INVESTMENT

OPPORTUNITIES IN BRAZIL

AUGUST 2014

“Overall the firm’s success is based on oldfashioned service excellence; it has a reputation

among clients for providing the most flexible,

efficient and personalized of both service style

and pricing of any of its rivals at the top of the

market.”

Latin Lawyer 250

“What sets them apart is their commercial

vision of our business, projects and priorities.

Their technical support is excellent and the

team is very versatile.”

Chambers Latin America

CONTENTS

3

3

4

4

5

OVERVIEW AND TRENDS

Country overview

Growth Acceleration Program Phase 2

Special Government Procurement Policy

Tourism

7

7

11

18

20

22

23

24

ONGOING AND ANNOUNCED INVESTMENTS

Power

Transportation

Ports

Oil & Gas

Mining

Sanitation

Hospitals

25

25

26

RIO DE JANEIRO: BRAZIL'S LARGEST INVESTMENT HUB

Valuable recent data

Ongoing projects

27

CONTACT AND REFERENCES

31

VEIRANO ADVOGADOS

INVESTMENT OPPORTUNITIES IN BRAZIL

1

2

INVESTMENT OPPORTUNITIES IN BRAZIL

OVERVIEW AND TRENDS

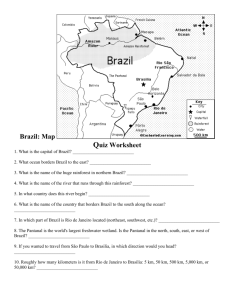

COUNTRY OVERVIEW

th

th

Brazil is currently the world's 7 largest economy and is predicted to become the 5 largest over the coming

decade. Stable economic growth and relatively low inflation provide solid economic foundations for Brazil and

make it one of the most attractive investment markets in Latin America.

As an example, Brazil experienced record levels of foreign direct investment (FDI) in 2011 (US$ 66.7 billion),

1

th

2012 (US$ 65.2 billion) and 2013 (US$ 64.045 billion) . Specifically in 2013, Brazil was ranked 7 on the list of

2

3

top FDI host economies , positioned between Canada and Singapore .

Along the past 10 years, Brazil has experienced a 240% growth in FDI:

Foreign direct investiment (FDI) in Brazil

70

66

65

64

60

50

40

34

FDI (US$ billion)

30

20

48

45

% in GDP

25

18

15

18

10

3

1,9

1,9

2,8

3,4

1,7

1,9

3

2,9

2,9

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

0

Source: Central Bank of Brazil, Itaú BBA.

Excellent investment prospects are forecast for the near future, associated with:

The World Cup in 2014, which attracted relevant investments and may have helped raise Brazil's profile as

a tourist destination, as well as the Olympic Games in 2016, which continue to provide significant

investment opportunities;

Phase 2 of the Federal Government's Growth Acceleration Program (“PAC 2”), which involves large-scale

public investment in priority projects;

The auctioning of infrastructure assets such as railways, highways, ports and airports, as part of the

Government's Infrastructure and Logistics Investment Program, which provides new investment

opportunities to the private sector via concession contracts.

INVESTMENT OPPORTUNITIES IN BRAZIL

3

GROWTH ACCELERATION PROGRAM PHASE 2

The Federal Government originally launched the Growth Acceleration Program (“PAC”) in 2007 to increase

public investment in specific infrastructure projects, as well as to insure high growth rates without generating

inflationary pressures. Phase 2 of the program (“PAC 2”) was launched in 2011 and, similarly to the original, is

focused on increased investment in housing, sanitation, transport and energy projects.

The PAC 2 has encompassed to date:

4

Investments of approximately US$ 350.9 billion between 2011 and 2014 ;

5

6

Investments in the energy (US$ 135 billion ), logistics (US$ 54.5 billion ), social and urban (US$ 189.5

7

billion ) sectors;

Investment of 76.1% of the total budget allocated, with completion rate of 82.3% of the planned projects.

The 10 largest projecst of the PAC are:

Total investment

of approximately

US$ 17.5 billion

Hydroeletric

Power Plant Belo

Monte

Total investment

of approximately

US$ 14 billion

Rio de Janeiro

Petrochemical

Complex

Total investment

of approximately

US$ 13 billion

Hydroelectric

Power Plant Santo

Antonio

Total investment

of approximately

US$ 13 billion

Papa Terra Oil

Field

Hydroeletric

Power Plant Jirau

Andra 3 Nuclear

Power Plant

Total investment

of approximately

US$ 6 billion

Total investment

of approximately

US$ 6 billion

Total investment

of approximately

US$ 6 billion

Conversion of

Refinery Pres.

Getulio Vargas

Total investment

of approximately

US$ 4 billion

South Reach of

North-South

Railway

Total investment

of approximately

US$ 3.4 billion

Premium Refinery

Abreu e Lima

Refinery

Total investment

of approximately

US$ 20.5 billion

SPECIAL GOVERNMENT PROCUREMENT POLICY

Established by Law 12,462/2011, the Special Government Procurement Policy (“RDC”) will be applied in

specific projects, such as the World Cup, the Olympic Games and the necessary infrastructure to support both

events. The RDC also applies to projects listed in the PAC 2 and speeds up (simplifies) procurement by the

Federal Government.

Objectives of the RDC:

Increase efficiency in government procurement and competition among bidders;

Promote the exchange of experience and technology in search of in search of cost efficiencies benefiting

the public sector;

Encourage technological innovation;

Ensure the equal treatment of bidders and selection of proposals most advantageous to the public interest.

4

INVESTMENT OPPORTUNITIES IN BRAZIL

TOURISM

Significant investment was made in tourism as a result of the recent World Cup, as evidenced in the following

chart that shows the recent increase in hotel capacity across the country.

Guest capacity (rooms) in major Brazilian cities

200

180

1%

3

160

13%

48%

11%

11%

38%

17%

4%

28%

14%

Increase (%)

16

140

120

Offer increase in

2014 (thousands)

100

23

80

Current offer

(thousands)

7

6

60

15

8

2

11

5

40

20

170

126

48

62

54

40

46

51

40

38

Brasília

Recife

Natal

0

São Paulo Rio de

Belo

Porto

Janeiro Horizonte Alegre

Salvador Fortaleza Curitiba

8

Between January and October 2013, tourism revenue in Brazil reached US$ 5.6 billion , the largest amount in

the country's history. The country hosted a record 6 million foreigners during this period.

9

Currently, the tourism industry represents 3.6% of the Brazilian GDP .

INVESTMENT OPPORTUNITIES IN BRAZIL

5

6

INVESTMENT OPPORTUNITIES IN BRAZIL

ONGOING AND ANNOUNCED INVESTMENTS

POWER

GENERATION

The National Agency of Electric Energy (ANEEL) usually promotes at least three auctions per year, where

interested generation companies bid for long-term power purchase agreements (“PPAs”) with Brazilian

distribution companies in connection with new power plant projects. These auctions are:

Back-up Auction - 20-year PPAs for wind farms and biomass-fueled thermoelectric power plants, aimed at

providing back-up energy for the Brazilian Interconnected Power Grid (“SIN”). Energy must be delivered

within one to three years from the auction date;

Regular A-3 Auction - 20-year PPAs for wind farms, biomass and natural gas plants and 30-year PPAs for

small hydro plants to be auctioned. Other thermoelectric sources are allowed from time to time. Energy

must be delivered within three years from the auction date; and

Regular A-5 Auction - 30-year PPAs for small and large hydro plants. Thermoelectric plants may be

allowed depending on availability of hydro plants to be auctioned. Energy must be delivered within five

years from the auction date.

Following these auctions, PPAs are entered into between power generators and the Energy Commercialization

Chamber (“CCEE”), in case of back-up auctions, or a pool of energy distributors, in case of regular auctions, for

the supply of energy under the relevant regulatory framework.

The Federal Government has announced that about 7 auctions for the supply of energy from new power

10

generation facilities will take place in 2014 , representing a total installed capacity of at least 6,000 MW of

11

new energy .

The first generation auction occurred on March for the Três Irmãos Hydroelectric Power Plant, in São Paulo.

An A-3 auction happened in July. For the second semester, two A-5 auctions, one A-3 auction, one A-1 auction

12

and one energy reserve auction are expected to take place .

