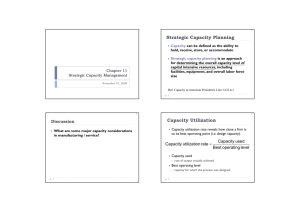

aggregate & capacity planning - Sihombing15's (Haery Sihombing)

advertisement

Aggregate Planning Determine the resource capacity needed to meet demand over an intermediate time horizon ¾ Aggregate refers to product lines or families ¾ Aggregate planning matches supply and demand Ir. Haery Sihombing/IP Sihombing/IP Pensyarah Fakulti Kejuruteraan Pembuatan Universiti Teknologi Malaysia Melaka Objectives ¾ Establish 7 AGGREGATE & CAPACITY PLANNING a company wide game plan for allocating resources ¾ Develop an economic strategy for meeting demand Aggregate Planning Process Meeting Demand Strategies Adjusting capacity Resources necessary to meet demand are acquired and maintained over the time horizon of the plan Minor variations in demand are handled with overtime or underunder-time Managing demand Proactive Strategies for Adjusting Capacity Level production Producing at a constant rate and using inventory to absorb fluctuations in demand Chase demand Hiring and firing workers to match demand Peak demand Maintaining resources for highhigh-demand levels Overtime and underunder-time Increasing or decreasing working hours Subcontracting Let outside companies complete the work PartPart-time workers Hiring part time workers to complete the work Backordering Providing the service or product at a later time period Level Production Demand Production Units demand management Time Chase Demand Strategies for Managing Demand ¾ Shifting demand into other time periods Incentives Sales promotions Advertising campaigns ¾ Offering products or services with countercounter-cyclical demand patterns Partnering with suppliers to reduce information distortion along the supply chain Demand Units Production ¾ Time Quantitative Techniques For APP Pure Strategies Mixed Strategies Linear Programming Transportation Method Other Quantitative Techniques Pure Strategies Example: QUARTER SALES FORECAST (LB) Spring Summer Fall Winter 80,000 50,000 120,000 150,000 Hiring cost = $100 per worker Firing cost = $500 per worker Regular production cost per pound = $2.00 Inventory carrying cost = $0.50 pound per quarter Production per employee = 1,000 pounds per quarter Beginning work force = 100 workers Level Production Strategy Chase Demand Strategy Level production (50,000 + 120,000 + 150,000 + 80,000) = 100,000 pounds 4 SALES FORECAST 80,000 50,000 120,000 150,000 PRODUCTION QUARTER PLAN INVENTORY Spring 100,000 20,000 Summer 100,000 70,000 Fall 100,000 50,000 Winter 100,000 0 400,000 140,000 Cost of Level Production Strategy (400,000 X $2.00) + (140,00 X $.50) = $870,000 QUARTER SALES PRODUCTION FORECAST PLAN Spring Summer Fall Winter 80,000 50,000 120,000 150,000 80,000 50,000 120,000 150,000 WORKERS WORKERS WORKERS NEEDED HIRED FIRED 80 50 120 150 0 0 70 30 20 30 0 0 100 50 Cost of Chase Demand Strategy (400,000 X $2.00) + (100 x $100) + (50 x $500) = $835,000 General Linear Programming (LP) Model Mixed Strategy Combination of Level Production and Chase Demand strategies Examples of management policies no more than x% of the workforce can be laid off in one quarter inventory levels cannot exceed x dollars Many industries may simply shut down manufacturing during the low demand season and schedule employee vacations during that time LP gives an optimal solution, but demand and costs must be linear Let Wt = workforce size for period t Pt =units produced in period t It =units in inventory at the end of period t Ft =number of workers fired for period t Ht = number of workers hired for period t Transportation Method LP MODEL Minimize Z = $100 (H1 + H2 + H3 + H4) + $500 (F1 + F2 + F3 + F4) + $0.50 (I1 + I2 + I3 + I4) Subject to P 1 - I1 I1 + P2 - I2 I2 + P3 - I3 I3 + P4 - I4 1000 W1 1000 W2 1000 W3 1000 W4 100 + H1 - F1 W1 + H2 - F2 W2 + H3 - F3 W3 + H4 - F4 Demand constraints Production constraints Work force constraints = 80,000 = 50,000 = 120,000 = 150,000 = P1 = P2 = P3 = P4 = W1 = W2 = W3 = W4 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) QUARTER EXPECTED DEMAND REGULAR CAPACITY OVERTIME CAPACITY SUBCONTRACT CAPACITY 1 2 3 