Bellwether Portfolio Performance

advertisement

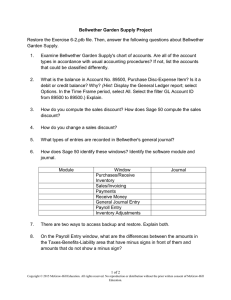

Bellwether Portfolio Performance Year Ended 31st March (FY) Bellwether Return (%) Large Cap Return Sensex (%) Mid Cap Return CNX 500 (%) Bellwether returns calculated on NAV basis, post all fees and expenses, to make it comparable to the indices. Bellwether returns include dividends. Comments FY 2005 64.05 9.57 11.60 Bellwether mid-cap outperformance FY 2006 52.54 73.73 64.16 Index on a tear FY 2007 -11.81 15.89 8.07 Liquidity driving up index sensitive stocks. Bellwether trailing index with 3 losers in the portfolio FY 2008 37.27 19.68 21.64 Momentum at peak just before sub prime crisis FY 2009 -55.41 -37.94 -40.02 Post Lehman era mid-caps fell on low volumes FY 2010 122.20 80.54 87.95 Bellwether portfolio rebalanced. Losers exited. Averaged down on winners FY 2011 15.90 10.94 7.26 Consolidated Bellwether outperformance FY 2012 22.86 -10.50 -8.75 Reaping benefits of rebalanced portfolio FY 2013 10.24 8.23 5.13 Sticking with the winners FY 2014 48.26 18.85 17.72 Bellwether mid-caps outperform, as market pays a premium for growth with quality FY2015 45.14 24.89 33.56 Opportunistic trades without disturbing the core portfolio structure helps Bellwether maintain outperformance FY2016 -2.13 -6.58 -3.63 Markets enter consolidation phase From 01/04/2004 to 31/12/2015 Bellwether Return (%) Large Cap Return Sensex (%) Mid Cap Return CNX 500 (%) Comments Total Return 900.83 340.76 323.14 Bellwether has returned more than double the sensex return Compounded Annualised Return 21.64 13.45 13.06 Comprehensive and sustained outperformance Portfolio Performance – Comparison with Equity Mutual Funds Source: Mutual Fund performance data is from publically available sources and is for the calendar year. All performance calculated on NAV basis, net of fees and expenses, to make comparison meaningful. Fund 1 year Return (%) Fund 3 year Return (%) Fund 5 year Return (%) Sundaram S.M.I.L.E Fund (G) 108.70 Franklin India Smaller Companies Fund (G) 226.30 Bellwether Capital 216.84 DSP BR Micro-Cap Fund (G) 101.80 Canara Robeco Emerging Equities (G) 201.10 Birla Sun Life MNC Fund – B (G) 208.80 Birla Sun Life Pure Value Fund (G) 99.00 UTI – Mid Cap Fund (G) 195.70 DSP BR Micro-Cap Fund (G) 208.10 Canara Rebeco Emerging Equities (G) 96.00 Principal Emerging Bluechip Fund (G) 195.70 Canara Robeco Emerging Equities (G) 200.30 UTI-Mid Cap Fund (G) 90.40 Bellwether Capital 195.25 Religare Invesco Mid N Small Cap Fund (G) 199.50 Franklin India Smaller companies Fund (G) 89.90 DSP BR Micro-Cap Fund (G) 194.10 HDFC Mid-cap Opportunities Fund (G) 191.80 Kotak Emerging Equity Fund (G) 87.30 SBI Magnum Midcap Fund (G) 189.00 Franklin India Smaller Companies Fund (G) 186.70 ICICI Pru Midcap Fund (G) 87.00 Sundaram S.M.I.L.E Fund (G) 187.00 UTI - MNC Fund (G) 180.30 HSBC Progressive Themes Fund (G) 85.40 ICICI Pru Midcap Fund (G) 182.30 Religare Invesco Mid Cap Fund (G) 176.30 Bellwether Capital 60.05 Birla Sun Life Pure Value Fund (G) 179.80 BNP Paribas Mid Cap Fund (G) 172.80 In line with our long term philosophy, Bellwether is on top of the Mutual Fund pack for the last 5 year period with a return of 217% Portfolio Performance – Comparison with Portfolio Management Companies Performance has been calculated on the basis of time weighted average return, net of fees and expenses, to make comparison meaningful with other portfolio managers. Source : www.sebi.gov.in/sebiweb/investment/PMRReport.jsp Portfolio Managers Calendar Year 2013 Return (%) Portfolio Managers Calendar Year 2014 Return (%) Portfolio Managers Cumulative Return Calendar Year 2013-14 (%) Bellwether Capital 28.10 Equity Intelligence India Pvt ltd 112.00 Equity Intelligence India Pvt Ltd 119.00 Valuequest Investment Advisors 19.30 KB Capital Markets 109.00 KB Capital Markets 117.00 Sundaram Asset management 15.20 95.00 15.20 Securities Investment Mgt Pvt Ltd 107.00 Dalal and Broacha Stock Broking Securities Investment Management Pvt Ltd Quest Investment Advisors 76.00 Bellwether Capital 89.00 Securities Investment Management 14.70 MIV Investment Service 66.00 85.00 MIV Investment service 14.40 Valuequest Investment Advisors Pvt Ltd 66.00 Valuequest Investment Advisors Pvt Ltd MIV Investment Service 81.00 BNP Paribas Asset Management 14.10 Karma Capital Advisors Pvt Ltd 64.00 Quest Investment Advisors 74.00 New Horizon Wealth Management 13.80 Bellwether Capital 61.00 Banyan Tree Advisors 68.00 Banyan Tree Advisors 12.50 Parag Parikh Financial Advisory Services 61.00 Dalal and Broacha Stock Broking Pvt Ltd 68.00 Emkay Investment Managers 11.00 Alchemy Capital Managment Pvt Ltd 59.00 Parag Parikh Financial Advisory Services 63.00