Among those, the first ever power auction dedicated to energy from solar photovoltaic generation projects is

scheduled to happen on October. Winners will enter into 20-year term PPAs under back-up energy rules, as

referred above. The market has big expectations for this auction, which is expected to create a new era for the

solar power generation industry in Brazil.

As an incentive for the new projects, the National Bank for Economic and Social Development (BNDES) has

allocated sources of funds and defined new rules for financing of solar photovoltaic projects winning the

auction in October.

INVESTMENT OPPORTUNITIES IN BRAZIL

7

The financial conditions shall be those of BNDES Finem (financing for enterprises program) and Fundo Clima

(climate fund) programs, as according to the source of the funds. The financial cost shall be 0.1% per annum

(Fundo Clima) or according to TJLP (long-term interest rate). The long-term interest rate (Finem) and BNDE’S

basic remuneration shall be 0.9% (Fundo Clima) or 1% per annum (Finem). The risk fee shall be in the 0.42.87% per annum range, according to the bank’s risk assessment. In case the financing is granted by a bank

accredited by BNDES, the basic remuneration shall be negotiated directly between the client and the bank.

The source of funds, which can be a combination of sources, and funding participation from BNDES shall

consider percentage limits applicable to certain project components, as well as the nationalization index of its

equipment, pursuant to a special enrollment methodology created by the bank.

TRANSMISSION

At the beginning of 2014, ANEEL announced that the 2014 schedule for transmission line auctions would be

very intense and with expectations of R$ 10 billion of investments in the first semester alone.

The Belo Monte transmission line auction was held on February and the winning bidder was the consortium

composed by Chinese company State Grid Brazil Holding SA (51%) and Brazilian companies Eletronorte

(24.5%) and Furnas (24.5%), both controlled by Eletrobras. The Belo Monte transmission line is expected to

require an investment of R$ 5.1 billion for its construction.

13

ANEEL also plans an auction for a second Belo Monte transmission line that will reach Rio de Janeiro for the

second semester of 2014, although this may be postponed to next year.

14

A further auction is proposed for October for five transmission lots which previously received a no-show

from bidders in the auction held on May, but should involve a total investment of R$ 1 billion.

As a reference for participation in future actions, the following table outlines the main requirements to

participate in a sample of recent power generation and transmission sector auctions. In our experience, the

requirements tend to be similar every year.

Auction

Foreign companies /

consortium allowed

Technical

qualification

Minimum amount

of assets

Guarantees required

Leilão de Reserva 2011

Foreign companies with a

winning bid are required to

incorporate a local specific

purpose company to

receive the necessary

authorization to produce

energy.

A generation project declared

as technically qualified by

Public Energetic Research

Company (“EPE”); declaration

nominating a technical

representative to ANEEL; and

a timeline for implementation

of the investment (only for

engagements without

granting).

The company must have a minimum net

worth of 10% of the investments’ total

amount.

Guarantee of participation:

1% of the amount of investment, for

engagements without granting the

concession or authorization.

Closed: May 19, 2011

(No auction was held in

2012)

A consortium incorporated

by Brazilian and foreign

companies must always be

led by the Brazilian

company.

8

Note: An analysis of the

qualifications of the company

only occurs after the auction

and disclosure of the winning

bid.

For consortiums, each participant must

contribute to the minimum net worth

proportionate to their participation.

Performance guarantee:

5% of the investment amount declared

to the EPE.

Such guarantee must be formalized by

means of: cash bond; performance

bond; bank guarantee; or government

bond.

INVESTMENT OPPORTUNITIES IN BRAZIL

Auction

Foreign companies /

consortium allowed

Technical

qualification

Minimum amount

of assets

Guarantees required

Leilão A-3 2012

(Auction cancelled)

Foreign companies with a

winning bid are required to

incorporate a local specific

purpose company to

receive the necessary

authorization to produce

energy.

A generation project declared

as technically qualified by

Public Energetic Research

Company (“EPE”); declaration

nominating a technical

representative to ANEEL; and

a timeline for implementation

of the investment

The company must have a minimum net

worth of 10% of the investments’ total

amount.

For Sellers - Guarantee of participation:

1% of the amount of investment, for

engagements without granting the

concession or authorization and R$

2,000 for each energy lot, for

engagements with granting of

concession.

Leilão A-5 2013

Closed: August 29, 2013

Auction for energy from

new generation projects

(hydro, wind and solar)

Closed: November 18, 2013

Leilão A-5 2013

A consortium incorporated

by Brazilian and foreign

companies must always be

led by the Brazilian

company.

For consortiums, each participant must

contribute to the minimum net worth

proportionate to their participation.

For Buyers - Financial guarantee:

R$ 200 per power lot.

Note: An analysis of the

qualifications of the company

only occurs after the auction

and disclosure of the winning

bid.

Such guarantee must be formalized by

means of: cash bond; performance

bond; bank guarantee; or government

bond.

Closed: December 13, 2013

Leilão A-1 2013 for existing

generation plants

Both not specified as a

possibility in the public bid

notice.

Closed: December 17, 2013

The public bid notice does

not require a technical

representative to be named.

The only requirement is that

the participants must be

energy distributors (Buyers)

or holders of a concession or

authorization (Sellers).

No minimum amount of assets is required

in the public bid notice.

For Sellers - Guarantee of participation:

R$ 5,000 per power lot.

Such guarantee must be formalized by

means of: bank deposit; government

bond; surety bond; bank guarantee;

bank deposit certificate; investment

fund shares.

For Buyers - Guarantee of participation:

R$ 5,000 per power lot.

Such guarantee must be formalized by

means of: bank deposit; government

bond; surety bond; bank guarantee;

bank deposit certificate; investment

fund shares.

Various auctions for the

transmission of energy

Closed: December 3, 2012

Closed: May 10, 2013

Closed: July 12, 2013

Closed: November 14, 2013

Foreign companies with a

winning bid are required to

incorporate a local specific

purpose company to

receive the necessary

authorization to transmit

energy.

A consortium incorporated

by Brazilian and foreign

companies must always be

led by the Brazilian

company.

Good standing with CREA

(the Brazilian Engineering

Council).

Note: An analysis of the

qualifications of the company

only occurs after the auction

and disclosure of the winning

bid.

Depending on the amount of power

transmission covered, the company must

have a minimum net worth ranging

between:

1% of the investment foreseen by

ANEEL, which, depending on the

amount of power transmission covered,

will range between:

R$ 184,000,000 - R$ 14,100,000 (Dec 3);

R$ 18,400,000 - R$ 2,350,000 (Dec 3);

R$ 2,522,940 - R$ 207,749,010 (May 10);

R$ 230,000 - R$ 18,880,000 (May 10);

R$ 5,400,000 - R$ 34,600,000 (Jul 12);

R$ 2,350,000 - R$ 17,300,000 (Jul 12);

R$1,800,000 - R$ 156,600,000 (Nov 14).

R$ 180,000 - R$ 15,660,000 (Nov 14).

Such guarantee must be formalized by

means of: cash bond; performance

bond; bank guarantee; or government

bond.

Various auctions for the

transmission of energy

Closed: December 12, 2013

Closed: February 7, 2014

Foreign companies with a

winning bid are required to

incorporate a local specific

purpose company to

receive the necessary

authorization to transmit

energy.

A consortium incorporated

by Brazilian and foreign

companies must always be

led by the Brazilian

company.

INVESTMENT OPPORTUNITIES IN BRAZIL

Good standing with CREA

(the Brazilian Engineering

Council).

Note: An analysis of the

qualifications of the company

only occurs after the auction

and disclosure of the winning

bid.

The company must have a minimum net

worth:

ranging between

R$ 1,800,000 - R$ 16,300,000,

depending on the amount of power

transmission covered (Dec 12);

of R$ 240,000,000 (Feb 7).

5% of the investment foreseen by

ANEEL, which, depending on the

amount of power transmission covered

,will range between:

R$ 900,000 - R$ 8,150,000 (Dec 12);

R$120,000 - R$ 250,000,000 (Feb 7),

depending on the amount of power

transmission covered.

Such guarantee must be formalized by

means of: cash bond; performance

bond; bank guarantee; or government

bond.

9

FUTURE AUCTIONS OF EXISTING CONCESSIONS

In 2012, the Federal Government approved Provisional Measure 579, later converted into Law 12,783/2013,

which established new rules for the renewal of 20 existing energy concession contracts that are due to expire

between 2015 and 2017. In particular, the law changed the conditions of the contract renewals with the aim of

reducing energy tariffs and making the Brazilian industry more competitive.

