussies use indirect quotation. f) EUR 1.2637/AUD show te calculations to confirm this g) Since all quotes appear to be indirect quotation seen from the view of London, London it is! Solution 6 a) Bank A is selling ABC for 20.55. You buy ABC for 20.55. Next sell to bank B at ABC/EUR 20.60 and make a profit of 0.05 for each transaction. There is no risk in this, so it constitutes risk-free profits. No capital is invested, since the transactions can be viewed as instantaneous. Profit is 0.05 on each transaction. b) This cannot continue, in the end the price will be the same everywhere. Arbitrage will result in the same price for the same cash flow. We can also refer to this as least-cost pricing. The seller with the lowest price attracts the costumers. Solution 7 Apply the CIP relation, but be careful of the interest rates. Here is one version: [(F-S)/S] x (360/90) x 100 = (i – i*) / (1+i*) and solve for F. The results are in the area of F = 6.43 Solution 8 a) S [EUR/USD] = P_eur / P_usd = EUR10/USD18 = EUR0.5556/USD. This implied exchange rate can now be compared with the actual rate. However, this example is a bit hypothetical. b) F = EUR 11/USD 20 = EUR0.5500/USD 6 Solution 9 a) Calculate dollars received from borrowing. USD received: CHF 5m / (CHF1.4515/USD) = USD 3.444712m b) After borrowing what is your foreign exchange position? Show in a pay-off diagram. You have a short position you gain if the foreign exchange rate appreciates (explain). The pay off diagram will have a line with a negative 45 degree line. c) How can you hedge that position? The principle of hedging is to create an off-setting cash flow, a cash flow that moves in the opposite direction to the risky pay-off you have. In other words you need to create a long foreign exchange position in the same currency. Anything that can achieve an opposite cash flow to the short position in the CHF constitutes a hedge. The hedge can be complete or partial. A forward or a futures contract in CHF can achieve a 100 % hedge. d) What is the cost of borrowing in CHF? The cost of borrowing in CHF is CHF5m x 0.03 = CHF150 000 e) Calculate how much you need to repay in USD. If relative PPP holds? In USD? We don’t know the future spot rate. If we assume that the random walk model holds, we take today’s value as the best predictor, and our estimated cost is CHF 150 000 / (CHF1.4515/USD) = USD103 341.37 The expected change in the spot rate next year, given by the inflation differential is (1%-4%) = 3%. Thus, if relative PPP holds the CHF will appreciate with 3% (or 0.03), against the dollar. First, the expected exchange rate if relative PPP holds: (CHF 1.4515/USD) x (1 + (- 0.03)) = (CHF/USD) x 1.45 (0.97) = CHF 1.4080/USD The cost of borrowing in CHF is CHF150 000. We are going to repay CHF5,150,000. In USD that is, assuming relative PPP CHF 5,150,000/ (CHF1.4080/USD) = USD3,657,670.05 f) Calculate the cost of borrowing in per cent. The cost of borrowing in per cent [(USD3,657,670.05 /USD3,444,712) - 1] = 0.0618 or 6.18% Solution 10 7 Notice there is no mentioning of a “home currency” or accounting currency here. The quotations are done with the NOK as the home currency, so we will stick to that. a) Calculate potential arbitrage profits (in percentage terms) if the 1-month forward exchange rate is 0.854 NOK/SEK. The pay off from investing 1 NOK in NOK for one month is NOK 1 (1 + 0.0206/12) = NOK (1 + 0.00172) = NOK 1.00172 Investing 1 NOK in SEK gives (change to SEK, invest one month, use one the month forward rate to change back) NOK 1 [1/(NOK 0.838/SEK)] * (1 + 0.0191) * NOK 0.854/SEK = NOK * SEK1.1933/NOK * (1 + 0.0001325) = SEK 1.1933 * (1.0001325) * NOK 0.854/SEK = SEK 1.19346 * NOK 0.854/SEK = NOK 1.0192 CHECK THESE numbers!!! It is more profitable to invest in SEK. The yield from SEK can directly compared with the NOK yield because we used the forward rate to eliminate (hedge) the foreign exchange risk. b) Is it possible that the resulting arbitrage capital movements between the two countries could trigger an international financial crisis? If the NOK/SEK rate is floating or fixed? In this case we talk about CIP. (We also ignore transaction costs since no bid-ask prices are quoted.) Given no default risk between the two counter partners and no political risk, CIP is an arbitrage condition, we know that F, S i, and i* must change to uphold the condition. If the exchange rate S is fixed or not will not matter for this condition. Can there be a currency crisis? This is a tricky question? Your first answer might be: No risk of currency crises since CIP is just an arbitrage condition that will be restored automatically. Therefore, no risk of a currency crisis. But … First, is the exchange rates fixed or floating? Start with fixed. Why are we observing a deviation from CIP? Normally we do not expect to see deviations from CIP. And, we are getting market quotations. Thus the deviation is for real and must be caused by 1) counter partner risk (default risk) in general between Swedish and Norwegian bank. And/or there is treat of foreign exchange regulations being imposed during the month. These regulations (perhaps a tax might remove part or all of the profit). Treats of FX regulations, huge default risk across many banks in a country are indeed signs of an international financial crisis. If the exchange rate is floating? The answer is that this will not change the argument above. The default risk and the political risk would still be there. If we think this is just a temporary mistake, floating rates would help to adjust back to CIP quicker (assuming no default or political risk). 8 c) Suppose that the forward rate is unbiased predictor of the future spot rate. What is the expected rate of depreciation? How will this information change your answer in b)? Given the information that F is an unbiased predictor F = Set+1 is not going to change our conclusions and reasoning from above. We know that the Forward rate is reflecting an expected depreciation F – S = 0.854 – 0.838 = 0.016. In percentage (F-S)/S = 0.01909 On annual basis [* (360/30)*100]: 0.01909 * (360/30) * 100 = 22.91% The interest rate differential is [(0.0206 – 0.0191)/ ( 1.0191)] * 100 = 0.1472 % 9