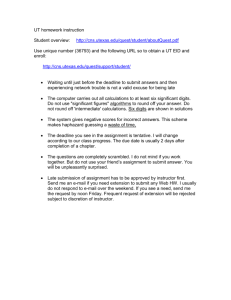

Gabelli & Company, Inc.

advertisement

One Corporate Center Rye, NY 10580-1422 Tel (914) 921-5072 Fax (914) 921-5098 February 19, 2004 Gabelli & Company, Inc. www.gabelli.com CNS, Inc (CNXS - $12.96 - NASD) FYE 3/31 2006P 2005P 2004E 2003A EPS $.75-.80 $.65-.70 $.57-.60 $0.46 P/E 17.1 19.3 21.6 27.9 Breathe Easy PMV $17.50 15.50 13.75 11.00 Dividend: $.16 Yield: 1.2% Shares O/S: 13.65 million 52-Week Range: $5.81 - $14.85 CNS is an innovative micro-cap company based in Eden Prarie, Minnesota. They manufacture a line of consumer health care products, most notably the Breathe Right Nasal strip and FiberChoice chewable fiber supplements. Expanded advertising, distribution, and new products have driven the company to a 11.8% compounded growth rate over the last five years. We estimate the company will generate almost $100 million in revenue during fiscal 2005 as the company follows this successful strategy. With over $3 per share in cash, a 1.3% dividend yield, and a 500,000 share buyback program, CNS minimizes its downside risk with significant growth potential as it follows its highly successful strategy. Breathe Right Products (73.5% of fiscal 2003 sales) CNS’s main product is the Breathe Right nasal strip, most visibly seen on professional athletes to improve their breathing and thus their athletic performance. However, the nasal strips are also FDA approved as a product that improves nasal breathing, reduces or eliminates snoring, and temporarily relieves nasal congestion. Over 90% of Breathe Right usage is for these FDA approved indications, with men representing about 60% of nasal strip users. Product extensions have included the addition of mentholated vapors for improved congestion relief, as well as different sizes and designs, especially for children. The company has an exclusive license on the nasal strip from its inventor and has strong patent protection for another 11 years. CNS continues to drive growth and acceptance of nasal strips through advertising and studies showing the benefits of improved breathing. In order to increase sales and build on the success of the nasal strip, the CNS has launched several complementary Breathe Right products in the areas of congestion and snore relief. These products are non-medicinal alternatives to the numerous over-the-counter cough and cold drugs. The company markets a saline nasal spray to moisten dry and irritated nasal passages, relieving stuffiness and sinus pressure. During fiscal 2002, the company launched a Snore Relief spray. This spray, taken shortly before sleep, lubricates the throat and firms loose tissue to reduce or eliminate snoring. Their most recent product, the VaporShot! Personal Vaporizer, is a menthol powder that is added to hot water, creating powerful vapors for congestion relief. This product is ideal for daytime congestion relief by professionals and others who cannot tolerate the drowsiness and other side effects of medication. CNS continues to innovate and extend its brand by launching one or more new product every year within the Breathe Right space. Table 1: CNS, Inc Income Statement ($Millions, except per share data) 2003A 2004E 2005P 2006P 2007P 2008P 03-'08 CAGR ---Breathe Right $57.9 $66.0 $73.3 $81.3 $90.3 $100.2 11.6% ---FiberChoice 5.8 7.1 9.1 10.5 12.0 13.8 19.0% ---International 15.2 13.8 14.6 16.1 17.7 19.5 5.1% Total Revenue 79.1 89.7 99.8 111.0 123.6 137.5 11.7% (69.4) (76.7) (85.1) (94.5) (104.9) (116.5) Expenses Operating income Pre-tax income 9.6 13.0 14.7 16.5 18.7 21.0 10.5 13.9 15.7 17.8 20.1 22.7 Income taxes (a) 4.0 5.2 5.8 6.6 7.4 8.4 Net income - cont. ops. 6.5 8.8 9.9 11.2 12.6 14.3 14.0 14.6 14.8 14.8 14.8 14.8 $0.46 $.57-.60 a) Assumes 37% tax rate Source: Company data and Gabelli & Company estimates $.65-.70 $.75-.80 $.85-.90 $.95-1.00 Diluted shares outstanding Diluted EPS -Please Refer to Important Disclosures at the End of this Report- 16.7% 15.8% Gabelli & Company, Inc. FiberChoice (10% of sales) In 2000, CNS launched a chewable, orange flavored fiber tablet to compete in the $300 million fiber supplement market. FiberChoice contains twice as much fiber as competitive supplements such as Metamucil, and its tablet form is easier to take than the powders of many competitors. FiberChoice is still being rolled out nationwide and is currently reaches about 68% of the United States. CNS is spending heavily on advertising and promotion to drive use and acceptance of this product, with significant room for growth. While fiber supplements continue to be used primarily by elderly people with medical conditions, CNS is positioning FiberChoice