Many of the concessionaires did not agree to the new conditions and therefore have declared that they do not

wish to renew their contracts. Therefore, upon expiry, the concessions that were not renewed are expected to

be auctioned and adjudicated to new concessionaires.

Currently, CESP, CEMIG and COPEL, the state-owned utility companies from the states of São Paulo, Minas

Gerais and Paraná, respectively, have not adhered to the rules and some of their generation concessions,

which are relevant in terms of installed capacity, are expected to expire and be reauctioned in the coming

years. However, it is expected that the companies are going to file lawsuits challenging the new legislation and

request the renewal of concessions under the conditions set forth in the prior legislation.

10

INVESTMENT OPPORTUNITIES IN BRAZIL

TRANSPORTATION

In mid-2012, the Federal Government launched the Infrastructure and Logistics Investment Program, which

provides for investment in specific transport projects and exceeds the total of all transportation investments

made in the country in the past. A total of US$ 66.5 billion is set to be invested only in highways and railways,

with US$ 21 billion for 7,500 km of roads and US$ 45.5 billion for 10,000 km of railways.

HIGHWAYS

As shown in the diagram, 9 different areas were set to be auctioned in 2013, out of which concession

agreements have been executed for the following:

BR-101 BA - State of Bahia, April 2013;

BR-040 DF/GO/MG - State of Goiás, December 2013;

BR-050 GO/MG - State of Minas Gerais, December 2013;

15

BR-060/153/262 DF/GO/MG - Federal District and states of Goiás and Minas Gerais, January 2014 ; and

16

BR-163 MS/MT - States of Mato Grosso do Sul and Mato Grosso, March 2014 .

Their purpose encompasses the recovery, operation, maintenance, monitoring, conservation and improvement

of the highways.

Source: National Logistics & Planning Company (EPL), Ministry of Finance of Brazil

INVESTMENT OPPORTUNITIES IN BRAZIL

11

New auctions were announced to take place in 2014 for further highway lots. A total of 2,625 km representing

17

a total investment of R$ 17.8 billion will be auctioned , out of which 2,282 km will include duplication works:

BR-101 RJ - Renewal of the concession agreement that includes the Rio-Niteroi bridge (13.2 km);

18

BR-163/230 MT/PA - 976 km ;

BR-364/060 MT/GO - 703.7 km;

BR-364 GO/MG - 439.2 km; and

BR-476/153/282/480 PR/SC - 493.3 km.

After 2014, the Government also plans an auction of the following highway lots:

GO 020, GO 060 and GO 070 - State of Goiás, by the state's regulatory agency. The concessions are

proposed to be delivered by way of a Public-Private Partnership (PPP) concession that will include

19

duplication works and other restoration works that have not yet been specified ; and

MT 010/249/235/170/338/325 - State of Mato Grosso, amounting to approximately 800 km of

20

21

highways . The concessions will include duplication, expansion and maintenance .

In February 2013, the Government issued Provisional Measure 606, later converted into Law 12,837/2013,

aimed at making highway and railway concessions more attractive to investors. The package of changes

introduced involves:

Subsidized interest rates in financing;

Increased term of concession;

Increased amortization periods for any financing undertaken; and

Reductions in security requirements for granting concessions and financing.

According to government sources, these measures could increase the real rate of return from 5.5% to 7.2% for

highway concessionaires.

RAILWAYS

There are 12 auctions announced to take place in the near future for the construction of railways under a

Public-Private Partnership (PPP) regime.

These bids are separated into two different groups:

Group 1

12

Açailândia-Vila do Conde - States of Maranhão and Pará;

Access to the Santos Port - State of São Paulo;

Estrela d'Oeste-Panorama-Maracaju - Connecting the states of Mato Grosso do Sul and São Paulo;

Ferroanel SP / Tramo Norte - State of São Paulo;

Ferroanel SP / Tramo Sul - State of São Paulo; and

Lucas do Rio Verde-Uruaçu - States of Mato Grosso and Goiás.

INVESTMENT OPPORTUNITIES IN BRAZIL

Group 2

Belo Horizonte-Salvador - States of Minas Gerais and Bahia;

Maracaju-Mafra - States of Mato Grosso do Sul, Paraná and Santa Catarina;

Rio de Janeiro-Campos-Vitória - States of Rio de Janeiro and Espírito Santo;

Salvador-Recife - States of Bahia and Pernambuco;

São Paulo-Mafra-Rio Grande - States of São Paulo, Santa Catarina and Rio Grande do Sul; and

Uruaçu-Corinto-Campos - States of Goiás, Minas Gerais and Rio de Janeiro.

Source: National Logistics & Planning Company (EPL), Ministry of Finance of Brazil

22

Of these projects, auctions are expected to take place in 2014 for the construction of the following railways :

Açailândia-Vila do Conde - Transport of iron ore, general cargo, soy oil, soy, sugar, corn and ethanol,

among others (457 km);

Anápolis-Estrela D'Oeste-Panorama-Dourados - Transportation of grains and sugarcane (1,300 km);

Belo Horizonte-Salvador - 1,350 km;

Lucas do Rio Verde-Campinorte-Palmas-Anápolis Railway - Transport of soy, corn and other grains. The

auction is expected to take place on the first semester of 2014 (1,920 km);

Maracaju-Eng Bley-Paranaguá - 989 km;

Rio-Campos-Vitória - 551 km;

Salvador-Recife - 893 km;

São Paulo-Mafra-Rio Grande - General cargo transportation (1,667 km); and

Uruaçu-Corinto-Campos - 1,706 km.

INVESTMENT OPPORTUNITIES IN BRAZIL

13

HIGH SPEED TRAIN (TAV)

The auction for the development and operation of a high-speed train railway connection and train service

between Rio de Janeiro and Campinas (through São Paulo) was set to take place in September 2013, but the

Federal Government postponed the bidding schedule indefinitely. The project is estimated to involve an

amount of US$ 17.5 billion, and the high speed train, covering the distance of 511 km between these cities, was

intended to be operating by 2020. There are various questions about the feasibility of the project in the

current Brazilian political environment.

Source: National Terrestrial Transportation Agency (ANTT),

Ministry of Finance of Brazil

The following table outlines the main requirements of various recent rail tender protocols which can be used

as a guide as to the likely requirements for future projects.

Auction

Foreign companies /

consortium allowed

Technical qualification

Minimum amount

of assets

Guarantees required

High Speed Train

(Rio de Janeiro-Campinas)

Yes for both.

Evidence of experience in high

speed trains and technical

capability to implement the

project.

Minimum net worth of

R$ 1,500,000,000.

Minimum amount of R$ 77,000,000.

Declaration identifying the

tenderer’s technical

representatives, evidencing

their experience and capability

to implement the project.

Minimum net worth of

R$ 100,000,000.

Declaration identifying the

tenderer’s technical

representatives, evidencing

their experience and capability

to implement the project.

Minimum net worth of

R$ 400,000,000.

Declaration identifying the

tenderer’s technical

representatives, evidencing

their experience and capability

to implement the project.

Minimum net worth of

R$ 350,000,000.

Closing date:

postponed indefinitely

Maintenance, Supervision,

Enhancement and Additional Services

regarding roads BR-050/GO/MG and

BR-262/ES/MG, in the states of

Minas Gerais and Goiás.

Yes for both.

For consortiums, each

participant must contribute to

the minimum net worth

proportionate to their

participation.

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

Minimum amount of R$ 60,000,000.

For consortiums, each of the

members must hold this

minimum net worth.

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

Closed: September 13, 2013

Maintenance, Supervision,

Enhancement and Additional Services

regarding road BR-040 in the state of

Minas Gerais.

Yes for both.

Closed: January 28, 2013

Maintenance, Supervision,

Enhancement and Additional Services

regarding road BR-116 in the Federal

District and the state of Minas Gerais.

Closed: January 28, 2013

14

Yes for both.

Minimum amount of R$ 80,000,000.

For consortiums, each of the

members must hold this

minimum net worth.

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

Minimum amount of R$ 80,000,000.

For consortiums, each of the

members must hold this

minimum net worth.

