Week 14, Chap14 Accounting 1A, Financial Accounting

Week 14, Chap14

Accounting 1A,

Financial Accounting

Analyzing Financial

Statements

Instructor: Michael Booth

Understanding The Business

Return on an equity security investment

Dividends

Increase in share price

Investors

How a company’s business strategy affects financial analysis.

Understanding a Company’s

Strategy

I need to know the company’s policies on product differentiation, pricing, and cost control to make my financial analysis more meaningful.

Understanding a Company’s

Strategy

Business

Strategy

Operating

Decisions

Transactions

Financial

Statements

Learning Objectives

Discuss how analysts use financial statements.

Financial Statement Analysis

FINANCIAL STATEMENT USERS

MANAGEMENT

EXTERNAL DECISION

MAKERS

. . . uses accounting data to make product pricing and expansion decisions.

. . . use accounting data for investment, credit, tax, and public policy decisions.

Financial Statement Analysis

THREE TYPES OF FINANCIAL

STATEMENT INFORMATION

Past

Performance

Income, sales volume, cash flows, return- on-investments,

EPS.

Present

Condition

Future

Performance

Assets, debt, inventory, various ratios.

Sales and earnings trends are good indicators of future performance.

Financial Statement Analysis

Financial statement analysis is based on comparisons.

Time series analysis

Examines a single

company to identify

trends over time.

Comparison with

similar companies

Google Finance

Financial Statement Analysis

Financial statement analysis is based on comparisons.

Time series analysis

Company

A Company

B

Comparison with

similar companies

Provides insights concerning a company’s relative performance.

Learning Objectives

Compute and interpret component percentages.

Component Percentages

Express each item on a particular statement as a percentage of a single base amount .

Net sales on the income statement

Total assets on the balance sheet

Component Percentages

The comparative income statements

of Home Depot for 2004 and 2003 appear on the next slide.

Prepare component percentage income statements where net sales equal 100%.

Home Depot

Component Percentages

HOME DEPOT

Comparative Income Statements (Condensed)

Amounts in Millions Except Per Share Data

2004 Percent 2003

Net Sales

Cost of Merchandise Sold

$ 64,816

44,236

100.0% $ 58,247

40,139

Gross Profit

Operating Expenses

Operating Income

Interest and Investment Income

Interest Expense

Earnings Before Income Taxes

Income Taxes

Net Earnings

20,580

13,734

$

6,846

59

(62)

6,843

2,539

4,304

18,108

12,278

$

5,830

79

(37)

5,872

2,208

3,664

Basic Earnings Per Share

Weighted-Average Number of

Common Shares Outstanding

Diluted Earnings Per Share

$ 1.88

2,283

$ 1.88

$ 1.57

2,336

$ 1.56

Percent

100.0%

Component Percentages

HOME DEPOT

Comparative Income Statements (Condensed)

Amounts in Millions Except Per Share Data

2004 Percent 2003

Net Sales

Cost of Merchandise Sold

$ 64,816

44,236

100.0% $ 58,247

68.2% 40,139

Gross Profit

Operating Expenses

Operating Income

Interest and Investment Income

Interest Expense

Earnings Before Income Taxes

Income Taxes

Net Earnings

20,580

13,734

6,846

59

18,108

12,278

5,830

79

2004 Cost ÷ 2004 Sales

6,843 5,872

2,539 2,208

$ 4,304 $ 3,664

Basic Earnings Per Share

Weighted-Average Number of

Common Shares Outstanding

Diluted Earnings Per Share

$ 1.88

2,283

$ 1.88

$ 1.57

2,336

$ 1.56

Percent

100.0%

Component Percentages

Comparative Income Statements (Condensed)

Amounts in Millions Except Per Share Data

2004 Percent 2003

Net Sales

Cost of Merchandise Sold

$ 64,816

44,236

100.0% $ 58,247

68.2% 40,139

Gross Profit

Operating Expenses

Operating Income

Interest and Investment Income

Interest Expense

Earnings Before Income Taxes

Income Taxes

Net Earnings

20,580

13,734

6,846

59

(62)

6,843

2,539

$ 4,304

31.8% 18,108

21.2% 12,278

10.6%

0.1%

-0.1%

5,830

79

(37)

10.6%

3.9%

6.7%

5,872

2,208

$ 3,664

Basic Earnings Per Share

Weighted-Average Number of

Common Shares Outstanding

Diluted Earnings Per Share

$ 1.88

2,283

$ 1.88

$ 1.57

2,336

$ 1.56

Percent

100.0%

68.9%

31.1%

21.1%

10.0%

0.1%

-0.1%

10.1%

3.8%

6.3%

Financial Statement to be used in Ratio Analysis

Comparative Statements

Continued

Comparative Statements

Learning Objectives

Compute and interpret profitability ratios.

Ratios Measuring Profitability,

Operating Results, and

Efficiency

Rate of return on common stockholders’ equity

Rate of return on total assets

Earnings per share of common stock (EPS)

Financial Leverage Ratio.

