Chapter 05 - Tex

advertisement

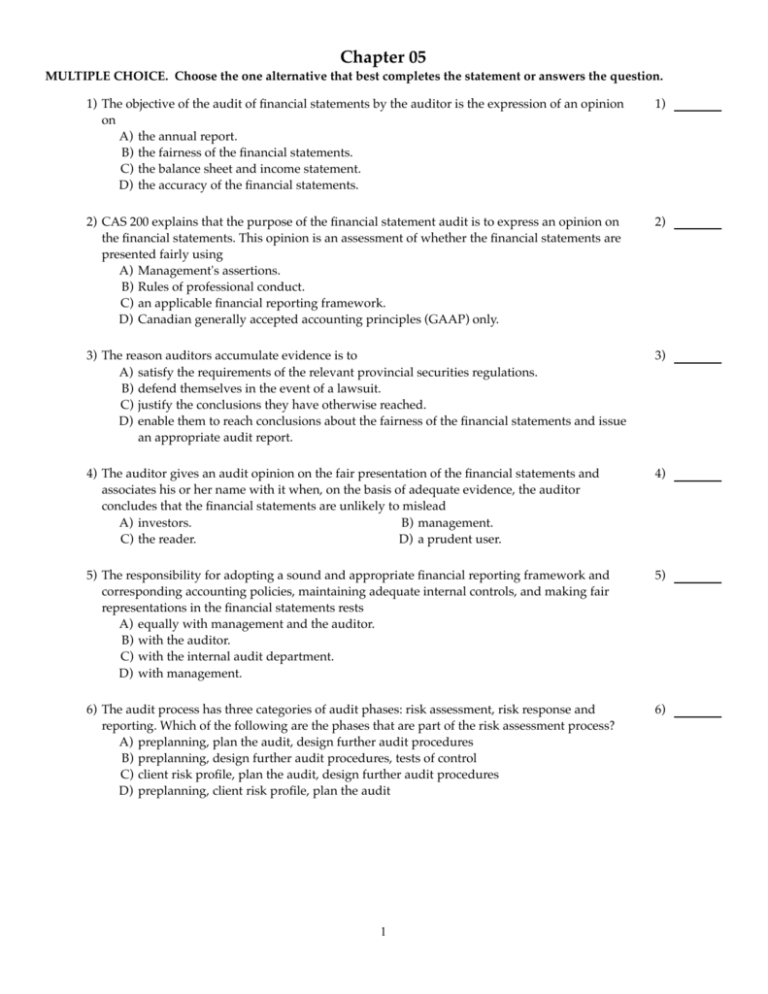

Chapter 05 MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) The objective of the audit of financial statements by the auditor is the expression of an opinion on A) the annual report. B) the fairness of the financial statements. C) the balance sheet and income statement. D) the accuracy of the financial statements. 1) 2) CAS 200 explains that the purpose of the financial statement audit is to express an opinion on the financial statements. This opinion is an assessment of whether the financial statements are presented fairly using A) Management's assertions. B) Rules of professional conduct. C) an applicable financial reporting framework. D) Canadian generally accepted accounting principles (GAAP) only. 2) 3) The reason auditors accumulate evidence is to A) satisfy the requirements of the relevant provincial securities regulations. B) defend themselves in the event of a lawsuit. C) justify the conclusions they have otherwise reached. D) enable them to reach conclusions about the fairness of the financial statements and issue an appropriate audit report. 3) 4) The auditor gives an audit opinion on the fair presentation of the financial statements and associates his or her name with it when, on the basis of adequate evidence, the auditor concludes that the financial statements are unlikely to mislead A) investors. B) management. C) the reader. D) a prudent user. 4) 5) The responsibility for adopting a sound and appropriate financial reporting framework and corresponding accounting policies, maintaining adequate internal controls, and making fair representations in the financial statements rests A) equally with management and the auditor. B) with the auditor. C) with the internal audit department. D) with management. 5) 6) The audit process has three categories of audit phases: risk assessment, risk response and reporting. Which of the following are the phases that are part of the risk assessment process? A) preplanning, plan the audit, design further audit procedures B) preplanning, design further audit procedures, tests of control C) client risk profile, plan the audit, design further audit procedures D) preplanning, client risk profile, plan the audit 6) 1 Chapter 05 7) There are three phases in the risk response category of the audit process (design further audit procedures, tests of control, substantive tests). When will the auditor conduct tests of controls? A) when a substantive audit approach is selected B) when there are poor internal controls C) if the auditor plans to rely upon them D) when there are low risks of material error 7) 8) The responsibility for the preparation of the financial statements and the accompanying footnotes belongs to A) management. B) both management and the auditor equally. C) management for the statements and the auditor for the notes. D) the auditor. 8) 9) Professional skepticism during the financial statement audit requires an appropriate state of mind, being impartial and objective and continuing to be throughout the whole audit engagement. Which of the following illustrates an appropriate state of mind? A) carefully assessing documents and not being the company's advocate B) matching documents to make sure that they are accurate and fair C) not having any ownership in the client's shares or being a debt-holder D) being aware that there could be material misstatements in the financial statements 9) 10) The requirement for an attitude of skepticism means that the auditor should A) plan and conduct the audit with an attitude of distrust in management. B) not consider management's explanation as evidence on any subject. C) not be blind to evidence that suggests the documents, books or records have been altered or are incorrect. D) perform additional tests of controls to increase the probability of discovering fraud or errors. 10) 11) The auditor has considerable responsibility for notifying users whether the financial statements are fairly stated. This imposes upon the auditor a duty to A) be a guarantor of the fairness in the statements. B) be equally responsible with management for the preparation of the financial statements. C) be an insurer of the fairness in the statements. D) provide reasonable assurance that material misstatements will be detected. 11) 12) The factor which distinguishes an error from fraud and other irregularity is A) whether it is a dollar amount or a process. B) materiality. C) whether it is a caused by the auditor or the client. D) intent. 12) 13) Which of the following is an example of fraudulent financial reporting (management fraud)? A) the purchasing manager submitting travel expenses twice (i.e. duplicate payment) B) intentional overstatement of sales to increase reported earnings C) managers or others taking bribes from accounts payable suppliers D) a clerk taking cash at the time a sale is made and not recording the sale 13) 2 Chapter 05 14) In comparing management fraud with employee fraud, the auditor's risk of failing to discover the fraud is greater for A) management fraud because of management's ability to override existing internal controls. B) management fraud because managers are inherently smarter than employees. C) employee fraud because of the larger number of employees in the organization. D) employee fraud because of the higher crime rate among blue collar workers. 