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

INVESTMENT OPPORTUNITIES IN BRAZIL

Auction

Foreign companies /

consortium allowed

Technical qualification

Minimum amount

of assets

Guarantees required

Maintenance, Supervision,

Enhancement and Additional Services

regarding road BR-101 in the state of

Bahia.

Yes for both.

Declaration identifying the

tenderer’s technical

representatives, evidencing

their experience and capability

to implement the project.

Minimum net worth of

R$ 461,000,000.

Minimum amount of R$

172,000,000.

For consortiums, each of the

members must hold this

minimum net worth.

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

Declaration identifying the

tenderer’s technical

representatives, evidencing

their experience and capability

to implement the project.

Minimum net worth of

R$ 569,000,000.

Minimum amount of R$

188,000,000.

For consortiums, each of the

members must hold this

minimum net worth.

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

Declaration identifying the

tenderer’s technical

representatives, evidencing

their experience and capability

to implement the project.

Minimum net worth of

R$ 715,000,000.

Minimum amount of R$

229,000,000.

For consortiums, each of the

members must hold this

minimum net worth

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

Declaration indicating the

technical representatives,

evidencing their experience

and capability to implement

the project.

Minimum net worth of

R$ 460,000,000.

Minimum amount of R$

147,000,000.

For consortiums, each of the

members must hold this

minimum net worth.

Formalized by means of: cash bond;

performance bond; bank guarantee;

or government bond.

Contract signed:

January 10, 2014

Maintenance, Supervision,

Enhancement and Additional Services

regarding road BR-163 in the state of

Mato Grosso do Sul.

Yes for both.

Contract signed:

February 20, 2014

Maintenance, Supervision,

Enhancement and Additional Services

regarding road BR 060/153/262 in

the Federal District and the states of

Goiás and Minas Gerais.

Yes for both.

Contract signed:

January 31, 2014

Maintenance, Supervision,

Enhancement and Additional Services

regarding road BR-163 in the state of

Mato Grosso.

Yes for both.

Contract signed:

January 31, 2014

AIRPORTS

In December 2012, Brazilian President Dilma Rousseff continued with the Logistics Investment Program,

encompassing a number of actions to improve the quality of airport infrastructure across the country. The

main measures comprised by this program were the concessions of two airports – Galeão, in Rio de Janeiro,

and Confins, in Minas Gerais – and the creation of a public services company to offer planning, consulting,

management, operational support and personnel training services concerning airport operation. Additionally,

the Federal Government plans to invest US$ 3.65 billion in regional aviation, with the goal of improving over

270 regional airport facilities.

The Galeão airport, located in the city of Rio de Janeiro, was auctioned on November 2013. The winning bid by

the Consortium Aeroportos do Futuro was R$ 19 billion for a concession period of 25 years, 293.91% above the

initial value of R$ 4.828 billion fixed by the Government. Consortium Aeroportos do Futuro includes in its

composition the operators of airports in Singapore, Zurich and Munich. The consortium is composed of

Odebrecht TransPort Airports SA (60%) and Excellent BV (40%), a holding of the Singaporean airport

operator Changpi.

The Confins airport, located in the state of Minas Gerais, was auctioned and the winning bid offered by the

Consortium Aerobrasil was R$ 1.82 billion for a concession period of 30 years, an increase of 66% from the

initial value of R$ 1.096 billion fixed by the Government. Consortium Aerobrasil is formed by Companhia de

Participações em Concessões (75%), Zurich Airport International AG (24%) and Munich Airport International

Beteiligungs GMBH (1%). Companhia de Participações em Concessões (CPC) is controlled by Brazilian

infrastructure concession group CCR.

INVESTMENT OPPORTUNITIES IN BRAZIL

15

Source: National Civil Aviation Agency (ANAC), Ministry of Finance of Brazil

According to the model adopted by the Government, Infraero must join with the winning consortium to

23

construct and operate the airport .

24

25

The concession agreements for Galeão and Confins were executed on April 2014. There will be a transition

period in which Infraero continues to manage the airports, accompanied by the concessionaire, within the first

120 days. After this period, according to the National Civil Aviation Agency (ANAC), the concessionaire will

manage the airports together with the Federal Union for another three months, with a possible extension of

another three months. Only then, the concessionaire will take over all airport operations.

During 2012, other similar relevant auctions were held for the following international airports:

Governador André Franco Montoro - City of Guarulhos, state of São Paulo;

Viracopos - City of Campinas, state of São Paulo; and

Presidente Juscelino Kubitschek - Brasília, Federal District.

The auction for the expansion, maintenance and operation of these three airports occurred simultaneously on

26

the São Paulo Stock Exchange (BM&FBOVESPA) in February 2012 .

The Guarulhos airport concession was granted to the Invepar consortium, composed of Invepar Investimentos

e Participações em Infraestrutura SA and Airport Company South Africa (ACSA), for the amount of US$ 8.1

billion. The US$ 1.91 billion concession amount for the Viracopos airport was awarded to the Aeroportos Brasil

consortium, formed by Triunfo Participações e Investimentos, UTC Participações and Egis Airport Operation.

Lastly, the Brasília airport concession was granted to the Inframerica Aeroportos consortium, composed of

Infravix Participações SA and Corporacion America), for the amount of US$ 2.25 billion.

16

INVESTMENT OPPORTUNITIES IN BRAZIL

A relevant aspect of the auctions held so far is the fact that the winning bidders must form a special purpose

vehicle for the operation of the airports, with a shareholding of up to 49% held by Infraero, the state-owned

company formerly in charge of the federal airports. As a result, Infraero is entitled to certain veto rights on key

matters concerning the administration of the airports, such as the execution of transactions involving certain

amounts, sale or disposition of assets, amendment of by-laws etc.

In addition, 270 regional small and medium-sized airports are scheduled to be auctioned in 2014 and after,

representing an investment of R$ 7.3 billion. Here is a breakdown by region:

Central-West - 31 airports, R$ 0.9 billion investment;

North - 67 airports, R$ 1.7 billion investment;

Northeast - 64 airports, R$ 2.1 billion investment;

South - 43 airports, R$ 1 billion investment; and

Southeast - 65 airports, R$ 1.6 billion investment.

The following table outlines the main requirements of various recent airport tender protocols which can be

used as a guide as to the likely requirements for future projects.

Auction

Foreign companies /

consortium allowed

Technical qualification

Minimum amount

of assets

Guarantees required

Concession for the expansion,

maintenance and operation of

Governador André Franco Montoro

(Guarulhos), Viracopos (Campinas),

and Presidente Juscelino Kubitschek

(Brasília) airports.

Yes for both.

5-years’ experience in airport

operations and minimum

processing of:

Bidding company must declare

that it owns sufficient financial

resources to comply with the

investment obligations

necessary to achieve the

concession objectives.

R$ 37,342,000 for the Brasília

airport;

Closed: February 2, 2012

Concession for the expansion,

maintenance and operation of

Aeroporto Internacional Antônio

Carlos Jobim - Galeão (Rio de

Janeiro) and Aeroporto Internacional

Tancredo Neves - Confins (Belo

Horizonte) airports.

A company that

participates in a consortium

is not allowed to

participate in another

consortium or

independently.

Yes for both.

A company that

participates in a consortium

is not allowed to

participate in another

consortium or

independently.

Closed: November 22, 2013

INVESTMENT OPPORTUNITIES IN BRAZIL

5 million passengers a year,

calculated on the basis of the

sum of passengers on board,

landed and in connections, in

at least one of the last 10 (ten)

years.

5-years’ experience in airport

operations, and minimum

processing of:

12 million passengers a year for

Confins; and

22 million passengers a year

for Galeão, calculated on the

basis of the sum of passengers

on board, landed and in

connections, in at least one of

the last 5 (five) years.

R$ 90,887,000 for the Viracopos

airport; and

R$ 123,879,000 for the Guarulhos

airport.

Formalized by either: cash bond;

government bond; performance

bond; or bank guarantee.

Bidding company must declare

that it owns sufficient financial

resources to comply with the

investment obligations

necessary to achieve the

concession objectives.

R$51,169,860 for the Confins airport;

and

R$129,530,710 for the Galeão airport.

The winning consortium must

incorporate a Specific Purpose Entity

(SPE) to perform the concession

agreement.

17

PORTS

The Federal Government plans to attract US$ 27 billion in private sector investments over the next few years

to modernize Brazil's ports and to reform the country's 20-year-old ports regulatory framework under Law

12,815/2013 and Decree 8,033/2013.

