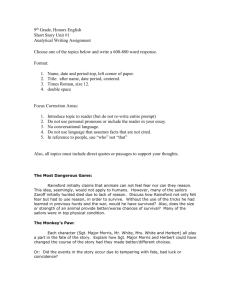

Economics and Greed - Kellogg School of Management

advertisement