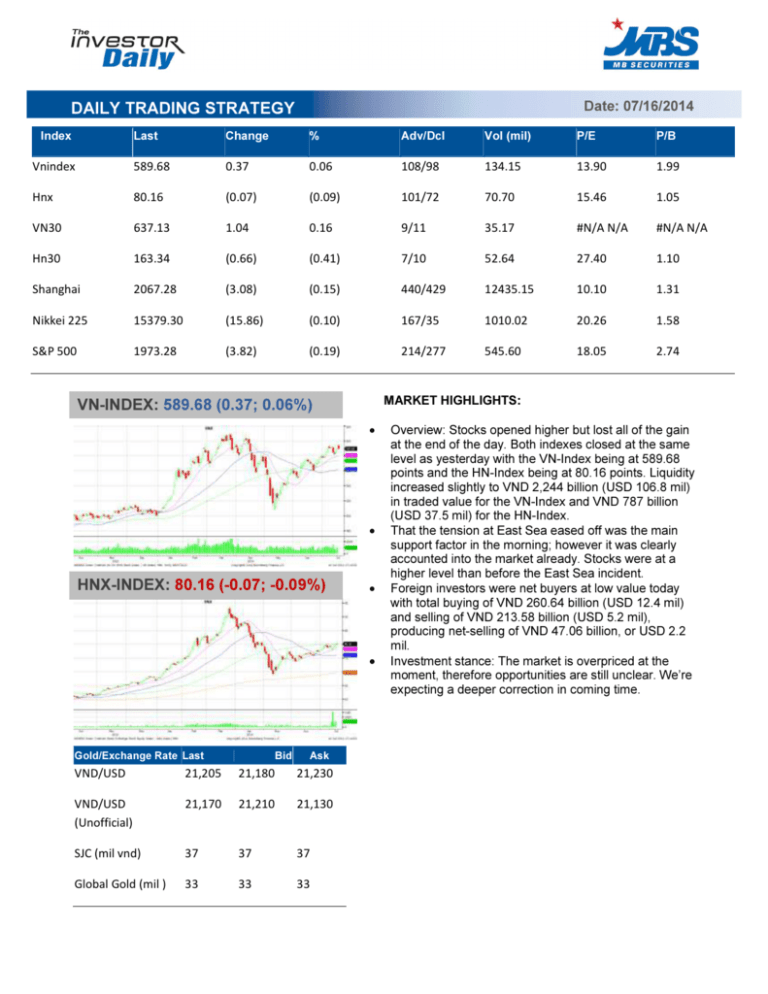

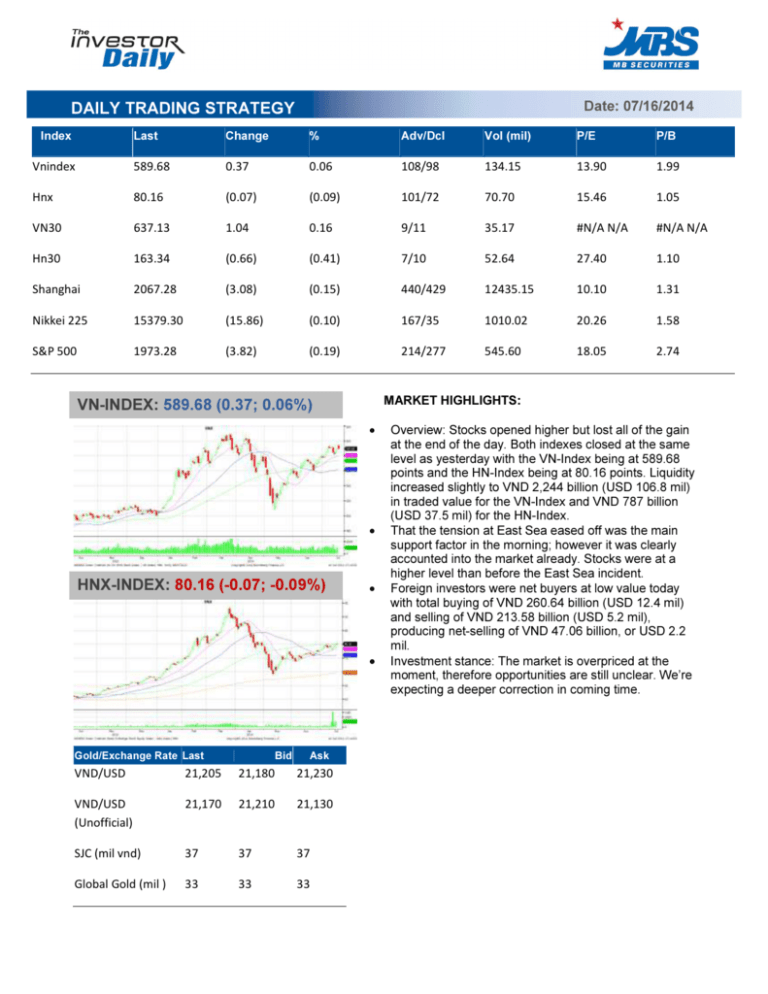

Date: 07/16/2014

DAILY TRADING STRATEGY

Index

Last

Change

%

Adv/Dcl

Vol (mil)

P/E

P/B

Vnindex

589.68

0.37

0.06

108/98

134.15

13.90

1.99

Hnx

80.16

(0.07)

(0.09)