as a health supplement, seeking to convince a younger population to take fiber regularly as part of a healthy diet. International (17.5% of sales) All of CNS’s products are sold internationally through local distributors, primarily in Europe and Japan. These relatively untapped markets are growing significantly faster than the United States as CNS continues to expand distribution and introduce new users to their products. CNS helps distributors support sales with advertising and promotional work. A planned inventory reduction at distributors has created a buying opportunity in the stock and will smooth out historically unpredictable sales levels going forward. Competition CNS and its Breathe Right product control over 90% of the nasal strip market. Their strong patent protection has successfully kept all but a few private label competitors out of the market. The Breathe Right brand extensions, particularly the saline nasal spray and snore spray, have less patent protection and face tough competition from private label alternatives. FiberChoice operates in a $270 million bulk fiber supplement market, competing against larger, established brands such as Metamucil, Citrucel, and FiberCon. While this is a mature, low-growth market, it has been shifting away from difficult to swallow powders towards easier to swallow tablets like FiberChoice Seasonality Since many of CNS’s products are targeted for the cough/cold market, the company’s fiscal 3rd and 4th quarters are traditionally the periods of highest sales, operating on a March 31st fiscal year end. During these quarters, CNS launches large advertising campaigns, reinvesting virtually all of their profits in the Breathe Right brand. The company’s first and second quarters provide the majority of the company’s annual profit despite their lower sales. Traditionally, international sales have also been very erratic due to fluctuations in distributor inventory levels, but CNS has recently taken steps to match these sales with the overall company’s seasonality. Strong Management CNS has grown with a unique corporate structure and has managed to attract very strong talent to their small company. CEO Marti Morfitt brings extensive consumer product experience from the Green Giant brand at Pillsbury, applying strong distribution and brand building strategies to CNS. Senior management as a whole owns just over 5% of the company’s stock. By outsourcing its manufacturing and focusing on core operations, such as advertising and servicing its top customers, CNS can operate with just 55 employees. This lean structure allowed the company to earn an incredible 88% return on invested capital in fiscal 2003 Growth Projections We conservatively project that Breathe Right sales will continue to increase at 11% annually, driven by new brand extensions and continued strong advertising support of existing products. As FiberChoice continues to increase its distribution and product awareness, it should be able to grow at 15% annually. International sales, while historically uneven, should begin to follow the company’s seasonal trends and grow 10% annually, again due to expanded distribution in Europe and Japan as well as continuing advertising support. With modest leverage through the income statement, earnings should be able grow by almost 16% annually for the next several years. While there is always risk that a new product will not succeed, we feel the company’s strong market research and brand name will minimize this risk. 2 Gabelli & Company, Inc. Balance Sheet and Cash Flow With $47 million in cash and no debt, CNS is actively looking for unique new products to acquire or license, as they did with FiberChoice product in 2002. In the absence of those opportunities, the company will continue to return cash to shareholders through its recently announced $.16 annual dividend and through share buybacks, with over 500,000 shares remaining on its current program. Management and the board of directors have also indicated their willingness to sell the company if they can no longer continue to expand the Breathe Right brand and grow the company. Inventory Reduction When CNS announced second quarter results on October 16, 2003, they said they planned to delay international shipments in the December quarter to reduce distributors’ inventories and align CNS’s sales with market demand. Due to this previously announced move, International sales in the third quarter were down 32%, with the majority of that $2.2 million in revenue simply shifted into the current quarter ending in March. Going forward, international sales will be more predictable, following the overall