2004 Form 99o - Foundation Center

advertisement

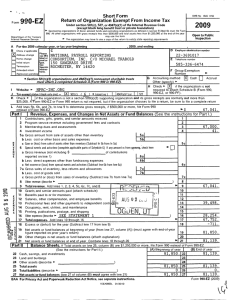

Form 99o Return of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) Department of the Treasury Internal Revenue Service The organization m . or tax ear be innin A For the 2004 calendar B Check if applicable Address change Name change Initial return 1-1 Final return Amended return Application pending Please use IRS label or print or type . See Specific Instruc- tions C Name of organization have to use a copy of this return to satisfy state 10/1/2003 . and endir Number and street (or P O box if mad is not delivered to street address) 2004 D Employer identification number Room/suite E Telephone number 1875 Connecticut Ave N . W . City or town State or country ZIP + 4 520 Washin gton D .C . [-]Other (specify) 20009-5728 H and I are not applicable to section 527 organizations. H(a) is this a group return for affiliates 1:1 Yes ~X No H(b) If "Yes ;" enter number of affiliates 0 Section 501(c)(3) organizations and 4947(a)(1) nonexempt charitable trusts must attach a completed Schedule A (Form 990 or 990-EZ). J Organization type (check only one) OMB No 1545-0047 " ~X 501(c) ( 3) 1 (insert no ) 1:14947(a)(1) or K Check here t0if the organization's gross receipts are normally not more than $25,000 The organization need not file a return with the IRS, but if the organization received a Form 990 Package in the mad, it should file a return without financial data Some states require a complete return . 527 202 483-1100 F Accounting method : Cash H(c) Are all affiliates included D Yes EK No (If "No," attach a list See instructions ) H(d) Is this a separate return filed by an organization covered by a group rulings Yes ~X No M Check " F_~if the organization is not required . to attach Sch B (Form 990, 990-EZ, or 990-PF) L Gross recei pts Add lines 6b 8b, 9b and 10b to line 12 6 920 207 Revenue, Ex p enses, and Chan g es in Net Assets or Fund Balances See p a g e 18 of the instructions . 0 1 Contributions, gifts, grants, and similar amounts received : C"i a Direct public support . . . . . . . . . . . . . . . . . 1a 192,813. . . . . . . . . . . . . . b Indirect public support . . 1b c Government contributions (grants) . . . . . . . . . . . . 1c d Total (add lines 1 a through 1c) (cash $ 192,813 noncash $ 0 ) 1d 192,813 2 Program service revenue including government fees and contracts (from Part VII, line 93) . 2 6,203,195 3 Membership dues and assessments . . . . . . . . . . . . . . . . . . . . . . 3 123,902 4 4 Interest on savings and temporary cash investments . . . . . . . . . . . . . . . . 8 5 Dividends and interest from securities . . . . . . . . . . . . . . . . . . 5 99,476 6 a Gross rents . . . . . . . . . . . . . . . . . . . . . 6a b Less : rental expenses . . . . . . . . . . . . . . . . . 6b 6c 0 c Net rental income or (loss) (subtract line 6b from line 6a) . . . . . . . . . . . . . . " UNREALIZED GAINS - MUTUAL FUNDS 7 Other investment income (describe 7 300 , 813 8 a Gross amount from sales of assets other (a) securities (B) Other than inventory . . . . . . . . . . . . . 0 8a 0 ` b Less : cost or other basis and sales expenses . 0 8b 0 c Gain or (loss) (attach schedule) . . . . . . 0 8c 0 d Net gain or (loss) (combine line Sc, columns (A) and (B)) . . . . . . . . . . . . . 8d 0 9 Special events and activities (attach schedule) If any amount is from gaming, check here 1 a Gross revenue (not including $ 192,813 of 9a 0 contributions reported on line 1a) . . . . . . . . . . . . b less : direct expenses other than fundraising expenses . . . . 9b 0 , c Net income or (loss) from special events (subtract line 9b from line 9a) . . . . . . . 9c 0 10a Gross sales of inventory, less returns and allowances . . . . 70a b Less : cost of goods sold . . . . . . . . . . . . . . . . 10b . . . 10c 0 c Gross profit or (loss) from sales of inventory (attach schedule) (subtract line 10b from line 10a) 71 Other revenue (from Part VII, line 103) . . . . DC~ ~+ ~ = . . . . . 71 0 12 Total revenue add lines 1d 2, 3, 4, 5, 6c, 7, 8d c, .10~e~1\VI I.VGD . 12 6 , 920,207 13 6,015,173 13 Program services (from line 44, column (B)) . . . . . . . . . . . .I:* . . . d 14 Management and general (from line 44, column ( , g D . . . . 14 389,089 'MAY '1 '6' 2005 15 180,681 d 15 Fundraising (from line 44, column (D)) . . . . o? . . . . . . . . . U) . . . . . 16 0 16 Payments to affiliates (attach schedule) . . . . ~ . . . . 17 6,584,943 17 Total ex penses add lines 16 and 44, column A . -CM DEN 18 335,264 18 Excess or (deficit) for the year (subtract line 17 fro . ' . . . .. . . . . . . . . . 19 4,986,545 19 Net assets or fund balances at beginning of year (from line 73, column (A)) . . . . . . . 20 0 20 Other changes in net assets or fund balances (attach explanation) . . . . . . . . . . . 21 5,321,809 z 21 Net assets or fund balances at end of ear combine lines 18, 19, and 20 For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions . (HTA) Form 990 (2004) 8 ~ Form sso (2004 I Statement of Functional Ex enses 53-0214030 Pag e 2 Po p ulation Reference Bureau All organizations must complete column (A) Columns (B), (C), and (D) are required for section 501(c)(3) and (4) organizations and section 4947(a)(1) nonexempt charitable trusts but optional for others (See page 22 of the instructions ) Do not include amounts reported on line Rh Rh Qh 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 b c d e f (A) Total 1l)h nr 1 R of Part I Grants and allocations (attach schedule) 0) (cash $ 0 noncash $ Specific assistance to individuals (attach schedule) Benefits paid to or for members (attach schedule) Compensation of officers, directors, etc. Other salaries and wages . . . Pension plan contributions . . . Other employee benefits . . . . Payroll taxes . . . . . . . . . Professional fundraising fees . . Accounting fees . . . . . . . Legal fees . . . . . . . . . Supplies . . . . . . . . . . Telephone . . . . . . . . Postage and shipping . . . . . Occupancy . . . . . . . . Equipment rental and maintenance Printing and publications . . . . Travel . . . . . . . . . . . Conferences, conventions, and meetings Interest . . . . . . . . . . . Depreciation, depletion, etc. (attach schedule) Other expenses not covered above (itemize): a INSURANCE _ _ _ NON-CAPITALIZED EQUIPMENT CONTRACTED SERVICES --------------------------------------------------------STAFF DEVELOPMENT / MISCELLANEOUS OVERHEAD ALLOCATION --------------------------------------------------------*f~iii ii~n_~ilional ----------------------------------------------expenses (add lines 22 through 43). Organizations completing columns (B)-(D) carry these totals tolines 13-15 . Joint Costs. Check "Dif you are following SOP 98-2 . (s) Program services (c) Management (D) Fundraising and general 22 23 24 25 26 27 28 29 30 31 32 33 0 0 0 260,706 1,861,637 155,511 500,756 178,527 0 18,170 1,788 50,457 0, 0 02, 114 570,978 115,266 371,163 132,325 0 234,122 269,491 36,901 118,825 42,363 0 24,470 21,168 3,344 10 ,768 3,839 0 36 37 38 39 40 41 42 43a 43b 43c 43d 43e 43f 507,838 13,192 505,612 578,814 144,469 0 56 ,779 19,829 23 ,616 1,373,668 22,173 0 0 17,550 550 476145 542,058 88,740 16,454 26,830 6,275 490,288 12,642 16,081 30,522 48 .148 0 75 0 16,781 0 0 13,386 6,234 7,581 44 6,584,943 0 0 18,637 1,161,796 7,0451 1,215,363 6,015,173 ". 