- Borden Ladner Gervais LLP

advertisement

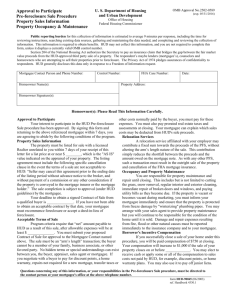

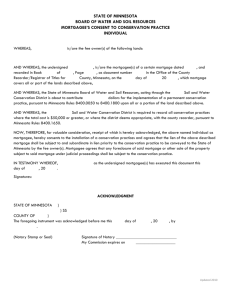

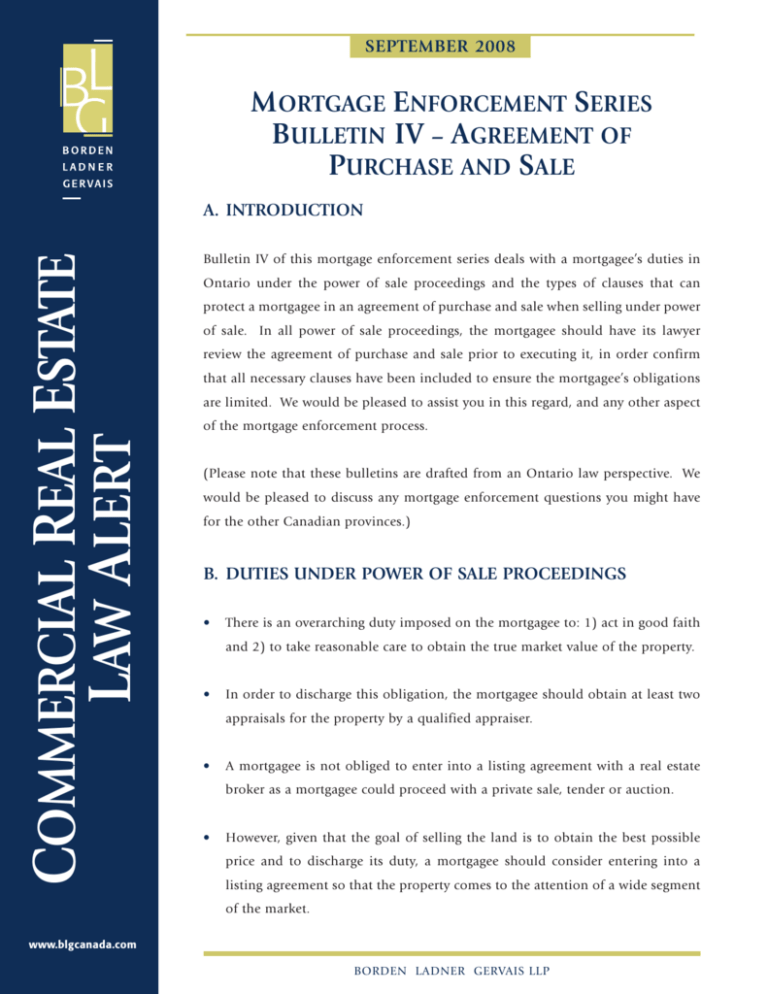

SEPTEMBER 2008 MORTGAGE ENFORCEMENT SERIES BULLETIN IV – AGREEMENT OF PURCHASE AND SALE COMMERCIAL REAL ESTATE LAW ALERT A. INTRODUCTION Bulletin IV of this mortgage enforcement series deals with a mortgagee’s duties in Ontario under the power of sale proceedings and the types of clauses that can protect a mortgagee in an agreement of purchase and sale when selling under power of sale. In all power of sale proceedings, the mortgagee should have its lawyer review the agreement of purchase and sale prior to executing it, in order confirm that all necessary clauses have been included to ensure the mortgagee’s obligations are limited. We would be pleased to assist you in this regard, and any other aspect of the mortgage enforcement process. (Please note that these bulletins are drafted from an Ontario law perspective. We would be pleased to discuss any mortgage enforcement questions you might have for the other Canadian provinces.) B. DUTIES UNDER POWER OF SALE PROCEEDINGS • There is an overarching duty imposed on the mortgagee to: 1) act in good faith and 2) to take reasonable care to obtain the true market value of the property. • In order to discharge this obligation, the mortgagee should obtain at least two appraisals for the property by a qualified appraiser. • A mortgagee is not obliged to enter into a listing agreement with a real estate broker as a mortgagee could proceed with a private sale, tender or auction. • However, given that the goal of selling the land is to obtain the best possible price and to discharge its duty, a mortgagee should consider entering into a listing agreement so that the property comes to the attention of a wide segment of the market. www.blgcanada.com www.blgcanada.com BORDEN LADNER GERVAIS LLP MORTGAGE ENFORCEMENT SERIES BULLETIN IV – AGREEMENT OF PURCHASE AND SALE C. AGREEMENT OF PURCHASE AND SALE In order to save on costs and expenses, the mortgagee is capable of negotiating an agreement of purchase and sale with a potential purchaser by itself or through its real estate broker. In these cases, such an agreement of purchase and sale should always be conditional upon review by the mortgagee’s solicitors to ensure that the mortgagee’s obligations are limited. Some matters that should be dealt with in the agreement of purchase and sale are as follows: • the purchaser should give an acknowledgment that the property is being sold by the power of sale remedy under the mortgage; • all standard form representations and warranties of the vendor/mortgagee should be removed, including the urea formaldehyde and "present use" wording; • the purchaser should provide an acknowledgment that it is accepting the property on an "as-is whereas" basis; • if a standard form is used, then careful review should be completed to ensure that the mortgagee is not referred to as the owner; • real estate commission should only be payable upon the successful completion of the sale (i.e., not until title is transferred to the purchaser); • the mortgagee must be entitled to terminate the agreement at any time prior to the completion of the sale without liability (except for the return of the deposit); • possession of the property will need to be dealt with, whether it will be vacant possession or subject to tenancies (be careful if this a residential rental property as the only way to obtain vacant possession will be through the Residential Tenancies Act); • the purchaser must agree to accept the property subject to all matters which are not extinguished by the power of sale and the mortgagee must not be responsible to discharge or release any encumbrances which have a priority to the mortgage; 2 BORDEN LADNER GERVAIS LLP MORTGAGE ENFORCEMENT SERIES BULLETIN IV – AGREEMENT OF PURCHASE AND SALE • if there is a prior mortgage, the agreement should be conditional upon obtaining the prior mortgagee’s consent to the purchaser’s assumption of that prior mortgage; • the