CHAPTER 10

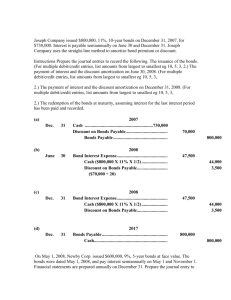

advertisement