activePDF WebGrabber

The Right Way: Sales Forecasting Tools That Work Like

Yahoo! Finance

Friday, February 13, 2009

Bruce Richardson

This week we caught up with Right90 CEO Kim Orumchian for a sneak preview of his new Change Analytics module coming out in April. The new release is the latest in a series of innovative sales-forecasting and revenue performance management products.

The last time we had talked was Friday, September 19, 2008. At the risk of dredging up painful memories, it was the week Lehman Brothers and AIG collapsed, the stock market had multiple days of 500+ point losses, the

Feds talked about needing a $180B bailout (it was soon revised to $500B by week’s end), and the global economy began to teeter on the edge. The financial malaise can now be found in every company. Even leaders like Intel are having $500M misses.

Reality bites: Know what’s in your forecast

Given what has occurred over the last few months, it’s safe to say executives and sales managers are even more fixated on the current states of their forecasts and pipelines. As I write this, millions of forecasts are in trouble, with companies missing revenue because they don’t see changes in their sales forecast fast enough to take action. What if you had the same insight into your sales forecast as you had into your stock portfolio?

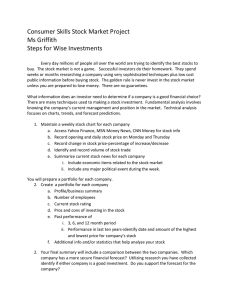

A forecast screen that looks like Yahoo! Finance

One of the features I like best about Yahoo! Finance is the ability to look at the performance of stocks relative to share price and trading volume. You can also track the prices of multiple stocks against each other at a certain trading period.

If you have a few minutes to register and view the Right90 demo, you’ll see what I mean by the Yahoo! comparison. Like the variations in stock prices, Right90 tracks changes to the forecast and, similar to the bottom of the Yahoo! screen, it also tracks the volume of changes. You can click on one of the spikes and it instantly provides insight on other parts of the screen on what happened that day.

To the right of the display is a change summary panel that tracks the top-five changes up and down. The data can be viewed by customer, product, and geography.

The bottom of your screen tracks the change details. This section can include data on the customer, product, region, person who made the change, date of the revision, as well as all of the deltas in revenue, quantities, and pricing. I especially liked the comments section, which helps alert you to the reasons for potentially losing the account. Knowing what’s wrong lets you fix it before it’s too late.

In the demo, the company was able to pinpoint the primary reason for the lower forecast: pricing pressures in a specific geography. With a couple of clicks, the reps were notified they could offer larger discounts. When the demo fast-forwards to a few days later, you see the new pricing resulted in positive changes to the forecast.

Or you can do it the hard way and risk missing your forecast

The idea of millions of people hunched over their own individual Excel screens or handouts makes Mr. Orumchian cringe. Why not load your company’s data into his forecasting engine and have that serve as the single version of the truth? The web-based application can provide views by product, region, sales rep, customer, and possibly any other slice you could want. And it can make you money. The typical Right90 user realizes up to a 5% increase in sales and a 4% improvement in margins.

The other advantage of Right90 is in the data collection. Mr. Orumchian estimates that his software can cut the time required to fill out and scrub the spreadsheets. Viewed another way, millions of managers in sales operations and finance now get their Sunday nights back.

Right90 has built a customer base of 40 companies, drawn from discrete manufacturing, software, semiconductors, apparel, food, and medical devices. You may not have heard about the company before, but that should change as it leverages its partnership with salesforce.com

and its inclusion as one of the Elite 8 software partners in the new Inner Circle partner program for Oracle CRM On Demand.

I think if you watch the demo, you’ll immediately see how your company can avoid being the next doom-andgloom headline.

What do you think?

I always found it ironic that Siebel insisted its salespeople update their weekly forecasts in Excel. It’s probably a safe bet this data was manipulated and scrubbed many times before making its way to the top floor at headquarters. While I haven’t asked, I bet many readers would tell me off the record that this is the same process at their companies too.

Are you ready to unplug Excel? Do you think you could find additional points in revenue and margin with a new approach? Sales managers, do you want your Sunday nights back? As always, I welcome your feedback and ideas—brichardson@amrresearch.com.

Copyright © 2009 AMR Research, Inc.