Middle Africa Briefing Note | Fixed Income

11 April 2014

Zambia: Successful Issuance of Eurobond despite Macroeconomic

Challenges

Highlights

On 7 April, the authorities issued USD1billion, 8.625% yield, 10-yr Eurobond in order to support infrastructural

developments.

The 10-yr Eurobond was oversubscribed by about 330%, reflecting continued confidence in the country’s economic

prospects despite ongoing fiscal challenges and lower copper prices.

Fund managers dominated the allocation of the bond with US investors accounting for most of the demand.

However, domestic problems alongside rising US Treasury yields pushed up the country’s Eurobond yields and

domestic rates.

Despite short term macroeconomic challenges, Zambia’s economic prospects remain reasonably good, with little

likelihood of Eurobond repayment problems.

Strong participation in the bond issuance despite macroeconomic challenges

On 7 April, the Zambia government issued new USD1billion, 10-yr 144/Reg S Eurobond at 8.625% in order to support

infrastructural developments in road, railway and healthcare. The 10-yr Eurobond was oversubscribed by about 330%,

reflecting strong confidence in the economy despite ongoing fiscally- and externally-induced challenges and rising US

Treasury yields; this positive development could be due partly to prospects of a potential rise in copper production

over the medium term and the re- assurance of real positive returns on sovereign yield curve, in light of ongoing

monetary tightening stance (in March 2014, the central bank of Zambia hiked its policy rate by 175bp to 12% due to

concerns over the effect of the recent currency weakness on inflation). However, while the maiden Zambia 10-yr

Eurobond was issued at a coupon rate of 5.625% in 2012, the latest issuance was issued at a higher coupon of 8.625%

with a price of 99.174, highlighting the high risk premium associated with Zambia’s sovereign rating (Table 1), and

domestic and external challenges.

