September 2010

Breakthroughs:

Hospital

Merger and

Acquisition

Strategies

Case Study | North Shore-LIJ

This is CASE STUDY 3 OF 4 from HealthLeaders Media Breakthroughs:

Hospital Merger and Acquisition Strategies

In collaboration with

20

B Y j im m o lp u s

Case Study | North Shore-LIJ

North Shore-LIJ

Sets Sights on Care

Coordination

N

orth Shore-LIJ Health System was already one of the

expressway that splits Queens, but those on the west side often

largest health systems in the nation, with 5,600 beds in

went into Manhattan for care.

its 15 hospitals. And even with 42,000 employees mak-

ing it the ninth-largest employer in the city, North Shore-LIJ had an

identity problem as far as New Yorkers were concerned, says president and CEO Michael Dowling.

“There is part of the world that believes if you’re not in

Manhattan, you don’t exist,” Dowling says. “I mean, people who live

health system snapshot

in Manhattan think that Manhattan is the only New York.”

So when Lenox Hill Hospital on East 77th Street in Manhattan

share

At the root of North-Shore LIJ’s growth and merger strategy is

the drive to get scale—size that allows the health system to coordinate care and chop off costs that come from overlapping markets

and gaps in care. Itself the product of a 1991 merger of North Shore

University Hospital and Glen Cove Hospital, the system now has a

service area of more than 7 million people.

Robert S. Shapiro, North-Shore-LIJ’s chief financial officer, says

Lenox Hill was a standalone hospital in need a stronger financial

came looking for a merger partner, the North Shore-LIJ team saw

partner. (The deal technically was a no-cash assumption of assets

it as an opportunity to get a footprint in a coveted borough. With

and a promise of capital.) “Some merge from a position of strength,

652 beds, a 153-year-old brand, and strength in key service lines

and some merge from a position of weakness. Unfortunately for

including cardiac and orthopedic care, Lenox Hill was a good stra-

Lenox Hill, they went through many years of struggling financially.

tegic fit. North Shore-LIJ’s analysis had found that its existing

It was and is a world-class institution, providing high-quality health-

hospitals drew well from residents on the east side of the Van Wyck

care with known and named physicians.”

HealthLeaders Media Breakthroughs: Hospital Merger and Acquisition Strategies

in collaboration with

©2010 HealthLeaders Media, a division of HCPro, Inc.

21

Case Study | North Shore-LIJ

Shapiro’s financial due diligence requires looking at the balance

sheet, sifting through debt, analyzing if the population base is strong

enough to support positive revenue performance. With Lenox Hill,

he found that the hospital had tried to negotiate with payers back

Michael Dowling,

President and CEO,

North Shore-LIJ

Having trouble listening?

Click here.

in the 1990s on its own, and without the leverage of a large system

their resulting revenue per discharge was lower than they needed to

operate. As a result, investment in capital had been down for some

time, including the loss of some administrative staff and the loss of

some key physicians.

But not all the news was bad. While the revenue cycle needed

“On the one hand, I think the net employment usually rises when

we take on an acquisition, but where we create the value is that we

create additional throughput and efficiency, so we are able to serve

more people and get more volume in a place with that increment

of staff. Because usually what happens is that when you take those

people out of the mix, the hospital operations get a little gummed up

and less efficient.”

Physician ties

were some areas that had to be improved, but all in all, it was in pretty

Mergers live and die by the will of the physicians involved. But that

good condition. There are many books that describe how organiza-

does not mean that North Shore-LIJ seeks to “own” all physicians

tions fail, and the various stages they go through; they were not near

on staff. Of the more than 9,000 physicians at the system, approxi-

the end.” While some investment to replace key positions would come,

mately 1,600 are salaried, says Dowling. North Shore-LIJ’s strategy

the need was more for investments that could be made over time and

is to create as much cultural and virtual alignment as possible with

not a large, immediate infusion of cash, Shapiro says. Mark Solazzo,

physicians, including a lot of leadership face-to-face time. The same

North Shore-LIJ’s chief operating officer, says as with many of the

was true when the Lenox Hill merger became a possibility.

“Because Lenox Hill was struggling to survive financially, they

“I don’t own them, but there is a core body of physicians at

Lenox Hill that are unbelievably loyal to the institution and have

pulled staff out of the mix that they would deem non-core, and that

stayed loyal even during a period of time when the hospital was hav-

we deem extremely core, for example, nurse educators, supervisors

ing some trouble, so there is a great foundation there,” Dowling says.

on off shifts, unit clerks that help the nurses stay at the bedside,

those types of positions,” Solazzo says.

