Syllabus - B. Korcan Ak

advertisement

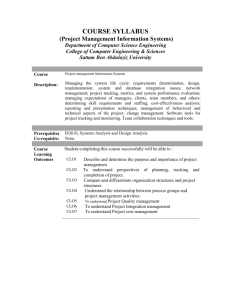

Introduction to Financial Accounting – UGBA 102A

Professor: B. Korcan Ak

Email: korcan_ak@haas.berkeley.edu

Office Hours: MW 11:00am-12:00pm or by appointment

Office: F502

Tel: (510)705-2259

Course Dates: May 26, 2015 to July 1, 2015

Lecture Time and Location: MW 8:00-10:30am C110-Cheit

GSI: SEI KYU SONG

GSI Email: seikyu_song@berkeley.edu

GSI – Office Hours:. Tu 10:30-11:30am F422

Discussion Time and Location: TuTh 8:00-10:30am C110

Course Description

Catalog Description: The identification, measurement, and reporting of financial

effects of events on enterprises, with a particular emphasis on business organization.

Preparation and interpretation of balance sheets, income statements, and statements

of cash flows.

Objective

This required core course in Financial Accounting covers the accounting principles

and methods (GAAP) used in preparing the four principal financial statements – the

balance sheet, the income statement, the statement of stockholders’ equity and the

statement of cash flow.

This course emphasizes the rationale for, and implications of the fundamental

accounting concepts. We use problems to enhance the learning of these concepts

and to bridge the gap between the preparation of financial statements and their

interpretation and use in various decision situations.

Textbook (required)

Financial Accounting (8th Edition)

by Libby, Libby, Short

Publisher: McGraw-Hill Irwin

ISBN13: 978-0-07-802555-6

1

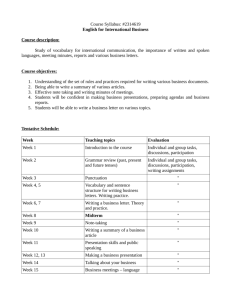

Grading

Your grade will be determined in the following way:

Final Grade = Max {Grade Based on Option1, Grade Based on Option2}

Problem-Sets

Cases

Quizzes

Midterm

Final

Option 1

Option 2

15%

5%

15%

5%

20%

10%

20%

30%

30%

50%

Letter grades will be awarded based on relative performance within the class (Haas

Curve).

•

Examinations

o Quizzes

There are 3 quizzes planned. They will be closed book and will

comprehensively cover all of the materials we have studied. You can bring a

calculator, however devices that can store data or transmit a wireless signal

are not allowed.

o Midterm

The midterm will take place on June 10, 2015 during the lecture. The

midterm will include Chapters 1, 2, 3, 6, and 7. The midterm will be closed

book. You can bring a calculator, however devices that can store data or

transmit a wireless signal are not allowed.

o Final

The final will take place on July 1, 2015 during the lecture. The final will be

comprehensive, covering all material we have studied. The final will be

closed book. You can bring a calculator, however devices that can store data

or transmit a wireless signal are not allowed.

2

All the examinations are mandatory unless a student is excused, ahead of time, for a

documented illness or University-approved absence. There are no exceptions.

Students who miss an exam and have not been previously excused will receive a

score of zero.

•

Assignments

For accounting, there is really no other way to learn than to work through as many

problems as possible yourself. For this reason the course has many problem-sets

and case assignments. These are a key element in ensuring you get the most out of

this course.

o Problem Sets (PS)

Problem sets should be submitted through bcourses before the section when

they are due. Problem sets will be graded based on effort not correctness.

Each problem set gets an equal weight, and there are a total of 4 problem

sets. You may work together on problem sets, but each student must write up

and submit the assignments individually.

o Cases

There are a total of 5 Cases; you need to submit a write-up for each case

before beginning of each lecture when they are due. The cases will be based

on material you have not seen previously. Given this, I am looking for effort

and imaginative thinking as opposed to the right answer. You may work

together, but each student must write up and submit the assignments

individually.

3

Academic Honesty

Any cheating, copying or other academic dishonesty is strongly discouraged. The

punishment for academic dishonesty is (minimum) a zero on the assignment or (for

serious cases, such as cheating on a closed book examination) expulsion from the

course with an ‘F’ grade.