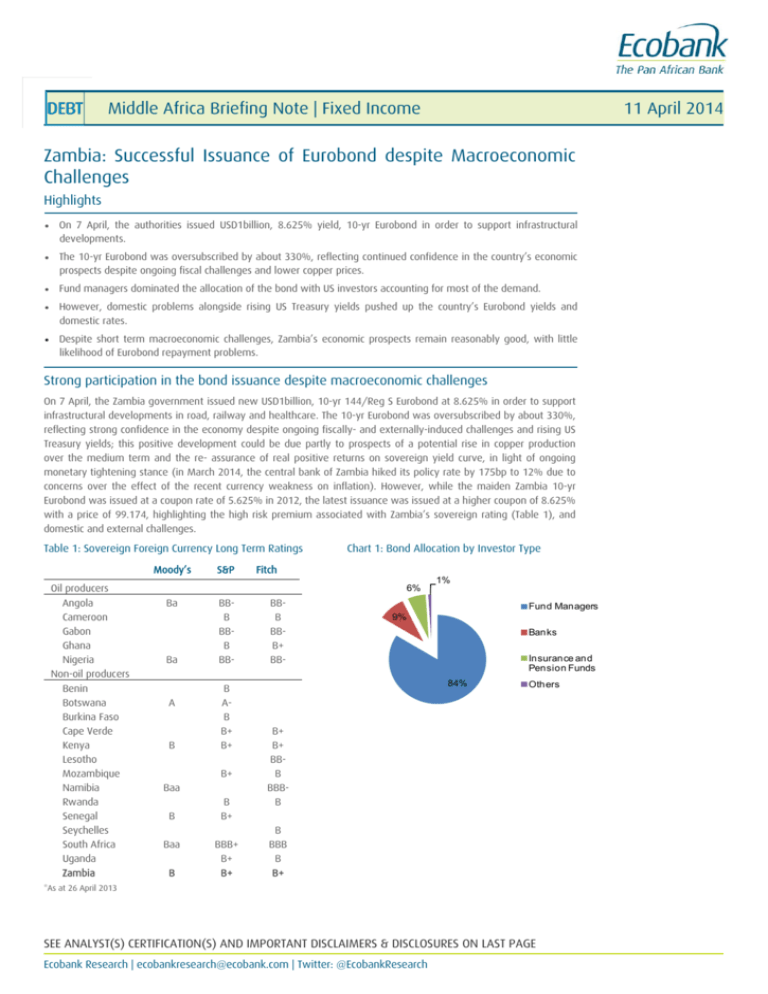

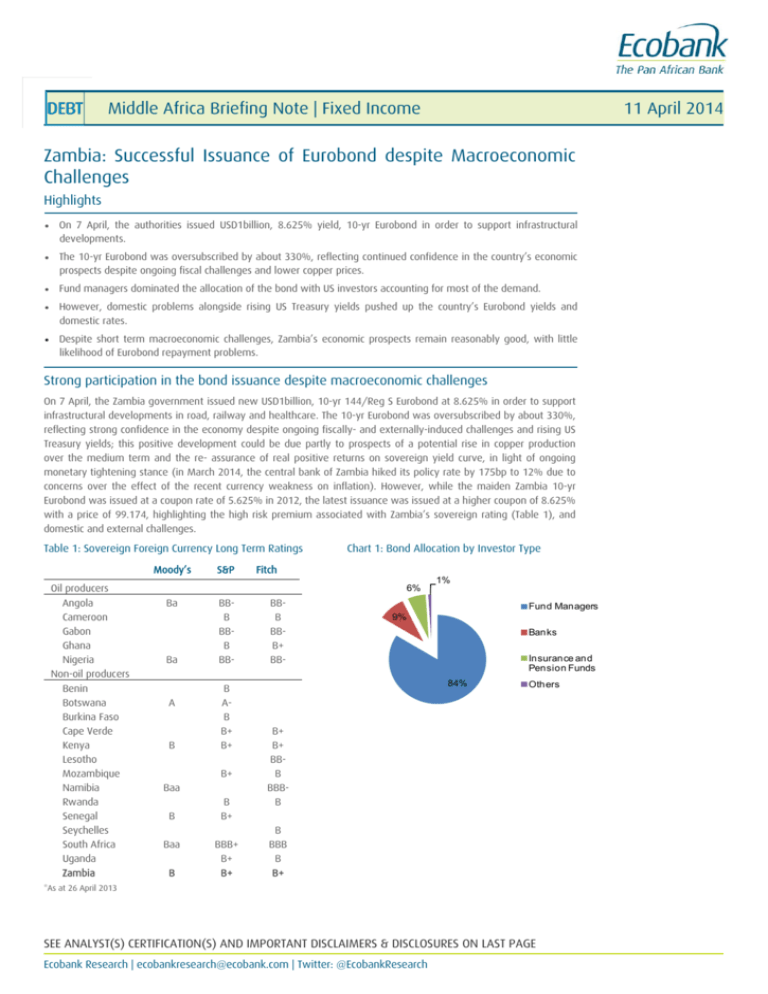

Table 1: Sovereign Foreign Currency Long Term Ratings

Moody’s

Oil producers

Angola

Cameroon

Gabon

Ghana

Nigeria

Non-oil producers

Benin

Botswana

Burkina Faso

Cape Verde

Kenya

Lesotho

Mozambique

Namibia

Rwanda

Senegal

Seychelles

South Africa

Uganda

Zambia

S&P

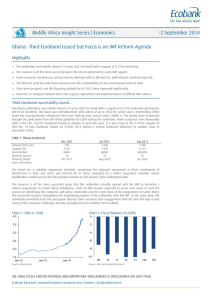

Chart 1: Bond Allocation by Investor Type

Fitch

6%

Ba

Ba

A

B

BBB

BBB

BBB

AB

B+

B+

B+

Baa

B

Baa

B

B

B+

BBB+

B+

B+

BBB

BBB+

BB-

1%

Fund Managers

9%

Banks

Insurance and

Pension Funds

84%

Others

B+

B+

BBB

BBBB

B

BBB

B

B+

*As at 26 April 2013

SEE ANALYST(S) CERTIFICATION(S) AND IMPORTANT DISCLAIMERS & DISCLOSURES ON LAST PAGE

Ecobank Research | ecobankresearch@ecobank.com | Twitter: @EcobankResearch

Middle Africa Briefing Note | Fixed Income

11 April 2014

Demand was particularly strong from the US

Over 275 investors participated in the issuance, reflecting strong demand for the bond. The final allocation statistics

showed that fund managers dominated the allocation of the bond, particularly US-based investors. Fund managers

accounted for 84% of total bond allocation (Chart 1), of which US-based investors accounted for 56% of demand,

followed by UK-based investors, 27%, other European investors, 14%, Asian-based investors, 2%, and others, 1%.