7 -1 0 0 4,979 174,097 15,128 389,089 - . . . " [:]Yes Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services 0 , (Ii) the amount allocated to Program services $ If "Yes," enter (i) the aggregate amount of these joint costs $ $ and Iv the amount allocated to Fundraising $ Ifi the amount allocated to Mana gement and g eneral ".r Statement of Proaram Service Accomplishments (See page 25 of the instructions .) What is the organization's primary exempt purpose? " SEE STATEMENT 3----------------------------------------------- All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number of clients served, publications issued, etc. Discuss achievements that are not measurable . (Section 501(c)(3) and (4) organizations and 4947(a)(1) nonexempt charitable trusts must also enter the amount of grants and allocations to others ) a COMMUNICATIONS : SEE STATEMENT 3 --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Grants and allocations $ b INTERNATIONAL -PROGRAMS :-SEE -STATEMENT -3 --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Grants and allocations $ STATEMENT 3 c DOMESTIC PROGRAMS -: SEE --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Grants and allocations d------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Grants and allocations $ Grants and allocations $ Other ram services attach schedule e prog . " f Total of Program Service Expenses (should equal line 44, column (B), Program services) 18 ~X No Program Service Expenses (Required for 501(c)(3) and (4)orgs,and4947(a)(1) trusts, but optional for others 934,500 3,282,060 1 ,798,613 6,015,173 Form 990 (2004) Form 990(2004) Population Reference Bureau Page 3 53-0214030 Balance Sheets (See page 25 of the instructions .) Note : 45 46 Where required, attached schedules and amounts within the description column should be for end-of-year amounts only. Cash-non-interest-bearing . . . . . . . . . . . . . . . . . . Savings and temporary cash investments . . . . . . . . . . . . . 47 a Accounts receivable . . . . . . . . . . b less : allowance for doubtful accounts . . . 48 a b 49 50 y 51 a b 52 53 54 55 a b 56 57 a b 58 47a 47b ~ 457,764 0 48a 0 Pledges receivable . . . . . . . . . . 48b 0 less : allowance for doubtful accounts . . . Grants receivable . . . . . . . . . . . . . . . . . . . . . . Receivables from officers, directors, trustees, and key employees (attach schedule) . . . . . . . . . . . . Other notes and loans receivable (attach 0 schedule) . . . . . . . . . . . . .. .. 51a 51b 0 Less : allowance for doubtful accounts . Inventories for sale or use . . . . . . . . . . . . . . . . . . Prepaid expenses and deferred charges . . . . . . . . . X FMV Investments-securities (attach schedule) . . . . No-[:]Cost Investments-land, buildings, and equipment: basis . . . . . . . . . . . 55a 0 Less : accumulated depreciation (attach 0 schedule) . . . . . . . . . . . . . . 55b . . . . . . . Investments-other (attach schedule) . . . . 57a 511 ,206 Land, buildings, and equipment: basis . . . Less : accumulated depreciation (attach 57b 362,772 schedule) . . . . . . . . . . . . . . Other assets (describe ) " DUE FROM PRB ASSOCIATES Total assets add lines 45 through 58 must equal line 74 . Accounts payable and accrued expenses . . . . . . . . . . . Grants payable . . . . . . . . . . . . . . . . . . . . . Deferred revenue . . . . . . . . . . . . . . . . . . . . Loans from officers, directors, trustees, and key employees (attach schedule) . . . . . . . . . . . . . . . . . . . . . . 64 a Tax-exempt bond liabilities (attach schedule) . . . . . . . . . b Mortgages and other notes payable (attach schedule) . . . . . . 65 Other liabilities (describe " STATEMENT 8 59 60 61 62 63 . . . . . . . . . . ) (A) Beginning of year (B) End of year 37,408 2,075,278 45 46 66,631 1-47c I programs and accomplishments . 457 0 48c 49 0 0 0 50 0 51c 52 28,681 53 3,989,692 54 0 34,340 5,201,431 0 55c0 0 0 56 205,213 57c 883,117 58 7,286 020 223,273 1 ,665 , 189 0 0 0 411,013 59 60 61 62 xM. 63 64a 64b 65 2,299,475 66 Total liabilities add lines 60 throug h 65 . Organizations that follow SFAS 117, check here . . " X and complete lines 67 through 69 and lines 73 and 74 . 4,944,665 67 Unrestricted . . . . . .. .. . . : : : : . . : : . . . . : : ; : . . : : . 67 68 68 Temporarily restricted . 41,880 69 m 69 Permanently restricted . . . . . . . . . . . . . . . . . . . follow SFAS 117, check here " Organizations that do not 1--land complete lines 70 through 74 . 70 70 Capital stock, trust principal, or current funds . . . . . . . . . . . ..`' 71 y 71 Paid-in or capital surplus, or land, building, and equipment fund . . . . 72 10 y~ 72 Retained earnings, endowment, accumulated income, or other funds . . Total net assets or fund balances (add lines 67 through 69 or d 73 lines 70 through 72 ; 4,986,545 73 column (A) must equal line 19 ; column (B) must equal line 21) . . . . 7,286,020 74 74 Total liabilities and net assets / fund balances add lines 66 and 73 Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization . How the public perceives an organization in such cases may be determined by the information presented on its return . Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's 66 46 , 677 422,671 148,434 883,215 7, 194,532 193,014 1,276,438 0 0 0 403,273 1,872 725 5,279,927 41,880 5,321,807 7,194,532 Form 990 (2004) ;] a b (1) (2) ( 3) (4) c d Reconciliation of Revenue per Audited Financial Statements with Revenue per Return See page 27 of the instructions . Total revenue, gains, and other support per audited financial statements . . 6,920 " a Amounts included on line a but not '° on line 12, Form 990: Net unrealized gains ' on investments . . . . $ Donated services and ., . use of facilities . . . . $ Recovenes o f prior ' year grants . . . . . $ Other (specify). PRB ASSOC _____ $ 2 Add amounts on lines (1) through (4) t b Line a minus line b . . . . . . . Amounts included on line 12, Form 990 but not on line a : (1) Investment expenses not included on line 6b, Form 990 . . . . $ (2) Other (specify): " c Reference Bu 6,920,207 a b (1) (2) (3) (4) c d (1) (2) ------------- :---- rceconciiiation or cxpenses per Auaitea Financial Statements with Expenses per Total expenses and losses per audited financial statements . . . " a Amounts included on line a but not on line 17, Form 990 : Donated services and use of facilities . . $ Prior year adjustments reported on line 20, Form 990 . . . . . . $ Losses reported on line 20, Form 990 . . $ Other (specify) : PRB $ 100 ----- ASSOC $ . ------------Add amounts on .line s (1) through (4) " b c Line a minus line b . . . . . . . " c Amounts included on line 17, Form 990 but not on line a: Investment expenses not included on line 6b, Form 990 . . . . $ Other (specify): 6.! 6, 584,94 : ' - - _ 'P --------~ $ ---------Add amounts on lines (1) and (2) . . " d ~ 0 Add amounts on lines (1) and (2) . " d Total revenue per line 12, Form 990 e Total expenses per line 17, Form 990 line c plus line d " e 6,920 207 line c plus line d " e 6,584,E List of Officers, Directors, Trustees, and Key Employees (List each one even if not compensated; see page 27 of the instructions .) e (B) Title and average hours per week devoted to position (A) Name and address Name WILLIAM P BLITZ Sir 1875 CONN AVE Title PRES/CEO at WASHINGTON Sr DC ziP 20009----- Hr/WK 60 Name JAMES E SCOTT Str 1875 CONN AVE WASHINGTON s7 DC zip 20009 Titre CFO/COO HrNVK 50 Name Str ----Ci-------------------ST ------ZIP----------Name SEE ATTACHED Name Ci ty Name City Title Hr/WK Title Title ZIP Hr/WK ZIP Hr/WK qtr ST Title Name At[ ----Cit-------------------ST ------ZIP ---------Name At[ 0 Title qt[ qtr 13 I (E) Expense account and other allowances Title Str ST 191 I (D) Contributions to employee benefit plans 8 deferred compensation Hr/WK Name qtr ----Cd ------------------ST ------ZIP --------Name (C) Compensation (If not paid, enter -0-.) Title Hr/WK I Title 75 Did any officer, director, trustee, or key employee receive aggregate compensation of more than $100,000 from your organization and all related organizations, of which more than $10,000 was provided by the related organizations? 1110,0Yes ~X No If "Yes," attach schedule-see page 28 of the instructions . Form 990 (2004) Form sso 2004 76 77 PPopulation Reference Bureau 53-0214030 Other Information See page 28 of the instructions . Did the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detailed description of each activity Were any changes made in the organizing or governing documents but not reported to the IRS? . . . . . If "Yes," attach a conformed copy of the changes. 78 a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return? . . b If "Yes," has it filed a tax return on Form 990-T for this year? . . . . . . . . . . . . . . . . . . 