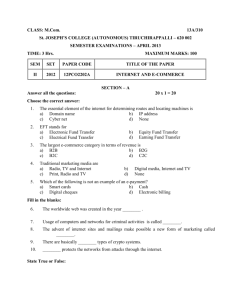

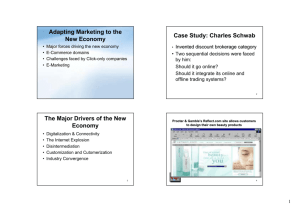

Latin America B2C E-commerce Report 2014

advertisement