Recent CRA Challenges Involving Partnerships

advertisement

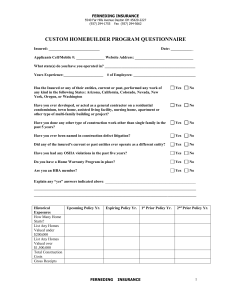

Recent CRA Challenges Involving Partnerships CPTS Luncheon Series May 15, 2013 Robert Kopstein and Carrie Aiken 1 Overview • General Legal Principles • CRA Challenges and Assessments – – – – 2 Formation / Validity of Partnerships Character Conversion Transactions Issues under Successor Rules in subs. 66.7 Deduction of Partnership Expenses at Partner Level General Legal Principles • Under the Partnership Act (Alberta) (“APA”), a partnership means: “The relationship that subsists between persons carrying on a business in common with a view to profit” • Formation of a partnership is determined under common law and provincial statute • “Partnership” is not defined in ITA 3 General Legal Principles • A partnership is not an entity distinct from its partners - it is a relationship between the partners • No distinction between limited and general partnerships in this regard (except that a limited partnership must be registered) • A partnership acts through its partners in a relationship of mutual agency – one partner’s actions bind the other partners (APA, s. 6-10) • At common law, each partner is viewed as carrying on the business of the partnership (see Robinson, 98 DTC 6232 (FCA) and s. 253.1) 4 General Legal Principles • An aggregation of partners who own the property that is used to carry on the partnership’s business • Property of the partnership is held and applied by the partners exclusively for the purposes of the partnership and in accordance with the partnership agreement (APA, s. 23) • Madsen v. The Queen, 2001 DTC 5093 (FCA) – ownership of property does not vest in the partnership; the acquisition of partnership property takes place between the partners on behalf of the partnership 5 Interaction of Partnership and ITA • Partnership is not a taxpayer under ITA – income is computed at the partnership level “as if” the partnership were a separate person • ITA does not deal with partnerships consistently or comprehensively – Some provisions recognize the partnership interest as a property distinct from the underlying assets – Some deem the partnership to be a separate person – Others preserve the nature of the income or loss of the partnership in the hands of the partners 6 Interaction of Partnership and the ITA Examples: • S 96 deems the partnership to be a person for the purpose of computing income but does not address the issue of ownership of assets • Elections under subs 85(3) and 97(2) treat members of the partnership as the operative parties and not the partnership itself • S 116 looks through the partnership to require any nonresident person who is a member to file the requisite notifications 7 Formation of Partnerships • Leading cases on legal requirements for the formation of a partnership: – Continental Bank of Canada v. The Queen, 98 DTC 6505 (SCC) – Spire Freezers Ltd. V. The Queen, 2001 DTC 5158 (SCC) – Backman v. The Queen, 2001 DTC 5149 (SCC) See Appendix for case summaries • Three essential ingredients to form a partnership: (1) a business (2) carried on in common (3) with a view to profit 8 Formation of Partnerships • Objective determination of whether the documentary evidence and the surrounding facts (including what the parties actually did) was consistent with the subjective intention to carry on business in common with a view to profit (See Backman) 9 (1) A Business • Partnership can exist even if partners do not carry on business for tax purposes – Common law definition of “business” is relevant – Not the definition of “business” under the ITA • At common law, a business is “anything which occupies the time and attention and labour of a man for the purpose of profit” • Relatively low threshold – generally any commercial activity, including a mere investment in property, can be a business 10 (1) A Business • No need for sustained activity – can be formed for a single transaction or short period of time • There is no minimum time frame over which the partnership must exist – 1 day, 2 months, 1 year? (Hickman Motors) • Examine what happened after closing – did the business continue to be carried on? (Spire Freezers) • Period of inactivity is not fatal 11 (1) A Business • Sufficient to continue an existing business into the partnership • May include passive activities (e.g., receipt of rent) and investment in other partnerships • Existence of a business is not dependent upon a reasonable expectation of profit or positive revenue stream – This is particularly acute in the oil and gas industry where there is often a time lag