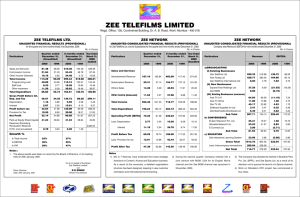

Zee Entertainment Enterprises Ltd.

Zee Entertainment Enterprises Ltd.

BSE Code: 505537 NSE Code: ZEEL Reuters Code:

Zee Entertainment Enterprises Ltd. (ZEEL), incorporated in 1992, is one of

India’s leading television, media and entertainment companies. It is amongst the largest producers and aggregators of Hindi programming in the world, with an extensive library housing over 100,000 hours of television content. With rights to more than 3,000 movie titles from foremost studios and of iconic film stars, ZEE houses the world’s largest Hindi film library. Through its strong presence worldwide, Zee entertains over 650 million viewers across 168 countries.

Investor’s Rationale

returns to its shareholders. The company has recorded robust growth of 18.8%

YoY in its consolidated net profit to ` 18.8 billion in the second quarter ended

September 2012. The company’s consolidated net sales too increased at a better than expected rate of 13% YoY to ` 9.5 billion from ` 8.4 billion during the same period driven by strong growth of 35.7% YoY and 3.7% YoY in subscription as well as advertising revenues respectively.

ZEEL continued to build on the momentum growth to deliver superior

ZEEL has been quite bullish on the investment front in Q2FY’13 as it has invested substantially in content and marketing for the existing channels during the period. Several new programs were launched along with increased marketing activities. Over the last 12 months, several new initiatives have been initiated which includes the launch of HD channels, Ten Golf, Ditto TV, Zee Alwan and Zee Bangla Cinema. This reflects the company’s philosophy of investing in the business for the long term growth.

October 26, 2012

ZEE.BO

Market Data

Rating

CMP ( ` )

Target ( ` )

Potential Upside

Duration

Bloomberg Code: Z:IN

52 week H/L ( ` )

All time High ( ` )

Decline from 52WH (%)

Rise from 52WL (%)

Beta

Mkt. Cap ( ` bn)

Enterprise Value ( ` bn)

Fiscal Year Ended

Y/E

Revenue ( ` bn)

Net Profit( ` bn)

FY11A

31.0

6.4

1.0 Share Capital

EPS (

`

)

P/E (x)

6.5

28.8

P/BV (x) 5.8

EV/EBITDA (x)

ROCE (%)

20.6

28.4

ROE (%) 20.6

One year Price Chart

FY12A

31.8

5.9

1.0

6.1

31.2

5.1

21

24.5

17.1

FY13E

36.3

7.4

1.0

7.8

24.9

4.5

16.7

21.6

19.1

BUY

184.1

220

~19.5%

Long Term

208.4/112.2

FY14E

41.5

8.7

1.0

9.1

21.2

3.9

14.4

21.6

19.1

6,740

11.7

64.1

0.3

174.9

177.7

We expect the company to benefit significantly from digitization. Thus, with the deadline of first phase of digitalization, the company has a long range of regional and general entertainment channels, which would push the company’s subscription revenues considerably in the coming quarters. However, the company's operating profit margin would under pressure due to new business ventures, but the fact is that ZEEL with its virtually debt free structure, addresses the concerns related to high interest expense.

The company expects its ad-revenues to grow faster than expected industry growth of 8-9% in FY13E on the back of increased GRPs, with higher investment in content and lower base of previous year and would like to maintain its EBIDTA margin in the range of 25-30% in FY’13E-14E. Going forward, the company also planned to increase its programming hours from 24hrs in

Q1FY’13 to 33hrs by Q4FY’13E to garner higher GRPs that would drive adrevenue growth.

Shareholding Pattern

Promoters

FII

DII

Others

Sep’12

43.4

36.1

12.6

7.9

Jun’12

43.9

35.3

13.1

7.7

Diff.

(0.5)

0.8

(0.5)

0.2

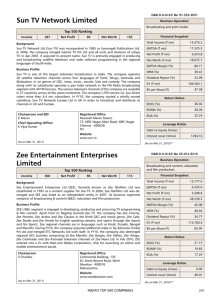

ZEEL has 30 channels under its kitty that serve the widest array of content in India and is the leading broadcaster across the 168 countries with over 650 million viewers

ZEEL: a leading player in the Indian pay television market…..

