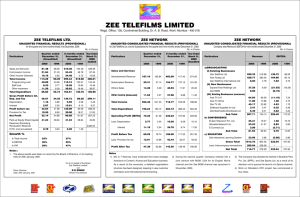

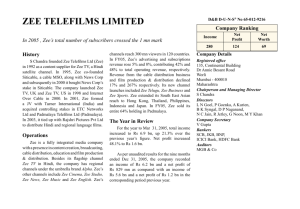

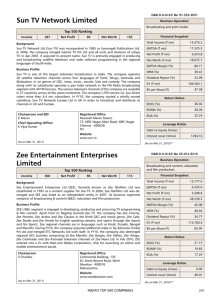

Zee Annual Report 2001-2002

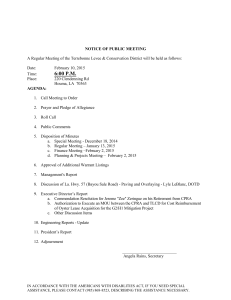

advertisement