14) 15) If the auditor were responsible for making certain that all the assertions of management in the statements were correct, A) bankruptcies would be reduced to a very small number. B) bankruptcies could no longer occur. C) audits would not be economically feasible. D) audits would be much easier to complete. 15) 16) When comparing the auditor's responsibility for detecting employee fraud and for detecting errors, the profession has placed the responsibility A) equally on discovering either one. B) on the senior auditor for detecting errors and on the manager for detecting employee fraud. C) more on discovering errors than employee fraud. D) more on discovering employee fraud than errors. 16) 17) The auditor's evaluation of the likelihood of material employee fraud is normally done initially as a part of A) the tests of controls. B) the assessment of whether to accept the audit engagement. C) the tests of transactions. D) understanding the entity's internal controls. 17) 18) What is the auditor's role in the detection of computer fraud? A) use computer assisted audit techniques to make sure that the computer programs do not have any unauthorized processing B) only detect fraud if it has been ongoing for a long period of time and leaves many different types of evidence C) investigate unusual relationships or patterns, conduct the audit properly, and report to management D) use test data to make sure that the computer programs are functioning as described by the client 18) 19) Auditing standards regarding the detection of illegal acts clearly state that the auditor provides A) assurance that they will be detected, if highly material. B) no assurance that they will be detected. C) the same reasonable assurance provided for other items. D) assurance that they will be detected, if material. 19) 3 Chapter 05 20) Which of the following is an example of a direct-effect illegal act that could be performed by a client? Violation of A) income tax laws and incorrect calculation of income taxes payable. B) employment equity laws for a large group of non-unionized employees. C) insider securities trading regulations by senior management. D) environmental protection laws for the production facility. 20) 21) What is one of the first things that an auditor would do upon discovering an illegal act at an audit client? A) call the police B) inform the Board of Directors C) resign from the audit D) consult with a lawyer 21) ESSAY. Write your answer in the space provided or on a separate sheet of paper. 22) A financial statement audit typically consists of three sections. Identify each of the three sections of an audit and discuss the major activities performed by the auditor in each section. 23) In May 2012, the firm of Chang and Crown (C&C) became the auditors of Laua Limited (LL) for the fiscal year ended December 31, 2011. LL's shareholders and Board approved the change from its previous audit firm on the recommendation of LL's senior management. One of the new board members is a bit confused about management's role with respect to the financial statements and thought that Chang and Crown would be preparing the financial statements. He was also glad that the auditors would be able to help prevent illegal acts and fraud. Required: A) Distinguish between management's responsibility and the auditor's responsibility for the financial statements under audit. B) Explain to the board member why the auditor does NOT help prevent illegal acts and fraud. What is the role of the auditor with respect to illegal acts and fraud? 24) Frank has come to you because he is worried about recovering the cost of his share of a law firm partnership. His partner, Jennifer, is exercising the "shotgun" clause in their partnership agreement, and wants to buy him out. Over the last two years, Frank and Jennifer have had numerous battles over the way that Frank handles his accounts receivable. Frank is lenient with his customers, and has converted many of his accounts into long term notes extending two and three years into the future. He is confident that these amounts are collectible, because every one of his clients continues to make small monthly payments. Frank thinks that Jennifer may have been hiding profits from him and collecting some of her accounts in cash. He wants you to audit the books so that he can figure out what the 'true' profits are and how much Jennifer should pay him for his share of the partnership. Required: A) Explain to Frank what you would be able to do during the audit engagement. B) List the management assertions that may have been violated. Justify your answer. 