4 900 1500 1600 3000 1000 1200 1300 1300 100 150 200 200 500 500 500 500 Regular production cost per unit Overtime production cost per unit Subcontracting cost per unit Inventory holding cost per unit per period Beginning inventory $20 $25 $28 $3 300 units Burruss’ Burruss’ Production Plan Transportation Tableau PERIOD OF USE PERIOD OF PRODUCTION 1 Beginning 1 2 2 0 Inventory 300 Regular 600 — — 300 26 — 29 1000 31 100 34 100 Subcontract 28 31 34 37 500 1200 20 100 — 25 28 Subcontract 23 — 26 1200 28 150 31 150 31 Regular 1300 Overtime 200 20 25 28 Subcontract 4 — 28 300 23 Capacity 9 25 Regular 20 Unused Capacity 4 6 Overtime Overtime 3 3 3 250 — — 500 Regular 1300 Overtime 200 Subcontract Demand 500 900 1500 1600 3000 34 250 23 500 1300 28 200 31 500 20 1300 25 200 28 500 250 REGULAR SUBENDING SUBPERIOD DEMAND PRODUCTION OVERTIME CONTRACT INVENTORY 1 2 3 4 Total 900 1500 1600 3000 7000 1000 1200 1300 1300 4800 100 150 200 200 650 0 250 500 500 1250 500 600 1000 0 2100 Other Quantitative Techniques Linear decision rule (LDR) Search decision rule (SDR) Management coefficients model Available-to-Promise (ATP) Quantity of items that can be promised to the customer Difference between planned production and customer orders already received Hierarchical Nature of Planning Items Production Planning Capacity Planning Resource Level Product lines or families Aggregate production plan Resource requirements plan Plants Individual products Master production schedule Rough-cut capacity plan Critical work centers Components Material requirements plan Capacity requirements plan All work centers Manufacturing operations Shop floor schedule Input/ output control Individual machines ATP: Example AT in period 1 = (On-hand quantity + MPS in period 1) – - (CO until the next period of planned production) ATP in period n = (MPS in period n) – - (CO until the next period of planned production) ATP: Example (cont.) ATP: Example (cont.) Take excess units from April ATP in April = (10+100) – 70 = 40 = 30 ATP in May = 100 – 110 = -10 =0 ATP in June = 100 – 50 = 50 Rule Based ATP Aggregate Planning for Services Product Request Yes Is an alternative product available at an alternate location? Is the product available at this location? No Availableto-promise No No Allocate inventory Allocate inventory Is the customer willing to wait for the product? Is this product available at a different location? Yes Availableto-promise Capable-topromise date Is an alternative product available at this location? Yes Yes Yes Revise master schedule 1. 2. 3. 4. Most services can’ can’t be inventoried Demand for services is difficult to predict Capacity is also difficult to predict Service capacity must be provided at the appropriate place and time 5. Labor is usually the most constraining resource for services Trigger production No Lose sale No Yield Management Yield Management (cont.) Yield Management: Example TIME - BREAK NONO-SHOWS PROBABILITY P(N < X) 0 1 2 3 .15 .25 .30 .30 .00 .15 .40 .70 Optimal probability of nono-shows P(n P(n < x) d Cu 75 = = .517 C u + Co 75 + 70 Hotel should be overbooked by two rooms .517 OBJECTIVES Strategic Capacity Planning Defined Capacity Utilization & Best Operating Level Economies & Diseconomies of Scale The Experience Curve Capacity Focus, Flexibility & Planning Determining Capacity Requirements Decision Trees Capacity Utilization & Service Quality Strategic Capacity Planning Strategic Capacity Planning Capacity Utilization Defined Capacity can be defined as the ability to hold, receive, store, or accommodate Strategic capacity planning is an approach for determining the overall capacity level of capital intensive resources, including facilities, equipment, and overall labor force size Capacity utilization rate Where is it used Capacity used rate Average unit cost of output Overutilization Underutilization Best Operating Level Volume of output actually achieved Best operating level capacity for which the process was designed Best Operating Level Example: Engineers design engines and assembly lines to operate at an ideal or “best operating level” to