79 Was there a liquidation, dissolution, termination, or substantial contraction during the yeah If "Yes," attach a statement . . 80 a Is the organization related (other than by association with a statewide or nationwide organization) through common membership, governing bodies, trustees, officers, etc., to any other exempt or nonexempt organizations . . . . . . . b If"Yes,"enter the name of the organization tPRBASSOCIATES ---------------------------------------- ______ .___ . ._________ ._andcheckwhetheritis Dexemptor OX nonexempt. 81 a ----------------------------------------------Enter direct and indirect political expenditures . See line 81 instructions . . . 81a 0 b Did the organization file Form 1120-POL for this year? . . . . . . . . . . . . . . . . . . . . . . 82 a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental value? . . . . . . . . . . . . . . . . . . . . . . . . . . b If "Yes," you may indicate the value of these items here. Do not include this amount as revenue in Part I or as an expense in Part II . (See instructions in Part III .) . 82b 10,000 83 a Did the organization comply with the public inspection requirements for returns and exemption applications? . b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? . . . . 84 a Did the organization solicit any contributions or gifts that were not tax deductible? . . . . . . . . . . . b If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts were not tax deductible? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85 501(c)(4), (5), or (6) organizations. a Were substantially all dues nondeductible by members? . . . . . . b Did the organization make only in-house lobbying expenditures of $2,000 or less? . . . . . . . . . . . If "Yes" was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed for the prior year. c Dues, assessments, and similar amounts from members . . . . . . . . 85c d Section 162(e) lobbying and political expenditures . . . . . . . . . . . 85d e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices . . 85e f Taxable amount of lobbying and political expenditures (line 85d less 85e) . . 85f g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f? . . . . . . . . . . h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86 501(c)(7) orgs . Enter: a Initiation fees and capital contributions included on line 12 . . . 86a . b Gross receipts, included on line 12, for public use of club facilities . . . . . 86b 87 501(c)(12) orgs. Enter: a Gross income from members or shareholders . . 87a b Gross income from other sources. (Do not net amounts due or paid to other sources against amounts due or received from them .) . . . . . . . . . 87b 88 At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301 .7701-2 and 301 .7701-3? If "Yes," complete Part IX . . . . . . . . . . . . . . . . . . . . . . 89 a 501(c)(3) organizations. Enter: Amount of tax imposed on the organization during the year under: section 4911 . 0 ; section 4912 . 0 ; section 4955 . 0 b 501(c)(3) and 501(c)(4) orgs . Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year? If "Yes," attach a statement explaining each transaction . . . . . . . . . . . . . . . . . . . . . . . . . . c Enter: Amount of tax imposed on the organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . " d Enter: Amount of tax on line 89c, above, reimbursed by the organization 90 a List the states with which a copy of this return is filed 91 92 " DC : NY . . . . . . . . " Name THE ORGANIZATION 76 77 78a 78b N/A 80a x, 79 81b Pa ge 5 No X X .°' X X X 82a X 83a 83b 84a X X 84b 85a 85b N/A X ° .~M. 85 85h _ 88 X _ 89b x X 0 . . . . . . " b Number of employees employed in the pay period that includes March 12, 2004 (See instructions .) The books are in care of Yes 0 I 90b Telephone no . " 202483-1100 - ---------------------ST------ ZIP +4 X20009=5728 ._______, ._______ . Located at " 1875 CONNECTICUT AVE NW__City WASHINGTON________ Section 4947(a)(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1041-Check here . . . . . . . . . . . " 0 and enter the amount of tax-exempt interest received or accrued during the tax year . . t 1 92 IN/A Form 990 (2004) Form 990 (200A Note : Enter gross amounts unless otherwise indicated. 93 94 95 96 97 98 99 100 101 102 103 104 a b c d Program service revenue' Unrelated business income (A) Business code (B) Amount COMMUNICATIONS INTERNATIONAL PROGRAMS DOMESTIC PROGRAMS PUBLICATIONS SALES e f Medicare/Medicaid payments g Fees and contracts from government agencies . Membership dues and assessments Interest on savings and temporary cash investments . Dividends and interest from securities Net rental income or (loss) from real estate: debt-financed property b not debt-financed property Net rental income or (loss) from personal property . . Other investment income b c d e Gain or (loss) from sales of assets other than inventory Net income or (loss) from special events Gross profit or (loss) from sales of inventory Other revenue : a Subtotal (add columns (B), (D), and (E)) 105 Total (add line 104, columns (B), (D), and (E)) Note : Line 105 plus line 1d. Part 1. should equal the GEM Line No. 94 1 Analysis of Income-Producing Activities See page 33 of the instructions . . . . . . . . . . . t on line 12 . Part l. Excluded b section 512, 513, or 514 ~p) (C) Exclusion code Amount 14 14 14 14 737,718 3,820,160 1 ,574,431 70 .886 14 14 8 99,476 14 300 .813 (E) Related or exempt function ncome 123,902 6,603,492 OF' a -`'1 . . . . . . . . . . . . " 123,902 6,727,394 Relationshi p of Activities to the Accom p lishment of Exem pt Pur p oses See p a g e 34 of the instructions . Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization's exempt purposes (other than by providing funds for such purposes) MEMBERS ARE INTERESTED IN THE SOCIAL ECONOMIC AND ENVIRONMENTAL IMPACTS OF POPULATION ISSUES . AND SUPPORT THE EXEMPT PURPOSES OF THE ORGANIZATION . Information Reg ardin g Taxable Subsidiaries and Disre g arded Entities See Name, address, and EIN of corporation, p artnershi p, or disreg arded entity PRB ASSOCIATES 1875 CONNECTICUT AVE N .W . # 520 WASHINGTON, D .C . 2009 EIN 52-1278952 a e 34 of the instructions . Percentage of Nature of activities Total income ownershi p interest 100 .00% RESEARCH 2 0 % % ~ OI % 0 End-of-year assets 1 , 919 0 0 0 Information Regarding Transfers Associated with Personal Benefit Contracts (See page 34 of the (a) Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? (b) Did the organization, during the year, pay premiums, directly or Note : If " Yes" to b ale Form 8870 and Form 4720 see instructs Under penalties of penury, I declare th I have examined this return, inclu and belief, i tn)6, corr t, and co to Decl ion of preparer (other t Please ' ~~'//~~ / Sign ~t Signature of officer Here ' WILLIAM P . BUTZ, RESIDENT AND CEO Type or pant name and title Paid Preparer's Use Oily Preparer's ' signature Firm's name (or yours' XXXXXXXXXXXXX if self-employed), address . and ZIP + 4 SCHEDULE A Organization Exempt Under Section 501(c)(3) (FORTI 990 Of 990-EZ) OMB No 1545-0047 (Except Private Foundation) and Section 501(e), 5010, 501(k), 501(n), or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury " internal Revenue Service Name of the organization Supplementary Information-(See separate instructions.) MUST be completed by the above organizations and attached to their Form 990 or 990-EZ 2004 Employer ids Po p ulation Reference Bureau Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees See page 1 of the instructions List each one . If there are none enter "None ." (b) Title and average hours I per week devoted to position (a) Name and address of each employee paid more than $50,000 I (c) Compensation Name JOHN HAAGA Str 1875 -CONNECTICUT AVE N W --- -------------------------------------- CitY WASHINGTON ST DC Title (d) Contributions to I employee benefit plans 8 deferred compensation (e) Expense account and other allowances DIR, DOMESTIC Name NANCY YINGER Str 1875 CONNECTICUT AVE N .W . -----Y--------------------------------------Cit WASHINGTON ST DC Title DIR, INTL Zio 20009 Country Ava hr/wk 50 Name ELLEN CARNEVALE AVE N --- Str 1875 -CONNECTICUT ------------------------------ CitY WASHINGTON ST.W--------DC Title DIR, COMMS Name RHONDA SMITH AVE- N--- Str 1875 -CONNECTICUT -----------------------------City WASHINGTON ST.W--------DC Title DEP DIR, INTL 1 Name CHARLES PAQUETTE Str 1875 CONNECTICUT AVE N .W . --- -------------------------------------- CitY WASHINGTON ST DC Title DIR DEV Zi p 20009 Count Av hr/wk 50 Total number of other employees paid over $50, 000 . " 13 . Compensation of the Five Highest Paid Independent 83 , 613 1 6 .104 Y Contractors for Professional Services See page 2 of the instructions . List each one whether individuals or firms ) . If there are none enter "None ." (a) Name and address of each independent contractor paid more than $50,000 (b) Type of service Name NONE Str Check here if a businessL Name Sty City Check here if a businessL Name Str City ST Name Str City ST Name Str City Check here if a businessL (c) Compensation City ZIP Count ZIP Count Total number of others receiving over $50,000 for professional services . " Check here if a business Check here if a business I For Paperwork Reduction Act Notice, see the Instructions for Form 990 and Form 990-EZ . (HTA) 01 Schedule A (Form 990 or 990-EZ) 2004 Schedule A (Form 990 or 990-EZ) 2004 Page 2 Statements About Activities (See page 2 of the instructions .) 1 During the year, has the organization attempted to influence national, state, or local legislation, including any attempt to influence public opinion on a legislative matter or referendum? If "Yes," enter the total expenses paid or incurred in connection with the lobbying activities " $ 0 (Must equal amounts on line 38, Part VI-A, or line i of Part VI-B ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VI-A . Other organizations checking "Yes" must complete Part VI-B AHD attach a statement giving a detailed description of the lobbying activities . During the year, has the organization, either directly or indirectly, engaged in any of the following acts with any substantial contributors, trustees, directors, officers, creators, key employees, or members of their families, or with any taxable organization with which any such person is affiliated as an officer, director, trustee, majority owner, or principal beneficiary? (If the answer to any question is "Yes," attach a detailed statement explaining the transactions .) 2 . . . , 1 X X X X Safe, exchange, or leasing of property? . . . . . . . . . . . . . . . . . . . . . Lending of money or other extension of credit? . . . . . . . . . . . . . . . . . . . . . . . . . . Furnishing of goods, services, or facilities? . . . . . . . . . . . . . . . . . . . . . . . . . . . . Payment of compensation (or payment or reimbursement of expenses if more than $1,000)7 . . EXPENSE REIMB 2a 2b 2c 2d e Transfer of any part of its income or assets? 2e 3a b 4a b ' . a b c d . . . . . . . . . . . . . . No Yes . . . . . . . . . . . . . . . . . Do you make grants for scholarships, fellowships, student loans, etc .? (If "Yes," attach an explanation of how you determine that recipients qualify to receive payments .) . . . . . . . . . . . . . . . . . . . . . . . . . Do you have a section 403(b) annuity plan for your employees? . . . . . . . . . . . . . . . . . . . . . . Did you maintain any separate account for participating donors where donors have the right to provide advice on the use or distribution of funds? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Do you provide credit counseling, debt management, credit repair, or debt negotiation services . 3a 3b 4a r4b ~ X X X X ~ X X Reason for Non-Private Foundation Status (See pages 3 through 6 of the instructions .) The organization is not a private foundation because it is : (Please check only ONE applicable box ) 5 F-1 A church, convention of churches, or association of churches . Section 170(b)(1)(A)(i) . 6 F-1 A school . Section 170(b)(1)(A)(ii) . (Also complete Part V.) 7 F~ A hospital or a cooperative hospital service organization . Section 170(b)(1)(A)(iii) . 8 F I A Federal, state, or local government or governmental unit . Section 170(b)(1)(A)(v) . 9 El A medical research organization operated in conjunction with a hospital . Section 170(b)(1)(A)(ui) . Enter the hospital's name, city, and state 10 - ------------------------------- City----------------------- ST--------Country -------------------An for the benefit of a college or university owned or operated by a governmental unit . Section organization operated El 170(b)(1)(A)(iv) . (Also complete the Support Schedule in Part IV-A ) 10 11 a FK An organization that normally receives a substantial part of its support from a governmental unit or from the general public. Section 170(b)(1)(A)(vi) . (Also complete the Support Schedule in Part IV-A .) 11 b ~ A community trust. Section 170(b)(1)(A)(w) . (Also complete the Support Schedule in Part IV-A ) 12 ~ An organization that normally receives : (1) more than 33 113% of its support from contributions, membership fees, and gross receipts from activities related to its charitable, etc , functions-subject to certain exceptions, and (2) no more than 33 1/3% of its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975 . See section 509(a)(2) (Also complete the Support Schedule in Part IV-A ) 13 El An organization that is not controlled by any disqualified persons (other than foundation managers) and supports organizations described in' (1) lines 5 through 12 above ; or (2) section 501(c)(4), (5), or (6), if they meet the test of section 509(a)(2) (See section 509(a)(3) ) Provide the following information about the supported organizations . (See page 5 of the instructions .) (b) Line number (a) Name(s) of supported organization(s) from above 14 a An organ iza ti on org anized a nd op erated to test fo r public safety Section 509(a)(4) (See page 5 of the instructions ) Schedule A (Form 990 or 990-EZ) 2004 Schedule A (Form 990 or 990-ez) 2004 PPopulation Reference Bureau 53-0214030 MUM Support Schedule (Complete only if you checked a box online 10, 11, or 12 .) Use cash method of accounting. Note : You ma use the worksheet in the instructions for converting from the accrual to the cash method of accounting. Calendar year (or fiscal year beginning in) 15 Gifts, grants, and contributions received (Do 16 17 Membership fees received Gross receipts from admissions, merchandise sold or services performed, or furnishing of facilities in any activity that is related to the 18 Gross income from interest, dividends, amounts received from payments on securities loans (section 512(a)(5)), rents, royalties, and unrelated business taxable income (less section 511 taxes) from businesses acquired by the organization after June 30, 1975 Net income from unrelated business activities not included in line 18 Tax revenues levied for the organization's benefit and either paid to it or expended on 19 20 21 The value of services or facilities furnished to the organization by a governmental unit without charge . Do not include the value of services or facilities generally furnished to the 22 Other income . Attach a schedule . Do not include g ain or loss from sale of ca p ital assets Total of lines 15 throu gh 22 . Line 23 minus line 17 . Enter 1% of line 23 . 23 24 25 26 27 Organizations described on lines 10 or 11 : 1 ~ (a) 2003 ~ (b) 2002 ~ 165,160 1 134.972 1531 1 . a ~ (c) 2001 (d) 2000 90 ,861 1 152.277 595,424 558 .312 316.2851 355,173 7 -223 .4881 -240 .4171 0 7 , 469 , 092 803 . 516 74 , 691 0 6 , 679 , 797 76 , 644 66 , 798 0 7 , 450 , 633 69 , 326 74 , 506 . (e) Total 166,4331 143.310 502 .7931 Enter 2% of amount in column (e), line 24 ~ Page 3 . . . . 