4 Chapter 05 25) Your PA firm has been auditing Ontario Pulp Company for three years. Two years ago, a letter was received from the provincial government informing them that they needed to reduce the level of contaminants that they were releasing into the air and into local waterways. The deadline for this reduction is three months from today. The letter indicates significant fines (several hundred thousand dollars) if the targets are not met. Alternatively, the Company will need to shut down operations until the targets are met. During your audit planning process management informed you that they have not taken any action, but plan to start construction of the new pollution devices next month. Required: Explain the impact the above situation has upon your audit planning process. 26) The controller who had been with Bianca Limited for six years was fired last month, allegedly for pocketing cash. Unfortunately, there was a fire in the accounting department the week before he was fired, destroying the accounting records, including the computer equipment and current backup disks. The only records available for the current year is a copy of the computer system that is a month old. There are also disks for the year ends going back three years. These were at the president's home, the place where the company kept archival records. Required: Explain how this situation might affect the audit process. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 27) At what point during the audit should the auditor conduct an independence threat analysis? A) prior to signing the audit report B) prior to the acceptance of the engagement C) after the audit evidence assessment and collection process D) after gathering sufficient knowledge of the client's business 27) 28) The decision to continue doing the audit of an existing client is A) less important than deciding whether or not to accept a new client. B) more important than deciding whether or not to accept a new client. C) only to be reconsidered if the client's operations or upper management has changed. D) as important as deciding whether or not to accept a new client. 28) 29) Your PA firm has just obtained a new client and you have been assigned the task of preparing the knowledge of business section of the file. Which of the following best describes the process of gathering the knowledge of business for a client? A) examining the legal expenses file for possible regulatory infractions B) gathering information about the industry and regulatory environment C) understanding the client's business, industry, and regulatory environment D) discussing processes and business objectives with company employees 29) 30) Analytical procedures are those that A) analyze the effect of management procedures on the accounting system. B) assess the overall reasonableness of account balances or other data. C) review the effectiveness of internal controls. D) evaluate the accuracy of the account balances. 30) 5 Chapter 05 31) Where the auditor has decided to rely upon internal controls, he or she will then A) proceed to expand the sample sizes in that area. B) eliminate the need to gather evidence in that area. C) test the effectiveness of the controls in that area. D) negotiate with management to determine which controls will be tested in that area. 31) 32) Tests of details of balances are specific procedures intended to A) identify the details of internal controls. B) test for monetary errors in the financial statements. C) prove that the accounts with material balances are classified correctly. D) prove that the trial balance is in balance. 32) 33) After the auditor has completed all the procedures, it is necessary to combine the information obtained to reach an overall conclusion as to whether the financial statements are fairly presented. This is a highly subjective process that relies heavily on A) the provincial institutes' Rules of Professional Conduct. B) generally accepted auditing standards. C) generally accepted accounting principles. D) the auditor's professional judgment. 33) ESSAY. Write your answer in the space provided or on a separate sheet of paper. 34) You have been assigned the in-charge -auditor for a new client, Beltair House. Beltair House is a non-profit charitable organization which operates a home for unwed mothers who have decided that they would like to keep their child. In the past, the organization had been almost fully funded by the provincial government. However, due to recent budget cut-backs, Beltair has to raise operating funds from public donations. Because of financial constraints, there is now only one full time manager, Joan Ng. Joan has the help of several volunteers, and the residents help out with the chores and with maintenance and cleaning. Ng has been able to arrange for a local food bank to provide a large portion of the food required for meals. Door-to-door canvassers have been able to raise money to keep the House going, but Ng is concerned that this will change. Required: Identify issues that you will need to consider that affect the risk of this audit engagement. 