between the start of a project and associated revenue streams 12 (2) Carried On In Common • Question of the intent of the partners • Management can rest with a single partner • Contracting out under a services agreement should be no different than delegating to a managing partner 13 (2) Carried On In Common Continental Bank (at para 34): “… I am satisfied that the business that was carried on was carried on by the partners in common. Under the Partnership Agreement, the Partners "delegate to the Managing Partner full power and authority to manage, control, administer and operate the business and affairs of the Partnership and to represent and enter into transactions which bind the Partnership" (Art. 4.01). The fact that the management of the Partnership was given to the Managing Partner does not mandate a conclusion that the business was not carried on in common. Nor does the fact that Central, acting alone, was negotiating transactions relating to the lease portfolios prior to December 29, 1986. The respondent argues that the exclusion of Leasing and the Bank from any of those activities negates any claim that the Central entities and the Continental entities were actually carrying on business in common during that period. As Lindley & Banks on Partnership, supra, point out, at p. 9, one or more parties may in fact run the business on behalf of themselves and the others without jeopardizing the legal status of the arrangement.” 14 (2) Carried On In Common • Evidence consistent with an intention to carry on business in common may include: – – – – Contribution of time, skill, cash or assets Joint property interest in subject-matter of the adventure Sharing of profits and losses Filing of tax returns as a partnership and, where applicable, financial statements, joint bank accounts and correspondence with third parties • These evidentiary factors have been developed through long line of case law and there is no hierarchy or need to demonstrate all factors • For example, the SCC noted in Continental Bank that holding oneself out as a partner does not “alone have the effect of validating the partnership”, but rather evidences the partners’ intentions 15 (3) With a View to Profit • • • • Intention of the parties is relevant Profit making purpose may be ancillary Amount of profit is not determinative Do not need a net gain over a specific time frame • A tax-motivation for the formation of the partnership may exist – need to distinguish between motivation and intention 16 (3) With a View to Profit • Backman (at para 24): In determining whether there is a view to profit courts should not adopt or employ a purely quantitative analysis. The amount of the expected profit is only one of several factors to consider. The law of partnership does not require a net gain over a determined period in order to establish that an activity is with a view to profit. For example, a partnership may incur initial losses during the start up phase of its enterprise. That does not mean that the relationship is not one of partnership, so long as the enterprise is carried on with a view to profit in the future. Therefore, where a partnership is formed with the predominant motive of acquiring a tax loss, it is not necessary to show an intention to profit by the amount necessary to recoup the acquired losses or produce a net gain. 17 Challenges from the CRA • Two streams of challenges – Partnership is not validly created and does not meet requirements under common law and applicable statute; or – the benefits associated with the use of the partnership should be denied under the GAAR • Seeing challenges in several contexts – Contribution of asset to a partnership under subs 97(2) followed by sale of partnership interest to third party or investment by third party in partnership (e.g., capital carry arrangements) – Package and bump transactions (e.g., Oxford Properties) – transfer assets (that would otherwise be ineligible for 88(1)(d) bump) to partnership under subs 97(2) so that on change of control, partnership interest can be bumped under 88(1)(d) 18 CRA Arguments on Valid Formation of Partnerships • “Business” for purposes of determining whether a partnership exists is the more restrictive definition in the ITA and not under common law • Requires an active business (activities must occur on regular or continuous basis) • No revenue streams possible or expected • Intention to form a partnership solely attributable to tax motivation 19 CRA Arguments on Valid Formation of Partnerships • Insufficient levels of activity – Partner undertook activities / incurred expenses directly – Partners and partnership’s participation in business removed because of services agreement • Insufficient assumption of risks / responsibilities by partnership • Duration of partnership (e.g., only in place for short period of time before transaction) 20 CRA Arguments on Valid Formation of Partnerships • Partners did not sufficiently hold themselves out as partners • In some cases, CRA is alleging the partnership is a sham (particularly where partnership not publicized in annual reports, etc.) – High threshold for establishing sham – Requires an element of deceit – Is there an element of deceit in circumstances where disclosure is not required (e.g., consolidated financial statements)? 21 CRA Arguments on Character Conversion Transactions • The partnership does not exist (see above) • If a person transfers assets to a partnership in anticipation of a sale, the partnership interest is akin to a trading asset • Under the GAAR on the basis that there is an abuse of the ITA where a person converts an income gain into a capital gain through the use of a partnership (e.g., a person should directly sell assets instead of a partnership interest) 22 Character Conversion Transactions • Point in time test – did the taxpayer hold capital property at the time of the disposition? • Question of whether something is income or capital for tax purposes is the underlying legal question and is not mandated by a specific provision or scheme in the ITA 23 Character Conversion Transactions • Partnership Interest held on capital account – SCC commentary in procedural appeal relating to Continental Bank, 98 DTC 6501 (at para 16) “Assuming that the Bank transferred its partnership interest to 693396 Ontario Limited ("693396") and 693397 Ontario Limited ("693397"), I agree with Bastarache J. that the transfer should be construed as a capital transaction and not an adventure in the nature of trade, making the alternative assessment untenable. None of the circumstances indicate that the Bank's acquisition and subsequent disposition of Leasing's partnership interest was a speculative trading venture…” – Walchuk v. The Queen, 2004 DTC 2184 (TCC) – Cardella v. The Queen, 2001 DTC 5451 (FCA); 99 DTC 631 (TCC) 24 Character Conversion Transactions Walchuk v. The Queen, 2004 DTC 2184 (TCC) at para 14-15: “A partner, by nature, carries on business with a view to profit, not from resale, but from the ongoing business. That is the nature of a partnership interest. For income tax purposes the partnership interest is treated as capital property, separate from the assets of the partnership… The partnership unit may have some similar characteristics to a share in that it too constitutes something which, by its nature is an investment, and not itself, an ordinary transferable widget. However, to overcome the normal status of a partnership unit as capital property is a more onerous task than doing likewise for shares, simply due to the nature of the structure. There are ready markets for shares. The owner of the share is not coincidentally the owner of the business' underlying assets. The partner, however, is both the owner of the capital property, the partnership interest, and the owner of the underlying assets, the business itself. This is only to indicate that to claim there are two businesses there must be compelling, convincing evidence that the dealing with the one - the partnership unit - is distinct and separate from the dealing with the other.” 25 Character Conversion Transactions • A note on GAAR - there will be a finding of abusive tax avoidance where the taxpayer is in compliance with the wording of the provision, but the transaction: – Achieves an outcome that the statutory provision was intended to prevent; – Defeats the underlying rationale of the provision; or – Circumvents the provision in a manner that frustrates or defeats its object, spirit or purpose (See: Canada Trustco & Copthorne) • Minister has obligation to prove the underlying policy that it asserts is being abused in a GAAR challenge 26 Character Conversion Transactions • As noted by the SCC in Canada Trustco: – “Despite Parliament's intention to address abusive tax avoidance by enacting the GAAR, Parliament nonetheless intended to preserve predictability, certainty and fairness in Canadian tax law. Parliament intends taxpayers to take full advantage of the provisions of the Income Tax Act that confer tax benefits. Indeed, achieving the various policies that the Income Tax Act seeks to promote is dependent on taxpayers doing so.” (at para 31) 27 Character Conversion Transactions • ITA provides for carrying on