Banks (both public and private) were the second main participants, accounting for 9% of total bond allocation,

followed by Insurance and pension fund, 6%, and others, 1%.

Although strong demand for the bond reflects ongoing search for yield among OECD investors that have large and in

many cases growing pension, insurance and other liabilities that require funding, the current yields also underpin

continued attractiveness of Middle Africa’s bond market despite weaker economic fundamentals. Yields in Middle

Africa currently average 13-14% on local currency denominated assets and 7-9% on US-denominated Eurobond.

Challenges arising from poor performance of Zambia’s maiden Eurobond impact negatively

on new bond pricing and yield outlook…

Meanwhile, Zambia’s 5.625% 2022 maiden bond have performed poorly in recent months. Yields on Zambia’s 5.625%

2022 maiden bond have risen significantly above 8.0%, while the bidding price has dropped to 84.87 from a price of

98.108 in September 2012. This is due to both internal and external factors. With regard to the former, the country’s

deteriorating public finances and recent weakness of the kwacha have been the main factors responsible for the poor

performance of the bond. The ZMW has depreciated 11.1% YTD partly due to a significant reduction in copper export

proceeds and huge fiscal deficit (equalling 6.8% in 2013), thereby increasing the country’s risk profile. In addition,

recent revelation by Federal Reserve of the likelihood that US interest rates may rise by March/April 2015 has

increased sentiment towards assets priced in US dollars (particularly US Treasuries); this has seen US Treasury yields

rise by around 150bp to 200bp across the 5- to 10 year maturity spectrum. The risks associated with the new bond

also stem from internal and external factors. While the internal factors are driven by Zambia’s deteriorating economic

fundamentals, the external risks arise from weaker copper prices and a solid investment option in US treasury.

.....but recent monetary tightening could help re-position the economy to perform better

Zambia’s economy is expected to grow 6.5% this year, according to the IMF, supported by the mining and construction

sectors. However, there are growing concerns over the fiscal account, which has been undermined by high off-budget

expenses and a hike in public sector wages. Amid this, the authorities have tightened monetary policy significantly by

raising the cash reserves requirement to 14% from 8% and increasing the policy interest rate by 175bp to 12% to

address money market liquidity and currency depreciation. The short term ZMW and inflation outlook remain uncertain

following the 11.1% YTD ZMW depreciation and acceleration of annual inflation to 7.6% in March. The authorities’

medium-term inflation target is 6.5%, but domestic prices pressures are likely to remain strong reflecting delays in

agricultural food harvest and the slump in global copper prices; this suggests that the authorities will find it difficult to

meet the inflation target. Inflation, therefore, is unlikely to slow below high single digits in 2014 and foreign exchange

stability will remain a major challenge. However, Zambia’s bond still performed exceptionally well. We think this

reflects investor confidence in the country’s long term growth performance, and expectation that the monetary

tightening stance will help re-position the economy to perform better. The economy is forecast to grow by 7.2% in

2014 and by 7.5% in 2015 due to strong infrastructure spending and continued growth in the copper sector.

Conclusion

The issuance of Zambia’s new Eurobond was successful, although the issuance was issued at a higher coupon of

8.625% with a price of 99.174, highlighting the high risk premium associated with Zambia’s sovereign rating and

domestic and external challenges. However, despite uncertainty over the exchange rate and inflation outlook, broader

prospects for Zambia’s economy remain reasonably good and there is little likelihood of Eurobond repayment

problems arising given strong medium-term prospects for global copper prices. Moreover, the strong participation and

geographical spread of investors reflect investor confidence in the country’s long term growth performance and

expectation that the monetary tightening stance will help re-position the economy for better performance. However,

if the fiscal situation deteriorates and the currency depreciates further, Treasury yields would rise and further limit the

marketability and credit attraction of the bond for secondary market trading.

Ecobank Research | ecobankresearch@ecobank.com | Twitter: @EcobankResearch

2

Middle Africa Briefing Note | Fixed Income

11 April 2014

DISCLAIMER

This document was prepared under the supervision from the Research Division of EBI SA (a member of Ecobank Group), and is not necessarily definitive,

current or authoritative. Data used in this document was gathered from reliable sources, but the analyst(s) and the publishers of this document do not hold

themselves responsible for the accuracy or completeness of data used. The document provides the opinions, analyses and conclusions of the Research division

only and is provided without any warranties of any kind.EBI SA and any member of Ecobank Group and its affiliates do not in any way endorse the findings,

views and conclusions in this document.EBI SA, Ecobank Group and its affiliates' Directors, Employees or Agents do not accept any liability for any direct or

remote loss or damage arising out of the use of all or any part of the information contained in this document.