35) Sean Clem has done a review engagement and prepared the tax return for your web design business for the last five years. The books and records have always been well organized, although year end adjusting entries have been required. You do some of the accounting yourself and the rest of the accounting records are handled by your wife, who is also an employee of the business. This year, you would like to expand your business to provide ISP (internet service provider) services to your clients. This would entail you purchasing additional computer equipment and software. You are also considering hiring an additional employee (you currently have three), and you are looking at obtaining a loan for $100,000 from the bank. The bank says that you should have your records audited, but you are not sure what this will mean. Required: A) What would Sean say to you about the differences between an audit and a review? B) Identify the issues that Sean needs to consider during the planning of the audit. 6 Chapter 05 36) Pet Shop Ltd. is a large retail outlet with ten full time employees in addition to the owner. You dropped by on your way home one day to organize the audit planning process for the coming year, and noticed brand new terminals at the cashier's desk. One of the employees was having fun zapping inventory items. The owner teased him about the new laser scanning devices and told him to get to work to see which items needed to be ordered. It turns out that Pet Shop Ltd. has implemented a new point of sale computer system that is integrated with inventory. The last time you were there to buy dog food (about three months ago) there were old computer terminals that were no longer functional and recorded sales transactions manually in the sales journal. Required: List the three sections of the audit. For each section, explain how these new computer systems might affect the audit process. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 37) Prior to looking at the specific cycles, the auditor will first A) perform analytical review of specific accounts. B) perform a risk assessment for the audit of the organization. C) perform tests of controls on significant cycles. D) inquire and document corporate governance systems. 37) 38) Marianne is currently performing tests of controls on the presence of an employee code of conduct, the presence of a whistle blower line and on how management responded and implemented systematic penalties for instances where violations of the code of conduct existed. Marianne is currently evaluating the A) industry and business environment. B) entity-level controls. C) risk of fraud. D) client acceptance. 38) 39) Transaction cycles begin and end at A) the origin and final disposition of the company. B) the balance sheet date. C) January 1 and December 31. D) the beginning and end of the fiscal period. 39) 40) For the most part, auditors treat each transaction cycle A) separately as the audit is being performed. B) as a separate business unit with different audit teams. C) as a joint venture with other clients in the same industry. D) as an interrelated unit with the other cycles throughout the entire audit. 40) 41) Often, numerous classes of transactions affect the ending balance of a particular general ledger account. This is handled during the audit engagement by A) ensuring that tests are conducted for each class of transactions. B) testing only the ending balance, as this is the significant amount on the financial statements. C) using a combination of assurance for each class of transactions and for the ending balance. D) obtaining a high level of assurance for at least one of the transaction types. 41) 7 Chapter 05 ESSAY. Write your answer in the space provided or on a separate sheet of paper. 42) Your PA firm audits the Barney Bloke Parts company, which manufactures plastic bumpers and other automobile parts in eight factories scattered across southern Ontario. The company has a December year end. It is now November 14. The planning file indicates that internal controls in the accounts receivable area are poor, as there has been significant employee turnover. A review of the prior year's working paper file indicates that there was a poor response to the accounts receivable and accounts payable confirmation requests. There were several errors in inventory pricing and problems with obsolescence. Required: List the financial statement cycles that need to be tested. For each cycle, identify at least one transaction that needs to be examined. For that transaction, identify a management assertion that may have a high risk of error associated with it and explain why you believe the risk of error is high. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 43) Management assertions are A) explicitly expressed representations about the financial statements. B) provided to the auditor in the engagement letter, but are not disclosed on the financial statements. C) stated in the footnotes to the financial statements. D) implied or expressed representations about the accounts in the financial statements. 43) 44) Management assertions are A) indirectly related to auditing standards. B) directly related to auditing standards. C) directly related to accounting standards. D) indirectly related to accounting standards. 