0 6 , 748 , 197 559 , 423 67 , 482 -. . ~ b Prepare a list for your records to show the name of and amount contributed by each person (other than a governmental unit or publicly supported organization) whose total gifts for 2000 through 2003 exceeded the amount shown in line 26a . Do not file this list with your return . Enter the total of all these excess amounts . . . " for c Total support section 509(a)(1) test Enter line 24, column (e) . . . . . . . . . . . . . . . . . . . INd Add . Amounts from column (e) for lines 18 355,173 19 0 26b 230,214 . . . . . 22 0 10e Public support (line 26c minus line 26d total) . . . . . . . . . . . . . . . . . . . . . . . . . . ~ ~ f Public support percentage (line 26e (numerator) divided by line 26c (denominator)) . 0 28 , 347 , 719 1 , 508 , 909 ` " ' 26a 30,178 26b 26c 230 , 214 1 , 508 , 909 585 , 387 923 , 522 61 .20% 26d 26e 26f Organizations described on line 12 : a For amounts included m lines 15, 16, and 17 that were received from a "disqualified person," prepare a list for your records to show the name of, and total amounts received in each year from, each "disqualified person " Do not file this list with your return . Enter the sum of such amounts for each year: (2003) (2002) . . . . . . . . . . . . . . . . . . . . . . (2001) (2000) . . . . . . . . . . . .. . . . . . . . . ----------------------------------------b For any amount included in line 17 that was received from each person (other than "disqualified persons"), prepare a list for your records to show the name of, and amount received for each year, that was more than the larger of (1) the amount on line 25 for the year or (2) $5,000 . (Include in the list organizations described in lines 5 through 11, as well as individuals .) Do not file this list with your return . After computing the difference between the amount received and the larger amount described in (1) or (2), enter the sum of these differences (the excess amounts) for each year. (2003) 28 .................. ... (2002) . . .. . . . . . . . . . . . . . . . . . . (2001) --------------------- (2000) c Add : Amounts from column (e) for lines : 15 0 16 0 0 . . . . . . . . 17 0 20 0 21 d Add : Line 27a total . . . 0 and line 27b total . . 0 . . . . . . . . . . . . . . . . . . . . . . e Public support (line 27c total minus line 27d total) . f Total support for section 509(a)(2) test : Enter amount from line 23, column (e) . . . . . . . " 27f . g Public support percentage (line 27e (numerator) divided by line 27f (denominator)) . . . . . . . . . . . h Investment income p ercenta g e line 18 column e numerator divided b line 27f denominator --------------------- 101011111- 27c 27d 27e 0 0 0 ~ ~ 27 27h 0 .00% 0 .00% Unusual Grants : For an organization described in line 10, 11, or 12 that received any unusual grants during 2000 through 2003, prepare a list for your records to show, for each year, the name of the contributor, the date and amount of the grant, and a brief description of the nature of the grant . Do not file th i s list with you r retur n . Do not include these grants in line 15 . Schedule A (Form 990 or 990-EZ) 2004 Schedule A (Form sso or 990-ez) 2004 PPopulation Reference Bureau Private School Questionnaire (See page 7 of the instructions .) Page 4 53-0214030 To be com pleted ONLY b schools that checked the box on line 6 in Part IV 29 Does the organization have a racially nondiscriminatory policy toward students by statement in its charter, bylaws, other governing instrument, or in a resolution of its governing body? . . . . . . . . . . . . . . . . . . . 30 Does the organization include a statement of its racially nondiscriminatory policy toward students in all its brochures, catalogues, and other written communications with the public dealing with student admissions, programs, and scholarships? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 . . . . . . . Has the organization publicized its racially nondiscriminatory policy through newspaper or broadcast media during the period of solicitation for students, or during the registration period if it has no solicitation program, in a way that makes the policy known to all parts of the general community it serves? . . . . . . . . . . . . . . Yes . 19 ~ . . No p 30 . 31 If "Yes," please describe ; if "No," please explain (If you need more space, attach a separate statement.) 1 -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- -----------------------------------32 a Does the organization maintain the following : Records indicating the racial composition of the student body, faculty, and administrative staff? . b Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory basis . . . . . . . . . . . . . . . . . . . . c Copies of all catalogues, brochures, announcements, and other written communications to the public dealing with student admissions, programs, and scholarships? . . . . . . . . . . . . . d Copies of all material used by the organization or on its behalf to solicit contributions? If you answered "No" to any of the above, please explain . (If you need more space, attach a separate statement .) ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Does the organization discriminate by race in any way with respect to : 33 a Students' rights or privileges? b Admissions policies? c Employment of faculty or administrative staff? . . . . . . . . . . . . . d Scholarships or other financial assistance? . . . . . . . . . . . . . e Educational policies? . f Use of facilities? . . g Athletic programs? . h Other extracurricular activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33e . 33f If you answered "Yes" to any of the above, please explain . (If you need more space, attach a separate statement.) ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------34 a b 35 Does the organization receive any financial aid or assistance from a governmental agency? Has the organization's right to such aid ever been revoked or suspended? . . . . If you answered "Yes" to either 34a or b, please explain using an attached statement . . . . . . . . . Does the organization certify that it has complied with the applicable requirements of sections 4 01 through 4 .05 of Rev. Proc 75-50, 1975-2 C.B 587, coverin g racial nondiscrimination !f "No , " attach an exp lanation . . . . . . . 34b 35 Schedule A (Form 990 or 990-EZ) 2004 Schedule A (Form sso or 990-ez) 2004 Page 5 PPopulation Reference Bureau 53-0214030 Lobbying Expenditures by Electing Public Charities (See page 9 of the instructions .) (To be completed ONLY by an eligible organization that filed Form 5768) Check t a 1:1 if the organization belongs to an affiliated group. Check " b ~ if you checked "a" and "limited control" provisions apply. Limits on Lobby in g Ex p enditures 42 43 for ALL electing ____, totals ( The term -Fe d .tores means amount s vu . d or incurre d .) 36 37 38 39 40 41 To be completed Affiliated group Total lobbying expenditures to influence public opinion (grassroots lobbying) . . . . . . . . Total lobbying expenditures to influence a legislative body (direct lobbying) . . . . . . . . . Total lobbying expenditures (add lines 36 and 37) . . . . . . . . . . . . . Other exempt purpose expenditures . . . . . . . . . . . . . . . . Total exempt purpose expenditures (add lines 38 and 39) . . . . . . . . . . . . . . . . Lobbying nontaxable amount Enter the amount from the following tableIf the amount on line 40 isThe lobbying nontaxable amount isNot over $500,000 . . . . . . .20% of the amount on line 40 Over $500,000 but not over $1,000,000 . . $100,000 plus 15% of the excess over $500,000 Over $1,000,000 but not over $1,500,000 $175,000 plus 10% of the excess over $1,000,000 Over $1,500,000 but not over $17,000,000 $225,000 plus 5% of the excess over $1,500,000 Over $17,000,000 . . . . . . . . . $1,000,000 . Grassroots nontaxable amount (enter 25% of line 41) . . . . . . . . . . . . . Subtract line 42 from line 36 . Enter -0- if line 42 is more than line 36 . . . . . . . . Subtract line 41 from line 38 Enter -0- if line 41 is more than line 38 . . 36 37 38 39 40 0 0 41 0 ~0 42 43 44 Caution : If there is an amount on either line 43 or line 44, you must file Form 4720 . 