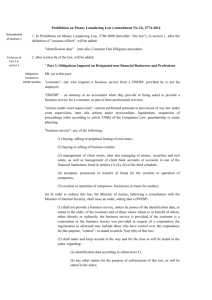

income tax ordinance - Ministry of Finance

advertisement