44) 45) Frankinfurter Limited decided that it wanted to improve earnings. To do this, it understated its expenses by omitting unpaid expenses from the accrued liabilities account at year end. Which management assertion has been violated? A) completeness B) existence C) disclosure D) rights and obligations 45) 46) Gabori Company would like to pay less income tax this year. It decided that it could do this by understating its inventory values, increasing costs of goods sold. This was done by deliberately pricing the inventory at incorrect amounts, so that it would be shown at a lower value than it was really worth (for example, items worth five dollars each were shown at fifty cents each). Which management assertion has been violated? A) accuracy B) statement presentation C) valuation D) completeness 46) 47) If the purchase of a long-term note receivable is included as cost of goods sold, there is a violation of the A) timing objective. B) completeness objective. C) classification objective. D) existence objective. 47) 8 Chapter 05 48) When considering each material type (or class) of transactions during the audit, which general transaction-related audit objectives are assessed during the audit? A) all five transaction-related audit objectives B) primarily completeness, occurrence and accuracy, since this is where most errors occur C) those transaction-related audit objectives where there are poor internal controls D) those transaction-related audit objectives where there is the highest risk of error 48) 49) XYZ Brick Company decided to inflate sales by recording fictitious sales. Several non-existent clients were created and the sales were added into the sales journal throughout the year. The general transaction-related audit objective affected by these actions is A) occurrence. B) completeness. C) accuracy. D) posting and summarization. 49) 50) Georgina was working as the part time accountant for three small businesses. Whenever she could, she pocketed cash and neglected to record the sale in the sales system. The general transaction-related audit objective affected by her actions is A) occurrence. B) completeness. C) accuracy. D) posting and summarization. 50) 51) Flagpole Company Limited recently upgraded its accounting software due to changes in the payroll income tax rates. Unfortunately, there was an error in the software, and income tax was calculated incorrectly. The general transaction-related audit objective affected by these errors is A) occurrence. B) completeness. C) accuracy. D) posting and summarization. 51) 52) Big Bank had a program failure occur on Sunday night due to a maintenance program error. Transaction posting was interrupted, with several errors occurring in posting to the master files. Although sales had been posted to the general ledger, individual accounts were not recorded until subsequent days. The general transaction-related audit objective affected by this activity is A) classification. B) occurrence. C) timing. D) accuracy. 52) 53) In testing for cutoff, the objective is to determine A) that no transactions from the prior period are included in the current period's balances. B) whether transactions are recorded in the proper period. C) whether all of the current period's transactions are recorded. D) that no transactions of the current period have been delayed and recorded in a future period. 53) 54) Heavy Manufacturing Company is in the business of making steel plates, forming heavy metal slabs and drilling and scoring metals. Recently, it upgraded many of its forming machines. Fortunately, the company was able to sell its old equipment at a reasonable price. The effect was that sales for the quarter are substantially improved over the same period in the prior year. The general transaction-related audit objective affected by this activity is A) timing. B) classification. C) accuracy. D) occurrence. 54) 9 Chapter 05 55) Balance-related audit objectives are applied to which types of general ledger accounts? A) income statement accounts only B) balance sheet accounts only C) balance sheet accounts and some income statement accounts D) accounts that affect the cash flow statement 55) 56) Heavy Manufacturing Company is in the business of making steel plates, forming heavy metal slabs and drilling and scoring metals. Recently, it upgraded many of its forming machines. There were five machines purchased on four different invoices. Unfortunately, one of the invoices was recorded twice, resulting in five invoices being recorded. The general balance -related audit objective affected by this activity is A) existence. B) completeness. C) classification. D) accuracy. 56) 57) Camilla is preparing the audit program for the inventory of Summers, a large department store. Camilla listed "select a sample of invoices from suppliers to verify that the risks and rewards of the inventory were transferred to Summers". Camilla is concerned that some of the inventory in the store might be on consignment. The account balance related objective that Camilla is concerned about is A) rights and obligation (ownership). B) accuracy. C) existence. D) valuation. 57) 58) The sole shareholder of Jade Company had a contractor pave the parking lot at the company building, and also pave the driveway of his home. Both paving jobs were billed to the company on a single invoice. The general balance-related audit objective affected by this activity is A) existence. B) rights and obligations. C) completeness. D) allocation. 