Strategic Management

advertisement

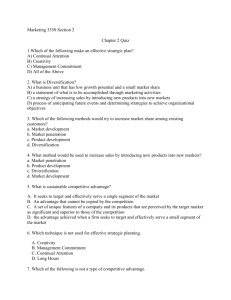

Session 11 Long Term Objectives, Generic and Grand Strategies 1 Session Objectives 1. Setting your dominant long term objective. 2. Define the 3 generic (drivers) of effective competitive strategies. 3. Define and clarify 15 recurring grand strategies. 2 Long-Term Objectives Short-run profit maximization is rarely the best approach to achieving sustained corporate growth and profitability Types of Long Term Objectives: – – – – Profitability Competitive Position Employee Relations Tech Leadership – – – – Productivity Employee development Productivity Public Responsibility 3 Usage Frequencies of Long Term Objectives (N = 82) Profitability Growth Market Share Social Responsibility Employee Welfare Product/Service Quality R&D Diversification Efficiency 89% 82 66 65 62 60 54 51 50 4 Qualities of Long-Term Objectives Acceptable Achievable Understandable Suitable Flexible Criteria used in preparing objectives Measurable Motivating 5 Forces Driving Industry Competition Potential entrants Threat of new entrants Bargaining power of suppliers Industry competitors Suppliers Bargaining power of buyers Buyers Rivalry Among Existing Firms Threat of substitute products or services Substitutes 6 Generic Strategies A long-term BL strategy must be based on a core idea about how the firm can best compete in the marketplace. The popular term for this core idea is generic strategy. 7 Three Generic Strategies Low-cost leadership Differentiation Focus 8 3 Generic Strategies 1.Striving for overall low-cost leadership in the industry. 2.Striving to create and market unique products for varied customer groups through differentiation. 3.Striving to have special appeal to one or more groups of consumers or industrial buyers, focusing on their cost or differentiation concerns 9 Low-Cost Leadership Low-cost producers usually excel at cost reductions and efficiencies They maximize economies of scale, implement cost-cutting technologies, stress reductions in overhead and in administrative expenses, and use volume sales techniques to propel themselves up the earning curve A low-cost leader is able to use its cost advantage to charge lower prices or to enjoy higher profit margins 10 Differentiation Strategies dependent on differentiation are designed to appeal to customers with a special sensitivity for a particular product attribute By stressing the attribute above other product qualities, the firm attempts to build customer loyalty Often such loyalty translates into a firm’s ability to charge a premium price for its product The product attribute also can be the marketing channels through which it is delivered, its image for excellence, the features it includes, and its service network 11 Focus A focus strategy, whether anchored in a low-cost base or a differentiation base, attempts to attend to the needs of a particular market segment A firm pursuing a focus strategy is willing to service isolated geographic areas; to satisfy the needs of customers with special financing, inventory, or servicing problems; or to tailor the product to the somewhat unique demands of the small- to mediumsized customer The focusing firms profit from their willingness to serve otherwise ignored or underappreciated customer segments 12 For each of the Three Requirements – Skills/resources – Organizational Risks 13 Requirements for Generic Competitive Strategies Generic Strategy Overall cost leadership Differentiation Focus Commonly Required Skills and Resources • Sustained capital investment and access to capital • Process engineering skills • Intense supervision of labor • Products designed for ease in manufacture • Low-cost distribution system • Strong marketing abilities • Product engineering • Creative flare • Strong capability in basic research • Corporate reputation for quality or technological leadership • Unique combination of skills • Strong cooperation from channels • Combination of above policies directed at the particular strategic target Common Organizational Requirements • Tight cost control • Frequent, detailed control reports • Structured organization and responsibilities • Incentives based on meeting strict quantitative targets • Strong coordination among functions in R&D, product development, and marketing • Subjective measurement and incentives instead of quantitative measures • Amenities to attract highly skilled labor, scientists, or creative people • Combination of above policies directed at the regular strategic target 14 Risks of the Generic Strategies Risks of Cost Leadership Cost of leadership is not sustained • Competitors imitate • Technology changes • Other bases for cost leadership erode Proximity in differentiation is lost Risks of Differentiation Differentiation is not sustained • Competitors imitate • Bases for differentiation become less important to buyers Cost proximity is lost Risks of Focus Focus strategy is imitated Target segment becomes unattractive • Structure erodes • Demand disappears Broadly targeted competitors overwhelm segment • Segment’s differences from others narrow Cost focusers achieve even lower cost in segments Differentiation focusers achieve greater differentiation in segments • Advantages of broad line increase 15 Types of Grand Strategies Concentrated Growth Conglomerate Diversification Market Development Turnaround Product Development Divestiture Innovation Liquidation Horizontal Integration Bankruptcy Vertical Integration Joint Ventures Concentric Diversification Strategic Alliances Consortia 16 Concentrated Growth A grand strategy in which a firm directs its resources to the profitable growth of a single product, in a single market, with a single dominant technology. 