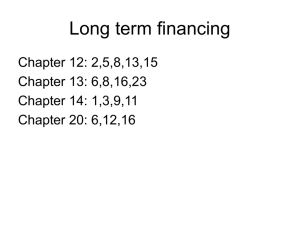

Appendix 16B

advertisement

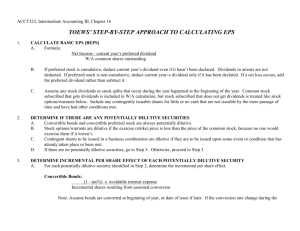

APPENDIX 16B (15th ed.) Basic EPS = NI – PD = $1,750,000 - $250,000 = WACS 500,000 shares $3.00 Step 1 – Compute per share effect of each potentially dilutive security and rank per share effects from smallest to largest. Options $0 16,667 = $0.00 8% convertible bonds = ($2,500,000 x 8% x 60%) ($2,500,000 $1,000) x 40] = $120,000 100,000 = $1.20 10% convertible bonds = ($2,500,000 x 10% x 60%) ($2,500,000 $1,000) x 40] = $150,000 100,000 = $1.50 Convertible preferred = $250,000 100,000 = $2.50 = $2,500,000 x 10% 25,000 x 4 Step 2 – Compute diluted EPS assuming conversion or exercise of one potentially dilutive security at a time, starting with the one with the lowest per share effect (most dilutive on a per share effect basis), provided that it is dilutive, and proceeding in order to the next higher per share effect as long as the assumed conversion or exercise is dilutive. Assume exercise/conversion of the options first, because the options per share effect ($0.00) is lowest of all potentially dilutive securities and < base EPS ($0.00 per share effect of options < $3.00 BEPS). “DEPS” = NI – PD = $1,750,000 - $250,000 WACS + “opt” 500,000 + 16,667 = $1,500,000 516,667 = $2.90 Next determine if potentially dilutive security with next lowest per share effect (8% convertible bonds, with per share effect of $1.20) is dilutive. Since $1.20 per share effect of 8% convertible bonds < “DEPS” of $2.90, the assumed conversion of 8% convertible bonds is dilutive. “DEPS” = (NI – PD) + Int (net of tax) = $1,500,000 + $120,000 = $1,620,000 = (WACS + “opt”) + “8% bonds” 516,667 + 100,000 616,667 $2.63 Next determine if potentially dilutive security with next lowest per share effect (10% convertible bonds, with per share effect of $1.50) is dilutive. Since $1.50 per share effect of 10% convertible bonds < “DEPS” of $2.63, the assumed conversion of 10% convertible bonds is dilutive. “DEPS” = [NI – PD + 8% int (net of tax)] + 10% int (net of tax) (WACS + “opt” + “8% bonds”) + “10% bonds” = $1,620,000 + $150,000 616,667 + 100,000 = $2.47 Since per share effect of potentially dilutive security with next lowest per share effect (convertible preferred, $2.50) > “DEPS” of $2.47, assumed conversion of convertible preferred is anti-dilutive. Therefore, DEPS = “DEPS” = $2.47