Zee Entertainment Enterprises Ltd (ZEEL), formed in 1982, is one of India’s largest vertically integrated media and Entertainment Company. ZEEL is engaged primarily in broadcasting and content development, production and its delivery via satellite. ZEEL has 30 channels under its kitty that serve the widest array of content in India and is the leading broadcaster across the country.

ZEEL is also the forerunner in the international markets and has garnered the highest market share amongst all South East Asian broadcasters across Europe and USA. The company served 22

Indian channels across 168 countries. ZEEL offerings span across various categories viz; General

Entertainment, Movies, Music, Sports, Lifestyle covering most languages across the world.

ZEEL has garnered the reputation of becoming the first company to launch a satellite channel in

India and has moved up the ladder from operating a single channel for a single geography and now become the operator of multiple channels across multiple geographies in different languages and genres that caters to over 650 million viewers. ZEEL channel portfolio, across various genres in the Indian market, includes:

Hindi Entertainment: Zee TV, Zee Smile, 9X

Hindi Movies: Zee Cinema, Zee Premier, Zee Action, Zee Classic

English Entertainment, Movies and Life style: Zee Studio, Zee Café, Zee Trendz

Regional Language Entertainment: Zee Marathi, Zee Bangla, Zee Talkies, Zee Telegu, Zee

Kannada, ETC Punjabi, Zee Tamil

Sports: TEN Cricket, TEN Action, TEN Sports, TEN Golf

Religious and Alternate Lifestyle: Zee Jagran, Zee Salaam

Music: Zing, ETC

Niche and Special Interest: Zee Khana Khazana

HD: Zee TV HD, Zee Cinema HD, Zee Studio HD, TEN HD

Growth journey

1992-95 1996-98 1999-2000 2001-03 2006-10 2011-12

Launches Zee TV

Initial Public Offering of

Zee Telefilms Ltd

Commences Siticable operations Joint Venture with News Corp

Launches Zee News and

Zee Cinema.

Zee TV goes global - launches Zee TV, UK

Starts first cable channel in India - Siti

Channel.

Launches Zee TV,

Africa.

Launches Zee Music

Launches Zee TV in the

US.

Institutes a prime award in the film segment called 'Zee

Cine Awards'

Acquires News Corp's

50% stake in joint ventures of their television broadcasting business tie-up.

Launches regional channels.

Launches Internet over

Cable services

Enters into content distribution joint ventures with MGM and Viacom

Introduces Zee TV and Zee

New

Acquires controlling stakes in ETC Networks Ltd and

Padmalaya Telefilms Ltd.

Launches 5 new channels for the DTH market

Enters into a distribution tie-up with Rajshri

Pictures

Launches 'Trendz' - A premium fashion and style channel

De-merger of Zee

Telefilms Ltd.

ZEE gets listed as an independent company

Launches Zee Khana

Khazana

Launches Zee Salaam

Acquires stake in Ten

Sports

Launches Ten Cricket

Launches Ten Action+

Launches India.com

Zee-Turner Ltd, enters into a 50:50 JV with

Star Den Media

Services Pvt. Ltd. to form MediaPro

Enterprise India Pvt.

Ltd

Announces share buyback amount not exceeding 7,000 million

Launches Ditto TV

Launches Ten Golf

ZEEL focused to deepen its presence in the geographies where it operates. Therefore, recently the company has signed a contract with

Russia’s third largest GSM operator

Megafon for Mobile TV and with regional analog cable operator

Barshinform.

ZEEL has 29 channels catering to the well diversified genres including Hindi GEC, Regional

GEC, Hindi & English Movies,

Sports, Music, Lifestyle, Niche and International channels.

Fortify its expansion in the international markets

ZEEL’s international operations contribute a significant part to the company’s revenues. The company serves to more than 650 million viewers globally and in 168 countries worldwide. Zee

Network maintains its supremacy in the International South Asian (SA) Business globally. Zee TV continues to dominate its position in the US, Middle East & Africa markets in terms of viewership within the SA channels. Zing has emerged as the No. 1 channel among South Asians in the UK market, while Zee TV maintain its leadership position among Asian expatriates in UAE and South Africa.