17 Example 1 In 2011, McDonald’s uses promotional campaign “Monopoly” to increase the rate of use of their current customers. If you make a game out of it, people will purchase your products to play. http://www.associatedcontent.com/article/6 239272/increasing_your_sales_using_con centrated.html?cat=3 Example 2 Best Buy focused on the ‘Concept Stores’ and the initiatives that improved its performance and differentiated the company from its main competitor. http://www.ibscdc.org/businesscasebookspdfs/Growth%20Stratiges%20Vol.%20II.p df Example 3 Paypal revolutionized financial services through its on-line person-to-person (P2P) money transfer service. Paypal’s growth strategy is to increase its customer base and sales through focusing on its online payment market. http://www.ibscdc.org/businesscasebookspdfs/Growth%20Stratiges%20Vol.%20II.p df Market Development A grand strategy of marketing present products. Often with only cosmetic modification, to customers in related marketing areas. 21 Example 1 Pacific Andes achieved considerable growth in seafood and vegetable business within a short span expanding into other countries. It also increased its global market share and gained a sustainable competitive advantage through synergy. http://www.ibscdc.org/businesscasebookspdfs/Growth%20Stratiges%20Vol.%20II.pdf Example 2 Toyota expanded its presence in the European car market. Toyota succeeded in localizing its strategies in tune with the needs of the European car market. Toyota also analyzed its strategy in Europe in the wake of currency fluctuations and the new needs of the market. http://www.ibscdc.org/businesscasebookspdfs/Growth%20Stratiges%20Vol.%20II.pdf Product Development A grand strategy that involves the substantial modification of existing products that can be marketed to current customers. 24 Example 1 The entire Nikon group is implementing the “Nikon Product Assessment” to create new products which offer enhanced power consumption efficiency, are smaller and lighter, use less harmful substances, and utilise Eco-glass. http://www.nikon.com/about/csr/report/2004/ eco_e_09.pdf Example 2 Miller/Coors with their Coors Light cold themed packaging bells and whistles: frost brewed, cold activated can, wide mouthed, cold filtered, home keg… 26 Example 3 Sears Circa 1975 with their “buy your stocks where you buy your socks” expansion into financial services: Discover Card, Dean Witter, Coldwell Banker, Allstate Insurance 27 Innovation A grand strategy that seeks to reap the premium margins associated with creation and customer acceptance of a new product or service. 28 Example 1 Apple is one of the most creative companies in the world. It designs and launches every Mac, iPhone, iPad. Its innovation on electronic products is so successful that everyone wants to own the new Apple products. (I wrote it.) Example 2 Google’s most recent innovation is on the Android OS for smartphones. It will challenge Apple's iPhone in the hotly competitive world of mobile devices. http://money.cnn.com/magazines/fortune/ mostadmired/2010/snapshots/11207.html Example 2 Virgin Galactic – For profit commercial and consumer space travel and transportation 31 Example 3 Google’s most recent innovation is on the Android OS for smartphones. It will challenge Apple's iPhone in the hotly competitive world of mobile devices. http://money.cnn.com/magazines/fortune/ mostadmired/2010/snapshots/11207.html Horizontal Integration A grand strategy based on growth through the acquisition of similar firms operating at the same stage of the productionmarketing chain. Example 1 Wachovia merging with First Union only to be acquired by Wells Fargo 34 Example 2 USAirways merging with Piedmont Airlines 35 Example 3 Exxon Acquiring Mobil in 2000 for $85.1 Billion Vertical Integration A grand strategy based on the acquisition of firms that supply the acquiring firm with inputs or new customers for its outputs. Backward VI is the desire to increase the dependability of the supply or quality of the raw materials used as production inputs Forward VI is the desire to gain greater control of the distribution/marketing/selling/service of products or services 37 Example 1 AT&T has ownership over companies that transmit equipments, including stations, cable lines, telephones, etc. which tremendously helped AT&T in providing one stop services and products. Without paying AT&T for its entitled infrastructure, other companies would never be able to use or provide similar services or products which AT&T is said to be a “dominating winning mix”. http://ccit300.wikispaces.com/Horizontal+Integr ation Example 2 Starbucks originally started as a roaster and retailer of coffee-beans, when its founder, Howard Schultz joined the company as a young salesman. The company is immensely vertically integrated for one purpose alone, maintaining perfect quality throughout the value-chain. http://www.techiteasy.org/2007/07/28/starb ucks-an-example-of-vertical-integration/ Example 3 Apple figured out how to link the content, the hardware, the software, and the pricing and distribution