Josh Lerner - HBS People Space

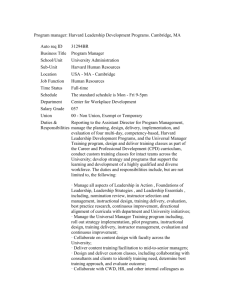

advertisement