During the calendar year 2011, the Company has taken various steps to further deepen its presence in the geographies where it operates.

Launched 4 new channels viz; Zee Marathi, Zee Kannada, Zing & Zee Smile on Charter LA,

CenturyLink and also channels were launched in new markets like Aruba, Curacao, Grenada.

Launched Zee Cinema International in Indonesia, Myanmar & Hong Kong with English subtitles and also bagged landing rights in China.

In APAC, Zee Cinema International launched in Indonesia, Myanmar & Hong Kong with

English sub-titles and received landing rights in China. Further, the company also successfully conducted Zee Nite in Durban, Mauritius and Reunion and Zee Bollywood Nite in Malaysia.

Zee TV the sole channel among the Asian peers to commence product placement digitally bringing in additional sales revenue.

Besides, in order to further deepen its presence in the international markets, the company undertook a number of initiatives in Q2FY13. ZEEL has signed a contract with Russia’s third largest

GSM operator Megafon for Mobile TV and with regional analog cable operator Barshinform. Further, the company has successfully launched all its five UK channels on Yupp TV IPTV platform. In order to maintain its growth trajectory, the company aims to further augment the market share through a planned content lineup and continue to grow business profitability in a sustained manner. The international subscription revenues in Q2FY13 stood at ` 1,141 million, registering a growth of 19%

YoY.

Diversified portfolio of channels catering different audience requirements

ZEEL has 29 channels catering to the well diversified genres including Hindi GEC, Regional GEC, Hindi

& English Movies, Sports, Music, Lifestyle, Niche and International channels. In addition to its diverse portfolio of assets in media, ZEEL is part of MediaPro, which distributes a bouquet of 68 channels along with 8 HD offerings across all the platforms, making it the biggest channel distributing agency in

India. In line with its strategy of further strengthening its position in the regional markets, the company has launched Zee Bangla Cinema, a 24 hour Bangla movie channel, in Q2FY13. With over 400 exclusives titles under its belt, Zee Bangla Cinema offers a mixed bag of commercial blockbuster and alternative cinema. This quarter also saw the launch of Zee Alwan, an Arabic GEC channel, as part of its international growth strategy. Sports business of the company was strengthened with the launch of dedicated channels in popular sports like football and golf. Ten Golf and Ten HD are the new offerings in the sports bouquet. Recently, the company has launched new channel – ZeeQ - which will cater to the needs of children in India. ZeeQ will address the educational need gaps through engaging content. The 24-hour channel will be available on leading DTH & Digital Cable Platforms as a paid-for channel. With the onset of digitization, arrival of 4G and elimination of anomalies, a positive industry growth is in sight, the company plans to implement, all the planned strategies to capitalize on the opportunities. Backed with cutting edge technology support, the company is ready to gear up for the digital dawn.

With successful implementation of digitization, the television ecosystem will benefit immensely.

The company expects its sports business to be profitable in a couple of years through digitization. Thus, we believe that the company will be a major beneficiary of the digitization wave with jump in subscription & adrevenues.

ZEEL has entered into the distribution JV (50:50 Joint

Venture between Zee Turner and Star-Den) MediaPro to address various anomalies of the present distribution market analogue

Digitization to drive subscription revenue

India is on the phase of digitization and FY13 is expected to be a landmark year for the television media industry. The industry is on the verge of a big change with the implementation of Digital

Addressable System (DAS), with India’s four metro cities are in the process of implementing the

Phase 1 of digitization i.e switching over from analog to digital by November 1, 2012. The successful implementation of digitization will bring a new evolution in the television ecosystem and this is expected to significantly improve transparency in the pay-TV ecosystem by providing more choice to the consumers, with better picture quality and improved business economics for all players. ZEEL earned 30% of its revenues from domestic subscription while international subscription contributed 13% of its revenues in FY12. India is a fast digitizing market and the consumer shift towards digital services is visible through the consistent increase in subscribers base adopted satellite based television services via DTH has grown strongly by 10.5 million in FY2012, taking the gross DTH subscriber base to 44.6 million. Further, the domestic subscription income is expected to grow significantly going forward owing to the impending digitization. The rollout of

India’s DAS will provide opportunities to launch subscription-driven speciality channels. The company has already sensed the opportunity and has launched various niche channels due to their immense potential and is planning to launch new niche content channels going forward, in order to boost its revenues. Moreover, its international markets will be further penetrated and the global presence will be enhanced.