agreement should contain a clause that either excludes or amends the statutory covenant that the mortgagee will grant such further assurances as necessary; • if there are tax arrears or other utility arrears on the property, then the mortgagee should negotiate that the purchaser accept the arrears and adjust for that accordingly on the statement of adjustments; • clauses dealing with chattels will have to be removed unless the mortgagee is also selling personal property under the Personal Property Security Act; • depending on the likelihood of receiving payment from the mortgagor and the general relationship between the mortgagor and the mortgagee, the mortgagee may want to make the agreement conditional on not being redeemed; • the time period for acceptance by the mortgagee should be somewhat longer than the usual period for acceptance to ensure that the mortgagee is satisfied that it has or will have discharged its duties under the power of sale remedy; and • always provide that the agreement is conditional upon review by the mortgagee’s solicitor. BORDEN LADNER GERVAIS LLP 3 MORTGAGE ENFORCEMENT SERIES BULLETIN IV – AGREEMENT OF PURCHASE AND SALE BLG’s COMMERCIAL REAL ESTATE GROUP Our Commercial Real Estate Group consists of more than 50 experts across the country in all facets of commercial real estate law. We provide excellent creative legal advice to a broad spectrum of clients including developers, builders, pension funds, private financiers, lending institutions, private, public and crown corporations, national and international business communities, including aerospace and airlines, banking and finance, securities, manufacturing, construction, insurance, government agencies, natural resources, high technology, retail, transportation and real estate. Our services include: Acquisition and Development Negotiation and preparation of all documentation relating to the acquisition, development, construction, financing and marketing of commercial, industrial and residential properties, including: • Retail plazas • Hotels • Office buildings • Business parks • Apartment buildings • Condominium projects • Mixed-use developments • Residential subdivisions • Shopping centres Public/Private Arrangements Negotiation of arrangements between private enterprise and governmental bodies relating to land and infrastructure development. Formulation and preparation of proposal calls for public/crown corporations and all ancillary agreements. 4 BORDEN LADNER GERVAIS LLP MORTGAGE ENFORCEMENT SERIES BULLETIN IV – AGREEMENT OF PURCHASE AND SALE Construction and Infrastructure Negotiation and preparation of construction contracts. Negotiation, structuring and financing of infrastructure projects. Financing and Restructurings Mortgage enforcement and preparation of all notices and court documents on behalf of lenders. Negotiation and preparation of all financing documentation on behalf of private and institutional lenders and borrowers, for project and term financing. Negotiation of arrangements between investors and developers pertaining to the restructuring of financial affairs, including attending to all due diligence matters. Hotels Negotiation and preparation of all documentation relating to the acquisition, development, construction and financing of hotels, including advising with respect to all related issues including, hotel management agreements, licensing agreements, employment issues, co-owner arrangements, liquor licensing agreements and franchise agreements. Environment Performance of due diligence reviews and advising on compliance with laws and regulations, advising on obtaining required authorizations and licences and on co-ordinating environmental audits and clean-ups. Negotiation of environmental representations and warranties, advising on the management and disposal of contaminants and their transport, storage and export, and providing representation before administrative tribunals, the civil courts and in governmental inquiries related to these matters. Municipal Advise and assist on all aspects of zoning and planning