The purpose of the new regulatory framework is to improve the country's logistics infrastructure, adapting it to

standards of international efficiency and modernizing the old-fashioned and obsolete legislation that had

previously been in place.

Source: National Logistics & Planning Company (EPL), Ministry of Finance of Brazil

Auctions are planned to take place in blocks. The first auction block will include at least 7 terminals in the

Santos Port (state of São Paulo), and the Belém Complex (state of Pará), which were expected to be auctioned

in the first semester of 2013 but were delayed to 2014. The reason for the delay was the release of the Federal

Audit Court's reports confirming that studies undertaken by the Government were incomplete and fixing 19

conditions for approval prior to the auctions taking place. The main conditions require:

A price cap on tariffs; and

Re-evaluation of costs to calculate the indemnification amount to be paid to the current operators.

In total, the Federal Audit Court approved further studies for 29 terminals, subject to complying with the

specified conditions.

18

INVESTMENT OPPORTUNITIES IN BRAZIL

After the conditions are met, the bid documents undergo a new period of public exhibition held at the Federal

Audit Court, not yet scheduled. The Government expects the Federal Audit Court to approve the studies for

27

the Santos Port and the Belém Complex and publish the auction rules and conditions in 2014 .

Among the 159 terminals that the Government intends to auction, 42 are new and the remainders are existing

areas with concession agreements that have either expired or will mature by 2017. The winning tenderers will

be those that provide the lowest transportation price for the largest load.

According to the Government's investment plan, the ports concession agreements and ports facilities lease

agreements will have a 25-year term, renewable only once for an equal period of time. The projects are to be

28

grouped into four blocks :

Block 1 - Santos, in the state of São Paulo (7 terminals), and Belém, in the state of Pará (2 terminals);

Block 2 - Paranaguá, Salvador, São Sebastião and Aratu;

Block 3 - Suape, Recife, Cabedelo, Fortaleza, Maceió, Itaqui and Macapá; and

Block 4 - Manaus, Imbituba, Itaguaí, Itajaí, Niterói, Porto Alegre, Rio de Janeiro, Rio Grande, São Francisco

do Sul and Vitória.

In order to illustrate the amount of investment being made, following are some of the many projects to be

implemented in the Paranaguá Port, in the state of Paraná:

Export Corridor Refurbishing - Refurbishment of existing equipment that carries soy, corn, sugar and wheat

to the ships. These changes will increase the port's capacity by at least one third. The tender invitation is

expected to be published soon;

Access Revitalization - New accesses to the patio for loading and unloading holding trucks, and

improvements to urban streets of Paranaguá to make them suitable for heavy vehicles. Auctions will

requiring investments of approximately US$ 2.5 million;

New Operational System - Implementation of a new system that will require investments around US$ 3.4

million;

Dredging for Deepening - Dredging to enable the port to receive larger ships. This project has already

secured environmental clearance, and awaits a decision from the Government regarding its inclusion in its

new dredging plan, which has already reserved US$ 430 million for Paranaguá; and

Maintenance Dredging - A US$ 65 million project to maintain access levels in the port, which is currently

awaiting environmental clearance.

While auctions for the above public ports are being restructured, the Government has already held auctions

and granted authorizations for 13 private ports, amounting to investments of R$ 6 billion.

INVESTMENT OPPORTUNITIES IN BRAZIL

19

OIL AND GAS

Following the discoveries made in the pre-salt layer in 2008, the Federal Government decided to rethink the

contractual-regulatory regime for exploration and production activities in the pre-salt area. This caused the

National Agency of Petroleum, Natural Gas and Biofuels (ANP) to withhold any concession bid rounds for

almost 5 years, during which the industry became stagnant after growing over 300% in the previous decade.

th

On May 2013, the ANP held the 11 Bid Round for concessions of blocks for oil and gas exploration and

production. A total of US$ 4.4 billion was raised with signing bonuses. The commitments assumed, including

minimum investments, have reached approximately US$ 3.5 billion, breaking the previous record for funds

collected.

The regional diversification of the offered areas caused the ANP, for the first time, to offer blocks in states

where oil production has been insignificant or virtually nonexistent. The attractiveness of these areas resulted

from studies undertaken by the agency, which involved an investment of almost R$ 800 million since 2007.

The granted blocks are located in the following states: Amapá, Pará, Maranhão, Piauí, Ceará, Rio Grande do

Norte, Paraíba, Pernambuco, Alagoas, Sergipe, Bahia and Espírito Santo.

th

A significant number of small, medium and large companies took part in the 11 Bid Round. A total of 39

companies from 12 countries made bids at the auction and 30 of them were the selected winners, attesting to

the competition for the areas while ensuring avoidance of sectorial concentration.

Also in 2013, the Government held the first bid round for pre-salt areas in the Libra field of the Santos basin

under a new Production Sharing Regime. The winning consortium for the Libra field was formed by Petrobras,

Shell Brazil, the French company Total and the Chinese companies CNPC and CNOOC, with estimated 8-12

billion barrels of reserves recoverable oil (i.e. what can be commercially removed from underground).

According to the special bid commission, the shares will be divided into 40% for Petrobras, 20% for Shell

Brazil, 20% to Total, 10% to CNPC and 10% to CNOOC.

The consortium was the only one to bid, and won while offering a minimum of 41.65% of profit of oil, which is

the volume that exceeds operating costs and royalties. The consortium will pay a signing bonus of R$ 15 billion

and a minimum exploration program of approximately R$ 610.9 billion.

nd

The 12 Bid Round for concessions of blocks for oil and gas exploration and production also took place in 2013,

offeering 240 exploration blocks, distributed in seven sedimentary basins, being:

110 exploration blocks in new frontier areas in the basins of Acre, Parecis, São Francisco, Paraná and

Parnaíba; and

130 exploratory blocks in the mature basins of Recôncavo and Sergipe-Alagoas.

Petrobras offered its highest bid for a block located in the Reconcavo basin, in the amount of R$ 15.2 million.

The blocks that were auctioned but not purchased will be offered again in future Bid Rounds.

The basins of Paraná and the Reconcavo were the most disputed exploration sites which helped to increase

the amounts offered in the auction. The Reconcavo, along with the basins of Sergipe-Alagoas and San

Francisco, were identified as having the biggest potential for the discovery of shale gas.

20

INVESTMENT OPPORTUNITIES IN BRAZIL

nd

The 12 Bid Round was focused on areas of onshore exploration of natural gas, and for the first time offered

opportunities for shale gas exploration, a type of gas that uses the technique of hydraulic fracturing to release

th

the gas trapped in rocks (conventional gas is released in the reservoirs). Unlike the 11 Bid Round, this auction

attracted only a few companies, most of which were Brazilian.

Shale gas has been found by the ANP in the Parnaíba and São Francisco basins. The ANP advises that shale

gas and the technology used to extract it, which has already been used extensively by the Brazilian oil industry,

make it possible to explore these areas at only one third of the cost of natural gas exploration. More

specifically, the cost of natural gas exploration is US$ 16 per cubic meter, while the exploration of shale gas

costs US$ 5 or US$ 6 per cubic meter.

The following table, provided for guidance purposes, outlines the requirements of these previous bidding

rounds.

Auction

st

1 Bid Round under Production

Sharing Agreement Regime

Closed: September 9, 2013

Participation fee:

R$ 2.067.400

th

Foreign companies /

consortium allowed

Technical qualification

Minimum amount

of assets

Guarantees required

Yes for both.

Evidenced experience in

exploration and production of

oil and gas. The company may

request technical qualification

as operating or non-operating

company.

The minimum net worth ranges

between R$ 277,000,000 and

R$ 554,000,000, depending on

the type of operating or nonoperating company.

R$ 156.109.000.

Evidenced experience

exploration and production of

oil and gas. The company may

request technical qualification

as operating or non-operating

company.

The minimum net worth ranges

between R$ 1,900,000 and

R$107,000,000, depending on

the type of operating or nonoperating company.

Ranges between R$ 524,000

and R$ 106,000 depending on

the block to which the proposal

is presented by the company, in

the form of a letter of credit.

Foreign companies with a winning bid

are required to incorporate a Brazilian

subsidiary to receive the concession.

For foreign companies, a

performance guarantee is also

required.

