Mikeska Company Balance Sheet Example (2011)

advertisement

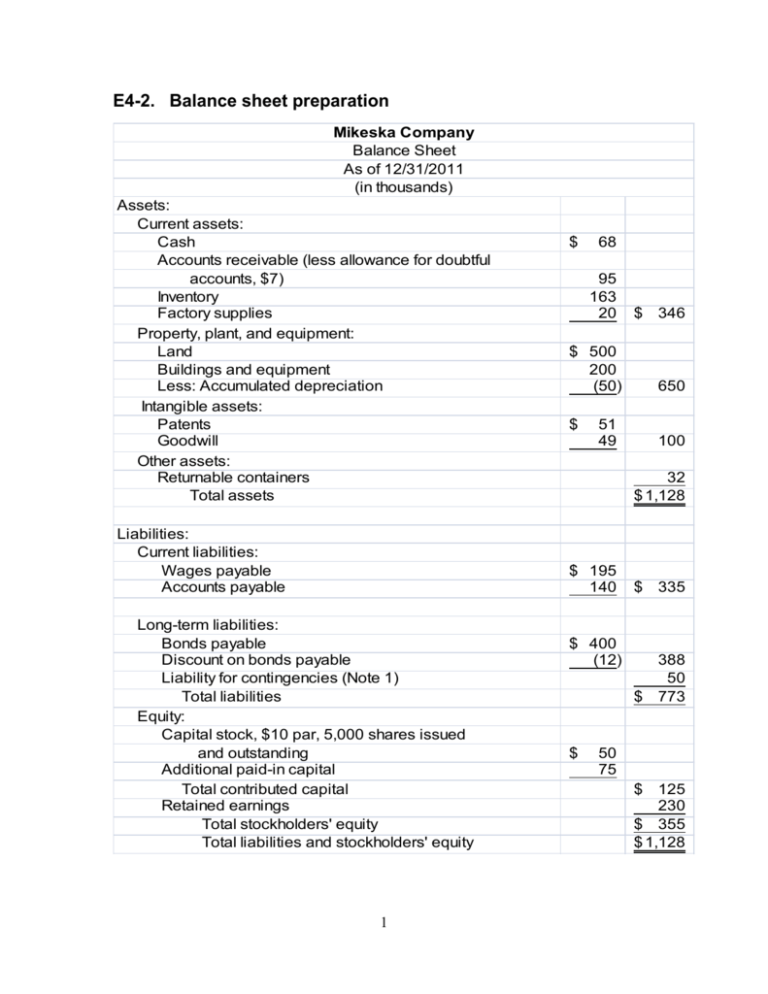

E4-2. Balance sheet preparation Mikeska Company Balance Sheet As of 12/31/2011 (in thousands) Assets: Current assets: Cash Accounts receivable (less allowance for doubtful accounts, $7) Inventory Factory supplies Property, plant, and equipment: Land Buildings and equipment Less: Accumulated depreciation Intangible assets: Patents Goodwill Other assets: Returnable containers Total assets Liabilities: Current liabilities: Wages payable Accounts payable $ 68 95 163 20 $ 500 200 (50) $ 1 346 650 51 49 100 32 $ 1,128 $ 195 140 Long-term liabilities: Bonds payable Discount on bonds payable Liability for contingencies (Note 1) Total liabilities Equity: Capital stock, $10 par, 5,000 shares issued and outstanding Additional paid-in capital Total contributed capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ $ 335 $ 388 50 773 $ 400 (12) $ 50 75 $ 125 230 $ 355 $ 1,128 Note 1: This classification assumes that this amount has been properly accrued. If, instead, the item is interpreted as an appropriation of retained earnings, it would be classified as a part of retained earnings. In either case, the company should specify more precisely the nature of the contingency. E4-2.Balance sheet preparation E4-4. Balance sheet classifications Reagan Company Balance Sheet As of December 31, 2011 Liabilities and Stockholders’ Assets Equity Current assets: Current liabilities: Cash Accounts payable Short-term investments Accrued expenses Trade accounts receivable Income taxes payable Current portion of long-term Inventories: debt Raw materials Notes payable Work in process Total current liabilities Finished goods Prepaid expenses Long-term liabilities Total current assets Bonds payable Deferred income taxes Plant assets: Total liabilities Land Buildings Stockholders’ equity: Less: Accumulated Preferred stock depreciation Machinery and equipment Common stock Less: Accumulated Contributed capital in excess depreciation of par Retained earnings Intangible assets: Total stockholders’ equity 2 Goodwill Total liabilities and stockholders’ equity Trademarks Total assets E4-9. Determining cash collections on account (AICPA adapted) Cash collected from customers can be determined by finding the change in accounts receivable. Sales Increase in accounts receivable Cash collections from customers for 2011 438,000 (8,800) $429,200 E4-10. Determining cash from operations and reconciling with accrual net income Requirement 1: Cash provided by operating activities: Net income $100,000 Noncash expenses: Depreciation _30,000 130,000 Changes in working capital accounts: Increase in accounts receivable Decrease in inventories Increase in prepaid expenses Decrease in accounts payable Increase in salaries payable Decrease in other current liabilities Cash provided by operating activities (110,000) 50,000 (15,000) (150,000) 15,000 _(70,000) (280,000) ($150,000) Requirement 2: Net income is $100,000, yet