Price-earnings ratio.

Quality of Income

Fixed Asset turnover.

Return on Equity

Return on Equity =

Net Income

Average Owners’ Equity

Return on Equity =

$4,304

($22,407 + $19,802) ÷ 2

= 20.4%

Net Sales

Comparative Income Statements (Condensed)

Amounts in Millions Except Per Share Data

Cost of Merchandise Sold

HOME DEPOT

2004

44,236

Percent

100.0%

68.2%

2003

$ 58,247

40,139

Gross Profit

Operating Expenses

20,580

13,734

31.8%

21.2%

18,108

12,278

Operating Income

Interest and Investment Income

Interest Expense

Earnings Before Income Taxes

Income Taxes

Net Earnings

6,846

59

(62)

6,843

2,539

10.6%

0.1%

-0.1%

10.6%

3.9%

6.7%

5,830

$

79

(37)

5,872

2,208

3,664

Basic Earnings Per Share

Weighted-Average Number of

Common Shares Outstanding

Diluted Earnings Per Share

$ 1.88

2,283

$ 1.88

$ 1.57

2,336

$ 1.56

Percent

100.0%

68.9%

31.1%

21.1%

10.0%

0.1%

-0.1%

10.1%

3.8%

6.3%

This measure indicates how much income was earned for every dollar invested by the owners.

Return on Assets

Return on

Assets

=

Net Income + Interest Expense (net of tax)

Average Total Assets

Return on

Assets

=

$4,304 + ($62 × (1 - .37))

($34,437 + $30,011) ÷ 2

= 13.5%

Corporate tax rate

is 37%.

This ratio is generally considered the best overall measure of a company’s profitability.

Financial Leverage

Percentage

Financial

Leverage

= Return on Equity – Return on Assets

=

6.9% = 20.4% – 13.5%

Return on Equity =

Net Income

Average Owners’ Equity

-

Return on

Assets

=

Net Income + Interest Expense (net of tax)

Average Total Assets

Financial leverage is the advantage or disadvantage that occurs as the result of earning a return on equity that is different from the return on assets. (Positive indicates borrowed money at low rate and employed at a higher rate of return.

Earnings per Share (EPS)

EPS

Net Income (less preferred stock dividends)

=

Average Number of Shares of

Common Stock Outstanding

EPS =

$4,304

= $1.82

2,368

Average number of shares outstanding is from Home Depot’s 2004 Income Statement.

Earnings per share is probably the single most widely watched financial ratio. Ability to produce income per share of stock

Quality of Income

(see page 712 in text)

Quality of Income

=

Cash Flow from Operating Activities

Net Income

Add: Depreciation and Amortization

Decrease in Receivables, net

Increase in Accounts Payable

Increase in Deferred Revenue

Increase in Deferred Income Taxes

Other

Deduct: Increase in Merchandise Inventories

Decrease in Income Taxes Payable

Cash Flow from Operating Activities

$ 4,304

1,076

25

790

279

605

186

(693)

(27)

$ 6,545

Quality of Income

Quality of Income

Quality of Income

=

=

Cash Flow from Operating Activities

Net Income

$6,545

= 1.52

$4,304

A ratio higher than 1 indicates high-quality earnings.

Profit Margin

Profit

Margin

=

Net Income

Net Sales

Profit

Margin

=

$4,304

$64,816

= 6.6%

This ratio tells us the percentage of each sales dollar that is income.

Fixed Asset Turnover

Fixed

Asset

Turnover

=

Fixed

Asset

Turnover

=

Net Sales Revenue

Average Net Fixed Assets

$64,816

($20,063 + $17,168) ÷ 2

= 3.5

This ratio measures a company’s ability to generate sales given an investment in fixed assets.

Learning Objectives

Compute and interpret liquidity ratios.

Ratios Measuring Liquidity

Cash Ratio

Current Ratio

Quick (Acid-test) ratio

Accounts receivable turnover

Inventory turnover

Cash Ratio

Cash

Ratio

=

Cash + Cash Equivalents

Current Liabilities

Cash

Ratio

=

$2,826

$9,554

= 0.296 to 1

This ratio measures the adequacy of available cash. This must be viewed in conjunction with Cash Flow from operating activity, inventory turns, and A/R turns.

Current Ratio

Current

Ratio

=

Current Assets

Current Liabilities

Current

Ratio

=

$13,328

= 1.39 to 1

$9,554

This ratio measures the abilityof the company to pay current debts as they become due. Highly dependent on management of cash flows. A ratio of 2 is acceptable, but less can also be

OK if cash flow support debt.

Quick Ratio (Acid Test)

Quick

Ratio

=

Quick Assets

Current Liabilities

Quick

Ratio

=

$3,949

$9,554

Cash & Cash Equivalents

Receivables, net

Short-term Investments

Quick Assets

= 0.41 to 1

$ 2,826

1,097

26

$ 3,949

This ratio is like the current ratio but measures the company’s immediate ability to pay debts.

