Allens: Legal guide to investment in Vietnam

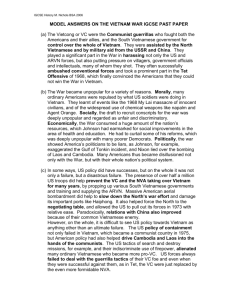

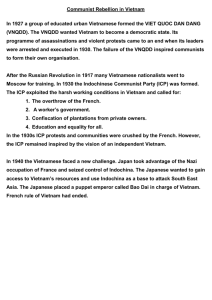

advertisement