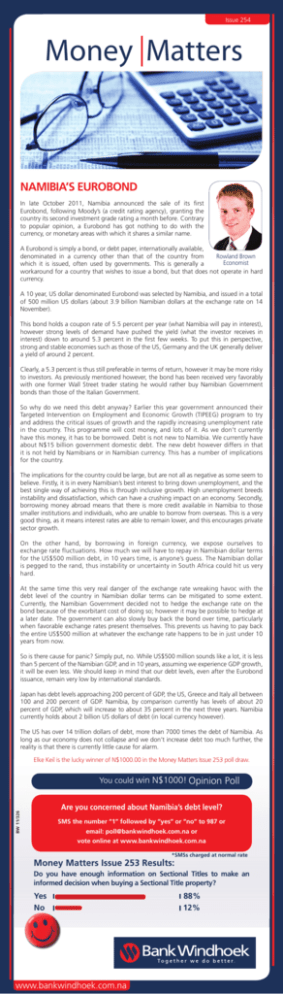

Namibia's Eurobond

advertisement

Issue 254 Money Matters NAMIBIA’S EUROBOND In late October 2011, Namibia announced the sale of its first Eurobond, following Moody’s (a credit rating agency), granting the country its second investment grade rating a month before. Contrary to popular opinion, a Eurobond has got nothing to do with the currency, or monetary areas with which it shares a similar name. A Eurobond is simply a bond, or debt paper, internationally available, denominated in a currency other than that of the country from Rowland Brown Economist which it is issued, often used by governments. This is generally a workaround for a country that wishes to issue a bond, but that does not operate in hard currency. A 10 year, US dollar denominated Eurobond was selected by Namibia, and issued in a total of 500 million US dollars (about 3.9 billion Namibian dollars at the exchange rate on 14 November). This bond holds a coupon rate of 5.5 percent per year (what Namibia will pay in interest), however strong levels of demand have pushed the yield (what the investor receives in interest) down to around 5.3 percent in the first few weeks. To put this in perspective, strong and stable economies such as those of the US, Germany and the UK generally deliver a yield of around 2 percent. Clearly, a 5.3 percent is thus still preferable in terms of return, however it may be more risky to investors. As previously mentioned however, the bond has been received very favorablyx with one former Wall Street trader stating he would rather buy Namibian Government bonds than those of the Italian Government. So why do we need this debt anyway? Earlier this year government announced their Targeted Intervention on Employment and Economic Growth (TIPEEG) program to try and address the critical issues of growth and the rapidly increasing unemployment rate in the country. This programme will cost money, and lots of it. As we don’t currently have this money, it has to be borrowed. Debt is not new to Namibia. We currently have about N$15 billion government domestic debt. The new debt however differs in that it is not held by Namibians or in Namibian currency. This has a number of implications for the country. The implications for the country could be large, but are not all as negative as some seem to believe. Firstly, it is in every Namibian’s best interest to bring down unemployment, and the best single way of achieving this is through inclusive growth. High unemployment breeds instability and dissatisfaction, which can have a crushing impact on an economy. Secondly, borrowing money abroad means that there is more credit available in Namibia to those smaller institutions and individuals, who are unable to borrow from overseas. This is a very good thing, as it means interest rates are able to remain lower, and this encourages private sector growth. On the other hand, by borrowing in foreign currency, we expose ourselves to exchange rate fluctuations. How much we will have to repay in Namibian dollar terms for the US$500 million debt, in 10 years time, is anyone’s guess. The Namibian dollar is pegged to the rand, thus instability or uncertainty in South Africa could hit us very hard. At the same time this very real danger of the exchange rate wreaking havoc with the debt level of the country in Namibian dollar terms can be mitigated to some extent. Currently, the Namibian Government decided not to hedge the exchange rate on the bond because of the exorbitant cost of doing so; however it may be possible to hedge at a later date. The government can also slowly buy back the bond over time, particularly when favorable exchange rates present themselves. This prevents us having to pay back the entire US$500 million at whatever the exchange rate happens to be in just under 10 years from now. So is there cause for panic? Simply put, no. While US$500 million sounds like a lot, it is less than 5 percent of the Namibian GDP, and in 10 years, assuming we experience GDP growth, it will be even less. We should keep in mind that our debt levels, even after the Eurobond issuance, remain very low by international standards. Japan has debt levels approaching 200 percent of GDP, the US, Greece and Italy all between 100 and 200 percent of GDP. Namibia, by comparison currently has levels of about 20 percent of GDP, which will increase to about 35 percent in the next three years. Namibia currently holds about 2 billion US dollars of debt (in local currency however). The US has over 14 trillion dollars of debt, more than 7000 times the debt of Namibia. As long as our economy does not collapse and we don’t increase debt too much further, the reality is that there is currently little cause for alarm. Elke Keil is the lucky winner of N$1000.00 in the Money Matters Issue 253 poll draw. You could win N$1000! Opinion Poll BW 11/326 Are you concerned about Namibia’s debt level? SMS the number “1” followed by “yes” or “no” to 987 or email: poll@bankwindhoek.com.na or vote online at www.bankwindhoek.com.na *SMSs charged at normal rate Money Matters Issue 253 Results: Do you have enough information on Sectional Titles to make an informed decision when buying a Sectional Title property? Yes No ww www.bankwindhoek.com.na 88% 12%