101/72

70.70

15.46

1.05

VN30

637.13

1.04

0.16

9/11

35.17

#N/A N/A

#N/A N/A

Hn30

163.34

(0.66)

(0.41)

7/10

52.64

27.40

1.10

Shanghai

2067.28

(3.08)

(0.15)

440/429

12435.15

10.10

1.31

Nikkei 225

15379.30

(15.86)

(0.10)

167/35

1010.02

20.26

1.58

S&P 500

1973.28

(3.82)

(0.19)

214/277

545.60

18.05

2.74

MARKET HIGHLIGHTS:

VN-INDEX: 589.68 (0.37; 0.06%)

•

•

HNX-INDEX: 80.16 (-0.07; -0.09%)

•

•

Gold/Exchange Rate Last

Bid

Ask

VND/USD

21,205

21,180

21,230

VND/USD

(Unofficial)

21,170

21,210

21,130

SJC (mil vnd)

37

37

37

Global Gold (mil )

33

33

33

Overview: Stocks opened higher but lost all of the gain

at the end of the day. Both indexes closed at the same

level as yesterday with the VN-Index being at 589.68

points and the HN-Index being at 80.16 points. Liquidity

increased slightly to VND 2,244 billion (USD 106.8 mil)

in traded value for the VN-Index and VND 787 billion

(USD 37.5 mil) for the HN-Index.

That the tension at East Sea eased off was the main

support factor in the morning; however it was clearly

accounted into the market already. Stocks were at a

higher level than before the East Sea incident.

Foreign investors were net buyers at low value today

with total buying of VND 260.64 billion (USD 12.4 mil)

and selling of VND 213.58 billion (USD 5.2 mil),

producing net-selling of VND 47.06 billion, or USD 2.2

mil.

Investment stance: The market is overpriced at the

moment, therefore opportunities are still unclear. We’re

expecting a deeper correction in coming time.

Date: 07/16/2014

DAILY TRADING STRATEGY

TRANSACTIONS OF FOREIGN INVESTORS (Bil VND)

Cuu Long Pharmaceutical JSC

HPG – Hoa Phat Group

HIGHLIGHTED STOCKS:

•

Chart: Revenue growth and net income

•

Net

sales

Operati

ng

income

•

Net

incom

e

Chart: Total asset growth

•

Cash

Financial

Investments

•

(Source: Stox24)

HPG has published positive business performance in

the first 6 months of the year with revenue reaching

VND 13,339 billion and net income reaching VND

1,874 billion.

Net income of the Company rose sharply year on

year from the consumption of construction steel

increased 38% year on year, increasing consumption

of steel tube, the revenue recognition project at

Mandarin Garden (a revenue of 2,000 billion VNĐ).

Steel production complex Phase II of Hoa Phat

continuously shows promising performance as it has

contributed significantly to the increase in business

performance for the Company. Production of

construction steel of the company increased 228,000

tons year on year. Coke and power output also

increased respectively 80% and 93% year on year.

Thanks to modern technology investment and input

material, HPG continues to maintain its competitive

advantage as manufacturer has the lowest cost of

good sold in steel industry. Market share of HPG has

increased by 18% compared to 15% last year.

Currently, we do not see any steel company that has

the ability to challenge HPG in the northern market

and thus the company will likely continue to maintain

the current position in the coming years. HPG

intends to continue to invest in Hoa Phat Steel

Complex phase III with a capacity 750,000 tons /

year, the time investment is 1.5 years.

We appreciate investment in key areas of HPG. In

the context of most of the steel companies in the

North are facing difficulties, the leader in

strengthening investment and production efficiency

will help HPG continues to maintain its leading

position in the industry in the coming years

DAILY TRADING STRATEGY

Date: 07/16/2014

DISCLAIMER: Copyrights. MBS 2014, ALL RIGHTS RESERVED. Authors have based this document on

information from sources they believe to be reliable but which they have not independently verified. The views

expressed in this report are those of the authors and not necessarily related, by any sense, to those of MBS.

Neither any information nor comments were written for advertising purposes or recommendation to buy / sell any

securities. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any

form or by any means, electronic, mechanical, photocopying recording, or otherwise, without the prior written

permission of MBS.

MB SECURITIES (MBS)

Established since May 2000, MBS was one of the first 5 securities firms operating in Vietnam. After years of

continuous development, MBS has become one of the leading securities company in Vietnam, providing a full

range of services including: brokerage, research and investment advisory, investment banking and capital

markets underwriting. MBS’s network of branches and transaction offices has been expanded and operated

effectively in many major cities such as Hanoi, Ho Chi Minh City, Hai Phong and other strategic areas. MBS’s

clients include individual investors and institutions, financial institutions and enterprises. As a member of the MB

Group, including MB Bank, MB Land, MB Asset Management, MB Capital and Viet R.E.M.A.X (Viet REM), MBS

is able to leverage substantial human, financial and technological resources to provide its clients with tailored

products and services that few securities firms in Vietnam can match.

MBS is proud to be recognized as:

- A leading brokerage firm – ranked No.1 in terms of brokerage market share since 2009;

- A renowned research firm with a team of experienced analysts that provides market-leading research products

and commentaries on equity markets and the economy; and

- A trusted provider of investment banking services for corporate clients.

MBS HEAD OFFICE

MB Building, 3 Lieu Giai, Ba Dinh, Ha Noi

Tel: +84 4 3726 2600 – Fax: +84 4 3726 2600

Website: www.mbs.com.vn.