2014 Financial Statement - Vanguard Life Assurance Malawi

advertisement

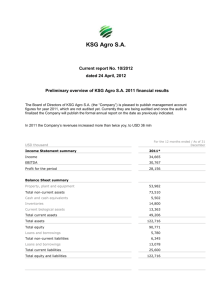

Vanguard Life Assurance Company Limited ABRIDGED AUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31 DECEMBER 2014 ABRIDGED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2014 Audited 31-Dec-14 K’000 Audited 31-Dec-13 K’000 Gross premium 1,307,283 1,014,474 Reinsurance cost (40,952) (13,551) Net income 1,266,331 1,000,923 Investment and other income 334,003 513,583 Total revenue 1,600,334 1,514,506 Gross insurance benefits and commissions (255,426) (172,058) Reinsurance recoveries 19,305 11,626 Operating expenses (512,117) (399,971) Net benefits, commissions and operation expenses (748,238) (560,403) Profit before change in insurance liabilities 852,096 954,103 Change in insurance contract liabilities (730,767) (694,193) Profit after change in insurance contract liabilities 121,329 259,910 Finance costs (5,680) (3,826) Profit before tax 115,649 256,084 Income tax expense (52,338) (60,473) Profit for the year 63,311 195,611 Other comprehensive income 4,420 1,700 Total comprehensive income 67,732 197,311 91 282 Basic earnings per share (Tambala) ABRIDGED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2014 Audited Audited 31-Dec-14 31-Dec-13 K’000 K’000 ASSETS Property, equipment and intangible assets 173,145 137,455 Investment property 1,035,400 968,626 Deferred acquisition cost 215,404 266,853 Held for trading investments 290,727 225,319 Inventories 1,798 3,598 Trade and other receivables 345,941 189,835 Cash and cash equivalents 1,212,289 746,895 Total assets 3,274,704 2,538,581 EQUITY AND LIABILITIES Capital and reserves Share capital 69,355 69,355 Share premium 277,069 277,069 Revaluation reserves 6,120 1,700 Retained earnings 317,235 268,924 Total equity and reserves 669,779 617,048 Liabilities Life assurance policyholder liabilities 2,422,927 1,792,195 Trade and other payables 181,998 129,339 Total liabilities 2,604,925 1,921,534 Total equity and liabilities 3,274,704 2,538,581 ABRIDGED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2014 Audited Audited 31-Dec-14 31-Dec-13 K’000 K’000 Cash flows from operating activities Profit before tax 115,649 256,084 Adjustments for non cash items: 117,024 (147,222) Changes in working capital (102,543) (5,567) Cash generated from operations 130,130 103,295 Income taxes paid (51,322) (44,821) Net cash from operating activities 78,808 58,474 Cash flows from investing activities (229,146) (505,963) Cash flows from financing activities 615,732 624,566 Net increase in cash and cash equivalents 465,394 177,077 Cash and cash equivalents at beginning of year 746,895 569,818 Cash and cash equivalents at end of year 1,212,289 746,895 Statement of changes in equity for the year ended 31 December 2014 Share Share Revaluation Retained Total capital premium reserve earnings equity MKMKMKMKMK Balance at 1 January 2013 69,354,839 277,069,081 - 73,313,026 419,736,946 Total comprehensive income for the year - - 1,700,000 195,610,716 197,310,716 Balance at 31 December 2013 69,354,839 277,069,081 1,700,000 268,923,742 617,047,662 Dividend paid - - - (15,000,000) (15,000,000) otal comprehensive income for the year Balance at 31 December 2014 - 69,354,839 - 277,069,081 4,420,499 63,311,084 67,731,583 6,120,499 317,234,826 669,779,245 ABRIDGED AUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31 DECEMBER 2014 PERFORMANCE OVERVIEW Gross premiums increased from K1.01 billion to K1.31 billion representing a growth of 29% while total revenue grew by 7% from MK1.51 billion in 2013 to MK1.65 billion in 2014. Total assets grew by 29% from MK2.5 billion to MK3.3 billion due to growth in investments assets which grew by 31% from MK1.8 billion in 2013 to MK2.5 billion in 2014. These favourable growth levels have been achieved on account of The Pension Act 2010 combined with the company’s marketing efforts. Due to reduction in rates, money market investment and other income went down by 35% from MK508 million to MK334 million in 2014. The Company made a profit of MK852 million before changes in insurance liabilities of MK731 million which were transferred to the policyholders. Profit before tax at MK116 million was down by 55% on 2013 profit of MK256 million due to a decision to impair deferred acquisition cost PROSPECTS The stabilisation of the Kwacha and the downward trend in inflation, if sustained, is expected to bring positive results as this should translate into disposable incomes that allow potential customers to take up insurance. The ongoing reforms in the pensions industry will continue to positively impact on the business. ACTUARY’S CERTIFICATE I hereby certify that, to the best of my knowledge and belief, as at 31st of December 2014, the value of assets in respect of all classes of Life and Pension business carried out by Vanguard Life Assurance Company Limited exceeds the amount of liabilities. Piyush I Majmudar Fellow of the Institute of Actuaries, UK REPORT OF THE INDEPENDENT AUDITORS ON THE ABRIDGED FINANCIAL STATEMENTS TO THE MEMBERS OF VANGUARD LIFE ASSURANCE COMPANY LIMITED The accompanying abridged financial statements, which comprise the abridged statement of financial position as at 31 December 2014 and the abridged statements of profit or loss and other comprehensive income, changes in equity and cash flows for the year then ended, are derived from the audited financial statements of Vanguard Life Assurance Company Limited for the year ended 31 December 2014. We expressed an unmodified audit opinion on those financial statements in our report dated 7th of March 2015. Those financial statements, and the summary financial statements, do not reflect the effects of events that occurred subsequent to the date of our report on those financial statements. The abridged financial statements do not contain all the disclosures required by International Financial Reporting Standards applied in the preparation of the audited financial statements of Vanguard Life Assurance Company Limited. Reading the abridged financial statements, therefore, is not a substitute for reading the audited financial statements of Vanguard Life Assurance Company Limited. Directors’ responsibility The directors are responsible for the preparation and fair presentation of these abridged financial statements in accordance with the provisions of the Companies Act (Chapter 46:03) and in conformity with the International Financial Reporting Standards (IFRS). Auditors’ responsibility Our responsibility is to express an opinion on these abridged financial statements based on our procedures which were conducted in accordance with International Standards on Auditing (ISA) 810, Engagements to Report on Summary Financial Statements. Opinion In our opinion, the abridged financial statements derived from the audited financial statements of Vanguard Life Assurance Company Limited for the year ended 31st December 2014 are consistent, in all material respects, with those financial statements, in accordance with the International Financial Reporting Standards (IFRS), the Financial Services Act, 2010, and the Companies Act (Chapter 46:03). BDO Chartered Accountants Public Accountants and Business Advisors Blantyre, Malawi 7th March 2015 BY ORDER OF THE BOARD G. Kambale N. Mupfurutsa Chairman Managing Director Every part of life, throughout life, for life.