58) 59) The Big Insurance Company implemented a new computer system to track and record insurance premiums receivable. The program automatically prints invoices and sends them to customers when premiums are due. Due to a program error, a whole series of invoices were included in sales but not in accounts receivable. The general balance-related audit objective affected by this activity is A) completeness. B) existence. C) accuracy. D) classification. 59) 60) Radio Supplies Limited sells parts and components to organizations that repair radios and other forms of audio equipment. It has many parts on its inventory listing at cost that were purchased up to fifteen years ago. Some of these parts have not seen any movement in the last ten years. The general balance-related audit objective affected by this activity is A) existence. B) accuracy. C) completeness. D) valuation. 60) 61) To help improve the cash balance on the financial statements, the controller recorded several deposits from early January in the month of December. The general balance-related audit objective affected by this activity is A) allocation timing. B) existence. C) accuracy. D) classification. 61) 10 Chapter 05 62) Jane's employer purchased a new calculator this month. When Jane added up the sales for the day, she was a bit confused with the new calculator and made numerous adding errors. The daily sales total for the next week was incorrectly posted to the general ledger. The general balance -related audit objective affected by this activity is A) cutoff. B) existence. C) accuracy (of allocation). D) classification. 62) 63) Formamould Inc. sells plastic moulds to a variety of companies. Some moulds are custom made and cost thousands of dollars. To help customers finance these purchases, Formamould uses a variety of methods, such as payment terms stretched over three years, delayed payment, and pay-as-you-produce models tailored to the individual customer's needs. The outstanding balance is included in current accounts receivable. The general balance-related audit objective affected by this activity is A) existence. B) accuracy. C) allocation to accounts. D) completeness. 63) 11 Chapter 05 ESSAY. Write your answer in the space provided or on a separate sheet of paper. 64) In the following table, there are listed common audit objectives for accounts payable or purchases. For each procedure, list the management assertion, and the related general audit objective. State whether the audit objective is transaction-related or balance -related. Accounts payable or purchases Management objectives assertion 1. Accounts payable in the accounts payable trial balance are for valid purchases. 2. Recorded acquisitions are for goods and services received, consistent with the best interests of the client. 3. All acquisition transactions are recorded. 4. Recorded acquisition transactions are recorded at the correct amount. 5. Acquisition transactions are correctly allocated between current and long-term. 6. Acquisition transactions are recorded on the correct dates. 7. Purchase transactions are properly included in the vendor and inventory master files, and are correctly posted to the general ledger. 8. The accounts payable recorded in liabilities are obligations of the company. Audit objective Transaction Balance-related? related? (Y/N) (Y/N) 65) Bratlett Company has purchased all of the shares of another company, but does not want to consolidate its financial statements. Management has drafted a rather long and confusing note to the financial statements that describes the transaction that took place briefly, and states that debt has been acquired in a foreign currency. In your view, the transaction, its effect on the company and the accounts have not properly been disclosed. Required: List the audit objectives about presentation and disclosure that have been affected and explain how they are affected. 12 Answer Key Testname: UNTITLED1 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 16) 17) 18) 19) 20) 21) 22) B C D D D D C A D C D D B A C C D C B A D I: Risk assessment. In this section, the auditor obtains an understanding of the client's business and industry. In addition, the auditor obtains an understanding of the client's internal control structure and makes a preliminary assessment of control risk. The planning takes place in this phase by developing a strategic audit approach overall and by cycle. II: Risk Response. In this section, the auditor develops audit programs and tests internal controls. The auditor also performs substantive tests and assesses the impact upon the risk of material misstatements. The results of the tests are evaluated and risk is reassessed if required. Final evidence and documentation is gathered. III: Reporting. In this section, the auditor communicates with the audit committee and management as required. A final quality control review is also performed before the report is issued. 