So Solazzo’s team released 110 new positions at Lenox Hill for

share

gain efficiency. Solazzo sees the opposite.

work, the hospital’s balance sheet was good, Shapiro says. “There

system’s 14 previous mergers, they found Lenox Hill understaffed.

editor’s note

ally lead to a net loss of employees, as redundancy is eliminated to

Much of the work with physicians is done during an extensive

due diligence, where the team analyzes how the physician partners

really work, says Solazzo.

hire and plans to add 100 more over the next year. On the outside it

“The part that you have to be most careful of is how you seek to

might seem counter-intuitive. Mergers in non-healthcare fields usu-

integrate the physicians into your clinical programs. We take a very

HealthLeaders Media Breakthroughs: Hospital Merger and Acquisition Strategies

in collaboration with

©2010 HealthLeaders Media, a division of HCPro, Inc.

22

Case Study | North Shore-LIJ

cautious and deliberate approach, really trying to understand the

physician medical staff network, because a medical staff of a hospital is very unique—how they operate, how they function, how their

referral network exists, who are the influence makers, and who are

the people in leadership positions, Solazzo says.

Dowling and Solazzo take a “go to them” approach in creating

the physician communication for a merger.

between

the lines

1,600

physicians of the more

than 9,000 at the North

Shore-LIJ system are

salaried.

“Since we started this process a number of months ago, I think

I have had about another thousand dinners and breakfasts,” Solazzo

says. “You have got to go to their office to understand where they

live and what they face. It gives you a sort of sense of who they

are and their work environment. Bringing a dozen doctors into a

boardroom tells you very little.”

Once the integration process starts, the merged physicians and

“From the very beginning we developed

our system differently than anybody

else in this region, where we have

single administration, single clinical

leadership, single board structure,

and everything is owned. We not only

have hospitals but we have the whole

continuum of care.”

Michael Dowling, President and CEO,

North Shore-LIJ

clinical staff are brought to system-level expectations of quality and

performance, but with the understanding that not everyone will get

North Shore-LIJ has seen a lot of interest from private practice

to those standards in the exact same way, says chief medical officer

physicians looking for the safety of linkage with a health system.

Lawrence G. Smith, MD.

While the system is in no rush to necessarily employ in large num-

“If you look at how we manage quality and how do we really

actually function as a system instead of a bunch of independent

hospitals, the approach is very clear, which is that we set standards

share

“

bers, Smith believes offering options for integration will serve the

private practitioner and North Shore-LIJ.

“We are trying very hard through this electronic medical record

centrally, and then we allow local solutions,” Smith says, “We are

initiative to build synergies and linkages with physicians without

pretty cognizant of the fact that you can’t impose solutions on an

them having to become a full-time employed physician, so that

individual place, because the local culture, the resources, and the

there’s the option of working together and being able to function in

traditions can be very different, hospital to hospital. But you can’t

an integrated healthcare delivery system without them having to

compromise on standards. Everybody has to get to excellence.”

give up their own personal business and become fully employed.”

HealthLeaders Media Breakthroughs: Hospital Merger and Acquisition Strategies

in collaboration with

©2010 HealthLeaders Media, a division of HCPro, Inc.

23

Case Study | North Shore-LIJ

Integration

The long and prestigious history

Dowling and his team say they are acutely aware of the downside

of mergers where hospitals add size without integration. “There are

The road we

have traveled

many hospital systems, even in this region, that’ll tell you they’re integrated where there is no integration at all,” Dowling says. “People collect hospitals so that they can put them on letterhead. The alternative

is that you have hospitals join you and you integrate them fully.”

The hospitals, nursing homes and other facilities that comprise

Having trouble listening?

Click here.

much longer than that. And so we know each other, we know how

we operate, and we’re all singing the same tune together.”

Dowling says that from the beginning of the system North

Shore-LIJ has been moving toward a fully-integrated system “that

manages and coordinates care.” So Dowling says federal healthcare

payment reform and the creation of accountable care structures is

not a major shift for his organization.

“From the very beginning we developed our system differently

share

President’s Award for Exceptional Patient

Service established

CFAM Mammography Center opens

2007

CFAM Smith Institute for Urology opens

history of providing communities with the most innovative

2001

Cardiac Cath program established at

Huntington Hospital

2007

Pavilion at 9 Monti opens

and effective care available in the New York

2001

SI Heart Institute opens

2007

Cardiac Intervention Program established at

Southside Hospital

metropolitan area. These are the milestones

2001

Syosset Hospital transformed into a surgical

specialty hospital.