Also, Petrobras will be sole operator

and therefore have a minimum stake

of 30% in all contracts, as well as the

new State company, Sal Petróleo SA

(PPPSA).

11 Bid Round

Yes for both.

Closed: March 26, 2013

Foreign companies with a winning bid

are required to incorporate a Brazilian

subsidiary to receive the concession.

For Foreign Companies, a

performance guarantee is also

required.

th

12 Bid Round

Yes for both.

Closed: October 28, 2013

Foreign companies are not required

to submit documents to prove tax

and labor requirements are satisfied.

Evidenced experience in the

field of exploration and

production of oil and gas. The

company may request technical

qualification as operating or

non-operating company.

The minimum net worth ranges

between R$ 107,000,000 and

R$ 1,900, depending on the

type of operating or nonoperating company.

Ranges between R$ 2,415,000

and R$ 116,000 depending on

the block to which the proposal

is presented by the company, in

the form of a letter of credit.

Petrobras published its strategic plan for 2014 through to 2030, which provides that, by 2017, 1 million barrels

of oil will be produced per day in the pre-salt areas only. To reach this estimate, Petrobras will focus on the

exploration and production sectors. A total of US$ 236.7 billion will be invested, of which US$ 207.1 billion will

be for implementation projects. The exploration and production sector will receive US$ 147.5 billion, with a

focus on developing the pre-salt areas for eventual sale via transfers of rights.

Petrobras also estimated production, in Brazil and abroad, of an average of 4 million barrels per day in the

29

30

period from 2020 to 2030 , as it plans to acquire new exploration rights on additional areas . The fuel sector

will also be highlighted, as it will benefit from investments in the order of US$ 64.8 billion for the extension of a

refining park, operational improvements, and petrochemical, among others.

INVESTMENT OPPORTUNITIES IN BRAZIL

21

MINING

The Mining Code (Decree 227/67) establishes a system for bestowal/grant and oversight of concessions

based on bureaucratic and centralized procedures. Under the code, the bestowal/grant of a concession is a

“bound act” in which mining rights are obtained by fulfilling certain regulatory requirements – this prevents the

granting authority from exercising its discretion to raise technical issues or societal interests that prevent the

bestowal/grant.

With the goal of improving the regulatory system, a new regime is under discussion by the Federal

Government. Highlights of this new mining regime include:

Draft bill containing transitional rules aimed at safeguarding legally constituted arrangements and ensuring

that the transition to the new regulatory system does not harm stakeholders;

Public offer of areas by means of public bidding and contracts process, to expand opportunities for access

and to replace the current procedure of “availability areas” of complex operation; and

Creation of a national council on mineral policy, an advisory body to the President tasked with the

formulation and implementation of mining policy.

The new mining regulation is still in discussion and while it is expected to be approved in 2014 after the

presidential elections happening in October, it is not yet in force.

22

INVESTMENT OPPORTUNITIES IN BRAZIL

SANITATION

31

Law 11,445/2007 requires the Federal Government to draft a National Sanitation Plan . Hence, the Ministry of

Cities drafted the Pact for Basic Sanitation in 2008, which constitutes the first stage of a participative process

for the drafting of such plan.

During 2008 and 2009, the Ministry invested in studies required to inform the drafting of the plan. These

studies are set out in the document “Panorama of Basic Sanitation in Brazil”, which includes a preliminary

version of the National Sanitation Plan. Finally, in 2012, public consultation took place and a total of 649

different contributions were received by 108 different institutions and persons, with 42.6% of all contributions

being incorporated into the plan. The Interministerial Ordinance 571 was published on December 2013,

32

implementing the National Sanitation Plan (Plansab) .

The Plansab provides that universal sanitation – water supply and sewage collection and treatment – will be

achieved in the entire country by 2033. The Government expects 93% of all urban areas in Brazil to have a

sewage collection and treatment system, and expects that all cities have water supply services by 2023. The

Government has invested, on average, R$ 8-9 billion per year on sewage. However, in order to reach the goal

of universal sanitation by 2030, this investment needs to double.

According to the Trata Brasil Institute, R$ 313.2 billion would be required to achieve universal sanitation.

Moreover, the study shows that the existence of a sanitation system in a region increases the values of real

estate by 13.6% on average. The Ministry of Cities expects R$ 300 billion to be invested by federal agents until

33

2033. The Plansab further includes investments of other agents in the amount of R$ 208.5 billion .

As significant investment is required to achieve universal sanitation by 2030, the Government is currently

investigating the possibility of joining forces with the private sector through Public-Private Partnerships (PPPs)

with Municipal or State Governments. Investment in sanitation is not only a public service, but could also

34

represent a profitable business that would be attractive to the private sector .

The first sanitation PPP was undertaken in the city of Jaguaribe, in the state of Bahia, and the contract was

35

executed in 2006 with the Special Purpose Entity Concessionária Jaguaribe, controlled by the Odebrecht

Group. The total value of the contract is R$ 240 million, and the private partner is responsible for the

36

construction and operation of the sewage system for 183 months .

Upcoming sanitation projects include the following:

The City of Jaú, in the state of São Paulo, undertook public consultation in May 2014 on the bid document

for a proposed project involving the construction, operation and maintenance of a water supply and sewage

37

treatment system ;

The City of Santo André, in the state of São Paulo, will enter into a PPP for the operation of a water

treatment station. The bid document has not been released as yet, but should be published in the coming

38

months . City Hall expects the station to supply 25% of the city's demand. The Government approved the

investment of R$89 million for the project;

In May 2013, the state of Rondonia held a Procedure for the Expression of Interest for the gathering of

39

information for an upcoming PPP to implement a basic sanitation system .

INVESTMENT OPPORTUNITIES IN BRAZIL

23

HOSPITALS

As part of an ongoing effort to improve hospitals and health related facilities, various projects are currently

proposed including:

Hospital complex in Brasilia - The administrative concession is for the construction, purchase of equipment

and furniture and management support services for a 20-year term.

PPP Logística de Medicamentos - PPP in the state of São Paulo for the development of logistics and

distribution processes for medication and health products. The administrative concession is offered by the

Secretary of the State of São Paulo Health for 20 years and includes building infrastructure, distribution and

technology infrastructure. The value of the contract is estimated to be R$ 150 million. Bid documents have

been publicly released, but a deadline for submitting bids has not yet been specified.

Military hospital in Brasília - Feasibility studies are proposed for an administrative concession for the

construction, purchase of equipment and management support services for a military hospital. A date for

the delivery of bids is not yet known.

Foreigners are prevented by law from operating hospitals and rendering medical and health services.

Therefore, the PPPs for hospitals in Brazil concern the construction and administration of the hospital's

buildings and facilities.

24

INVESTMENT OPPORTUNITIES IN BRAZIL

RIO DE JANEIRO: BRAZIL'S LARGEST INVESTMENT HUB

VALUABLE RECENT DATA

The state of Rio de Janeiro, according to recent data, has the largest amount of investment per kilometer in the

world. The state's privileged location allows access to 50% of Brazil's GDP within a radius of 500 km, and the

per capita income has more than doubled since 2000.

Energy

ITC

Largest oil producer in Brazil

HQ of Petrobras, regulatory agencies and

research institutions

Clusters of energy and pre-salt R&D

3 of the best O&G engineering courses

5 of the best engineering courses in Brazil

Largest number of IT professionals

Cluster of R&Ds, incubators and science parks

Center of media and broadcasting for 2014

World Cup and 2016 Olympic Games

Creative Industries

Hospitality

Industry

HQ of the largest media

company in Latin America

Cultural, arts and intelligence

hub of the country

85% of national film box

office produced in Rio

Main tourist destination

Reference in lifestyle

Host of major world events

5 industrial districts

Largest steel industry center

New industrial areas

Source: Rio Negócios - Investment Promotion Agency of Rio de Janeiro

40

Specifically with respect to the oil and gas industry, Rio is responsible for 81% and 45% of Brazil's total oil

41

and gas proven reserves, respectively, as well as 85% and 50% of Brazil's total oil and gas production,

respectively. The state is host to major headquarters of the key decision-makers and players in the sector,

such as Petrobras, the National Agency of Petroleum, Natural Gas and Biofuels (ANP) and the Brazil Institute

of Oil, Gas and Biofuels (IBP).

