Defining a Market Cycle

A White Paper by Manning & Napier

www.manning-napier.com

Unless otherwise noted, all figures are based in USD.

1

Defining a Market Cycle | A White Paper by Manning & Napier

Introduction

The Market Cycle and Its Stages

Performance measurement is one of the most discussed

topics in the investment industry. For example, if an

investment has strong returns over the past 12 months, is

it a good investment? What if returns are attractive over

three, five, or ten years? Before answering this question,

let’s pose another one:

Over any given time period, there are two main factors that

can affect the returns on of an investment portfolio:

How many hours are in a single day?

A. 24 hours B. 10 hours C. 5,800 hours

The answer that obviously comes to mind is 24. However,

all of these answer are, in fact, correct depending on what

perspective you are answering from. The length of a day

on the planet Jupiter is only 10 earth hours (the shortest

in the solar system) while the length of a single day on

Venus is an astonishing 5,800 hours (243 earth days). Yet

despite these vast differences in time, we can all agree on

the basic parts of a day (morning, afternoon, and night).

No matter how long or short a day is, it is likely that it will

progress through these three parts as the sun moves

through the sky.

Evaluating performance of investments isn’t all that

different from determining the length of a day. The financial

markets are inherently cyclical and each “market cycle”

has defined parts or stages. The three broadest stages of

a market cycle can be defined as a bear market, recovery,

and bull market. Looking back in time, full market cycles

have spanned as little as five years to as long as 20 years.

• The investment manager’s decisions

• The market environment

While an investment manager’s specific decisions will

certainly have an impact on portfolio returns, the market

environment can also be a major driver of returns and

a source of context for performance evaluation. If the

financial markets constantly went up, there would be very

little need for investment managers or financial advisors.

Investors could simply place their money in the markets,

leave it alone, and retire happy. While stocks have, in fact,

significantly appreciated in value over the long run, the

financial markets are inherently cyclical. There have been

prolonged periods where the markets increased, declined,

or even stayed relatively flat.

As such, we believe that an effective method of evaluating

investment or market returns is the concept of a full

market cycle. Most broadly defined, a full market cycle is

a period of time which contains a wide variety of market

environments. However, the most basic stages of a market

cycle are listed below.

• Bear Market

• Recovery

• Bull Market

When evaluating investment managers it is important to

understand that managers can perform differently during

various parts of the market cycle. Just as some people

might function better in the morning than during the

night, some investment managers may outperform in bull

markets but trail in bear markets. Since a full market cycle

incorporates a diverse range of environments, it provides

context for performance evaluation. The analysis to follow

will further discuss the concept of a market cycle and its

various stages. Additionally, the paper highlights several

factors which can provide useful context for performance

evaluation across market environments.

While each market cycle and even each bull or bear

market is different, the following pages will highlight

several important characteristics of bear markets,

recoveries, and bull markets, as well as provide some

examples of historical market environments that are

broadly consistent with each stage. Time periods for

market cycle stages were determined on a price return

basis utilizing returns of the S&P 500 Index1 from 1926

through current.

2

Defining a Market Cycle | A White Paper by Manning & Napier

Bear Market

A bear market is a sustained period of negative market returns resulting in a substantial decline of wealth. Understandably,

this is the part of the market cycle that few investors enjoy. However, for those managers focused on capital preservation,

bear markets provide important opportunities to generate superior relative returns.

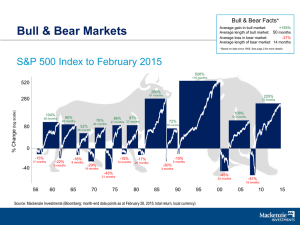

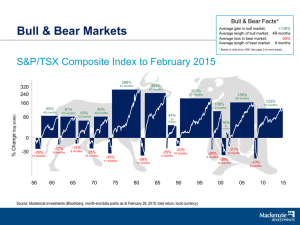

The average price decline during a U.S. stock bear market has been approximately -43% (cumulative). Historically, bear

markets have lasted as little as three months to as long as 34 months. Table 1 provides examples and brief descriptions of

several notable bear markets in the past 40 years.

