Middle Africa Insight Series | Economics

12 September 2014

Ghana: Third Eurobond Issued but Focus is on IMF Reform Agenda

Highlights

The authorities successfully closed a 10-year, US$1 bn bond with a coupon of 8.125% yesterday.

The issuance is all the more successful given the recent agreement to seek IMF support.

Given economic weaknesses, strong investor demand reflects the hunt for yield despite relatively high risk.

This hunt for yield has side-lined concerns over the sustainability of non-concessional external debt.

Short term prospects and the financing outlook for H1 2015 have improved significantly.

However, to mitigate medium term risks requires agreement and implementation of difficult IMF reforms.

Third Eurobond successfully issued…

The Ghana authorities successfully closed a 10-year, US$1 bn bond with a coupon of 8.125% yesterday (pricing has

still to be decided). The bond was oversubscribed with orders of up to US$3 bn, which was a tremendous effort

given the macroeconomic imbalances that have built up over several years (Table 1). The strong level of demand

brought the yield down from the initial guideline of 8.50% during the roadshow, which compares more favourably

with a US$1 bn, 8.625% Eurobond issued by Zambia in April this year. It is also close to the 7.875% coupon on

US$1 bn, 10-year Eurobond issued on 25 July 2013 (Ghana’s second Eurobond following its maiden issue in

December 2007).

Table 1: Ghana Eurobonds

Dec 2007

750

8.50

Bullet

10

Oct 2017

Amount (US$ mn)

Coupon (%)

Amortisation

Maturity (years)

Maturity (date)

Jul 2013

1,000

7.875

Bullet

10

Aug 2023

Sep 2014

1,000

8.125

Sinkable

10

Jan 2026

Source: Bloomberg

The bond has a sinkable repayment schedule, amortising the principal repayment in three instalments of

US$333 mn in 2024 and 2025, and US$334 mn in 2026, compared to a bullet repayment schedule where

bondholders would receive the full principal amount on the January 2026 redemption date.

The issuance is all the more successful given that the authorities recently agreed with the IMF to formalise a

reform programme to correct these imbalances, with an IMF mission expected to arrive next week to start the

process of identifying the economic and policy constraints and the main focus of the programme to tackle them.

The successful issuance strengthens the negotiating position of the authorities with the IMF. At the same time, the

authorities benefited from the perception held by some investors that engagement with the IMF will help rectify

many of the economic challenges thereby strengthening the medium term outlook.

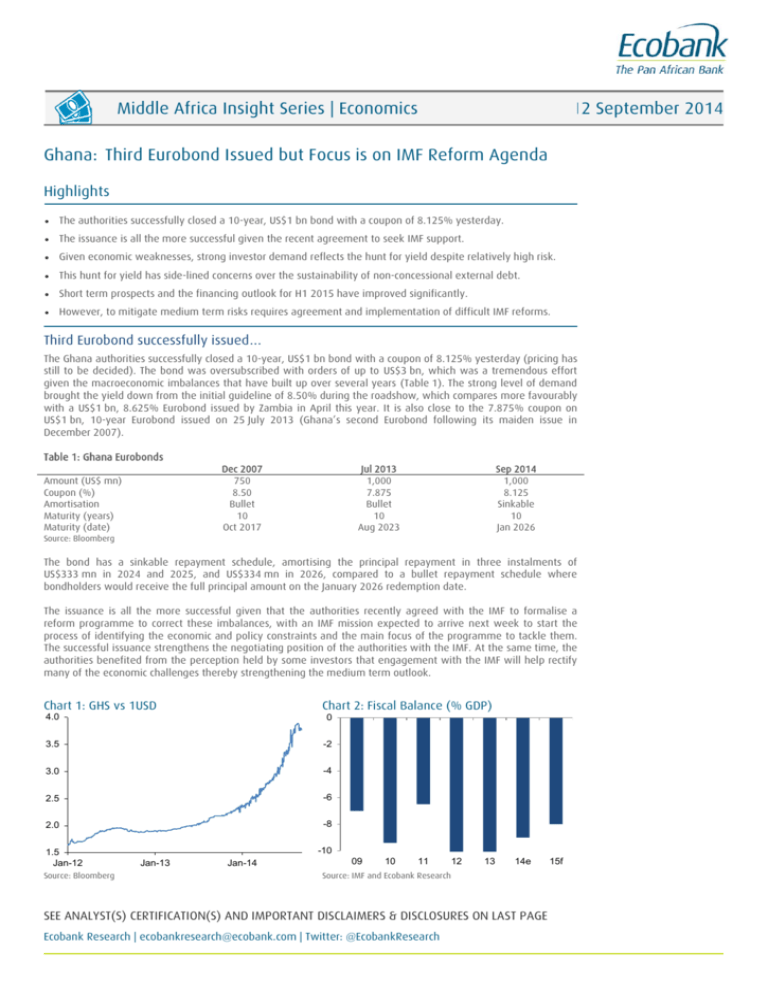

Chart 1: GHS vs 1USD

Chart 2: Fiscal Balance (% GDP)