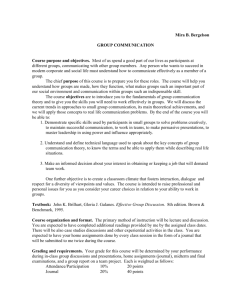

Berkeley-Haas Defining Principles

We will try to study the course in line with the defining principles of Haas which are:

•

Question the Status Quo

•

Confidence without Attitude

•

Students Always

•

Beyond Yourself

For more information on the Berkeley-Haas defining principles please visit

http://www.haas.berkeley.edu/strategicplan/culture/

Feedback

I encourage you to provide feedback on class topics, content, and cases. I appreciate

any concerns, questions, or opinions regarding the course. Participants’ feedback is

critical to the improvement of the course over time.

Instructor Bio

B. Korcan AK is a PhD candidate in Accounting at the Haas School of Business at the

University of California, Berkeley. He gained his Bachelor’s in Management

Engineering from Istanbul Technical University in 2009. His research interests

include: Measurement of Financial Distress, Implications of Financial Distress on

Firm Performance, Financial Statement Analysis and Valuation, and Sports Finance.

4

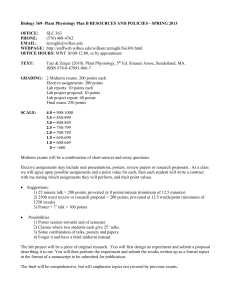

Schedule:

Week

1

2

3

4

5

6

Date

26-May

27-May

L

Topic

Introduction to Financial Accounting and Review of Financial Statements

Assignments

Read Chapter 1 - No Assignments

L

Chapter 2 - Investing and Financial Decisions and the Accounting System

Discussion: P2-5, P2-6

28-May

D

Practice Problems for Chapters 1 & 2. Review P2-5 & P2-6.

PS-1*: E1-2, E1-5, E1-11, E2-1, E2-5, E2-12

1-Jun

L

Chapter 3 - Operating Decision and the Accounting System,

Case-1*: M3-1 to M3-11

2-Jun

D

QUIZ 1 – Review Quiz 1. Review Case 1.

3-Jun

L

Chapter 6 - Reporting and Interpreting Sales Revenue, Receivables, and Cash

Discussion: CP6-2 & CP6-4

4-Jun

D

Practice Problems for Chapter 6.

PS-2*: MC6-2, MC6-9, M6-1, M6-4, P6-3

8-Jun

L

Chapter 7 - Reporting and Interpreting Cost of Goods Sold and Inventory

Case-2*: P7-2

9-Jun

D

Practice Midterm, Review Case 2.

10-Jun

L

MIDTERM

11-Jun

D

15-Jun

L

16-Jun

D

Review of Midterm (Optional)

Chapter 4 - Adjustments, Financial Statements, and the Quality of Earnings

Chapter 5 - Communicating and Interpreting Accounting Information

(Guest Speaker)

Review Case 3. Practice Problems for Chapters 4 & 5.

17-Jun

L

Chapter 8 - Reporting and Interpreting Property, Plant and Equipment;

Intangibles; and Natural Resources

18-Jun

D

QUIZ 2 – Review Quiz 2. Review P8-3 & E8-5.

22-Jun

L

Chapter 9 - Reporting and Interpreting Liabilities

Chapter 11 - Reporting and Interpreting Owners' Equity,

23-Jun

D

Review Case 4. Practice Problems for Chapters 9 & 11.

24-Jun

L

Chapter 12 - Statement of Cash Flows

25-Jun

D

QUIZ 3 - Review Quiz 3. Review E12-1, E12-2, E12-5, E12-16.

29-Jun

L

Chapter 13 - Analyzing Financial Statements

30-Jun

D

Practice Final. Review Case 5.

1-Jul

L

FINAL

Discussion: P4-2

PS-3*: P4-4, E5-2, E5-5, E5-12

Case-3*: P8-3 & E8-5

Case-4*: P9-11 & P11-5

PS-4*: MC9-4, M9-2, M9-4, M11-3, M11-5,

M11-7

Discussion: E12-1, E12-2, E12-5, E1216

Case-5*: P13-10

Bold Lettering – Lectures

Italic Lettering – Discussion Sections

5