2007

First Kidney Transplant performed at NSUH

LIJ

2001

North Shore-LIJ receives Pinnacle Award

for Critical Care Quality.

2008

Bed Tower — Katz Women’s Hospital and

Zuckerberg Pavilion construction begins

2001

C-Port Cardiac Intervention Program

established at Southside Hospital

2008

Bioskills Laboratory opened

2002

Hillside Hosptial renamed The Zucker

Hillside Hospital Center for Learning and

Innovation (CLI) established

2008

1,000 car Parking Garage at LIJ opens

2008

50,000 sq. ft. expansion of Feinstein

Institute

2002

NSUH and LIJ faculty practices consolidated

2008

2002

Picower Institute acquired

Execute agreement to establish School

of Medicine in partnership with Hofstra

University

2002

Elmezzi Graduate School approved

2009

2002

Mirror Board established at Franklin

Hospital

Emergency and Trauma Center at SIUH

opens

2009

Mirror Board established at SIUH

2003

NSLIJ bonds receive “A” rating

2009

2003

SIUH receives HANYS Pinnacle Award for

Quailty in Falls Prevention

Construction begins at NSUH for Katz

Women’s Hospital

2009

Syosset receives JD Power Award for

Service Excellence for the 4th consecutive

year

that have shaped our journey to becoming

•

u

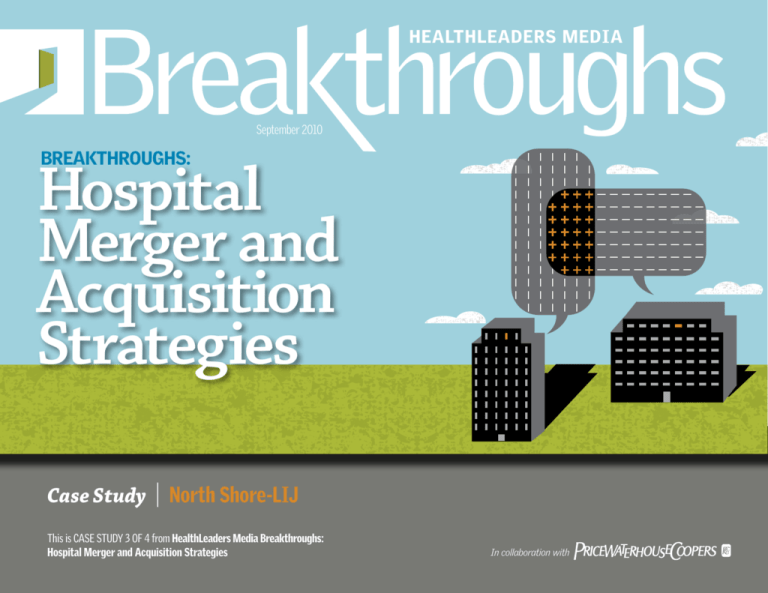

1990’s

1991-92 North Shore University Hospital and Glen Cove merge

1992-93 North Shore Regional Health Service Corp. renamed North

Shore Health System

1995 Hospital Huntington Hospital joins Health System

1995 Franklin Hospital joins Health System Syosset Hospital joins

Health System

1995 LaGuardia Hospital acquired and remamed Forest Hills

Hospital

2003

Research Institute receives GCRC grant

from NIH

2004

New North Shore-LIJ logo introduced

illustrating integration of the Health System

2010

North Shore-LIJ receives NQF Healthcare

Quality Award

1996 Hospice Care Network formed

2004

Huntington Surgical Building opens

2010

1997 North Shore-LIJ Health System formed through merger of North

Shore Health System and Long Island Jewish Medical Center

2004

Hospice Inn opens

$400 million investment in Electronic

Medical Record initiated

2004

System-wide Financial Assistance Policy

established

2010

Patient Safety Institute expanded

2010

1999 Research Institute created

2004

Zucker Hillside Ambulatory Pavilion opened

Children’s Hospital renamed Cohen Children’s

Medical Center of NY

North Shore Regional Health Service

Corp. formed

1999 North Shore-LIJ receives JCAHO Codman Award

2004

SIUH receives JCAHO Codman Award

Center for Extended

Care and Rehabilitation

(CECR) opens

1999 Center for Emergency Medical Services established at Syosset

2005

1999 Home Care Network consolidation

Research Institute renamed Feinstein

Institute for Medical Research

2005

Center for Advanced Medicine (CFAM)

established

1996 Southside Hospital joins Health System

1996 Staten Island University Hospital joins Health System

•

1988

1989

u

1980’s

1998 Core Laboratory established

2000 Hospice Care Network joins Health System

2010

Hofstra North Shore-LIJ School of Medicine

receives preliminary accreditation to accept

its first class of 40 students in summer 2011

2010

Lenox Hill Hospital joins North ShoreLIJ, establishing the health system’s first

hospital in Manhattan

Click the timeline to maximize.