Table 1: Bear Market Time Periods

Cumulative

Price Return

Cumulative

Total Return

Length

(Months)

09/30/1974

-46.2%

-42.6%

21

09/01/1987

11/30/1987

-30.2%

-29.6%

3

04/01/2000

09/30/2002

-45.6%

-43.8%

30

Tech and telecom bubble bursts

11/01/2007

02/28/2009

-52.6%

-50.9%

16

Housing bubble bursts and broad

deleveraging

Start Date

End Date

01/01/1973

Description

Broad economic recession and spike in

energy prices

Black Monday

As the table illustrates, each bear market possesses its own unique characteristics. For example, the 1973 and 2007 bear

markets generally coincided with broad macroeconomic weakness, while the 1987 and 2000 bear markets were more

driven by valuations. As such, while investment managers focused on downside protection should be able to mitigate

these market downturns, the degree of downside protection may not be uniform across bear markets.

Recovery

A recovery is defined as a time period from the end of a bear market (i.e., a market bottom) until markets increase to their

previous peak. Given the math of market returns, the markets can experience a substantial rally, in absolute terms, without

actually recovering back to peak. For example, to completely recover a -50% market decline, a subsequent return of 100%

would be required.

As might be expected, there have been periods of time where markets fail to recover completely before experiencing

another meaningful downturn (bear market). In those instances, a bear market combined with a failed recovery and

another bear market could result in the entire period being defined as a single bear market.

Bull Market

A bull market is a sustained period of positive market returns following a complete recovery to the previous market peak.

Since a bull market represents the markets achieving new highs, it can be characterized as a period of wealth creation.

Similar to bear markets, certain managers excel during bull market environments.

The average price increase during a U.S. stock bull market has been approximately 86% (cumulative). Historically, bull

markets have lasted as little as four months to as long as 128 months. Table 2 on the following page provides examples

and brief descriptions of several notable bull markets in the past 40 years. It is evident from the table that some bull

markets have generally been much more prolonged than even the longest bear market.

3

Defining a Market Cycle | A White Paper by Manning & Napier

Table 2: Bull Market Time Periods

Start Date

End Date

Cumulative

Price Return

Cumulative

Total Return

Length

(Months)

Description

01/01/1983

08/31/1987

134.5%

182.8%

56

Declining energy prices and inflation.

Valuation expansion

08/01/1989

03/31/2000

333.0%

464.8%

128

Post Savings and Loan Crisis rally as well

as the tech and telecom bubble

At the tail end of some bull market time periods, the markets can be classified as reaching a speculative stage.

Speculative bull markets may be characterized by significant valuation expansion and narrow segments of the market

driving index performance. For example, during the tech bubble of the late 1990s, the price to earnings ratio of the S&P

500 Index1 increased from approximately 17 times earnings at the end of 1994 to 30 times earnings at the end of 1999.

Likewise, the Information Technology sector grew from approximately 8% of the S&P 500 Index1 in 1992 to over 30% in

2000.

During these types of speculative environments, valuation conscious managers may struggle relative to broad equity

benchmarks as their valuation disciplines preclude them from purchasing the most overvalued, and usually strongest

performing, market segments. That said, those same market segments often suffer the largest declines in the subsequent

correction or bear market.

The Current Market Cycle for U.S. Stocks

While most market cycles generally progress through bear market, recovery, and bull market stages, any single stage

may persist for a long period of time. For example, the last complete bull market time period spanned from 08/01/1989 to

03/31/2000, with the market increasing by approximately 333% on a cumulative price basis. The markets subsequently

declined by approximately 46% (cumulative) as the technology bubble burst. From the end of 2002 until the end of 2007,

the markets rallied from their previous lows before the 2008/2009 financial crisis struck, but was this truly a recovery? The

table below illustrates various market environments during this time period.

S&P 500 Index1 Cumulative Price Return (07/31/1989 - 02/28/2009)

Start Date

End Date

Event

Price Returns

08/01/1989

03/31/2000

Bull Market

333.0% cumulative return

04/01/2000

09/30/2002

Tech Bubble Bursts

45.6% decline

10/01/2002

10/31/2007

Bull Market?