company’s seasonal patterns. While this move had been announced well in advance and does not represent any change in the company’s underlying business strength, CNS’s stock price has fallen over 15% since announcing third quarter results, creating a buying opportunity for investors. Private Market Value We value an innovative and rapidly growing company such as CNS with a 10x EBITDA multiple. On a price/earnings basis, after subtracting the company’s $3.17 per share in cash, the stock is trading just 17 times expected 2004 earnings. We feel the company is worth approximately $13.75 today, growing 15% annually due to double digit sales growth and improving operating leverage. This return is in addition to the company’s 1.6% dividend yield and share buybacks that return significant amounts of cash to shareholders. The adjustment in international inventories has made CNS undervalued in the short term with strong long term growth prospects going forward. Table 2: CNS, Inc Private Market Value 2003A 2004E 2005P 2006P 2007P 2008P $79.1 10.9 10.0 108.9 $89.7 14.1 10.0 141.1 $99.8 15.9 10.0 158.6 $111.0 17.8 10.0 178.0 $123.6 20.0 10.0 199.9 $137.5 22.4 10.0 224.4 Shares (basic) 49.3 (8.2) 150.0 13.6 57.0 (11.5) 186.6 13.6 65.4 (13.7) 210.3 13.6 75.3 (16.2) 237.1 13.6 86.6 (19.0) 267.5 13.6 99.6 (22.1) 301.9 13.6 PMV Per Share $11.00 $13.75 $15.50 $17.50 $20.00 $22.50 ($Millions, except per share data) Revenue: EBITDA Valuation Multiple Total Private Market Value Plus/ (Less): Net Cash (Debt) Less: Net Options Payments (a) Equity PMV a) Payments to option holders at PMV, net of taxes Source: Company data and Gabelli & Company data 3 03-'08 CAGR 11.7% 15.6% 15.3% Gabelli & Company, Inc. E P S P M V MANAGEMENT CASH FLOW RESEARCH I, Jeff Jonas, the Research Analyst who prepared this report, hereby certify that the views expressed in this report accurately reflect the analyst’s personal views about the subject companies and their securities. I also certify that I have not, am not and will not be receiving direct or indirect compensation for expressing the specific recommendation or view in this report. Gabelli & Company, Inc. 2004 Jeff Jonas (914) 921-5072 ONE CORPORATE CENTER RYE, NY 10580 GABELLI & COMPANY, INC. TEL (914) 921-3700 FAX (914) 921-5098 Gabelli & Company, Inc. (“we or “us”) attempts to provide timely, value-added insights into companies or industry dynamics for institutional investors. We do not have any formal ratings system for our research reports, and we do not undertake to “upgrade” or “downgrade” ratings after publishing a report. We generally write reports on securities that we believe to be undervalued and do not issue any “sell” ratings. Thus, virtually all of our reports containing recommendations would be considered “buy” ratings. We prepared this report as a matter of general information. We do not intend for this report to be a complete description of any security or company and it is not an offer or solicitation to buy or sell any security. All facts and statistics are from sources we believe to be reliable, but we do not guarantee their accuracy. We do not undertake to advise you of changes in our opinion or information. Unless otherwise noted, all stock prices reflect the closing price on the business day immediately prior to the date of this report. We do not use “price targets” predicting future stock performance. We do refer to “private market value” or PMV, which is the price that we believe an informed buyer would pay to acquire 100% of a company. There is no assurance that there are any willing buyers of a company at this price and we do not intend to suggest that any acquisition is likely. Additional information is available on request. In the last 12 months we have provided investment banking services as a syndicate or selling group member of underwritten offering to approximately none of the companies that were the subjects of our research reports (all of which would be considered “buy” ratings). Our affiliates beneficially own on behalf of their investment advisory clients or otherwise approximately 2.8% of the common stock of CNXS. Because the portfolio managers at our affiliates make individual investment decisions with respect to the client accounts they manage, these accounts may have transactions inconsistent with the recommendations in this report. These portfolio managers may know the substance of our research reports prior to their publication as a result of joint participation in research meetings or otherwise. The analyst who wrote this report may receive commissions from customers’ transactions in the securities mentioned in this report. 4