Source: North Shore-LIJ

is owned. We not only have hospitals but we have the whole

continuum of care,” Dowling says.

In addition to hospital mergers like Lenox Hill, Dowling has

been buying other pieces of the continuum, including placing a

winning $17 million bid on the homecare license left from the bankruptcy of Saint Vincent Catholic Medical Center’s Certified Home

Health Agency based in Manhattan. The one piece of the continuum

than anybody else in this region, where we have single administra-

missing from North Shore-LIJ is a health plan, which Dowling says

tion, single clinical leadership, single board structure, and everything

is “something we are definitely planning for.”

HealthLeaders Media Breakthroughs: Hospital Merger and Acquisition Strategies

in collaboration with

©2010 HealthLeaders Media, a division of HCPro, Inc.

CLI Patient Safety Institute established

2007

Cardiac surgery program initiated at SIUH

but are converted to advisory boards only.

15 years together, and many of us have been in the organization for

CFAM Diagnostic Imaging Center opens

2006

2001

all integrated. Governing boards at the merged hospitals are kept

the management team here has worked together at a minimum of

CFAM Monter Cancer Center opens

2006

the North Shore-LIJ Health System have a long and prestigious

1994 Central General Hospital acquired and renamed Plainview

hospitals, one CFO and one COO. And I’m also very proud to say that

Mirror Board established at Southside

Hospital

2006

2007

tion is centralized. Systems from finance to procurement to IT are

Mark Solazzo,

Executive Vice President and

Chief Operating Officer,

North Shore-LIJ

Nassau University Medical Center (NUMC)

affiliation executed

2005

Hospice Care Network joins Health System

As with all hospitals in the North Shore-LIJ system, administra-

call it, ‘separateness,’ Shapiro says. “We have one CEO over all the

2000’s

CFAM Ambulatory Surgery opens

2005

2000

a national healthcare leader.

“We don’t have sponsorship agreements that provide for, I’ll

•

u

2005

About PricewaterhouseCoopers

About HealthLeaders Media

Committed to the transformation of healthcare through innovation, collaboration and thought

leadership, PricewaterhouseCoopers’ Health Industries Group offers industry and technical

expertise across all health-related industries, including providers and payers, health sciences, biotech/

medical devices, pharmaceutical and employer practices.

HealthLeaders Media is a leading multi-platform media company dedicated

to meeting the business information needs of healthcare executives and

professionals.

The firms of the PricewaterhouseCoopers global network (www.pwc.com) provide industry-focused

assurance, tax and advisory services to build public trust and enhance value for clients and their

stakeholders. PricewaterhouseCoopers has aligned its professional service offerings around the future

direction of the health system. By applying broad understanding of how individual, specialized sectors

work together to drive the performance of the overall health system, the Health Industries Group is

positioned to help clients, industry and governments address the changing market forces of globalization,

consumerism, consolidation and expansion, regulation, technology, and margin compression. More than

163,000 people in 151 countries across our network share their thinking, experience and solutions to

develop fresh perspectives and practical advice.

disclaimer: © 2010 PricewaterhouseCoopers LLP. All rights reserved. “PricewaterhouseCoopers” refers to PricewaterhouseCoopers LLP, a Delaware limited liability

partnership, or, as the context requires, the PricewaterhouseCoopers global network or other member firms of the network, each of which is a separate and independent

legal entity. This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Looking for the rest of the issue?

To keep up with the latest on trends in physician alignment and other critical

issues facing healthcare senior leaders, go to: www.healthleadersmedia.com

Sponsorship

For information regarding underwriting opportunities for HealthLeaders Media

Breakthroughs, contact:

Paul Mattioli, Senior Director of Sales

800/639-7477

pmattioli@healthleadersmedia.com

To view this full issue of HealthLeaders Media Breakthroughs:

Hospital Merger and Acquisition Strategies, please click

here to download: www.healthleadersmedia.com/breakthroughs

Copyright ©2010 HealthLeaders Media, 5115 Maryland Way, Brentwood, TN 37027 • Opinions expressed are not necessarily those of HealthLeaders Media. Mention of products and services does not constitute endorsement. Advice given is general, and readers should consult professional counsel for specific legal, ethical, or clinical questions.