CREATING BUSINESS INFORMATION SYSTEM FOR AN

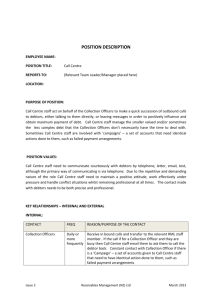

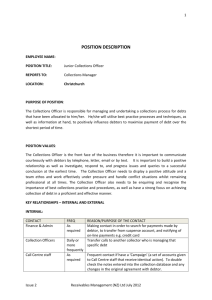

advertisement

TALLINN UNIVERSITY OF TECHNOLOGY IDY0320: Business Information Systems Rein Nõukas 132720IVGMM CREATING BUSINESS INFORMATION SYSTEM FOR AN INNOVATIVE BUSINESS MODEL Professor Enn Õunapuu Tallinn, 2013 Contents Introduction ................................................................................................................................ 2 Business Model .......................................................................................................................... 3 Key Partners ........................................................................................................................... 3 Key Activities ......................................................................................................................... 3 Key Resources ........................................................................................................................ 4 Value Propositions ................................................................................................................. 4 Customer Segments ................................................................................................................ 4 Customer Relationships.......................................................................................................... 4 Channels ................................................................................................................................. 5 Cost Structure ......................................................................................................................... 5 Revenue Streams .................................................................................................................... 6 Business Process Description ..................................................................................................... 7 Old Model .............................................................................................................................. 7 New Model ............................................................................................................................. 8 MS Access Database ................................................................................................................ 11 Balanced Scorecard .................................................................................................................. 12 1 Introduction Every year thousands of companies are founded and also thousands of these are closed due to bankruptcy and/or mismanagement. The companies which manage to maintain their economic activities sometimes suffer from overly ambitious business plans leading to overinvestment and the following lack of funds to cover the unavoidable losses. The reasons are varying but the result of the insolvency is always the same – company is not able to pay its bills. What happens next? The creditor has two choices – either to write off the unpaid invoices or continue demanding the payment for the used services, goods etc. Debt collection is usually handled by the creditor itself or outsourced to a specialized business organization. Utilizing both ways is beneficial for boosting the competition between the external service provider(s) and the creditor’s debt collection teams, also bench-marking is enabled in order to detect the efficiency gaps and track market trends (Roland Berger1). Outsourcing depends on the collection phase – during the early phases the debt is collected mostly inhouse as the probability of a successful collection is the highest. During the financial crisis, however, the overall willingness to outsource has grown for all collection phases as delinquencies increased. For example in the banking sector early collections including most of the easy-to-solve cases are mostly handled in-house – only 35% of banks use or plan to use the support of collection agencies. In late collection, more than two thirds of the banks, however, outsource at least partially.(ibid.) On the other hand, outsourcing is justified in the debt collection because of the aim to retain the customer relationship. Today’s debtor can be again a customer tomorrow. Also building a new customer relationship expensive than maintaining an existing one. Having a dual role – selling goods and/or services and in parallel claiming overdue invoices – is not logical as customers may get confused about which role the company is using in its communication with the former. Therefore the debt collection companies have emerged in order to assist customer-facing companies to overcome this problem. FinanceFix is a leading outsourced receivables management company in Estonia. Its services range from customer selection to credit evaluation, invoicing, reminders, debt collection, portfolio management and customer services. FinanceFix has been acting In Estonia for over 15 years, having experienced both economic booms and recessions. Now the management of the company is standing on a crossroad – in the light of diminishing debt collection success rate and increasing dissatisfaction among the customers the company must re-design its core operation (voluntary Business-to-Business debt collection) in order to become profitable and sustainable business again. Also the reliance on human labour has to be decreased as it is getting expensive while showing limited to no growth in the effectiveness. 1 Roland Berger, Retail Banking in CEE - debt collection in times of crisis, 2011 http://www.rolandberger.com/media/publications/2011-02-22-rbsc-pub-Retail_banking_in_CEE.html 2 Business Model The main asset of FinanceFix is the knowledge of organizing operations in a most effective and competitive way enabling the customers to free up their financial resources faster and with less costs involved. Below are described in detail the aspects of FinanceFix’ business model according to the structure given in Business Model canvas2. Key Partners Who are the Key Partners? - Commecial registry (äriregister.ee) - Population registry (andmevara.ee) - Credit history (payment defaults) registry (inforegister.ee) Who are the key suppliers? n/a Which Key Resources are acquired from partners? - Commecial registry: o data about the debtor - Population registry: o address data about the debtor’s members of the board - Credit history registry: o Previous payment defaults Which Key Activities do partners perform? - Credit history registry: o Publishing the debtors’ data (payment defaults) upon demand Key Activities What Key Activities are required by Value Propositions? The main asset of FinanceFix is the knowledge of organizing operations in the debt collection process in the most effective and competitive way. This is achieved by utilizing almost fully automated workflow, including data exchange with external partner network. Human labour is used only for calling debtors and qualitatively evaluating cases (for proposing legal action if volunatary collection has failed). Aforementioned process set-up allows to handle huge volume of unpaid debts in a unprecedented short timeframe and low cost both for the creditor and debtor. In parallel the control and monitoring ability per each individual submitted unpaid invoice is maintained giving the customer a clear and focused overview of the collection process (via self-service portal). Our Distribution Channels? n/a Customer Relationships? Customers are acuired via active sales conducted by a dedicated team, post-sales activities are handled by the Account Managers who manage the customer (data base) integration process and provide councel and feedback throughout the customer life-cycle. Revenue streams? 2 www.businessmodelgeneration.com 3 Revenue is gathered from the collection fees paid by the debtors and revenue-sharing scheme agreed with each customer separately. This scheme contains the bonus for early collection and certain percentage of collected overdue interest and credit interest. Key Resources What Key Resources are required by Value Propositions? The main resource of FinanceFix is the knowledge of organizing operations in the debt collection process in the most effective and competitive way. Our Distribution Channels? n/a Customer Relationships? See Key Activities. Revenue streams? See Key Activities. Value Propositions What value is delivered to the customer? - Cost-effectiveness (customer doesn’t have to spend any additional resources on getting the credit back) - Fast results (within 35 days in voluntary collection phase it is known if the debt is collectible) - Professional handling of debtors (minimized impact on the customer relationship) Which one of customer’s problems are being helped to solve? - Transform non-paying debtors to credit-worthy customers What bundles of products and services are offered to each Customer Segment? - Business-to-business debt collection (voluntary and legal collection) is the universal service for all customer segments. Which customer needs are being satisfied? - Bring the resources spent on non-performing credit back to the circulation (for creating a new value for the customer). Customer Segments For whom are created value? - FinanceFix targets volume B2B market: o Wholesellers o Banks o business real estate (for renting purposes) operators o telecom companies o utilities providers Who are the most important customers? The most important customers are defined according to the following criteria: - amount of new cases (unpaid invoices) - the value of the cases Both aspects have to be higher than the average parameters of all the customers’ cases from the previous year. Customer Relationships What type of relationship does each of Customer Segments expect FinanceFix to establish and maintain with them? 4 Differentiated treatment of customers is not justified as the nature of the service provided is the same. Which ones have we established? n/a How are they integrated with the rest of our business model? n/a How costly are they? - Maintaining a customer relationship involves: o direct costs (f. ex. salaries for Account Managers, development and maintenance of a self-service portal etc) o indirect cost (f. ex. organizing customer events&trainings, escalated problem-solving by senior management etc) o one-time cost (customer integration project) Channels Through which Channels do Customer Segments want to be reached? In the B2B sales personal contact is preferred as the source of showing dedication and building trust. Of course, prior the meetings the primary contact is established via cold and hot calls and email messaging. How are the Customers reached now? See the previous answer. How are the Channels integrated? n/a Which ones work best? n/a Which ones are most cost-efficient? n/a How are the Channels integrated with customer routines? All customer interaction, incl. prospecting, is stored in customer record management system. This is important as it is needed to track: - agreements, contracts - service configuration (fees, revenue sharing scheme, additional services etc) - any open discussions and cooperation projects - marketing activities (campaign emails, calls) - customer-related incidents (important for customer retention) Additionally this enables to monitor and supervise sales team and Account Managers and set relevant team and person KPI’s. Cost Structure What are the most important costs inherent in FinanceFix’ business model? FinanceFix is both: - cost-driven: o maximum automation o minimized human interference o extensive outsourcing (usage of external data sources) o usage of economies of scale - value-driven: o it is necessary to maintain a human capacity (a core team of debt handlers) to interact extensively with debtors (to get the most out of the case during a limited period of 5 time) while lessening the negative impact on the customer relationship (between the the creditor and debtor) by having a flexible (human-driven) collection process. Which Key Resources are most expensive? - Human labour (fixed costs): o maintain and grow the knowledge on automated processes o handle partially the interaction with the debtors Which Key Activities are most expensive? - Debtor interaction as it requires: o prior external data aqcuisition o manual activites (calling&follow-up activities) o usage of regular postal services (warning letters) Revenue Streams For what value are customers really willing to pay? Collection fees (a primary source of the FinanceFix’s revenue) are paid by the debtors. Therefore the customers don’t have consider the cost aspext of using the services of FinanceFix. Instead the collection success rate is the only major aspect (value) which is justifying the establishment of the cooperation. For what do they currently pay? See the answer above. How are they currently paying? See the answer above. How would they prefer to pay? See the answer above. How much does each Revenue Stream contribute to overall revenues? The most of the revenue is created by the collection fees as these represent the actual work done during the collection process. Other sources such as collected overdue and credit interests (paid by the debtor) and legal action fees (paid by the creditor) should be limited in their scale as FinanceFix aims to handle the debts in a limited period of time (35 days) and preferably in a voluntary collection phase. 