Strategy Formulation: Business Strategy

advertisement

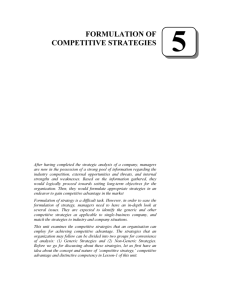

Strategic Marketing Management: Strategy Development and Role of CRM Presented by D.M.Ravi Dissanayake B.B.Mgt Marketing(Special) Kelaniya,,MBA (PIM;Sri J’pura) ,Dip.Mktg (SLIM) Senior Lecturer Department of Marketing Mgt,University of Kelnaiya dmravidissa@gmail.com , 0716833615 MULTIDIVISIONAL – SBU STRUCTURE Corporate Strategy Corporate Portfolio Strategy Functional Strategy 07-Feb-14 SBU 1 Functions SBU 2 Functions Functions Functions 2 Analysis of SBU • What is SBU??? • Why SBU should be analyzed??? Formulate generic strategies • Porter’s view on competitive advantages theory • Cost leadership and differentiation • Base on these options , initially he suggested the concept of 3 generic model. 3 generic options • Cost leadership: Being the lowest cost manufacturer, a company could maintain its strategic position against competitors. (customer enjoys price advantages) • Differentiation: company could do the differentiation for its products and service thereby customers love the brand difference against competitive offerings. • Focus: Company operates in a selected market rather focus for broad market( it may either cost ledership approach or differentiation) Present day practices of generic strategies • Discussion The Five Competitive Strategies There are countless variations of competitive strategies that companies employ, because each has a different internal and industry environment The biggest differences can be summarized as: Is the company’s target market broad or narrow? Is the company trying to be a low cost provider, or is it competing by product differentiation? Important Note: Role of CRM in strategy • Relationship marketing as an integral part of holistic marketing • Use CRM as a tool for market penetration ( discussion of examples) • Use CRM as a differentiation tool ( connect to 3 generic strategies) • Use CRM as a functional strategy (connect to overall marketing strategies: marketing mix) • Use CRM as a tactical strategy( connect to sales promotion) The Five Generic Competitive Strategies Types of Differentiation Unique taste – Dr. Pepper Multiple features – Microsoft Windows and Office Wide selection and one-stop shopping – Home Depot, Amazon.com Superior service - FedEx, Ritz-Carlton Spare parts availability – Caterpillar Engineering design and performance – Mercedes, BMW Prestige – Rolex Product reliability – Johnson & Johnson Quality manufacture – Michelin, Toyota Technological leadership – 3M Corporation Top-of-line image – Ralph Lauren, Starbucks, Grey Poupon Best-Cost Provider Strategies Combine a strategic emphasis on low-cost with a strategic emphasis on differentiation • Make an upscale product at a lower cost • Give customers more value for the money Objectives Be the low-cost provider of a product with good-to-excellent product attributes, then use cost advantage to underprice comparable brands When Does a Best-Cost Provider Strategy Work Best? Where buyer diversity makes product differentiation the norm and Where many buyers are also sensitive to price and value Focus / Niche Strategies Concentrate attention on a narrow piece of the total market Objective Serve niche buyers better than rivals Keys to Success Choose a market niche where buyers have distinctive preferences, special requirements, or unique needs Develop unique capabilities to serve needs of target buyer segment Focus / Niche Strategies and Competitive Advantage Approach 1 Achieve lower costs than rivals in serving a well-defined buyer segment – Focused low-cost strategy Approach 2 Offer a product appealing to unique preferences of a well-defined buyer segment – Focused differentiation strategy Growth strategy formulation ANSOFF MATRIX Market Existing New Existing Market Penetration Market Development New Product Development Diversification Product 07-Feb-14 16 Growth strategy formulation • Penetration Growth strategy formulation • NPD and Market Development Related vs. Unrelated Diversification Related Diversification Involves diversifying into businesses whose value chains possess competitively valuable “strategic fits” with value chain(s) of firm’s present business(es) Unrelated Diversification Involves diversifying into businesses with no competitively valuable value chain match-ups or strategic fits with firm’s present business(es)