business through corporation, partnership, trust, proprietorship • Taxpayers are entitled to choose the appropriate vehicle based on their circumstances • Specific rules governing dispositions into and out of corporations, partnerships, trusts • No rules on when a taxpayer can or cannot use a particular vehicle (other than subs 69(11)) or how long the vehicle must be in place • Anti-stuffing provisions in the bump rules (e.g., when purchaser adds property following acquisition or new para 88(1)(d)(ii.1), 88(1)(e) and 97(3)) 28 Oxford Properties • Oxford was a large commercial real estate firm that owned and managed office, industrial and retail property that was listed on TSX • BPC was a Canadian corporation formed to make takeover bid for Oxford • Prior to the takeover Oxford transferred certain real properties to newly formed limited partnerships under subs 97(2) (“Tier1 LPs”) • Oxford was purchased by a subsidiary of BPC (in 2001) and then amalgamated to obtain a tax-bump to the partnership interest and other non-depreciable properties owned by Oxford (in 2002) • In 2002, Tier1 LPs formed limited partnerships (“Tier2 LPs”) and transferred properties to them under subs 97(2). Tier1 LPs wound-up under subs 98(3) and ACB of Tier2 LPs was bumped under para 98(3)(b) and (c) • In 2006, Oxford sold 3 of the Tier2 LPs to tax-exempts 29 Oxford Properties First Bump Transaction: BPC BPC Vertical Amalgamation, subs. 87(11), bumping ACB of Tier1LP and other property held by Oxford under 88(1)(d) Tier1 LPs Tier2 LPs Assets 30 Assets Oxford sells Tier2 LPs to tax-exempts Oxford Amalco 151 Tier1 LPs Third Transaction: Acquire Co Acquire Co Oxford Second Bump Transaction: Step 2: Tier1 LPs wind-up under 98(3) and ACB of Tier2 LPs bumped Step 1: Tier1 LPs transfer assets to Tier2 LPs under 97(2) Oxford Properties • Minister reassessed Oxford under the GAAR seeking to deny the bumps and apply subs 100(1) • Tax benefits identified by the Minister (and agreed to by the Appellant) were: – (1) deferral of tax on capital gains and recapture by virtue of subs 97(2); – (2) increase in the ACB of the interest in the Tier1 LPs and Tier2 LPs by virtue of subs 88(1) and 98(3); and – (3) the reduction of income tax payable by the Appellant on the sale of its partnership interests to the tax-exempts. • One of the arguments of the Appellant under the GAAR is that the first set of transactions (up to the creation of the Tier2 LPs) were “primarily tax motivated solely on the part of BPC, but not on the part of the Appellant as they can reasonably be considered to have been undertaken or arranged for bona fide purposes other than to obtain a tax benefit.” 31 Successor Rules • Rules in s 66.7 limit the deduction of resource expenses following direct or indirect transfers of Canadian resource properties (“CRP”) • General rule is that resource expenses may only be deducted by the corporation that incurred them • Direct or indirect purchaser of CRP may be entitled to deduct resource expenses incurred by the original owner of the CRP in limited circumstances • Rules also apply on an acquisition of control to deem a corporation to be a successor to itself • Overriding purpose of 66.7 is to provide a tracing mechanism 32 Successor Rules • Application of 66.7 to a partnership has been a source of significant uncertainty, particularly in light of the assessing practices of the CRA • Where CRP is owned by a partnership at the time of an acquisition of control of a corporation that is a member of the partnership, para 66.7(10)(j) provides the necessary link between any successored resource tax pools (which are at the partner level) and the CRP (which is owned by the partnership) at the time of the acquisition • Para 66.7(10)(j) addresses concept of “ownership” and deems a corporation to own the applicable proportionate interest in the CRP owned by the partnership and, thus, permits the corporation to deduct income and proceeds allocated by the partnership from those CRP against the corporation's successored resource pools • CRA’s view is that para 66.7(10)(j) does not look through multiple tiers of partnerships (2012-0432931E5) 33 Successor Rules Devon v. The Queen • Successor rules were triggered as a result of acquisition of control of Anderson Exploration Ltd., parent to Home Oil Company (now Devon) • Prior to acquisition, Home Oil owned CRP through a partnership • Following acquisition, the partnership transferred its CRP to a subsidiary partnership • CRA reassessed denying Devon’s claim for successor deductions attributable to the CRP on the grounds that para 66.7(10)(j) ceased to