HOA PHAT GROUP

advertisement

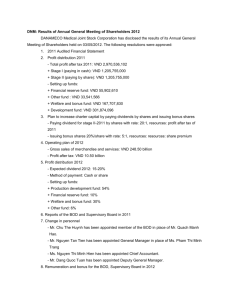

HOA PHAT GROUP - HPG Sector: Steel Spotlight in steel industry OVERWEIGHT Target price Current price VND 44,300 VND 37,200 Le Minh Triet (+84-8) 5413-5472 trietle@phs.vn 01.11.2013 Co. Profile Ticker HPG Charter Capital (VND bln) 4,191 Outstanding shares (mln) 419.053 Market Capital (VND bln) 15,379 16.5 - 37.2 52W range (VND) 486,313 Ave. trading volume 3M Beta 1.17 Foreign Ownership 44% 15/11/2007 First listing date HOSE - Vietnam Major shareholders Trần Đình Long 24.12% Vũ Thị Hiền 7.39% Deutsche Bank AG & Deutsche Asset Management (Asia) Ltd 6.42% Price movement 3M 6M 12M Absolute +8.3 +10.9 +20.7 Percentage (%) +28.7 +41.4 +125 Soaring EAT after reversing the provision: Weakening real estate market has caused the slump of construction steel sector since 2009. Furthermore, the continuous downtrend of material price of steel has dragged the selling price of HPG’s products down by 10% in 9M13. The consumption, ignited by the lower selling price, recorded an impressive growth of 14% YoY and boosted HPG’s net revenue up to VND 12,474 bln (+1.5% YoY). In contrast with the mild growth in revenue, HPG’s gross profit surged to VND 2,184 bln or 23.5% YoY thanks to the benefit from lower COGS. The reducing interest expense, which decreased 44% in the first nine months due to the declining streak of interest rate, also joined forces to enhance the company’s earnings performance. Additionally, HPG has reversed VND 164 bln provision related to a dispute between Hanoi ACB Investment Company and HPG’s subsidiary – Hoa Phat steel company. Thus, SG&A expenses plummeted 35% and propelled the EAT up to VND 1,520 bln (+12.2% YoY), a level which surpassed 26.7% annual target. Outperform the industry: According to the Vietnam Steel Association (VSA), the consumption of steel industry grew only 2.5% YoY in 9M13 due to a weak demand and fierce competition with cheap steel imported from China. In contrast to the gloomy business situation, HPG reported a 3.2 times higher growth rate in consumption than industrial average and stand firmly as the most profitable company in Vietnam steel industry. Moreover, its largest project, steel industrial complex in Hai Duong, was officially completed in early October and expected to give HPG a cost-saving advantage over its domestic rivals. This new fully-integrated blast furnace production line will bring down HPG’s steel price to an attractive level to compete with that of imported steel from China. By running 80% of designed capacity, which equivalent to 100,000 tons output, the company’s market shares is expected to increase from 14% to 20% by the end of this year. Positive outlook in 2013: FY13 will be the critical turning point for HPG. Its net revenue and profit growth has bounced back to positive after a slight dip last year. We forecasted that HPG’s FY13 net sales will rally to VND 17,980 bln, with an increase of 5% YoY. The downtrend of material price will reduce COGS and improve gross profit margin to 18% from 14.8% last year. Cost from financial activities also reduce 50% YoY to VND 208 bln thanks to the contribution from a 43% YoY decline in interest expense and 74% robust growth in interest income due to the incessant cash inflow. Estimated EAT, therefore, will be at VND 2,097 bln (+104% YoY) and surpass 75% of the annual target. Overweight recommendation with a target price of 44,300 VND: We evaluated