mechanisms, all more or less under one company's control. However, Apple is controlling the parts of the operation that touch customer experience. Apple aggressively uses contract manufacturing rather than having to manage everything itself. Apple has dug even deeper into vertical integration by announcing that it now intends to design the very chips that go into some of its products. http://blogs.hbr.org/hbr/mcgrath/2009/12/verticalintegration-can-work.html Vertical and Horizontal Integration 41 Concentric Diversification Concentric diversification involves the acquisition of businesses that are related to the acquiring firm in terms of technology, markets, or products With this grand strategy, the selected new businesses possess a high degree of compatibility with the firm’s current businesses The ideal concentric diversification occurs when the combined company profits increase the strengths and opportunities and decrease the weaknesses and exposure to risk 42 Example 1 The recent entry of Bell Atlantic Corporation, a telephone company, into the video programming business. http://bizcovering.com/management/busin ess-strategies-in-action/#ixzz1bC3scaBo Example 2 Dell Computers is pursing concentric diversification by manufacturing and marketing consumer electronic products (Flat Panel TVs, MP3 players, online music-downloading store.) This is an example of Personal computer business becoming more aligned with the entertainment business because both are becoming more and more digital. thinkpositive.ciprasystems.com/Admin/Commo n/163.ppt Example 3 Bill Gates (sorry - ahem - MS) bought Hotmail, which added a valuable e-mail service to the other internet activities and brought Microsoft a bright future. http://www.thinkingmanagers.com/managem ent/business-diversity.php Conglomerate Diversification Occasionally a firm, particularly a very large one, plans acquire a business because it represents the most promising investment opportunity available. This grand strategy is commonly known as conglomerate diversification. The principal concern of the acquiring firm is the profit pattern of the venture Unlike concentric diversification, conglomerate diversification gives little concern to creating product-market synergy with existing businesses 46 Example 1 General Electric is an example of a firm that is highly diversified. GE makes locomotives, light bulbs, and refrigerators. GE manages more credit cards than American Express. GE owns more aircraft that American Airlines. http://bizcovering.com/management/busin ess-strategies-in-action/#ixzz1bC4CLca9 Example 2 ITC, a primarily cigarette company, is pursing conglomerate diversification by entering into hotel industry. thinkpositive.ciprasystems.com/Admin/Co mmon/163.ppt Example 3 ESSAR GROUP is pursing conglomerate diversification by entering into these fields: iron and steel, oil support services, shipping, and marine constructions. thinkpositive.ciprasystems.com/Admin/Co mmon/163.ppt Turnaround The firm finds itself with declining profits Among the reasons are economic recessions, production inefficiencies, and innovative breakthroughs by competitors Strategic managers often believe the firm can survive and eventually recover if a concerted effort is made over a period of a few years to fortify its distinctive competences. This is turnaround. Two forms of retrenchment: – – Cost reduction Asset reduction 50 Divestiture A divestiture strategy involves the sale of a firm or a major component of a firm When retrenchment fails to accomplish the desired turnaround, or when a nonintegrated business activity achieves an unusually high market value, strategic managers often decide to sell the firm Reasons for divestiture vary 51 Liquidation When liquidation is the grand strategy, the firm typically is sold in parts, only occasionally as a whole—but for its tangible asset value and not as a going concern Planned liquidation can be worthwhile 52 Bankruptcy Liquidation (Chapter 7) bankruptcy—agreeing to a complete distribution of firm assets to creditors, most of whom receive a small fraction of the amount they are owed Reorganization (Chapter 11) bankruptcy—the managers believe the firm can remain viable through reorganization 53 Joint Ventures Occasionally two or more capable firms lack a necessary component for success in a particular competitive environment The solution is a set of joint ventures, which are commercial companies (children) created and operated for the benefit of the co-owners (parents) The joint venture extends the supplierconsumer relationship and has strategic advantages for both partners 54 Strategic Alliances Strategic alliances are distinguished from joint ventures because the companies involved do not take an equity position in one another In some instances, strategic alliances are synonymous with licensing agreements Outsourcing arrangements vary 55 Session Objectives 1. Setting your dominant long term objective. 2. Define the 3 generic (drivers) of effective competitive strategies. 3. Define and clarify 15 recurring grand strategies. 56 Group Exercise For your Case Company: 1. Are there examples of rivals that more closely follow CL, Diff, and Focus? 2. Provide 5 different company examples (hypothetical is ok) of rivals deploying one of the named grand strategies. 57 Break Out Reporting Case: Industry: Rival Generic Strategy Examples: Grand Strategy Examples: 58