cash used by operating activities is ($150,000). There are several reasons for the difference. Accounts receivable increased by $110,000 (i.e., not all of the 3 sales reported in the 2011 income statement were collected in cash in 2011). Inventories decreased by $50,000 (i.e., part of the cost of goods sold appearing in the 2011 income statement consists of inventory that was paid for in an earlier year (i.e., 2010). Accounts payable decreased by $150,000 (i.e., the firm paid cash for all of its 2011 purchases 4 of merchandise from suppliers, as well as $150,000 for purchases made in 2010). Other current liabilities decreased by $70,000 (i.e., the firm paid cash for the various operating expenses it incurred in 2011 as well as $70,000 of operating expenses that were incurred, but not paid in cash in 2010). The changes in the prepaid expenses and the salaries payable accounts, along with the depreciation expense, explain the remaining difference between the firm’s net income and its cash flow from operating activities. Note: This problem demonstrates that a firm can be profitable under the accrual basis even though it does not generate positive cash flow from operating activities. P4-2. Preparation of a statement of cash flows and a balance sheet Requirement 1: Kay Wing, Inc. Statement of Cash Flows For the Year Ended 12/31/2011 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense 12,000 Gain on retirement of bonds (2,000) Loss on sale of equipment 4,000 Increase in accounts receivable ($37,000 - $41,500) (4,500) Increase in inventory ($70,000 - $73,000) (3,000) Decrease in accounts payable ($33,000 - $25,500) (7,500) Cash flow provided by operating activities Cash flows from investing activities Purchase of land Sale of equipment Purchase of short-term investments Net cash used in investing 5 $35,500 (1,000) 34,500 (15,000) 10,000 (8,300) (13,300) Cash flows from financing activities Issuance of capital stock 40,000 Retirement of bonds (28,000) Payment of cash dividends (5,000) Net cash provided by financing activities 7,000 Net increase in cash 28,200 Cash at beginning of year 65,000 Cash at end of year $93,200 Note to the instructor: The purchase of the building for $75,000 through the issuance of bonds is a significant noncash financing transaction that would be disclosed in the notes to the financial statements. Requirement 2: Kay Wing, Inc. Balance Sheet December 31, 2011 Cash Accounts receivable Short-term investments Inventory Long-term investments Land Plant and equipment (net) Total assets $ 93,200 41,500 8,300 (1) 73,000 20,000 89,000 (2) 158,000 (3) $ 483,000 Accounts payable $ 25,500 Taxes payable 4,000 Notes payable 35,000 (4) Bonds payable 125,000 (5) Capital stock 130,000 (6) Retained earnings 163,500 (7) Total liabilities and stockholders’ equity $ 483,000 (1) $0 + $8,300 (2) $39,000 + $50,000 (3) $109,000 – $14,000 – $12,000 $75,000 (4) $0 + $35,000 (5) $80,000 – $30,000 + $75,000 (6) $90,000 + $40,000 (7) $133,000 + $35,500 – $5,000 6