Furthermore, Rio de Janeiro is a hub for research and development excellence, as it hosts major universities

offering high quality oil and gas industry-focused undergraduate and post-graduate courses, as well as the

headquarters of several companies' research and development centers, including Petrobras (CENPES), which

provides a qualified workforce to the oil and gas supply chain. Moreover, the city of Rio was one of only two

Brazilian cities to be rated “Investment Grade” by Moody's and has retained such grading since 2011.

INVESTMENT OPPORTUNITIES IN BRAZIL

25

ONGOING PROJECTS

A diverse range of projects are currently underway in the state of Rio de Janeiro, including:

Açu port complex shipyard - US$ 1.5 billion for construction;

Brazilian Navy submarine shipyard (Prosub) - US$ 1 billion for construction;

Bus Rapid Transit system(BRT) - US$ 1.4 billion for construction;

Rio de Janeiro Petrochemical Complex (COMPERJ) - US$ 12.5 billion for construction of refining unit;

PSA Peugeot Citröen factory - US$ 850 million for extension of the current factory;

Renault-Nissan factory - US$ 1.3 billion for implementation in the city of Resende;

Rio port area redevelopment - US$ 700 million for the “Porto Maravilha” revitalization project;

Subway line 4 (Metrô Rio) - US$ 2.1 billion for construction;

“Sudeste” port - US$ 1 billion for construction upstate Rio de Janeiro.

Also, works to complete the Metropolitan Ring Road are underway and will see the COMPERJ in Itaboraí linked

with the Port of Itaguaí, bypassing the metropolitan area. Significant development opportunities are forecast

for transportation and logistics hubs in the surrounding areas.

26

INVESTMENT OPPORTUNITIES IN BRAZIL

CONTACT AND REFERENCES

This summary of opportunities for investment in Brazil is subject to further updates as the details of upcoming

auctions become known. We will be pleased to provide you with answers and additional information on the

opportunities mentioned herein, as well as future ones.

For further information, please contact:

Ana Carolina Barretto

Partner

ana.barretto@veirano.com.br

+55 11 2313 5822

Specialised in project development and finance, focusing

mainly on the energy and infrastructure sector, Ana Carolina

leads the firm's Projects practice in São Paulo.

She represents sponsors, lenders, EPC contractors and

equipment suppliers in a number of energy and

infrastructure projects in Brazil, including power plants,

shipyards, industrial facilities, mining and logistics projects.

Ana holds a law degree from Pontifícia Universidade Católica

(PUC-Rio), an M.Juris degree and an M.St in Legal Research

degree (hons), both from the University of Oxford, where

she was a full Chevening/FCO scholar.

INVESTMENT OPPORTUNITIES IN BRAZIL

27

SOURCES

Central Bankof Brazil (BCB)

Itaú BBA

Jornal do Comércio (business newspaper)

Ministry of Finance of Brazil

National Agency of Electric Energy (ANEEL)

National Agency of Petroleum, Natural Gas and Biofuels (ANP)

National Civil Aviation Agency (ANAC)

National Confederation of Industry (CNI)

National Logistics & Planning Company (EPL)

National Terrestrial Transportation Agency (ANTT)

National Whaterway Transportation Agency (ANTAQ)

O Globo (newspaper)

Petrobras

Portal Brasil

Rio Negócios - Investment Promotion Agency of Rio de Janeiro

The Federate Senate of Brazil

Valor Econômico (business newspaper)

Veja (magazine)

REFERENCES

1. Valor Econômico. http://www.valor.com.br/brasil/3406252/investimento-estrangeiro-direto-em-2013-

fica-acima-do-previsto-pelo-bc

2. O Globo. http://oglobo.globo.com/economia/brasil-cai-do-5-para-7-lugar-em-ranking-de-investimento-

estrangeiro-direto-11431120

3. UNCTAD. http://unctad.org/en/PublicationsLibrary/webdiaeia2014d1_en.pdf

4. PAC. http://www.pac.gov.br/pub/up/pac/9/3-PAC_9_exec_orc.pdf

5. Energia Business. http://energiabusiness.com.br/conteudo/governo-divulga-balanco-do-pac2-para-setorde-energia.html

6. ChinaGoAbroad.

http://www.chinagoabroad.com/sites/v2/files/article/attachment/Investment%20_Opportunities%20_i

n_Brazil-April%202013.pdf

7. ChinaGoAbroad.

http://www.chinagoabroad.com/sites/v2/files/article/attachment/Investment%20_Opportunities%20_i

n_Brazil-April%202013.pdf

8. Portal Brasil. http://www.brasil.gov.br/turismo/2013/12/turismo-ja-iguala-industria-automobilistica-ede-celulose-em-2013

9. Portal Brasil. http://www.brasil.gov.br/turismo/2013/12/turismo-ja-iguala-industria-automobilistica-ede-celulose-em-2013

10. MME. http://www.mme.gov.br/programas/leiloes_de_energia/menu/inicio.html

11. O Estado de S. Paulo. http://economia.estadao.com.br/noticias/economia-geral,governo-fara-7-leiloesde-energia-e-5-de-transmissao-em-2014,175518,0.htm

28

INVESTMENT OPPORTUNITIES IN BRAZIL

12. G1. http://g1.globo.com/economia/noticia/2014/02/governo-preve-ate-mais-11-leiloes-de-energia-em-

2014.html

13. Folha de S. Paulo. http://www1.folha.uol.com.br/mercado/2014/05/1451952-leilao-de-transmissao-deenergia-tem-preco-de-venda-menor-que-esperado.shtml

14. Folha de S. Paulo. http://www1.folha.uol.com.br/mercado/2014/05/1451952-leilao-de-transmissao-deenergia-tem-preco-de-venda-menor-que-esperado.shtml

15. O Estado de S. Paulo. http://economia.estadao.com.br/noticias/negocios-geral,triunfo-assina-contratode-concessao-da-br-060153262,176892,0.htm

16. Estado de Minas.

http://www.em.com.br/app/noticia/economia/2014/03/12/internas_economia,507110/dilma-assinacontratos-de-concessao-da-br-040-e-br-163.shtml

17. G1. http://g1.globo.com/economia/noticia/2014/01/dilma-rousseff-anuncia-concessao-de-mais-cincotrechos-de-rodovias.html

18. Portal Brasil. http://www.brasil.gov.br/infraestrutura/2014/02/anunciadas-novas-concessoes-paratrechos-de-rodovias

19. Portal 730. http://portal730.com.br/politica/governo-descarta-concessao-de-rodovias-estaduais-ecobranca-de-pedagios-em-2014

20. Diário de Cuiabá. http://www.diariodecuiaba.com.br/detalhe.php?cod=448140

21. G1. http://g1.globo.com/mato-grosso/noticia/2014/04/governo-pretende-conceder-quase-800-km-deestradas-em-mato-grosso.html

22. IG Notícias. http://brasileconomico.ig.com.br/noticias/concessao-de-ferrovias-apresentaproblemas_136219.html

23. G1. http://g1.globo.com/economia/negocios/noticia/2013/11/governo-arrecada-r-208-bilhoes-comleilao-de-confins-e-do-galeao.html

24. Portal Brasil. http://www.brasil.gov.br/infraestrutura/2014/05/anac-publica-novas-tarifas-para-galeaoe-confins

25. Isto É Dinheiro. http://www.istoedinheiro.com.br/blogs-e-colunas/coluna/6_PODER

26. The BMF&BOVESPA is a private company that provides registration, clearing and settlement services for

the securities and derivatives markets. However, it also provides other services such as a managed

platform for public and private auctions, and they help with the structuring of the operation, as well as with

the actual real time auction. More information is available at http://www.bmfbovespa.com.br/ptbr/intros/intro-leiloes.aspx?idioma=pt-br.