6 Business Process Description The board of FinanceFix has set itself three goals which must be achieved by the end of the transformation of the core operations (B2B debt collection). The goals are as follows: o o o minimize the usage of human labour as much as possible without risking the quality of the service automate all processes which doesn’t require human interference utilize extensively external data resources in order to add value to the service Below will be given the visual and textual description of the B2B debt collection in the voluntary phase and partially legal phase in its old and new form. Old Model In the old model (see the diagram below) it is visible the scale of the usage of human labour in almost every activity. Cases (unpaid invoices) are insersted manually to the customer records management system (CRM). CRM is used only for storing information and sending letters to debtors. The rest of the collection process is straigthforward: o o If warning letters and calls produce agreement with the debtor to schedule the payments, a respective letter is sent with the payment schedule dates and sums. Once all payments have been done, the case is closed. If warning letters and calls don’t produce any kind of agreement within 2-3 months the case is amended manually with additional background data (tax debts, other debts, members of board etc) and sent to the legal assessment. If customer agrees to proceed with the legal action the case is transferred to the legal phase. If affirmative answer is not given, the case is closed. 7 New Model The new model boasts with the additional functionality. The most visible is the addition of external data sources which are used two times (in the beginning and prior the legal assessment) to short-list the cases and get the most accurate contact details (postal addresses, email addresses, phone numbers) to be used in calling and sending warning letters. In order to add actual pressure and affect debtors’ business activities (obtaining new credit, signing partnerships etc) debtors can be published at credit history portals if they fail to respond and sign payment schedule (or pay the debt in a single payment). It is noticeable that all additional value-creating activities (data aqcuisitions, debtor publishing) have been automated 100%, allowing to focus the human labour only towards direct interaction with the debtor resulting in the most optimized usage of the high-cost input of this business process. The new situation can be noticed in the following diagram: 8 9 10 MS Access Database The new model also requires the updated database structure as it is necessary to accommodate additional information about the debtor. In general there is used only one database to store information about the customers, debtors (incl. its members of board), unpaid invoices, cases and payment schedules. It is possible to browse database items starting from the customer in order to review: o o all the invoices which have been submitted for collection; and cases which contain additional information (f. ex. overdue interest, collection fees, legal action confirmation etc). Same actions can be done from the debtor’s perspective as well (f. ex. applicable in the self-service portal). This allows also to review the debtor’s payment discipline in previous cases, thus enabling to predict the case’s collectibility (via scoring method) already in the beginning of the collection process. 11 Balanced Scorecard Balanced Scorecard is a performance metric used in strategic management to identify and improve various internal functions and their resulting external outcomes. The balanced scorecard attempts to measure and provide feedback to organizations in order to assist in implementing strategies and objectives. (Investopedia3) This management technique isolates four separate areas that need to be analyzed: 1. Learning and growth - focuses on how to educate employees, how to gain and capture knowledge, and how to use it to maintain a competitive edge within company’s target markets; 2. Business processes - measures critical-to-customer process requirements and measures; 3. Customers - measures customers' satisfaction and their performance requirements; 4. Finance - tracks financial requirements and performance. (Dummies4) Data collection is crucial to providing quantitative results, which are interpreted by managers and executives and used to make better long-term decisions. (Investopedia) 3 4 Investopedia, 2013 http://www.investopedia.com/terms/b/balancedscorecard.asp Dummies Biz, 2013 http://www.dummies.com/how-to/content/what-is-the-balanced-scorecard.html 12 Financials Profitability Cost Savings Higher Revenues Customers More Customers (new sales based on good reputation) Higher customer retention (re-sales) Increased customer satisfaction Better control over the submitted cases Optimized staff Internal Higher collection success rate Learning and Growth Automated processes Rising productivity (faster) Implement the new workflow (incl CRM enhancements) Re-train the staff Re-design the concept of B2B debt collection 13 Objectives Customers Financials Profitability Higher Revenues More customers (new sales based on good reputation) Higher customer retention (re-sales) Internal Increased profits: Revenue growth: More customers: Targets Year 1: 15 % Year 2: 20 % Year 3: 25 % Year 1: Year 2: Year 3: Year 1: Year 2: Year 3: 10 % 30 % 50 % 10 % 20 % 40 % New cases from existing customers: Year 1: 20 % Year 2: 30 % Year 3: 50 % Success rate: Year 1: 20 % Year 2: 30 % Year 3: 40 % Automated System Personnel Cost Savings: Year 1:-30 % Year 2:-10 % Year 3:-10 % Implementing the new workflow (incl CRM enhancements) Research, pilot project - 6 months research and test run - 12 months live Higher collection success rate Learning Measures Re-training the staff 14 Initiatives Review collection fees once a year to maintain the business margin Using the positive references from existing customers for active sales; Educating the customer about the debtor behaviour (to maintain realistic expetations). Monthly staff feedback; Promoting best practises; Minor process improvements and tweaks to CRM (bugfixing). Seminars for the staff; Brainstorming events; Involvement of external IT consultants and developers.