the punjab provincial cooperative bank limited

advertisement

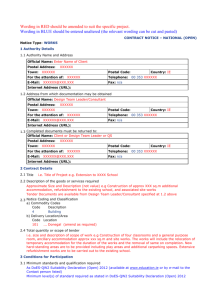

THE PUNJAB PROVINCIAL COOPERATIVE BANK LIMITED BALANCE SHEET AS AT JUNE 30, 2007 Note ASSETS Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Operating fixed assets Deferred tax assets Other assets 6 7 8 9 10 11 LIABILITIES Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Deferred tax liabilities Other liabilities 12 13 14 15 NET ASSETS REPRESENTED BY Share capital Reserves Unappropriated profit 16 Surplus on revaluation of assets 17 CONTINGENCIES AND COMMITMENTS 18 2007 2006 Rupees in ‘000' 715,017 5,586,775 558,009 8,009,821 2,571,139 216,136 17,656,897 409,993 6,511,008 506,876 6,798,803 1,288,477 219,225 15,734,382 39,654 12,000,000 2,007,645 185,623 14,232,922 3,423,975 20,677 12,000,000 1,657,013 123,553 13,801,243 1,933,139 430,351 370,827 133,776 934,954 2,489,021 3,423,975 425,533 337,269 38,939 801,741 1,131,398 1,933,139 The annexed notes form an integral part of these accounts CH.GHULAM MUSTAFA A.SENIOR MANAGER, ACCOUNTS/STAT MUHAMMAD ASHRAF A.CHIEF MANAGER, FINANCE RAJA ALLAH BUKHSH GENERAL MANAGER THE PUNJAB PROVINCIAL COOPERATIVE BANK LIMITED PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED JUNE 30, 2007 Note Mark-up/return/interest earned Mark-up/return/interest expensed Net mark-up/ interest income Provision against non-performing loans and advances Provision for diminution in the value of investments Bad debts written off directly 19 20 2007 2006 Rupees in ‘000' 1,228,805 547,198 681,607 375,366 375,366 306,241 1,029,645 253,508 776,137 157,609 157,609 618,528 22,805 4,811 347,161 374,777 681,018 4,467 8,177 37,501 50,145 668,673 24 550,203 551 550,754 130,264 481 481 129,783 38,939 168,722 512,511 99 512,610 156,063 1,030 1,030 155,033 (103,114) 51,919 25 38.59 9.3 9.4 Net mark-up/ interest income after provisions Non mark-up/interest income Fee, commission and brokerage Income Dividend Income Income from dealing in foreign currencies Gain / (loss) on sale of securities Other income Total non-mark-up/interest income 21 Non mark-up/ interest expenses Administrative expenses Other provisions/write offs Other charges Total non-interest/interest expenses Extra ordinary/ unusual items Profit before taxation Taxation - Current - Prior years - Deferred 22 23 Profit after taxation Unappropriated profit/(loss) brought forward Profit available for appropriation Basic and diluted earnings per share The annexed notes form an integral part of these accounts CH.GHULAM MUSTAFA A.SENIOR MANAGER, ACCOUNTS/STAT MUHAMMAD ASHRAF A.CHIEF MANAGER, FINANCE 46.46 RAJA ALLAH BUKHSH GENERAL MANAGER THE PUNJAB PROVINCIAL COOPERATIVE BANK LIMITED CASH FLOW STATEMENT FOR THE YEAR ENDED JUNE 30, 2007 Note CASH FLOW FROM OPERATING ACTIVITIES Profit before taxation Less:Dividend income Adjustments: Depreciation Amortization Provision Against Non-performing Advances (Gain) on sale of fixed assets (Increase)/ Decrease in operating assets Advances Others assets (excluding advance taxation) Increase/ (Decrease) in operating liabilities Bills Payable Borrowings from financial institutions Deposits Other liabilities (excluding current taxation) Income tax paid Net cash flow from operating activities CASH FLOW FROM INVESTING ACTIVITIES Dividend income Investments in operating fixed assets Capital work in progress Sale proceeds of property and equipment disposed-off Net cash flow from investing activities CASH FLOW FROM FINANCING ACTIVITIES Issue of share capital Dividend paid Medical aid to employees from Common Good Fund Net cash flow from financing activities Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year 26 2007 2006 Rupees in ‘000' 130,264 (4,811) 125,453 156,063 (8,177) 147,886 8,327 159 375,366 (296,600) 87,252 212,705 7,896 157,609 (3,114) 162,391 310,277 (1,586,384) 13,450 (1,572,934) 37,546 (19,844) 17,702 18,977 350,632 62,070 431,679 (928,550) (11,001) (939,551) 2,443 2,472,000 (31,784) (18,846) 2,423,813 2,751,792 (7,585) 2,744,207 4,811 (27,960) (898) 340,959 316,912 8,177 (15,038) 3,114 (3,747) 4,818 (1,388) 3,430 6,579 (1,408) 5,171 (619,209) 6,921,001 6,301,792 2,745,631 4,175,370 6,921,001 The annexed notes form an integral part of these accounts CH.GHULAM MUSTAFA A.SENIOR MANAGER, ACCOUNTS/STAT. MUHAMMAD ASHRAF A.CHIEF MANAGER, FINANCE RAJA ALLAH BUKHSH GENERAL MANAGER THE PUNJAB PROVINCIAL COOPERATIVE BANK LIMITED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED JUNE 30, 2007 Share capital Statutory reserve Common Good Fund Reserve for Unappropriated/ Consumer profit/(loss) Finance Total Rupees in '000' Balance as on June 30, 2005 418,954 318,748 5,469 1,480 (103,114) 641,537 