4.0

0

3.5

-2

3.0

-4

2.5

-6

2.0

-8

1.5

Jan-12

Source: Bloomberg

-10

Jan-13

Jan-14

09

10

11

12

13

14e

Source: IMF and Ecobank Research

SEE ANALYST(S) CERTIFICATION(S) AND IMPORTANT DISCLAIMERS & DISCLOSURES ON LAST PAGE

Ecobank Research | ecobankresearch@ecobank.com | Twitter: @EcobankResearch

15f

Middle Africa Insight Series | Economics

12 September 2014

…Despite economic deterioration

The current Eurobond’s rate was only slightly higher than last year despite the deterioration in Ghana’s

macroeconomic environment. The GHS has weakened 37% YTD (the worst performing currency worldwide after

Ukraine’s UAH), following nearly 20% in 2013 (Chart 1). The fiscal deficit is likely to remain large at around 9% of

GDP in 2014 from an earlier target of 8.5% driven by high government spending, including on civil-servant pay

increases, and lower revenue from key exports such as gold (Chart 2). Meanwhile, annual inflation accelerated

15.9% in August, which is outside of the 13% target for 2014 (Chart 3) and the current account deficit is expected

to remain large at nearly 11% of GDP in 2014 (Chart 4).

Chart 3: Inflation (%)

Chart 4: Current Account (% GDP)

20

0

-2

-4

15

-6

-8

10

-10

-12

5

2010 Jan

-14

2012 Jan

09

2014 Jan

Source: Ghana Statistical Service

10

11

12

13

14e

15f

Source: IMF and Ecobank Research

Demand driven by low yields from developed economies

Given the weak situation Ghana’s economy is in, the low rate the authorities were able to once again access the

Eurobond market largely reflects strong demand for yield by some investors despite relatively high risk sovereigns,

notably hedge funds and other non-core institutional asset managers. They appear to believe in the economy's

underlying strength. This hunt for yield, given the ultra-low Federal Funds rate and European Central Bank’s Main

Refinancing rate (Chart 5) has side-lined concerns some investors have over the sustainability of Middle Africa’s

non-concessional external debt. Nonetheless, the secondary market price of Ghana’s 2023 bond has been rising

strongly since late-February this year reflecting some investors’ confidence in the economic fundamentals (Chart 6)

despite Moody’s cutting its rating on 27 June to B2, five levels below investment grade that underlined to other

investors a weakening economy.

Chart 5: Federal Funds rate (%)

Chart 6: Ghana 2023 Price

0.8

102

0.7

100

0.6

ECB Main Refinancing Rate

0.5

98

96

0.4

94

0.3

0.2

Federal Funds Effective Rate

90

0.1

0.0

Jan 13

92

Jan 14

Source: Federal Reserve and European Central Bank

88

Aug-13

Dec-13

Apr-14

Aug-14

Source: Bloomberg

Conclusion

The authorities have achieved a successful result, which has improved the short term prospects of the economy by

providing FX to ease balance of payments constraints. As a result, the financing outlook for H1 2015 has improved

significantly. Meanwhile, the expected improvements coming from an IMF designed reform programme underpins

the strengthening of the medium term outlook.

However, there are risks. For the medium term outlook to strengthen requires the authorities reach agreement on

and implement the difficult reforms that will be advised by the IMF. With the end-2016 elections approaching and

despite the resolve of the current administration to implement the necessary reforms, it is not yet clear what the

2

Middle Africa Insight Series | Economics

12 September 2014

reform agenda will contain. It is also not clear how successful the reforms will be or if reforms will be carried over

into the new 2017 parliamentary period irrespective of which party wins the end-2016 elections (presidential and

party).

Overall, investors will likely become more discriminating towards Middle African Eurobonds as competition for

global funding increases when, as expected, the Federal Reserve starts to normalise it monetary policy stance by

raising interest rates in Q1 or H1 2015. Rising US interest rates will see investors scrutinise more closely African

governments’ economic policies and their results, governance, and commodity price outlooks. We think further

access to the Eurobond market in 2015 will likely only be possible if investors feel governments looking to re-issue

have a sound economic base with robust economic policies in place. This suggests monetary policy tightening

across Africa alongside fiscal prudence. Even with these measures in place, which is not guaranteed for all of

Middle Africa’s key economies, rising US Treasury yields will push up borrowing costs for both new and returning

issuers. With many traditional bilateral donors having already scaled back their aid and with multilateral donors

yet to make up much of the shortfall, Middle Africa’s financing prospects appear to have tightened at a time when

demand for funds to increase infrastructure and productive investment remains acute.