23) A) Management: Management is responsible for adopting appropriate accounting policies, maintaining adequate internal control, and making fair representations in the financial statements. Auditor: The auditor is required to plan and perform the audit with an attitude of professional skepticism, recognizing that circumstances may exist that cause the financial statements to be materially misstated. B) Since management is responsible for maintaining internal control, it is management's responsibility to design and monitor internal controls to help prevent and detect illegal acts and fraud. The auditor considers fraud and illegal acts in the context of whether they have a material effect upon the financial statements. Accordingly, the auditor is responsible for obtaining reasonable assurance that the financial statements are free of material error, which includes illegal acts that may have a material indirect effect on the financial statements, and material fraud, which may have a direct effect on the financial statements. Audits cannot be expected to provide the same degree of assurance for the detection of material management fraud, since concealment by management makes fraud more difficult for auditors to find. 13 Answer Key Testname: UNTITLED1 24) A) ∙ The purpose of an audit is to provide reasonable assurance that the financial statements are free of material error or fraud. ∙ The financial statements may not be 100% accurate. ∙ Since management fraud is difficult to detect, it would be impossible for you to quantify the amount of money that Jennifer has taken, if any. ∙ Frank might not be happy with the audit results, because one of the things that you would have to do would be to assess the collectability of the accounts receivable. B) Existence: some accounts receivable may not be recorded, if Jennifer took funds. Completeness: some sales may not have been recorded, if Jennifer took the funds. Valuation: accounts receivable may be overvalued for Frank's receivables, if they are not collectible. 25) 26) 27) 28) 29) 30) 31) 32) 33) Classification: If some receivables are long term rather than current, they may be incorrectly recorded as current in the financial statements. ∙ The above situation seems to indicate that management does not take the letter from the provincial government seriously. ∙ This could affect the ability of the company to continue as a going concern, and as a minimum would require disclosure in the financial statements, with possibly a qualification. ∙ The audit planning process would need to include gathering knowledge about other companies in this sector—have they also received such letters and have they complied? Have there been charges laid by the provinces where compliance did not occur? The answers to these questions will help assess the potential impact upon the client. ∙ The auditor should also look at any proposals that the company has received about implementing the anti-pollution equipment to see how quickly it can be implemented. ∙ The negative attitude about the anti-pollution equipment may also apply to other areas of the business. ∙ The auditor will need to assess the quality of corporate governance and of management integrity and assess the effect upon the engagement. Why has management really decided to wait so long? ∙ The absence of records will make it difficult to complete the audit; management actions with respect to reconstructing the one month of lost records will need to be assessed and the potential for material error considered. ∙ If records cannot be obtained from alternative sources (e.g. customers and suppliers and financial institutions) then a qualified audit report may be required. ∙ Due to the possible management fraud, it will be necessary to conduct extensive additional testing; it may not be possible to quantify the amount of the fraud (if any). ∙ It will be necessary to look at the quality of internal controls—if this fraud was possible, then other errors and irregularities could also have occurred at the business. ∙ It will not be possible to conduct tests of internal controls or tests of details of balances if there are no records. B D C B C B D 14 Answer Key Testname: UNTITLED1 34) Factors impacting risk include: ∙ a first time audit engagement (increases inherent risk) ∙ the reduction in government funding, affecting the going concern of the House ∙ numerous financial statement users (e.g. government, donors) ∙ cash collected by volunteers is subject to theft (receipts may not be issued for all donations —this may result in a need to qualify the audit report) ∙ a lack of segregation of duties (there is only one employee) ∙ there may be inexperienced people recording accounting transactions, leading to the potential for more errors (especially if accounting transactions are recorded by volunteers) ∙ since the food bank is providing a large portion of the food, this donation may need to be recorded at fair market value (need to determine how it is being recorded, and whether there are any additional services that need to be recorded) ∙ the lack of volunteers will hinder the canvassing to raise money and prevent the chores they perform from getting done (which threatens the viability and continuity of the charity). 