II

III

Phase

I

Mandatory digitization will proved to be beneficial for ZEEL

Regions covered

Delhi, Mumbai, Kolkata and

Chennai

All cities with population >

10 lacs

No of C&S

Households

~12mn

30-40mn

Completion (%)

68%

-

Deadline

31-Oct-12

31-Mar-13

All urban areas (municipal areas)

~ 20mn - 30-Sep-14

IV Rest of India ~ 20mn - 31-Dec-14

Besides, the company’s recent distribution joint venture with Star-Den (50:50 joint venture between

Zee Turner and Star-Den) to form Media Pro, a distribution company, for jointly distributing channels and services of the two entities across India would help the company to garner higher subscription income. The joint venture will address various glitches of the present analogue distribution market by restricting piracy and bring in transparency by spurring the pace of India’s digitization. Further, the blend of both the channels of ZEEL and Star India would provide Media Pro a higher bargaining power.

Foresaw the digitization revolution, ZEEL has formed MediaPro to address various anomalies of the present analogue distribution market. It curbs piracy and introduces transparency by accelerating the pace of India’s digitization. The potential revenue growth demonstrates the effectiveness of the collaboration. As a result, the company continues to enjoy double-digit profitability (24% EBITDA margin and 19% PAT margin) in a market where the majority of the companies are in red.

The company has introduced specific channels – Hindi and

Regional GECs to reflect family values, English Entertainment genre to reflect lifestyle attributes, Sports genre to offer live international sports content, and niche channels like

Zee Khana Khazana and Ten

Golf to cater to specific audience needs.

The Indian Television industry will grow from ` 329 billion to around

` 735 billion in the next five years.

This coupled with the growth of the TV households from ~153 million to ~188 million by 2016

Aims to deliver enhanced viewer value proposition…

Revenue contribution during FY’12

To address the varied entertainment requirements, the company has introduced specific channels – Hindi and Regional GECs to reflect family values, English Entertainment genre to reflect lifestyle attributes, Sports genre to offer live international sports content, and niche channels like Zee Khana Khazana and Ten

Golf to cater to specific audience needs. To deliver enhanced viewer value proposition, the company has always evaluated its content as a viewer, and not as broadcaster. Addressing the varied entertainment requirements through its expertise, ZEEL has launched ZEE BOLLYWORLD’, an umbrella brand under which it will consolidate its entire Indian content, including dramas, Bollymovies, Bolly-documentaries, Bolly-travel, for syndication. The company enjoys its debt free and strong net cash position of ` 11.5 billion gives the company ample buffer to invest in content and focus on increasing its market shares in the medium-to-long term. In its organic ventures, it has launched a certain number of new media properties in the last 7-8 months while for inorganic growth ZEE is also looking at opportunities and if needed, the company will utilize these cash reserves.

India TV market expected to reach ~188 million households by 2016

India, the world’s third largest TV market, is expected to grow at a rate of 17% annually. With rising demand for niche content, the number of channels is increasing. The digitization drive is shaping the future of the industry, and will definitely give a fillip to industry’s average revenue per user (ARPUs) over the next quarters. India’s Television industry is poised for a quantum leap, riding on the digitization wave. From mere aspiration, digitization is now going to become a reality over the next few quarters. As per the latest FICCI KPMG report, the Indian Television industry will grow from ` 329 billion to around ` 735 billion in the next five years. India’s multichannel television industry is on the cusp of a transformation as the GOI implements policies to increase FDI, digitize approximately 85 million cable television homes, and accelerate the rollout of broadband cable infrastructure. With

DAS gradually replacing the analog distribution system, the entire universe of subscribers will now be uniquely recognized leading to a multifold jump in the subscribers. This coupled with the growth of the TV households from ~153 million to ~188 million by 2016 and paid C&S TV household penetration levels expected to increase to 89% from the current ~76% should improve the visibility on revenue growth and profitability of the sector as a whole.

Television industry revenue growth

The company anticipates its adrevenues to grow faster than expected industry growth of 8-9% in FY13E. And also expects to maintain its EBIDTA margin in the range of 25-30% in FY13E.