87.7% cumulative price return

1.2% above prior peak*

(5 months above prior peak)

11/01/2007

02/28/2009

Financial Crisis

52.6% decline

*Represents returns after the month of recovery from the Tech Bubble decline and before the Financial Crisis decline.

4

Defining a Market Cycle | A White Paper by Manning & Napier

There are several conclusions that can be made from this chart:

• The markets recovered back to peak after the 2002 bear market.

• However, price returns beyond market peak were only approximately 1% (cumulative) before the next bear market.

• If this was a bull market, it would have been the lowest bull market return on record compared with the next lowest return

of approximately 8% from 06/01/1972 to 12/31/1972, and an average price return of approximately 86% for bull market

periods since 1926.

• Importantly, the markets failed to recover completely on an inflation adjusted basis.

• The length of this potential bull market time period from 06/01/2007 to 10/31/2007 was also one of the shortest on record,

spanning only five months compared with an average of 48 months for bull market periods since 1926.

As the markets never increased meaningfully past their peak by the end of 2007, and given overall market declines for the

period of 04/01/2000 to 02/28/2009 of approximately -51%, we consider the entire time period a bear market. It should also

be noted that certain benchmarks, such as the NASDAQ Composite Index2, never fully recovered back to their previous peak.

The Current Market Cycle Defined

The last major market downturn (which started on 04/01/2000) reached its bottom on approximately 02/28/2009. Since

then, the markets have increased meaningfully from their lows and recovered past their previous peak in March of 2013.

As such, we consider the period of 03/01/2009 to current a new bull market. Thus, the current market cycle spans from

04/01/2000 to current with the previous bear market spanning from 04/01/2000 to 02/28/2009.

Ultimately, the concept of market cycles argues for evaluating manager performance over a variety of market environments.

While track records over entire market cycles may not be available for some managers, we believe choosing a time frame

with a wide range of market conditions provides the best context for manager evaluation. As such, even for investment

managers with shorter-term performance track records, performance evaluation should include the following steps:

• Understand the performance drivers over a given market environment.

• Evaluate how the market environment affected the manager’s performance.

• Determine if the manager performed as expected during various market environments in light of their investment process.

For example, performance during the valuation driven downturn of 2000 to 2002 may be a more applicable period to judge

the downside protection of managers focusing on attractively priced securities compared to a more macro-dominated market

downturn such as 2008.

Conclusion

The cyclical nature of market returns suggests that evaluating manager performance over a full market cycle time period

can provide important context for returns attribution. A full market cycle time period should contain a wide range of market

conditions and usually consists of a bear market, recovery, and bull market stage. Despite these common characteristics,

each market cycle, and even each bull or bear market, is different.

As some market cycles may span several decades and manager performance track records vary in length, other shorter time

periods can also provide valuable insight into manager performance. Regardless of the time period utilized, we believe that

a clear understanding of a manager’s investment process and a determination of the major return drivers in a given market

environment are essential for effective performance evaluation.

Analysis by Manning & Napier.

Sources: Bloomberg and Morningstar. Morningstar, Inc. is a global investment research firm providing data, information, and analysis of stocks and mutual funds. ©2014 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete

or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or

excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

1

The S&P 500 Total Return (S&P 500) Index is an unmanaged, capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange, and the Over-theCounter market. The Index returns assume daily reinvestment of dividends and do not reflect any fees or expenses. S&P Dow Jones Indices LLC, a subsidiary of the McGraw Hill Financial, Inc., is the publisher of various

index based data products and services and has licensed certain of its products and services for use by Manning & Napier. All such content Copyright ©2014 by S&P Dow Jones Indices LLC and/or its affiliates. All rights

reserved. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to

accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

2

The NASDAQ Composite Index is a broad-based capitalization-weighted index of domestic and international based common type stocks listed in all three NASDAQ tiers: Global Select, Global Market

and Capital Market. The NASDAQ Composite includes over 3,000 companies. The Index returns do not reflect any fees or expenses.

Approved CAG-PUB031 (12/14)

5