HPG price at 44,300 VND by applying P/E (60% weight, expected P/E of 9.0x multiplied 2013 EPS forecast) and P/B (40% weight, expected P/B of 1.3x with figure of 2013 book value) evaluation method. In consideration of HPG short-term prospect and its current stock price level, we recommend OVERWEIGHT for HPG. (VND bln) www.phs.vn Net Revenue % gross margin % OP margin EBT Net profit % growth YoY EPS (TTM) BVPS 9M12 9M13 Co’s plan 18,500 2013E 12,656 12,474 13.97% 17.51% 18% 7.93% 14.24% 14.94% 988 1,770 2,467 1,200 17,980 850 1,520 6.71% 78.94% 103.5% 2,097 2,793 3,913 4,917 23,751 21,729 22,689 P/E 13.14 9.38 9.5 P/B 1.55 1.69 1.8 Source: PHS, HPG This report is for reference only and investors should be responsible for their own investment decisions. Phu Hung Securities Corporation Company description Hoa Phat Group (HPG) is one of the largest industrial manufacturer in Vietnam. Their core business Steel and related products such as coking coal, iron ore, etc. - accounted for over 80% of annual revenue. Hoa Phat Furniture is also a reputable brand with the largest market share in office furniture segment. Company history Starting with a trading company specializing in construction machines since 8/1992, Hoa Phat steadily extended their business to the field of Furniture (1995), Steel Pipe (1996), Steel (2000), Refrigeration (2001) and Real Estate (2001). In 2007, Hoa Phat reorganised under the group structure with Hoa Phat Group JSC as the holding company and its subsidiaries. 15/11/2007, Hoa Phat was officially listed in the Hochiminh Stock Exchange with the ticker of “HPG”. Capital increase process (VND bln) Source: HPG This report is for reference only and investors should be responsible for their own investment decisions. Phu Hung Securities Corporation Financial ratio (VND bln) Incomestatement 2010 2011 2012 Netsales 14,267 17,852 16,827 17,980 Growthrate 2011 2012 Costofgoodssold 11,808 14,979 14,342 14,744 Revenuegrowthrate -2.9% 75.6% 25.1% 6.9% 2,459 2,873 2,485 3,236 Grossprofitgrowthrate 57.0% 24.4% 16.8% 30.2% SG&Aexpense 454 619 861 550 Netprofitgrowthrate 15.7% 9.5% 6.9% 11.5% Financialincome 205 329 165 286 Totalassetgrowthrate 81.6% 45.5% 17.6% 4.2% Financialexpense 694 1,070 585 494 Equitygrowthrate 18.5% 32.6% 15.9% 17.6% Interestexpense 413 766 527 301 Profitabilityratios Operatingprofit 2,005 2,254 1,624 2,686 Grossprofitmargin 24.3% 17.2% 16.1% 18.0% Profitbeforetax 1,564 1,489 1,218 2,467 EBTmargin 18.6% 11.0% 8.3% 13.7% Profitaftertax 1,349 1,236 994 2,060 Netprofitmargin 15.7% 9.5% 6.9% 11.5% BalanceSheet 2010 2011 2012 2013E ROA 16.0% 10.7% 7.6% 10.6% 14,904 17,525 19,016 19,805 ROE 28.6% 24.0% 17.9% 23.4% Currentassets 7,866 9,486 10,221 9,718 Cashandequivalentcash 1,047 1,064 1,294 998 15.7% 9.5% 6.9% 11.5% Receivables 1,833 1,897 1,646 1,666 Assetturnover(2) 1.02 1.13 1.10 0.96 Inventories 4,541 6,347 6,822 6,602 Equitymultiplier(3) 1.79 2.24 2.35 2.21 Long-termassets 7,038 8,039 8,795 10,087 ROE=(1)x(2)x(3) 28.6% 24.0% 17.9% 24.4% 449 449 449 449 Fixedassets 4,604 5,920 7,007 8,077 39.09 46.16 38.28 33.83 Resources 14,904 17,525 19,016 19,805 Inventoryoutstandingdays 151.80 140.36 154.66 163.45 Liabilities 8,166 9,561 10,438 9,782 Payableoutstandingdays 23.56 23.76 20.48 30.65 Short-termloans 4,022 4,555 4,850 4,179 Assetturnover 1.02 1.13 1.10 0.96 898 942 1,521 1,279 Long-termassetturnover 2.65 3.10 3.02 2.23 Long-termloans 1,545 1,869 1,456 1,846 Fixassetturnover 0.38 0.32 