maximize output and minimize ware Capacity used Best operating level Example of Capacity Utilization During one week of production, a plant produced 83 units of a product. Its historic highest or best utilization recorded was 120 units per week. What is this plant’ plant’s capacity utilization rate? x Answer: Capacity utilization rate = Capacity used . Best operating level = 83/120 =0.69 or 69% The Experience Curve Economies & Diseconomies of Scale As plants produce more products, they gain experience in the best production methods and reduce their costs per unit Economies of Scale and the Experience Curve working Yesterday 100-unit plant Average unit cost of output 200-unit plant 300-unit plant 400-unit plant Cost or price per unit Today Tomorrow Diseconomies of Scale start working Total accumulated production of units Volume Capacity Flexibility Capacity Focus The concept of the focused factory holds that production facilities work best when they focus on a fairly limited set of production objectives Plants Within Plants (PWP) (from Skinner) Extend focus concept to operating Flexible plants Flexible processes Flexible workers level Capacity Planning: Balance Units per month Unbalanced stages of production Stage 1 Stage 2 6,000 7,000 Stage 2 6,000 6,000 Frequency of Capacity Additions External Sources of Capacity 5,000 Balanced stages of production Stage 1 Stage 3 Maintaining System Balance: Balance: Output of one stage is the exact input requirements for the next stage Units per month Capacity Planning Stage 3 6,000 Example of Capacity Requirements Determining Capacity Requirements 1. Forecast sales within each individual product line A manufacturer produces two lines of mustard, FancyFine and Generic line. Each is sold in small and family-size plastic bottles. 2. Calculate equipment and labor requirements to meet the forecasts The following table shows forecast demand for the next four years. Year: FancyFine Small (000s) Family (000s) Generic Small (000s) Family (000s) 3. Project equipment and labor availability over the planning horizon Example of Capacity Requirements (Cont): Product from a Capacity Viewpoint 1 2 3 4 50 35 60 50 80 70 100 90 100 80 110 90 120 100 140 110 Example of Capacity Requirements (Cont) : Equipment and Labor Requirements Question: Question: Are we really producing two different types of mustards from the standpoint of capacity requirements? Answer: Answer: No, it’ it’s the same product just packaged differently. Year: Small (000s) Family (000s) 1 150 115 2 170 140 3 200 170 4 240 200 •Three 100,000 unitsunits-perper-year machines are available for smallsmall-bottle production. Two operators required per machine. machine. •Two 120,000 unitsunits-perper-year machines are available for familyfamily-sizedsized-bottle production. Three operators required per machine. 47 Year: Small (000s) Family (000s) 1 150 115 2 170 140 3 200 170 48 Question: What are the values for columns 2, 3 and 4 in the table below? Question: What are the Year 1 values for capacity, machine, and labor? 4 240 200 Small Mach. Cap. 300,000 Labor 6 Family-size Mach. Cap. 240,000 Labor 6 150,000/300,000=50% At 1 machine for 100,000, it Small takes 1.5 machines for 150,000 Percent capacity used 50.00% Machine requirement 1.50 Labor requirement 3.00 At 2 operators for Family-size 100,000, it takes 3 operators for 150,000 Percent capacity used 47.92% Machine requirement 0.96 Labor requirement 2.88 ©The McGraw-Hill Companies, Inc., 2004 Year: Small (000s) Family (000s) Small Family-size Small Percent capacity used Machine requirement Labor requirement Family-size Percent capacity used Machine requirement Labor requirement 1 150 115 2 170 140 3 200 170 4 240 200 Mach. Cap. Mach. Cap. 300,000 240,000 Labor Labor 6 6 50.00% 56.67% 1.50 1.70 3.00 3.40 66.67% 2.00 4.00 80.00% 2.40 4.80 47.92% 58.33% 0.96 1.17 2.88 3.50 70.83% 1.42 4.25 83.33% 1.67 5.00 ©The McGraw-Hill Companies, Inc., 2004 Example of a Decision Tree Problem A glass factory specializing in crystal is experiencing a substantial backlog, and the firm's management is considering three