apply on the drop down of the CRP to the second level partnership • Recently won a Rule 58 motion for the determination of a question 34 of law before a hearing Successor Rules • CRA has taken the view that there is no “successoring transaction” when a partnership distributes CRP to a partner on a tax-deferred partnership wind-up and, therefore, subs 66.7(16) applies: “Where at any time a Canadian resource property or a foreign resource property is acquired by a person in circumstances in which none of … subsections (1) to (5) apply, every person who was an original owner or predecessor owner of the property by reason of having disposed of the property before that time shall, for the purpose of applying those subsections to or in respect of the person or any other person who after that time acquires the property, be deemed after that time not to be an original owner or predecessor owner of the property by reason of having disposed of the property before that time.” 35 Successor Rules • The CRA has generally taken the position that a partnership is not a "person" for purposes of the ITA so that no successor election can be made by a partnership and a partner for purposes of 66.7(7) • Effect of CRA’s position is that the link between successored resource pools at the partner level and the CRP distributed by the partnership to the partner is eliminated and the successored resource pools are stranded • Thus, because the successor rules do not, according to the CRA, apply, subsection 66.7(16) kicks in to deem there never to have been an original owner in respect of the transferred property 36 Successor Rules • Ultimately a question of statutory interpretation “In order to determine whether a transaction is an abuse or misuse of the Act, a court must first determine the "object, spirit or purpose of the provisions"... The object, spirit or purpose can be identified by applying the same interpretive approach employed by this Court in all questions of statutory interpretation—a "unified textual, contextual and purposive approach"… While the approach is the same as in all statutory interpretation, the analysis seeks to determine a different aspect of the statute than in other cases. In a traditional statutory interpretation approach the court applies the textual, contextual and purposive analysis to determine what the words of the statute mean. In a GAAR analysis the textual, contextual and purposive analysis is employed to determine the object, spirit or purpose of a provision.” Copthorne (at para 69-70) 37 Successor Rules • The purpose of para 66.7(10)(j) is to provide the necessary tracing to the “owner” of the CRP (which is the corporation itself) • No language under successor rules or supporting technical notes which provide that subs 66.7(16) should override the specific deeming rules in subs 66.7(10)(j) • To read in an override in subs 66.7(16) would remove all meaning from the specific relieving rule in subs 66.7(10)(j) enacted to address partners and partnerships under the successor rules 38 Successor Rules • Subs 66.7(16) was enacted as a specific anti-avoidance provision • If a corporation is deemed to be the “owner” of a property under para 66(10)(j) and the partnership is wound-up, the corporation is still the owner following the wind-up • CRA positions on para 66.7(10)(j) and 66.7(16) are inconsistent with the scheme, object and purpose of the successor rules or the ITA generally 39 Deduction of Expenses • Expenses incurred at partner level instead of at the partnership level • Partner is considered to be carrying on the business of the partnership; therefore, under general principles, expenses incurred in the course of the business are deductible “First, a taxpayer who complies with the provisions of the Act should not be denied the benefit of such provision simply because the transaction was motivated for tax planning purposes. Second, in the absence of evidence that the transaction was a sham or abuse […] and where the words of the act are clear, it is not the role of the Court to decide […] whether the taxpayer is deserving of the deduction. Third, it is an error for the Court to ignore the legal and commercial reality of a transaction.” (Continental Bank) 40 Deduction of Expenses • CRA has argued that the deduction should have been at the partnership level and denied it at the partner level • Accounting principles requiring “matching” of expenses to revenues are not law and need not be followed for the purposes of calculating income under the ITA, provided that an alternative method presents an accurate picture of income (Canderel) 41