3

Middle Africa Insight Series | Economics

12 September 2014

DISCLAIMER

This document was prepared under the supervision from the Research Division of EBI SA (a member of Ecobank Group), and is not necessarily definitive,

current or authoritative. Data used in this document was gathered from reliable sources, but the analyst(s) and the publishers of this document do not

hold themselves responsible for the accuracy or completeness of data used. The document provides the opinions, analyses and conclusions of the

Research division only and is provided without any warranties of any kind.EBI SA and any member of Ecobank Group and its affiliates do not in any way

endorse the findings, views and conclusions in this document.EBI SA, Ecobank Group and its affiliates' Directors, Employees or Agents do not accept any

liability for any direct or remote loss or damage arising out of the use of all or any part of the information contained in this document.

EBI SA is a credit institution authorized by the Autorité de contrôle prudentiel.

USE OF THIS PUBLICATION FOR THE PURPOSE OF MAKING INVESTMENT DECISION EXPOSES YOU TO SIGNIFICANT RISK OF LOSS.

Reception of this publication does not make you a client or provide you with the protections afforded to clients of EBI SA (A member of Ecobank

Group).When distributing this document, EBI SA or any member of Ecobank Group is not acting on behalf of the recipient of this document and will not

be liable for providing investment advice to any recipient in relation to this document. Accordingly, EBI SA (A member of the Ecobank Group) will not be

held accountable to any recipient for providing the protections afforded to its clients.

This document is published for information purposes only and is not an offer to solicit, buy or sell any security of any kind . This document does not

provide customised investment advice. It has been prepared without regard to the individual financial circumstances and risk and return objectives of

individuals who receive it. The appropriateness of a particular investment will depend on an investor’s individual circumstances, risk tolerance and return

objectives. The investments and shares referred to in this document may not be suitable for all or certain categories of investors.

The Research Division and EBI SA have implemented Chinese walls procedures to prevent any conflict of interest. Additional information may be

available to EBI SA or the Ecobank Group which is not discussed in this report. Further disclosure regarding Ecobank policy regarding potential conflicts of

interest in the context of investment research and Ecobank policy on disclosure and conflicts in general are available on request.

The opinions presented in this note may be changed without prior notice or cannot be depended upon if used in the place of the investor’s independent

judgment.

The historical performance of a security is not representative of the security’s future returns. Investment in securities can be highly risky as security prices

may go down in value as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than

the local currency of the recipient of the research report, changes in the exchange rates may adversely affect the value, pri ce or income of that

investment. In case of illiquid investments for which there is no organized market it may be difficult for investors to exit investment positions or to

obtain reliable information about its value or the extent of the risk to which it is exposed.

The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced,

further distributed to any other person or published, in whole or in part, for any purpose.

© EBI SA Groupe Ecobank 2014.All Rights Reserved. This note has been prepared by Edward George and the Ecobank Research Division.

For any question, please contact: Edward George, Group Head, Research, 20 Old Broad Street, London EC2N 1DP, United Kingdom

DISCLOSURES

Research analyst certification: The research analyst(s) primarily responsible for the preparation and content of all or any identified portion of this research

report hereby certifies that all of the views expressed herein accurately reflect their personal views. Each research analyst (s) also certify that no part of

their compensation was, is, or will be, directly or indirectly, related to the view(s) expressed by that research analyst in this research report.

Important disclosures

I.

The analyst(s) responsible for the preparation and content of this report (as shown on the disclaimer page of this report) holds personal positions in a

class of common equity securities of the company.

II.

The company beneficially owns more than 5% in EBI SA or Ecobank Group (“the Group”).

III.

EBI SA or the Group is a market maker in the publicly traded equity securities of the company.

IV.

EBI SA or the Group beneficially owns 5% or more of the equity securities of the company.

V.

EBI SA or the Group beneficially holds a significant interest of the debt of the company.

VI.

EBI SA or the Group has been lead manager or co-lead manager over the previous 12 months of any publicly disclosed offer of securities of the

company.

VII. The company is a client of EBI SA or the Group.

VIII. EBI SA or the Group has lead managed or co-lead managed a public offering of the securities of the company within the last 12 months.

IX.

EBI SA or the Group has received compensation for investment banking services from the company within the last 12 months.

X.

EBI SA or the Group expects to receive, or intends to seek, compensation for investment banking services from the company during the next 3 months

XI.

EBI SA or the Group has any liquidity contract between EBI or related entity and the issuer

XII. EBI SA and the issuer have agreed that EBI will produce and disseminate investment recommendations on the said issuer as a service to the issuer.

4

![Evidence based interventions (EBI)[1]-20111018](http://s2.studylib.net/store/data/005427921_1-e4102d7511bf468ef71a4cef5128c7b0-300x300.png)