courses of action: A) Arrange for subcontracting B) Construct new facilities C) Do nothing (no change) Example of a Decision Tree Problem (Cont): The Payoff Table The management also estimates the profits when choosing from the three alternatives (A, B, and C) under the differing probable levels of demand. These profits, in thousands of dollars are presented in the table below: The correct choice depends largely upon demand, which may be low, medium, or high. By consensus, management estimates the respective demand probabilities as 0.1, 0.5, and 0.4. Example of a Decision Tree Problem (Cont): Step 1. We start by drawing the three decisions A B C 0.1 Low 10 -120 20 0.5 Medium 50 25 40 0.4 High 90 200 60 Example of Decision Tree Problem (Cont): Step 2. Add our possible states of nature, probabilities & payoffs $90k $50k $10k High demand (0.4) Medium demand (0.5) Low demand (0.1) A A B High demand (0.4) Medium demand (0.5) B C Low demand (0.1) $200k $25k -$120k C $60k $40k $20k High demand (0.4) Medium demand (0.5) Low demand (0.1) Example of Decision Tree Problem (Cont): Step 3. 3. Determine the expected value of each decision Example of Decision Tree Problem (Cont): Step 4. Make decision High demand (0.4) High demand (0.4) Medium demand (0.5) $62k Low demand (0.1) $90k $50k $10k Medium demand (0.5) $62k A B A EVA=0.4(90)+0.5(50)+0.1(10)=$62k $80.5k Low demand (0.1) High demand (0.4) Medium demand (0.5) Low demand (0.1) $90k $50k $10k $200k $25k -$120k C High demand (0.4) $46k Medium demand (0.5) Low demand (0.1) $60k $40k $20k Alternative B generates the greatest expected profit, so our choice is B or to construct a new facility Capacity Utilization & Service Quality Planning Service Capacity vs. Manufacturing Capacity Time: Time: Goods can not be stored for later use and capacity must be available to provide a service when it is needed Location: Location: Service goods must be at the customer demand point and capacity must be located near the customer Volatility of Demand: Demand: Much greater than in manufacturing Best operating point is near 70% of capacity From 70% to 100% of service capacity, what do you think happens to service quality? Question Bowl The objective of Strategic Capacity Planning is to provide an approach for determining the overall capacity level of which of the following? a. b. c. d. e. Facilities Equipment Labor force size All of the above. above. None of the above Question Bowl To improve the Capacity Utilization Rate we can do which of the following? a. b. c. d. e. Reduce “capacity used” used” Increase “capacity used” used”. Increase “best operating level” level” All of the above None of the above (This increases the numerator in the Capacity Utilization Rate ratio, which is desirable.) Question Bowl Question Bowl When adding capacity to existing operations which of the following are considerations that should be included in the planning effort? When we talk about Capacity Flexibility which of the following types of flexibility are included? a. b. c. d. e. Plants Processes Workers All of the above . None of the above a. b. c. d. e. Maintaining system balance Frequency of additions External sources All of the above. above. None of the above Question Bowl Which of the following is a term used to describe the difference between projected capacity requirements and the actual capacity requirements? a. b. c. d. e. Capacity cushion. cushion. Capacity utilization Capacity utilization rate All of the above None of the above Question Bowl In determining capacity requirements we must do which of the following? a. b. c. d. e. Address the demands for individual product lines Address the demands for individual plants Allocate production throughout the plant network All of the above. above. None of the above Question Bowl In a Decision Tree problem used to evaluate capacity alternatives we need which of the following as prerequisite information? a. b. c. d. e. Expect values of payoffs Payoff values. values. A tree All of the above None of the above (Expected values are what is computed, not prerequisite to the analysis.) THE END