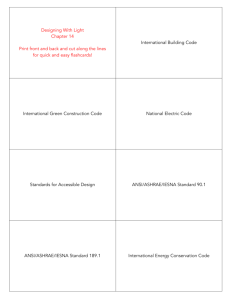

Green Building

advertisement