EBI SA is a credit institution authorized by the Autorité de contrôle prudentiel.

USE OF THIS PUBLICATION FOR THE PURPOSE OF MAKING INVESTMENT DECISION EXPOSES YOU TO SIGNIFICANT RISK OF LOSS.

Reception of this publication does not make you a client or provide you with the protections afforded to clients of EBI SA (A member of Ecobank Group).When

distributing this document, EBI SA or any member of Ecobank Group is not acting on behalf of the recipient of this document and will not be liable for

providing investment advice to any recipient in relation to this document. Accordingly, EBI SA (A member of the Ecobank Group) will not be held accountable

to any recipient for providing the protections afforded to its clients.

This document is published for information purposes only and is not an offer to solicit, buy or sell any security of any kind. This document does not provide

customised investment advice. It has been prepared without regard to the individual financial circumstances and risk and return objectives of individuals who

receive it. The appropriateness of a particular investment will depend on an investor’s individual circumstances, risk tolerance and return objectives. The

investments and shares referred to in this document may not be suitable for all or certain categories of investors.

The Research Division and EBI SA have implemented Chinese walls procedures to prevent any conflict of interest. Additional information may be available to

EBI SA or the Ecobank Group which is not discussed in this report. Further disclosure regarding Ecobank policy regarding potential conflicts of interest in the

context of investment research and Ecobank policy on disclosure and conflicts in general are available on request.

The opinions presented in this note may be changed without prior notice or cannot be depended upon if used in the place of the investor’s independent

judgment.

The historical performance of a security is not representative of the security’s future returns. Investment in securities can be highly risky as security prices may

go down in value as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local

currency of the recipient of the research report, changes in the exchange rates may adversely affect the value, price or income of that investment. In case of

illiquid investments for which there is no organized market it may be difficult for investors to exit investment positions or to obtain reliable information about

its value or the extent of the risk to which it is exposed.

The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further

distributed to any other person or published, in whole or in part, for any purpose.

© EBI SA Groupe Ecobank 2011.All Rights Reserved. This note has been prepared by Paul-Harry Aithnard and the Ecobank Research Division.

For any question, please contact: Paul-Harry Aithnard, Group Head, Research, Les Collines de l'Arche, 76 route de la Demi-Lune, 92057 Paris La Défense Cedex

France

DISCLOSURES

Research analyst certification: The research analyst(s) primarily responsible for the preparation and content of all or any identified portion of this research report

hereby certifies that all of the views expressed herein accurately reflect their personal views. Each research analyst(s) also certify that no part of their

compensation was, is, or will be, directly or indirectly, related to the view(s) expressed by that research analyst in this research report.

Important disclosures

I.

The analyst(s) responsible for the preparation and content of this report (as shown on the disclaimer page of this report) holds personal positions in a class

of common equity securities of the company.

II.

The company beneficially owns more than 5% in EBI SA or Ecobank Group (“the Group”).

III.

EBI SA or the Group is a market maker in the publicly traded equity securities of the company.

IV.

EBI SA or the Group beneficially owns 5% or more of the equity securities of the company.

V.

EBI SA or the Group beneficially holds a significant interest of the debt of the company.

VI.

EBI SA or the Group has been lead manager or co-lead manager over the previous 12 months of any publicly disclosed offer of securities of the company.

VII. The company is a client of EBI SA or the Group.

VIII. EBI SA or the Group has lead managed or co-lead managed a public offering of the securities of the company within the last 12 months.

IX.

EBI SA or the Group has received compensation for investment banking services from the company within the last 12 months.

X.

EBI SA or the Group expects to receive, or intends to seek, compensation for investment banking services from the company during the next 3 months

XI.

EBI SA or the Group has any liquidity contract between EBI or related entity and the issuer

XII. EBI SA and the issuer have agreed that EBI will produce and disseminate investment recommendations on the said issuer as a service to the issuer.

Ecobank Research | ecobankresearch@ecobank.com | Twitter: @EcobankResearch

3