0.33 0.45 Equities 6,398 7,414 8,085 9,508 Liquidityratios Charteredcapital 3,178 3,178 4,191 4,191 Currentratio 1.17 1.28 1.43 1.48 Capitalsurplus 2,258 2,258 2,207 2,221 Quickratio 0.61 0.54 0.47 0.47 - - - - Cashratio 0.32 0.17 0.16 0.15 757 1,540 1,393 2,808 2010 2011 2012 2013E Totaldebt/TotalEquity 1.07 1.28 1.29 1.03 Netoperatingcashflow 398 304 2,269 2,755 Totaldebt/TotalAsset 0.51 0.55 0.55 0.49 Netinvestingcashflow (1,421) (937) (1,660) (1,964) Totalasset/TotalEquity 2.12 2.33 2.36 2.08 Netfinancingcashflow 586 649 (380) (1,106) Indexpershare Netcashflows (437) 16 230 (314) PE 5.67 8.65 9.31 15.47 Cashatthebeginning 1,480 1,047 1,064 1,294 PBV 1.49 1.82 1.55 1.90 Cashattheend 1,047 1,064 1,294 998 PS 0.89 0.82 0.64 0.91 EPS 6,477 4,245 3,942 2,372 Cashearning/share 7,612 5,374 5,670 3,795 24,572 20,129 23,640 19,294 Grossprofit Totalassets Long-termreceivables Payables Developmentfund Retainedprofit Cashflow 2013E Financialratio 2010 2013E DuPontAnalysis Netprofitmargin(1) Managementratios Receivableoutstandingdays CapitalStructure Bookvalue Source:PHSestimation This report is for reference only and investors should be responsible for their own investment decisions. Phu Hung Securities Corporation Analyst Certification Each research analyst(s), strategist(s) or research associate(s) responsible for the preparation and content of all or any identified portion of this research report hereby certifies that, with respect to each issuer or security or any identified portion of the report with respect to each issuer or security that the research analyst, strategist or research associate covers in this research report, all of the views expressed by that research analyst, strategist or research associate in this research report accurately reflect their personal views about those issuer(s) or securities. Each research analyst(s), strategist(s) or research associate(s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst, strategist or research associate in this research report. Ratings Definition Overweight (OW) = Expected to outperform the local market by >10% Neutral (N) = Expected to in line with the local market by +10%~ -10% Underweight (UW) = Expected to underperform the local market by >10%. Not Rated (NR) = The stock is not rated in Phu Hung’s coverage universe or not listed yet. Performance is defined as 12-month total return (including dividends). Disclaimer This information has been compiled from sources we believe to be reliable, but we do not hold ourselves responsible for its completeness or accuracy. It is not an offer to sell or solicitation of an offer to buy any securities. Phu Hung Securities and its affiliates and their officers and employees may or may not have a position in or with respect to the securities mentioned herein. Phu Hung Securities (or one of its affiliates) may from time to time perform investment banking or other services or solicit investment banking or other business for any company mentioned in this report. All opinions and estimates included in this report constitute our judgment as of this date and are subject to change without notice. Phu Hung Securities Corporation (PHS) 5 Floor, Lawrence S. Ting Building 801 Nguyen Van Linh., District 7 HoChiMinh City, Viet nam Phone: (84-8) 5 413 5479 | Fax: (84-8) 5 413 5472 Website: www.phs.vn | E-mail: info@phs.vn This report is for reference only and investors should be responsible for their own investment decisions.