4-Year Averaging Period Under Section 501 (h) (Some organizations that made a section 501(h) election do not have to complete all of the five columns below . See the instructions for lines 45 throug h 50 on p a g e 11 of the instructions Lobbying Expenditures During 4-Year Averaging Perioc Calendar year (or fiscal year beginning in) (a) 2004 1 I (b) 2003 I (c) 2002 I (d) (e) 2001 -7Total 0 45 Lobbying nontaxable amount 46 Lobbying ceding amount (150% of line 45(e)) 47 Total lobbying expenditures 48 Grassroots nontaxable amount 49 Grassroots ceiling amount (150% of line 48(e)) 50 Grassroots lobbying expenditures Lobbying Activity by Nonelecting Public Charities (For reporting only by organizations that did not complete Part VI-A) (See page 11 . ° . . . :. During the year, did the organization attempt to influence national, state or local legislation, including any attempt to influence public opinion on a legislative matter or referendum, through the use of a Volunteers . . . . . . . . . . . . . . . . . . . . b Paid staff or management (Include compensation in expenses reported on lines c through h .) c Media advertisements . . . . . . . . . . . . . . . d Mailings to members, legislators, or the public . . . . . . . . . . . . e Publications, or published or broadcast statements . . . . f Grants to other organizations for lobbying purposes . . . . . . . . g Direct contact with legislators, their staffs, government officials, or a legislative body h Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means Total lobbying expenditures (Add lines c through h .) . . . . . . . . . . . . . . . . . . . I attach a statement giving a detailed description of the lobbying activities If "Yes" to any of the above, also Yes No Amount 0 Schedule A (Form 990 or 990-EZ) 2004 Schedule A (Form 990 or 990-ez) 2004 tom/ 51 PPopulation Reference Bureau 53-0214030 Information Regarding Transfers To and Transactions and Relationships With Noncharitable Page 6 Exempt Organizations (See page 11 of the instructions .) Did the reporting organization directly or indirectly engage in any of the following with any other organization described in section 501(c) of the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations? a Transfers from the reporting organization to a noncharitable exempt organization of : (i) Cash b . . (i1) Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes . . . . . . . . . . . . . . . . . . . . . . . . . 51a ( l) X a ii X b( l ) X b( II ) X . Other transactions : (i) Sales or exchanges of assets with a nonchantable exempt organization (ii) Purchases of assets from a noncharitable exempt organization (iii) Rental of facilities, equipment, or other assets . . (iv) Reimbursement arrangements . . . . . (v) Loans or loan guarantees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (vi) Performance of services or membership or fundraising solicitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b (b) (c) . . . . . . b ( III ) X . . b Iv X . . b( v) X b vi X . . . I (b) Type of organization . . . . . . I c I I X (d) Name of noncharitable exempt organization Description of transfers, transactions, and sharing arrangements Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in section 501(c) of the Code (other than section 501(c)(3)) or in section 527 . . . . . If "Yes ." complete the following schedule (a) Name of organization . . If the answer to any of the above is "Yes," complete the following schedule Column (b) should always show the fair market value of the goods, other assets, or services given by the reporting organization . If the organization received less than fair market value in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or services received : Amount involved . . . . . . . Sharing of facilities, equipment, mailing lists, other assets, or paid employees (a) . . d Line no . . . . . . . c 52 a No I . . . . . ~ D Yes X No (c) Description of Schedule A (Form 990 or 990-EZ) 2004 POPULATION REFERENCE BUREAU, INC FYE 9/30/04 FORM 990 53-0214030 GAIN (LOSS) FROM PUBLICLY TRADED SECURITIES SALES PRICE DESCRIPTION STATEMENT 2 NET GAIN OR (LOSS) COST OR EXPENSE OTHER BASIS SEE ATTACHED SCHEDULE 1 522,000 522,000 0 0 TO FORM 990, PART 1, LINE 8d 522,000 522,000 0 0 FORM 990 STATEMENT OF ORGANIZATION'S PRIMARY EXEMPT PURPOSE STATEMENT 3 EXPLANATION TO GATHER, ANALYZE AND DISSEMINATE POPULATION DATA AND INFORMATION FOR SCIENTIFIC AND EDUCATIONAL PURPOSES . POPULATION REFERENCE BUREAU, INC FYE 9/30/04 FORM 990 53-0214030 STATEMENT 4 OTHER NOTES AND LOANS REPORTED SEPARATELY NONE FORM 990 NON-GOVERNMENT SECURITIES STATEMENT 5 DESCRIPTION VALUE TOTAL NOW GOVT SECS MUTUAL FUNDS/CD'S MKT CORP STOCKS CORP BONDS 0 OTHER PUB OTHER TRADED SECS 0 5,201,431 TOTAL TO FORM 990, LN 54, COL B FORM 990 DESCRIPTION U .S. BONDS MKT TOTAL TO FORM 990, LN 54, COL B 5,201,431 5,201,431 GOVERNMENT SECURITIES VALUE 0 U .S. GOVT STATEMENT 6 STATE GOVT 0 TOTAL GOVT 0 0 0 POPULATION REFERENCE BUREAU, INC FYE 9/30/04 FORM 990 53-0214030 OTHER ASSETS STATEMENT 7 DESCRIPTION AMOUNT DUE FROM PRB ASSOCIATES 883,215 TOTAL TO FORM 990, LINE 58, COLUMN B 883,215 FORM 990 OTHER LIABILITIES STATEMENT 8 DESCRIPTION AMOUNT DEFERRED DUES ACCRUED ANNUAL LEAVE DEFERRED RENT 61,899 123,967 217,407 TOTAL TO FORM 990, PART IV, LINE 65, COL B 403,273 SCHEDULE A OTHER INCOME DESCRIPTION STATEMENT 9 2003 2002 2001 2000 0 0 0 0 ROYALTY ANNUAL DINNER FILM RENTAL JURY DUN PAYMENTS POSTAGE REIMBURSEMENT REFUNDS INSURANCE RECOVERY OTHER TOTAL TO SCHEDULE A, LINE 22 POPULATION REFERENCE BUREAU SCHEDULE OF INVESTMENTS - MARKETABLE SECURITIES 10/1/03 - 9/30/04 BALANCE MKT VAL BOUGHT SECURITIES 9/30/03 9/30/03 FY 04 SCHEDULE1 52-0214030 COST SOLD FY 04 GAIN (LOSS) BALANCE MKT VAL 9/30/04 9/30/04 LONG TERM FUND : S&P500SPDR's Wash Mutual Amcap Fund LM SIT Euro Pacific Heritage Series Royce Fund Bond Fund of Amer Total - Long Term 1,016,703 472,997 875,499 389,182 0 302,691 392,440 0 181,003 253,376 0 431,284 365,117 0 217,713 251,010 105,414 0 105,414 0 2,619,211 2,529,805 35,006 35,006 35,006 35,006 35,006 35,006 20,867 105,000 105,000 501,133 417,000 417,000 522,000 522,000 522,000 0 1,067,144 1,028,028 0 484,099 453,246 0 0 0 0 285,832 451,616 0 396,674 438,905 0 1 0 0 182,862 256,463 0 265,513 265,271 0 2,682,124 2,893,529 INTERMEDIATE TERM FUND : Cash - LM Money Market CD's Fundamental Inv Int Bond Fund of Am Total - Intermediate 800,000 0 0 905,414 800,000 0 0 905,414 SHORT TERM INVESTMENTS : INVESTMENT TOTAL 0 0 0 0 0 0 33,464 0 882,968 0 0 916,432 33,465 0 882,968 0 0 916,433 1,391,469 1,391,469 3,524,625 3,435,219 557,006 557,006 557,006 0 4,990,025 5,201,431 POPULATION REFERENCE BUREAU, INC FYE 9/30/04 53-0214Q30 FORM 990, PART IV, LINE 57B DESCRIPTION SCHEDULE2 COST ACQ METHOD YRS FURN & EQUIP LEASEHOLD 266,437 VARIOUS S/L 244,769 VARIOUS S/L TOTALS 511,206 5-10 5-10 DEPREC NET 224,510 138,262 41,927 106,507 362,772 148,434 POPULATION REFERENCE BUREAU, INC. 1875 CONNECTICUT AVE., N.W ., SUITE 520 WASHINGTON, D.C . 