work, including securing approval of amendments to zoning, advising on expropriation and permitted land uses and the appeal of realty tax assessments. In Québec, this BORDEN LADNER GERVAIS LLP 5 MORTGAGE ENFORCEMENT SERIES BULLETIN IV – AGREEMENT OF PURCHASE AND SALE includes representation before the Tribunal Administratif du Québec to contest municipal valuation assessments of major hotel, office, commercial and industrial properties. Long Term Ground Lease Negotiation and preparation of long-term ground leasing arrangements for both public and private sectors. Commercial Leasing Negotiation and preparation of all leasing documentation for retail centres, business parks, office buildings and warehouses. Condominiums Structuring, assistance, negotiation and preparation of all condominium documentation, including project financing documentation, declaration, by-laws and rules, disclosure statement, development agreements and sales agreements. Syndications Negotiation and preparation of all documentation required to form real estate syndicates and partnerships, as well as co-tenancy and joint venture arrangements for developers. Limited Partnerships Negotiation and preparation of all required documentation and advising with respect to the entering into and the structuring of limited partnerships. OUR TEAM The Borden Ladner Gervais LLP Commercial Real Estate Law Alert is necessarily of a general nature and cannot be regarded as legal advice. The firm would be pleased to provide additional details and to discuss the possible effects of these matters in specific situations. 6 BORDEN LADNER GERVAIS LLP MORTGAGE ENFORCEMENT SERIES BULLETIN IV – AGREEMENT OF PURCHASE AND SALE Borden Ladner Gervais LLP Lawyers • Patent & Trademark Agents If you have any questions about this alert, please contact us. Our National Commercial Real Estate Law group is chaired by: David P.L. Mydske Vancouver 604-640-4123 dmydske@blgcanada.com Our Regional Commercial Real Estate group coordinators are: Lawrence M. Kwinter Calgary 403-232-9554 lkwinter@blgcanada.com Sylvie Bouvette Montréal 514-954-2507 sbouvette@blgcanada.com Rocco D’Angelo Ottawa 613-787-3549 rdangelo@blgcanada.com Steven N. Iczkovitz Toronto 416-367-6214 siczkovitz@blgcanada.com Yvonne J. Hamlin Toronto 416-367-6649 yhamlin@blgcanada.com David C.S. Longcroft Vancouver 604-640-4211 dlongcroft@blgcanada.com David Shortt Waterloo 519-579-5600 x.313 dshortt@blgcanada.com Author: Sybil Johnson-Abbott, BLG Ottawa Visit our website at www.blgcanada.com where you can view the Commercial Real Estate Law Alert and other Borden Ladner Gervais LLP publications. This newsletter has been sent to you courtesy of Borden Ladner Gervais LLP. We respect your privacy, and wish to point out that our privacy policy relative to newsletters may be found at http://www.blgcanada.com/utility/privacy.asp. Calgary 1000 Canterra Tower 400 Third Avenue S.W. Calgary, Alberta, Canada T2P 4H2 tel: 403 232-9500 fax: 403 266-1395 Montréal 1000 de La Gauchetière Street West Suite 900, Montréal, Québec, Canada H3B 5H4 tel: 514 879-1212 fax: 514 954-1905 Ottawa World Exchange Plaza 100 Queen St., Suite 1100 Ottawa, Ontario, Canada K1P 1J9 tel: 613 237-5160 1-800-661-4237 legal fax: 613 230-8842 IP fax: 613 787-3558 To r o n t o Scotia Plaza, 40 King Street West Toronto, Ontario, Canada M5H 3Y4 tel: 416 367-6000 fax: 416 367-6749 Vancouver 1200 Waterfront Centre 200 Burrard Street, P.O. Box 48600 Vancouver, British Columbia, Canada V7X 1T2 tel: 604 687-5744 fax: 604 687-1415 Waterloo Reg ion Waterloo City Centre 100 Regina Street South, Suite 220 Waterloo Ontario N2J 4P9 tel: 519 579-5600 If you have received this newsletter in error, or if you do not wish to receive further newsletters, you fax: 519 579-2725 may ask to have your contact information removed from our mailing listing by phoning IP fax: 519 741-9149 www.blgcanada.com © 2008 Borden Ladner Gervais LLP Borden Ladner Gervais LLP is an Ontario Limited Liability Partnership BORDEN LADNER GERVAIS LLP Printed in Canada 1-877-BLG-LAW1 or by emailing subscriptions@blgcanada.com.