Receivable Turnover

Receivable

Turnover

=

Net Credit Sales

Average Net Receivables

Receivable

Turnover

=

$64,816

($1,097 + $1,072) ÷ 2

= (59.8) or 60 Times/yr

This ratio measures how quickly a company collects its accounts receivable. Can be over stated if Credit sales are not available, and total sales are use as surrogate.

Note: If credit sales is not available, total sales can be used, but possibly inflate the ratio

Average Age of Receivables

Average Age of Receivables

=

Days in Year

Receivable Turnover

Average Age of Receivables

=

365

59.8

= 6.1 Days

This ratio measures the average number of days it takes to collect receivables.

Inventory Turnover

Inventory

Turnover

=

Cost of Goods Sold

Average Inventory

Inventory

Turnover

=

$44,236

($9,076 + $8,338) ÷ 2

= 5.1 Times

This ratio measures how quickly the company sells its inventory.

Average Days’ Supply in

Inventory

Average Days’

Supply in

Inventory

=

Average Days’

Supply in

Inventory

=

Days in Year

Inventory Turnover

365

5.1

= 71.6 Days

This ratio measures the average number of days it takes to sell the inventory.

Accounts Payable Turnover

Accounts

Payable

Turnover

=

Cost of Goods Sold

Average Accounts Payable

Accounts

Payable

Turnover

=

$44,236

($5,159 + $4,560) ÷ 2

= 9.1 Times

This ratio measures how quickly the company pays its accounts payable.

Average Age of Payables

Average Age of Payables

=

Days in Year

Accounts Payable Turnover

Average Age of Payables

=

365

9.1

= 40.1 Days

This ratio measures the average number of days it takes to pay its suppliers.

Compute and interpret solvency ratios.

Ratios Measuring Solvency

Times Interest Earned Ratio

Cash coverage Ratio

Debt-to-Equity Ratio

Times Interest Earned

Times

Interest

Earned

= Income Expense Expense

Interest Expense

Times

Interest

Earned

=

$4,304 + $62 + $2,539

$62

= 111 Times

This ratio indicates a margin of protection for creditors.

Cash Coverage

Cash

Coverage

=

Cash Flow from Operating Activities

Before Interest and Taxes

Interest Paid

Cash Flow from Operating Activities

Net Income

Add: Depreciation and Amortization

Decrease in Receivables, net

Increase in Accounts Payable

Increase in Deferred Revenue

Increase in Deferred Income Taxes

Other

Deduct: Increase in Merchandise Inventories

Decrease in Income Taxes Payable

Cash Flow from Operating Activities

$ 4,304

1,076

25

790

279

605

186

(693)

(27)

$ 6,545

Cash Coverage

Cash

Coverage

=

Cash Flow from Operating Activities

Before Interest and Taxes

Interest Paid

Cash

Coverage

=

$6,545 + $70 + $2,539

$70

Cash interest paid

Income tax expense

$ 70

2,539

= 131

This ratio compares the cash generated with the cash obligations of the period.

Debt-to-Equity Ratio

Debt-to-Equity

Ratio

=

Total Liabilities

Owners’ Equity

Debt-to-Equity

Ratio

=

$12,030

$22,407

= 0.54

This ratio measures the amount of liabilities that exists for each $1 invested by the owners.

Learning Objectives

Compute and interpret market test ratios.

Market Tests

Price/Earnings (PE) Ratio

Cash coverage Ratio

Dividend Yield

Price/Earnings (P/E) Ratio

P/E Ratio =

Current Market Price Per Share

Earnings Per Share

P/E Ratio =

$40

$1.88

= 21

A recent price for Home Depot stock was $40 per share.

This ratio measures the relationship between the current market price of the stock and its earnings per share.

Dividend Yield Ratio

Dividend

Yield

=

Dividends Per Share

Market Price Per Share

Dividend

Yield

=

$0.27

$40

= 0.68%

Home Depot paid dividends of $.27 per share when the market price was $40 per share.

This ratio is often used to compare the dividend-paying performance of different investment alternatives.

Interpreting Ratios (Notice!!!)

Ratios may be interpreted by comparison:

Ratios of other companies in the same industry

Ratios from the same company over time

Industry average ratios

Note: Ratios may vary because of the company’s industry characteristics, nature of operations, size, and accounting policies. Care must be exercise with comparing ratios!!! Only EPS is a standardized ratio within the accounting profession, and is found on the

Income Statement!!!

Other Financial Information

In addition to financial ratios, special factors might affect company analysis:

Rapid growth.

Uneconomical expansion.

Subjective factors.

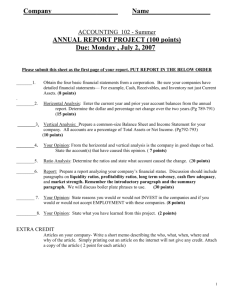

Assignments:

See web: http//www.cabrillo.edu/~mbooth

This will be updated weekly as required

• Update your weekly journal for the Final Journal

• Work weekly on your final project, do the analysis with information learned during the week

Note: Use McGrawHill HOMEWORK manager to submit assignments