ZEE expects to breakeven its sports business with the increase in subscription income through digitization by FY14-

FY15

Continued to build momentum with outstanding performance in Q2FY’13……

Despite economic headwinds, ZEEL has witnessed outstanding Q2FY’13 performance with 18.8%

YoY growth in consolidated net profit to ` 18.8 billion in the second quarter ended September 2012.

The company’s consolidated net sales too increased at a better than expected rate of 13% to ` 9.5 billion from ` 8.4 billion during the same period driven by robust growth in subscription as well as advertising revenues. The company's advertisement revenue grew by 33.7% YoY on account of sports, as India-Sri Lanka cricket series during the quarter added a lot to advertising growth. While its subscription revenues surged by 35.7% YoY. A major driver of the subscription revenues was domestic subscription revenue, which has gone up by 43.9% to ` 2.8 billion. International revenues have also chipped in with a growth of 19% to ` 1.14 billion. Further, the company registered 7.8%

YoY growth in its Q2FY’13 EBITDA at ` 2.2 billion with 22.8% EBITDA margin. Thus, the company has continued to build on the momentum growth to deliver superior returns to its shareholders.

The company anticipates its ad-revenues to grow faster than expected industry growth of 8-9% in

FY13E on the back of increased GRPs with higher investment in content. ZEEL continued to invest in

Q2FY’13, in line with its stated plan that considers FY13 as the year of investments. Increasing investment in content and launch of new channels also meant an increase in advertisement and marketing cost by ~42% in Q2FY’13. With strong investment in content in Q2FY’13, the company increased original programme hours from 24 hours to 27 hours and has plans to extend it to 32-34 hours per week by the end of FY13E. Further, the company expects to maintain its EBIDTA margin in the range of 25-30% in FY13E. With successful implementation of digitization, digital cable would also start contributing significantly to the subscription income and would be the next growth driver for subscription income.

Quarterly growth trend of ad-revenue & subscription revenue

Improved business performance during Q2FY’13..

The company’s flagship channel, Zee TV averaged 237 GRPs recording a relative share of 22% among the top five Hindi GECs in Q2FY’13 as against 21.2% in Q1FY’13 and 20.0% in Q2FY’12. Zee

TV continued to be no. 2 GEC in the quarter in terms of ratings. The company launched new shows

“Ramayan” and “Rab se Sona Ishq” in the quarter. Sports revenue represented a strong growth of

106.4% YoY and 83.3% QoQ to ` 1.8 billion on the back of the India-Sri Lanka series which was telecasted exclusively on Ten Cricket as Doordarshan was telecasting Olympics at that point of time. ZEE expects to breakeven its sports business with the increase in subscription income through digitization by FY14-FY15. Other channels such as Zee Marathi, Zee Bangla, Zee Telgu and Zee

Kannada delivered an average of 176 GRPs, 382 GRPs, 313 GRPs, 227 GRPs during Q2FY’13, with a relative market share of 26%, 33.4%, 19% and 17% respectively. The company plans to utilize increase in revenues for launching new media initiatives and investing in new contents to stay more competitive.

Balance Sheet (Consolidated)

Y/E ( ` million)

Share Capital

Share application

Money

Reserve and surplus

Net Worth

Minority Interest

Loan funds

Long Term Provisions

Current liabilities

Capital Employed

Fixed assets

Long-term loans and advances

Investment

Other asset

9.0

190.0

7,670.0

38,732.0

8,106.0

1,057.0

6,964.0

297

FY11A

978.0

-

30,004.0

30,982.0

(119.0)

12.0

228.0

8,591.0

43,153.0

9,400.0

857.0

7,999.0

316

FY12A

959.0

46.0

33,349.0

34,354.0

(32.0)

16.0

239.4

8,848.7

48,035.6

10,528.0

754.2

9,190.9

335

FY13E

959.0

-

37,972.5

38,931.5

0.0

18.7

287.3

9,919.4

55,729.7

12,338.8

663.7

11,029.0

398.6

Deferred tax asset

Current assets

Y/E

EBITDA Margin (%)

EBIT Margin (%)

192.0

22,116.0

Capital Deployed 38,732.0

Key Ratios (Consolidated)