20009 EIN 53-0214030 ; FYE 9/30/04 FORM 990, PAGE 2, PART III : PROGRAM SERVICE ACCOMPLISHMENTS : a) COMMUNICATIONS . Four Population Bulletins were published, covering these topics : Transitions in World Population ; China's Population ; Disability in America; and America's Military Population . More than 150,000 copies of PRB publications were distributed to audiences worldwide, and to our members and others interested in population issues . The 2004 World Population Data Sheet, the most popular PRB publication, was released at a press conference in August 2004, and hundreds of stones were published in newspapers and broadcast media. PRB's website, www.prb .org, served 1 .5 million web visitors during 2004, the most visitors thus far. PRB's library continued to handle information and reference requests from journalists, other libraries, and both public-sector and private-sector organizations, including NGOs, government agencies, and media. PRB also helped dozens of journalists and reporters find data and analysis on a wide range of population topics, including immigration to the United States, child health, HIV/AIDS, and marriage and family patterns . PRB and the Russell Sage Foundation co-published 14 reports in the new series "The American People : Census 2000 ." These reports represented straightforward and comprehensive analyses and interpretations of the vast amount of data gathered from the 2000 Census . b) INTERNATIONAL. PRB's International Programs works around the world to help ensure improved reproductive health . In 2004, with funding from USAID and other organizations, PRB staff participated in several new forums in Kenya to enhance population and health planning ; helped organize a symposium on eradicating female genital cutting; continued to facilitate the Women's Edition network for senior-level women journalists ; wrote and disseminated three policy briefs to enhance understanding of reproductive health in the Middle East and North Africa ; and, through a partnership with USAID's Interagency Working Group, published a report looking at whether integrating a gender focus into programs makes a difference to outcomes . With funding from the Bill & Melinda Gates Foundation, PRB developed materials to tackle health disparities in developing countries; and expanded the electronic library represented by InfoShare, a database of documents supplied by 114 member organizations (expanded from 60 in 2003) working in reproductive health and child health, HIV/AIDS, and population . In the Philippines, PRB's Population, Health, and Environment team hosted the world's First National Conference on Population, Health, and Environment, attracting more than 200 national and local decisionmakers, NGOs, private-sector representatives, academics, and journalists . PHE activities were also conducted in Madagascar . c) DOMESTIC . PRB continued and expanded its work on the KIDS COUNT project, funded by the Annie E. Casey Foundation, designed to call attention to U.S children's issues . We provided technical assistance to their network of child advocacy organizations, and published a series of working papers that describe social and demographic trends in the United States, using data from Census 2000 . In addition, PRB continued its work on programs to study demographic trends in the Appalachian region, and publicized research from the journal De»zography through the Center for Public Information on Population Research, funded by the National Institute of Child Health and Human Development (NICHD). PRB also continued its popular monthly policy seminars, which give audiences a chance to hear experts analyze important demographic topics . Seminars during the 2004 season highlighted the reengineered 2010 U.S . Census, the color line in American society, and HIV/AIDS in India. Domestic Programs also helped coordinate a press briefing for journalists, held in New York and funded by the National Institute on Aging, on "How Can We Prepare to Meet the Challenges of an Aging Society?" This seminar showcased the research of a NIAsupported group of leading social, behavioral, and economic scientists . SCHEDULE 3 Po pucsF72-~AJ S3-a1rYo3v P 9~3v~o y PRB BOARD OF TRUSTEES April 2004 sclfE~ucE ~7` *Patty Perkins Andringa 9122 Kittery Lane Bethesda, MD 20817 Tel: (301) 365-5672 Fax: (301) 365-0815 E-mail : ppandrin-ga(a),aol .com *Michael P. Bentzen, Secretary Hughes & Bentzen, PLLC 1667 K Street, NW, Suite 520 Washington, DC 20006 Tel : (202) 293-8975 C: (703) 217-5291 Fax: (202) 293-8973 E-mail: mbentzen@,aol .com Home : 8180 Madrillon Court Vienna, VA 22182 Tel: (703) 893-1607 Suzanne M. Bianchi Professor of Sociology and Director Maryland Population Research Center University of Maryland 2112 Art-Sociology Building College Park, MD 20742-1315 Tel: (301) 405-6409 *William P. Butz, President Population Reference Bureau 1875 Connecticut Avenue, NW, Ste. 520 Washington, DC 20009 Tel: (202) 939-5409 Fax: (202) 328-3937 Email : bbutz(a,prb .org Home Tel: (301) 946-5934 Joel Cohen Professor Laboratory of Populations Rockefeller University & Columbia University 1230 York Avenue, Box 20 New York, NY 10021-6399 *Bert T. Edwards Executive Director Office of Historical Accounting Department of Interior 1801 Pennsylvania Avenue, NW Suite 400 Washington, DC 20240 *Richard F. Hokenson Hokenson & Company 51 Gervin Road Lawrenceville, NJ 08648 *Member of Executive Committee Tel: (301) 405-6370 (MPRC) Fax: (301) 405-5743 E-mail: sbianchi(a)Lsocy .umd .edu Home Tel: (202) 364-2446 Tel: (212) 327-8883 Fax : (212) 327-7974 Email: cohen@rockefeller .edu Tel: (202) 327-5300 Fax: (301) 838-3125 (H) E-mail : Bert Edwards(a,ios .doi.gov Home : 309 Casey Lane Rockville, MD 20850-4733 Home Tel: 301-838-3105 E-mail : berttedwards(&,aol .com E-mail : rhokenson c(r~,hokenson.biz Home : 51 Gervin Road Lawrenceville, NJ 08648 Tel: (609) 888-5101 Cell: (609) 731-3217 Fax: (609) 716-1425 gcerw" Executive Assistant's Listing Tilburgseweg 6/22 B-2382 Poppel Belgium Tel: 32 14 67 38 58 James H. Johnson Jr . Distinguished Professor Kenan-Flagler Business School University of North Carolina at Chapel Hill CB#3440, Kenan Center Chapel Hill, NC 27599-3440 Tel: (919) 962-8201 Fax: (919 962-8202 E-mail: Jim Johnson a,unc .edu Wolfgang Lutz Professor and Leader World Population Project International Institute for Applied Systems Analysis (IIASA) Room S26 A-2361 Laxenburg, Austria Tel: 43-2236-807-294 Fax: 43-2236-71313 Email: lutz ,iiasa .ac.at Elizabeth Maguire President and CEO Ipas 143 Graylyn Drive Chapel Hill, NC 27516 Tel: (919) 967-7052 Fax: (919) 929-0258 Email: maguirel Aipas.org Home : 919-960-4503 Faith Mitchell Deputy Director for Special Projects Behavioral and Social Sciences and Education National Academy of Sciences/National Research Council 500 Fifth Street, NW Washington, DC 20001 Tel: (202) 334-3352 Fax: (202) 334-3768 Email: FMitchellAnas .edu Terry D. Peigh, Vice Chair Executive Vice President and Director of Corporate Operations Foote, Cone and Belding 101 East Erie Street Chicago, IL 60611-2897 Tel: (312) 425-5204 Fax: (312) 425-6871 E-mail: tpeigh(a~fcb .com Secretary: Chris E-mail: cmaslowicz a,fcb.com Tel: (312) 425-6506 Cell : (312) 543-7547 NY Office The Interpublic Group of Companies 1271 Avenue of the Americas New York, NY 10020 *Member of Executive Committee Executive Assistant's Listing Tel: (212) 399-8084 Email: tpeigh(&,interpublic .com Secretary: Jane Tel: (212) 399-8014 E-mail: )dicicco(&interpublic .com *Douglas Richardson, Chair Executive Director Association of American Geographers 1710 Sixteenth Street, NW Washington, DC 20009 Tel: (202) 234-1450 Fax: (202) 234-2744 E-mail: drichard@aag .org Home: 1015 Ross Thumb Road Cambridge, MD 21613 Tel: 410-228-4129 Gary B. Schermerhorn Managing Director of Technology Goldman, Sachs and Company 180 Maiden Lane, 13`h Floor New York, NY 10038 Tel: (212) 902-3662 Fax: (212) 428-9672 E-mail: gary..schermerhorn(abgs com Home: 296 Summit Avenue Summit, NJ 07901 Secretary: Selina Tel: (212) 357-7019 E-mail : Selina .Jarrett(aDgs com *Barbara Boyle Torrey Visiting Scholar Population Reference Bureau 1875 Connecticut Avenue, NW, Ste. 520 Washington, DC 20009 Tel: (202) 939-5455 Fax: (202) 328-3937 E-mail: btorrey a(D,prb.org Home : 6204 Ridge Drive Bethesda, MD 20816 Home Tel : 301-320-5812 Leela Visaria Professor Gujarat Institute of Development Research Gota, Ahmedabad 380 060 Gujarat, India Tel: 91 2717 242366 Fax: 91 2717 242365 E-mail: visaria(a,aidr .ac.in *Montague Yudelman, Secretary Senior Fellow World Wildlife Fund Washington, DC Tel: (202) 965-4642 Fax: (202) 965-4642 E-mail: zintalmy(&,aol.com Home: 3108 Garfield Street, NW Washington, DC 20008 Summer: Cottage Grove 235 Old Stage Road Roscommon, MI 48653 Tel: (989) 821-9206 *Member of Executive Committee Form 8868 (Rev December 2004) Department of the Treasury Internal Revenue Service Application for Extension of Time To File an Exempt Organization Return OMB No 1545-1709 " File a separate application for each return " If you are fling for an Automatic 3-Month Extension, complete only Part I and check this box . " If you are filing for an Additional (not automatic) 3-Month Extension, complete only Pan II (on page 2 of this form) . Do not complete Part 11 unless you have already been ranted an automatic 3-month extension on a previousl y fled Form 8868 . Automatic 3-Month Extension of Time-Only submit original (no copies needed) Form 990-T corporations requesting an automatic 6-month extension-check this box and complete Part I only . . _ " 0 All ocher corporations Including Form 990-C filers) must use Form 7004 to request an extension of time to file income tax returns . Partnerships, REMICs, and trusts must use Form 8736 to request an extension of time to file Form 1065, 1066, or 1041 . Electronic Filing (e-file) . Form 8868 can be filed electronically if you want a 3-month automatic extension of time to file one of the returns noted below (6 months for corporate Form 990-T filers) However, you cannot file it electronically if you want the additional (not automatic) 3-month extension, instead you must submit the fully completed signed page 2 (Part II) of Form 8868 . For more details on the electronic filing of this form, visit www .irs .gov/efile . Type or print File by the due date for filing your return See instructions Name of Exempt Organization Employer identification number City, town or post office, state, and ZIP code. For a foreign address, see instructions Gj1Arm.vC 7vA/ D_(- )-&Wp Check type of return to be filed (file a separate application for each return): Form Form Form Form 0~/ 5'ofo s3 Number, street, and room or suite no . If a P.O . box, see instructions. 990 990-BL 990-EZ 990-PF D 0 D El Form Form Form Form 990-T (corporation) 990-T (sec . 401(a) or 408(a) trust) 990-T (trust other than above) 1041-A D El 0 0 Form Form Form Form 4720 5227 6069 8870 ..6~%r7~U~ T/~_ _00 0 The books are in the care of ~----------- ---------------------~------------------------------------------I ------Telephone No . " 10 -' FAX No . " ~-~'~ -~-----~.~- .-(!f3 _ ~-----------------0 If the organization does not have an office or place of business in the United States, check this box " If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN) . If this is for the whole group, check this box " E] . If it is for part of the group, check this box " E] and attach a list with the names and EINs of all members the extension will cover. 1 I request an automatic 3-month (6-months for a Form 990-T corporation) extension of time until . . . . . ... (----------- , 200r to file the exempt organization return for the organization named above . The extension is for the organization's return for: El calendar year 20 . . or / / D tax year beginning 2 /Ul' . .. , 20?3., and ending If this tax year is for less than 12 months, check reason : D Initial return ------------------------ 20°y D Final return D Change in accounting period 3a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits . See instructions . . . . . . . b If this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax payments made . Include any prior year overpayment allowed as a credit . . . c Balance Due . Subtract line 3b from fine 3a . Include your payment with this form, or, if required, deposit with FTD coupon or, if required, by using EFfPS (Electronic Federal Tax Payment System) . See instructions . . . . . . . . . . . . . . . . . . . . . . . . , , , . . . $ Caution . If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO for payment instructions. For Privacy Act and Paperwork Reduction Act Notice, see Instructions . Cat No 2791sD Form 8868 (Rev 12-2004) Form 8868 (Rev 12-2004) Page 2 0 If you are fling for an Additional (not automatic) 3-Month Extension, complete only Part II and check this box , . " D Note . Only complete Part II if you have already been granted an automatic 3-month extension on a previously fled Form 8868. 9 If you are filing for an Automatic 3-Month Extension, complete only Part I (on page 1) . WITM Type Or print File by the extended due date for filing the return See instructions Additional not automatic 3-Month Extension of Time-Must File Original and One Co Name of Exempt Organization Employer identification number Number, street, and room or suite no If a P O box, see instructions. For IRS use only City, town or post once, state, and TIP code For a foreign address, see instructions Check type of return to be filed (File a separate application for each return) : Form 990 D Form 990-T (sec . 401(a) or 408(a) trust) El Form 5227 D Form 990-BL D Form 990-T (trust other than above) 0 Form 6069 Form 990-EZ D Form 1041-A D Form 8870 Form 990-PF D Form 4720 STOP : Do not complete Part II if you were not already granted an automatic 3-month extension on a previously filed Form 8868 . " The books are in the care of " --------------------------------------------------------------------------------------Telephone No . " ( ---------- ------ --------------------FAX No . " ( ---------- )- --------------------------" If the organization does not have an office or place of business in the United States, check this box . . . . . " Q " If this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN) If this is for the whole group, check this box " EJ . If it is for part of the group, check this box " [1 and attach a list with the names and EINs of all members the extension is for . 4 5 6 7 I request an additional 3-month extension of time until . . , 20 For calendar year . . . . . . . orother taxyear beginning .-------------------------------------,20 ._ . .,andending . . . . ._ . . . ._ . . . . . . ._ . . . . .,20 . . . . . If this tax year is for less than 12 months, check reason -----------------------: D initial return 0 Final return EJ Change in accounting period State m detail why you need the extension -----~---------------------~----------------- .------------------------------ .---------------- -----------------------------------------------------------------------------------------------------------------------------------------------8a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits. See instructions . . . . . . . . . b If this application is for Form 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax payments made . Include any prior year overpayment allowed as a credit and any amount paid previously with Form 8868 . . . . . . . . . . . . . . . c Balance Due . Subtract line 8b from line 8a . Include your payment with this form, or, if required, deposit with FTD coupon or, if required, by using EFTPS (Electronic Federal Tax Payment System) . See instructions $ Signature and Verification Under penalties of penury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it 1 is true . corr 1. t d complete, and that aut ized to prepare this form %. S gnature ~ Title 10, )oxiy-l 0,91~ , 'I -- ii rVotice to Applicant-To Be Completed by the IRS Date We have approved this application. Please attach this form to the organization's return We have not approved this application. However, we have granted a 10-day grace period from the later of the date shown below or the due date of the organization's return (including any prior extensions). This grace period is considered to be a valid extension of time for elections otherwise required to be made on a timely return . Please attach this form to the organization's return We have not approved this application. After considering the reasons stated in item 7, we cannot grant your request for an extension of time to file. We are not granting a 10-day grace period. We cannot consider this application because it was fried after the extended due date of the return for which an extension was requested . Other ----------------------------------------By Director Date Alternate Mailing Address - Enter the address if you want the copy of this application for an additional 3-month extension returned to an address different than the one entered above. Name Type or print I Number and street (include suite, room, or apt. no .) or a P .O . box number City or town, province or state, and country (including postal or ZIP code) Form 8868 (Rev 12-2004)