27. G1. http://g1.globo.com/economia/noticia/2014/02/leilao-de-areas-em-portos-deve-ser-liberado-emmarco-diz-ministro.html

28. MDIC. http://investimentos.mdic.gov.br/public/arquivo/arq1354909842.pptx

29. Petrobras. http://www.petrobras.com.br/fatos-e-dados/planejamento-estrategico-horizonte-2030-asgrandes-escolhas-da-petrobras.htm

30. Petrobras.

http://www.investidorpetrobras.com.br/lumis/portal/file/fileDownload.jsp?fileId=8A78D68443E2C489

01446B7C97741E0E

31. Law 11,445 of January 5, 2007, article 50.

32. MMA.

http://www.mma.gov.br/port/conama/processos/AECBF8E2/Plansab_Versao_Conselhos_Nacionais_02

0520131.pdf

33. O Globo. http://oglobo.globo.com/pais/saneamento-investimento-tera-que-duplicar-para-que-governocumpra-meta-11918266

INVESTMENT OPPORTUNITIES IN BRAZIL

29

34. Instituto Trata Brasil. http://www.tratabrasil.org.br/investimentos-em-saneamento-basico-podem-

incentivar-ppps-2

35. SEFAZ/BA. http://www.sefaz.ba.gov.br/administracao/ppp/projeto_emissariosub.htm

36. Odebrecht. http://www.odebrechtonline.com.br/materias/01001-01100/1057/

37. PPP Brasil. http://www.pppbrasil.com.br/portal/content/munic%C3%ADpio-de-jaú-inicia-consultapública-de-concessão-na-área-de-saneamento

38. Diário Regional. http://www.diarioregional.com.br/2014/03/26/sua-regiao/politica-abc/politica-santoandre/semasa-espera-que-ppp-arque-com-r-90-milhoes-de-emprestimo/

39. PPP Brasil. http://www.pppbrasil.com.br/portal/content/rondônia-publica-pmi-para-obter-estudos-deviabilidade-de-ppp-de-esgotamento-sanitário

40.ABPG. http://www.portalabpg.org.br/PDPetro/2/8042.pdf

41. Folha de S. Paulo. http://www1.folha.uol.com.br/fsp/mercado/35894-petroleo-muda-paisagem-do-nortedo-rj.shtml

30

INVESTMENT OPPORTUNITIES IN BRAZIL

VEIRANO ADVOGADOS

Veirano Advogados is one of the leading and most renowned Brazilian business law firms, focused on

developing tailored solutions for multinational companies operating in strategic sectors of the economy.

OUR FIRM

Founded in 1972, Veirano Advogados is a full-service law firm providing a complete spectrum of legal services

to support business activities in both regulated and unregulated sectors. With approximately 300 attorneys

working in an integrated fashion, we handle both routine and complex multidisciplinary cases that require the

coordinated talents of professionals with diverse areas of expertise.

Our services range from providing assistance in M&A transactions, privatizations and company formation to

representing clients in disputes, from offering advice on tax issues and infrastructure projects to guiding

companies through the challenges inherent in highly regulated industries, to name a few examples of our

broad range of work. Our main goal is to identify needs and develop tailored solutions, enabling safe and

informed decision making – one client at a time.

At Veirano, we understand that our professionals are our equity in a globalized market. In order to build strong

client-service teams of specialists, we recruit Brazilian attorneys with multicultural backgrounds who have

received additional education and training in first-tier law schools and law firms in the US, Europe and Asia.

For over 40 years we have built strong relationships with leading companies in various industry sectors,

simplifying international relations and opening pathways for business in Brazil, from Brazil to the world and

from the world to Brazil. This is how we contribute to the success of our clients and collaborate for a strong

economy.

ALLIANCES & PARTNERSHIPS

Beyond our presence in Rio de Janeiro, São Paulo, Porto Alegre and Brasília, we enjoy solid relationships with

law firms in the various Brazilian states and maintain a wide network of partner law firms across more than

120 countries around the world. As a result, we provide seamless services wherever they are required.

We also participate in several international legal organizations, such as:

Global Advertising Lawyers Alliance (GALA)

Ius Laboris - Global HR Lawyers

World Services Group (WSG)

INVESTMENT OPPORTUNITIES IN BRAZIL

31

PRACTICE AREAS

Our expertise covers a broad range of legal services, with emphasis on the following practices and industries:

Law Practices

Industry-Oriented Practices

Anticorruption, Corporate Integrity & Compliance

Antitrust & Competition

Banking & Finance

Commercial Contracts

Corporate & Mergers and Acquisitions

Corporate Immigration

Dispute Resolution

Environment

Government & Regulatory

Insolvency, Restructuring & Distressed Investing

Intellectual Property

International Trade / WTO

Labor & Employment

Private Equity & Capital Markets

Tax & Customs

White-Collar Crimes

Aerospace, Naval & Defense

Electric Energy

Information Technology & Communications

Infrastructure & Projects

Insurance, Reinsurance & Pension Funds

Media & Entertainment

Mining

Oil, Gas & Biofuels

Real Estate

Shipping

CLIENT INDUSTRIES

For over 40 years we have built strong relationships with leading companies operating in many different

industry sectors, such as:

32

Aerospace, Naval and Defense

Agribusiness

Automotive

Banks and Financial Services

Biofuels

Chemical and Petrochemical

Construction and Engineering

Consumer Goods

Education

Electric Energy

Health Care

Hospitality and Tourism

Information Technology

Infrastructure

Insurance and Complementary Welfare

International Bodies and NGOs

Machines and Equipment

Media and Entertainment

Metallurgy and Siderurgy

Mining

Oil and Gas

Pharmaceutical and Cosmetics

Pulp and Paper

Real Estate

Services

Shipping

Sports and Leisure

Telecommunications

Transport and Logistics

Water and Sanitation

Wholesale and Retail

INVESTMENT OPPORTUNITIES IN BRAZIL

RECOGNITIONS & AWARDS

As the first Brazilian firm to receive the Chambers Client Service Law Firm of the Year award, our continuous

dedication to clients is consistently recognized by leading industry publications, in particular:

Chambers Global 2014

Leading firm in 14 practice areas

37 leading individual recognitions

Latin Lawyer 250 2014

Recommended firm with 22 practice areas

highlighted

Chambers Latin America 2015

Leading firm in 26 practice areas

51 leading individual recognitions

Legal 500 Latin America 2014

Recommended firm in 20 practice areas

4 leading lawyer recognitions

53 lawyer recommendations

IFLR 1000 2015

Recommended firm in 5 practice areas

8 leading lawyer recognitions

2 rising star recognitions

Who’s Who Legal Brazil 2014

39 lawyer recognitions

Some of our recent awards include:

Marine Money International - Editor’s Choice Deal of the Year 2013

Veirano Advogados advised DNB Bank and DNB Markets, as sole advisor, global coordinator, bookrunner and

MLA, in the US$584 million project finance & ECA deal for Technip Odebrecht PLSV CV. As part of the

transaction, the Firm also advised all lenders involved: Banco Itaú, Bank of Tokyo-Mitsubishi UFJ, HSBC,

Standard Chartered, SMBC, Credit Agricole, ABN AMRO, K-Sure, GIEK and Eksportkreditt.

Latin Lawyer - Project Finance Deal of the Year 2013

Veirano Advogados acted as Brazilian counsel to the lenders, agents and hedge providers in the US$1.2 billion

financing of the Chaglla hydropower plant in Peru, sponsored by the Odebrecht Group. Bound to be the

country’s second largest hydropower facility, it is one of the first project finance facilities of the BNDES for a

project located outside of Brazil.

Chambers Latin America - Lifetime Achievement 2012

Founding partner Ronaldo C. Veirano received the prestigious Chambers Lifetime Achievement award in

recognition for a longtime and productive career spanning more than 40 years of contributions to the Brazilian

legal market.

Latin Lawyer - Bankuptcy/Restructuring Deal of the Year 2012

Veirano Advogados advised Bank of New York Mellon, in its acting as trustee to the bondholders in the

acquisition of Brazilian power distributor Centrais Elétricas do Pará (CELPA) by Equatorial Energia through

judicial restructuring, the largest of its kind since Brazil’s new bankruptcy and restructuring law entered in to

force.

INVESTMENT OPPORTUNITIES IN BRAZIL

33

CONTACT INFORMATION

For more information about Veirano Advogados, visit our web site or contact us anytime to discuss the current

legal needs of your business:

Rio de Janeiro

São Paulo

Av. Presidente Wilson, 231 - 23º andar

20030-021 - Rio de Janeiro RJ - BRASIL

t +55 21 3824 4747

f +55 21 2262 4147

Av. Brigadeiro Faria Lima, 3477 - 16º andar

04538-133 - São Paulo SP - BRASIL

t +55 11 2313 5700

f +55 11 2313 5990

Porto Alegre

Brasília

Rua Dona Laura, 320 - 13º andar