FY11A

29.4

28.5

337.0

24,244.0

43,153.0

FY12A

27.6

26.6

491.7

26,735.9

48,035.6

FY13E

29.6

28.6

555.6

30,744.0

55,729.7

FY14E

30.1

29.0

NPM (%)

ROCE (%)

ROE (%)

EPS ( ` )

P/E (x)

BVPS(

`

)

P/BVPS (x)

EV/Operating Income (x)

EV/EBITDA (x)

EV/EBIT (x)

20.6

28.4

20.6

6.5

28.8

31.7

5.8

6.2

20.6

21.2

18.5

24.5

17.1

6.1

31.2

35.8

5.1

6.1

21.0

21.8

20.5

21.6

19.1

7.8

24.9

40.6

4.5

5.2

16.7

17.3

21.2

47.4

3.9

4.5

14.4

14.9

21.0

21.6

19.1

9.1

FY14E

959.0

-

44,545.3

45,504.3

0.0

Profit & Loss Account (Consolidated)

Y/E ( ` million) FY11A FY12A FY13E

Total Income 30,970.0 31,789.0 36,322.3

Expenses 21,868.0 23,010.0 25,580.3

EBITDA 9,102.0 8,779.0 10,742.0

EBITDA margin (%) 29.4 27.6 29.6

Depreciation 289.0 323.0 369.5

EBIT 8,813.0 8,456.0 10,372.5

FY14E

41,468.7

29,000.6

12,468.1

30.1

422.4

12,045.7

Interest 88.0 50.0 57.2 65.4

Exceptional Item.

197.0 0.0 0.0 0.0

Profit Before Tax 8,922.0 8,406.0 10,315.3 11,980.4

Tax 2,671.0 2,500.0 2,860.0 3,269.0

Minority Interest (118.0) 17.0 17.0 17.0

Net Profit 0.0 2.0 2.0 2.0

Net Profit 6,369.0 5,891.0 7,440.3 8,696.4

NPM (%) 20.6 18.5 20.5 21.0

Valuation and view

ZEEL has witnessed robust performance during Q2FY’13, with a strong growth on the subscription as well as advertising revenues. Zee has a strong, diversified portfolio of channels and a solid balance sheet. Further, ZEEL expects an upward trend its advertisement revenue growth in the coming period.

The Company would like to maintain its EBIDTA margin in the range of 25-30% in FY13E-14E. ZEEL’s worldwide presence enables it to cater to the large audience base to Indian entertainment, thus providing impetus to growth. With the rollout of digitization, we believe that ZEEL will be the key beneficiary for the entire media & entertainment industry.

We rate the stock as ‘BUY’ at the current market price of

` 184.1, given the strong fundamentals, apt management and long term growth visibility. The current market price of

` 184.1 implies a P/E of ~24.9x FY’13E EPS of ` 7.8 and 21.2x on FY’14E EPS of ` 9.1 respectively.

Indbank Merchant Banking Services Ltd.

I Floor, Khiviraj Complex I,

No.480, Anna Salai, Nandanam, Chennai 600035

Telephone No: 044 – 24313094 - 97

Fax No: 044 – 24313093 www.indbankonline.com

Disclaimer

@ All Rights Reserved

This report and Information contained in this report is solely for information purpose and may not be used as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. The investment as mentioned and opinions expressed in this report may not be suitable for all investors. In rendering this information, we assumed and relied upon, without independent verification, the accuracy and completeness of all information that was publicly available to us. The information has been obtained from the sources that we believe to be reliable as to the accuracy or completeness. While every effort is made to ensure the accuracy and completeness of information contained, Indbank Limited and its affiliates take no guarantee and assume no liability for any errors or omissions of the information. This information is given in good faith and we make no representations or warranties, express or implied as to the accuracy or completeness of the information. No one can use the information as the basis for any claim, demand or cause of action.

Indbank and its affiliates shall not be liable for any direct or indirect losses or damage of any kind arising from the use thereof. Opinion expressed is our current opinion as of the date appearing in this report only and are subject to change without any notice.

Recipients of this report must make their own investment decisions, based on their own investment objectives, financial positions and needs of the specific recipient. The recipient should independently evaluate the investment risks and should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document and should consult their advisors to determine the merits and risks of such investment.

The report and information contained herein is strictly confidential and meant solely for the selected recipient and is not meant for public distribution. This document should not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced, duplicated or sold in any form.