Intermediate Accounting III, Chapter 16

advertisement

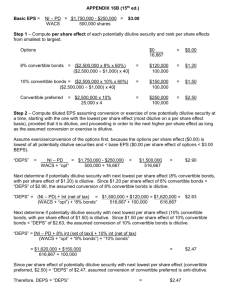

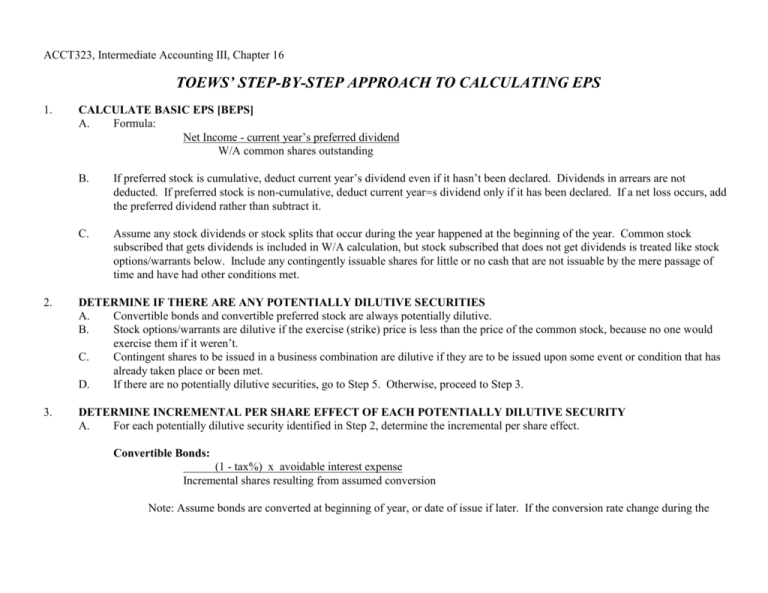

ACCT323, Intermediate Accounting III, Chapter 16 TOEWS’ STEP-BY-STEP APPROACH TO CALCULATING EPS 1. CALCULATE BASIC EPS [BEPS] A. Formula: Net Income - current year’s preferred dividend W/A common shares outstanding B. If preferred stock is cumulative, deduct current year’s dividend even if it hasn’t been declared. Dividends in arrears are not deducted. If preferred stock is non-cumulative, deduct current year=s dividend only if it has been declared. If a net loss occurs, add the preferred dividend rather than subtract it. C. Assume any stock dividends or stock splits that occur during the year happened at the beginning of the year. Common stock subscribed that gets dividends is included in W/A calculation, but stock subscribed that does not get dividends is treated like stock options/warrants below. Include any contingently issuable shares for little or no cash that are not issuable by the mere passage of time and have had other conditions met. 2. DETERMINE IF THERE ARE ANY POTENTIALLY DILUTIVE SECURITIES A. Convertible bonds and convertible preferred stock are always potentially dilutive. B. Stock options/warrants are dilutive if the exercise (strike) price is less than the price of the common stock, because no one would exercise them if it weren’t. C. Contingent shares to be issued in a business combination are dilutive if they are to be issued upon some event or condition that has already taken place or been met. D. If there are no potentially dilutive securities, go to Step 5. Otherwise, proceed to Step 3. 3. DETERMINE INCREMENTAL PER SHARE EFFECT OF EACH POTENTIALLY DILUTIVE SECURITY A. For each potentially dilutive security identified in Step 2, determine the incremental per share effect. Convertible Bonds: (1 - tax%) x avoidable interest expense Incremental shares resulting from assumed conversion Note: Assume bonds are converted at beginning of year, or date of issue if later. If the conversion rate change during the year, use the rate that results in the highest number of common shares. Interest expense includes any effect from discount/premium amortization. Convertible Preferred Stock: Eliminate Any Preferred Dividends from BEPS Numerator Incremental shares resulting from assumed conversion Note: Preferred stock dividends must be added back to net income because if they were converted, there would be no actual dividends to subtract in the first place. Again, assume conversion at the beginning of the year or date of preferred stock issue if later. Contingent Shares: Numerator Denominator 0 Incremental shares resulting from contingent issuance Stock Options/Warrants: Numerator Denominator 0 **Incremental shares resulting from assumed exercise ** Incremental shares equal: Avg mkt price of stock - exercise price X no. of options/warrants Avg mkt price of stock Note: Stock options and warrants are assumed to be exercised at the beginning of the year or at their date of issue if later. B. 4. If the incremental per share effect results in an number greater than BEPS, the security is anti-dilutive. Ignore it from here on. RANK DILUTIVE SECURITIES AND DETERMINE DEPS A. Rank each dilutive security from most dilutive to least dilutive. This would mean from the lowest fraction value to the highest. 5. B. Add the incremental effect of each dilutive security to BEPS, starting with the first one ranked. C. Keep going down the list until the new EPS figure is less than or equal to the prior one (i.e. becomes anti-dilutive). When this occurs, the current EPS figure is the DEPS. REPORT BEPS & DEPS A. Both BEPS and DEPS (if both exist) must be reported for each item below that appears on the income statement (also under old rules, cumulative effect of change in accounting principle): BEPS DEPS Income from continuing operations $XX $XX Discontinued items $XX $XX Extraordinary items $XX $XX Net Income $XX $XX ACCT323, Ch. 16, EPS, template # of Sh O/S Split or Stk Div Months W/A # of sh Net Income - Pref Div = Beginning balance W/A shares outstanding BEPS (net income) 0 WA # Sh O/S DEPS (net income) Incremental Effect EPS Adj Net Inc = BEPS Adj Net Inc = WA # Sh O/S BEPS SO PS CB Net Income 0 + Pref Div + Interest WA # Sh O/S Incr Sh Incr Sh Incr Sh num/den num/den num/den Cum EPS to this pt Cum EPS to this pt Cum EPS to this pt = Adj W/A # Sh DEPS Earnings per Share Income from Cont. Operations Discontinued Operations Extraordinary Gain/Loss Net Income BEPS DEPS Num BEPS Den BEPS Num DEPS Den DEPS