35) A) ∙ An audit has a higher degree of assurance, so additional work will be required. ∙ This will result in a higher fee for the work completed. ∙ It will be important to clearly document the role of the auditor and management. ∙ The report may be qualified if it is not possible to audit the opening balances. ∙ It may be possible to continue to have a review engagement rather than an audit if the owner (you) has other collateral to offer—then the bank would not require such a high level of assurance. B) ∙ This is a first audit engagement, so additional time will be needed to develop a client risk profile, document knowledge of business and knowledge of the industry. ∙ There is a need to conduct an independence threat analysis. ∙ Since the bank will be requiring the audit to possibly review the collectability of the loan, this increases the risk of the engagement. ∙ Internal controls will be poor since records are kept by a husband and wife team. ∙ Risks of management override or management deception are high because of the incentive to obtain the bank loan. ∙ Any bank covenants imposed on the new loan and the ability of the client to meet them. 15 Answer Key Testname: UNTITLED1 36) Risk assessment: ∙ The auditor will need to gather information about how internal controls have changed with the use of the new computer system. ∙ Since there are two different systems of internal control, the audit will need to consider both systems during the risk assessment, planning and execution phases. ∙ Depending upon the nature of the information that was stored in the old systems, the auditor may need to conduct a conversion audit. Risk Response: ∙ The controls will be different, so the auditor will need to design different tests of controls for each of the two systems. The audit programs will need to be updated. ∙ The system conversion will also have to be tested to ensure that data integrity was not compromised. ∙ Particular attention should also be given to the inventory and sales account. Given the scanning of items by the employee, it is possible that this recorded false sales and also recorded false decreases in inventory. ∙ Analytical procedures will need to take account of the fact that there may be a large shift in amounts in the accounts (for example, there may be capital expenditures for the computer equipment and software; inventory amounts may be lower if inventory management has improved with the new system). Reporting: ∙ The audit report will be prepared and total evidence gathered in the risk response section will be analyzed to determine if there is a material misstatement. An audit opinion will be formed based on the results and the audit report can be issued. 37) D 38) B 39) A 40) A 41) C 42) Transaction to Management assertion at risk with Financial statement cycle be tested reason Cutoff: new employees may record the transaction in the wrong period or on Sales and collection Cash receipts the wrong date Cash Classification: new employees may Acquisition and payment disbursement post transactions to the wrong account Payroll Accuracy: employees could be paid Human resources and payroll disbursement the wrong wage rate Accuracy: inventory issued might be Inventory recorded at the wrong cost or wrong Inventory and distribution issuance sales price Capital acquisition and Cutoff: payments may be recorded in repayment Note payment the wrong period or on the wrong date [Note: Students may select other transactions that are at high risk. Above is a representative response.] 43) D 44) C 45) A 46) A 47) C 48) A 49) A 50) B 51) C 16 Answer Key Testname: UNTITLED1 52) 53) 54) 55) 56) 57) 58) 59) 60) 61) 62) 63) 64) D B B C A A B A D A C C Accounts payable or purchases objectives 1. Accounts payable in the accounts payable trial balance are for valid purchases. 2. Recorded acquisitions are for goods and services received, consistent with the best interests of the client. 3. All acquisition transactions are recorded. 4. Recorded acquisition transactions are recorded at the correct amount. 5. Acquisition transactions are correctly allocated between current and long-term. 6. Acquisition transactions are recorded on the correct dates. 7. Purchase transactions are properly included in the vendor and inventory master files, and are correctly posted to the general ledger. 8. The accounts payable recorded in liabilities are obligations of the company. Management assertion Audit objective Existence Existence Occurrence Occurrence Transaction Balance-related? related? (Y/N) (Y/N) Y Y Completeness Completeness Y Accuracy Accuracy Y Classification Classification Y Cutoff Cutoff Y Classification Classification Y Rights and obligations Rights and obligations Y 65) Rights and obligations: Assets and liabilities belonging to the consolidated entity, such as the nature of the debt and of the new entity, will not be properly disclosed in the financial statements. Completeness: Disclosures about the debt and the consolidation are inadequate. Accuracy: Account balances shown in the financial statements are inaccurate because they are not consolidated. Valuation: Accounts such as goodwill may be inaccurately valued. Classification: Amounts are shown in the incorrect accounts since they are not consolidated. Understandability: The economic events that have taken place (the purchase, the financing and the combined results of operations) are not fully disclosed in an understandable way. 17