155,033 155,033 Profit for the year - - - Transfer to statutory reserve - 12,980 - - (12,980) - Transfer to reserve for Consumer Finance - - - - - - 6,579 - - - - 6,579 - - (1,408) Issue of share capital Medical aid to staff Balance as on June 30, 2006 425,533 331,728 (1,408) 4,061 1,480 38,939 801,741 129,783 Profit for the year - - - - 129,783 Transfer to statutory reserve - 32,446 - - (32,446) - Transfer to reserve for Common Good Fund - - 2,500 (2,500) - Issue of share capital 4,818 4,818 Medical aid to staff Balance as on June 30, 2007 (1,388) (1,388) 430,351 364,174 5,173 1,480 133,776 934,954 The annexed notes form an integral part of these accounts Note: Common Good Fund is created for the welfare/medical aid to staff under Section 42 of Cooperative societies Act, 1925. Under the Bylaw No.57 of the Bank not less than one quarter of the net profit shall be carried to the statutory reserve. CH.GHULAM MUSTAFA A.SENIOR MANAGER, ACCOUNTS/STAT MUHAMMAD ASHRAF A.CHIEF MANAGER, FINANCE RAJA ALLAH BUKHSH GENERAL MANAGER The Punjab Provincial Cooperative Bank Limited Notes to the Accounts 5.6 Year Ended June 30, 2007 Taxation Provision for taxation is based on the assessable income for the year after taking into account tax credits available, if any, and any under/over provisions in respect of prior years. 5.7 Staff retirement benefits 5.7.1 Defined benefit plan The bank operates a funded pension scheme for all its permanent employees. Retirement benefits are payable to the members of the scheme on completion of prescribed qualifying period of service under the pension scheme. Contribution of 25% of the basic salary are being made by the bank. The gratuity is also paid to the employees on the basis of maximum period of service and last basic pay drawn subject to a maximum of Rs. 125,000 at the end of service. 5.7.2 Defined contribution plan The bank also operates a recognized provident fund scheme for all its regular employees, which is administered by the board of trustees. Equal monthly contribution of 10% of the basic salary is made in accordance with the terms of the scheme. 5.8 Impairment of assets The carrying amount of Bank's assets except deferred tax assets are reviewed at each balance sheet date to determine whether there is any indication of impairment loss. If such indication exists, the assets recoverable amount is estimated in order to determine the extent of the impairment loss, if any. Impairment losses are recognized as expense in profit and loss account. 5.9 Transactions with related parties The transactions with related parties are entered into at arm's length prices using the comparable uncontrolled price method except for advances to the employees which are extended in accordance with the industry practice. 5.10 Offsetting Financial assets and financial liabilities are only offset and the net amount reported in the balance sheet when there is legally enforceable right to set off the recognized amounts and the Bank intends to either settle on net basis or to realize the assets and settle the liability simultaneously. The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 Note 6. CASH AND BALANCES WITH TREASURY BANKS In hand Local currency With State Bank of Pakistan in Local currency current account With National Bank of Pakistan in Local currency current account Local currency deposit account NIDA 6.1 2007 2006 Rupees in '000' 125,482 84,640 6.1 169,861 95,650 6.1 6.1 133,697 285,977 113,213 116,490 715,017 409,993 These accounts are maintained under the requirements of BSD Circular No.16 and 18 dated August 10, 2002 and March 31, 2001 respectively, issued by the SBP. The NIDA account bears profit @ 2.50% per annum (2006 : 1.40% per annum) 7. BALANCES WITH OTHER BANKS In Pakistan On current account On deposit account 7.1 208,364 5,378,411 89,552 6,421,456 5,586,775 6,511,008 Deposit accounts maintained with the banks bear profit @ 3.00% to 10.50% per annum (2006 :1.40% to 10.00% per annum) 2007 2006 8. INVESTMENTS Note Held by Total Total Given as Held by Given as bank collateral bank collateral Rupees in '000' 8.1 INVESTMENTS BY TYPES: 7.1 Available-for-sale securities Share of Listed Companies Share of Cooperative Institutions Held-to-maturity securities Pakistan Investment Bonds Provincial Government Securities Investment at cost Less: Provision for Diminution in value of Investments Investments (Net of Provisions) Add: Surplus on revaluation on Available-for-sale securities Total investments at market value 8.2 8.4 8.5 7,023 3,551 - 7,023 3,551 7,023 3,551 - 7,023 3,551 8.6 8.7 300,000 12,051 322,625 - 300,000 12,051 322,625 300,000 12,051 322,625 - 300,000 12,051 322,625 322,625 - 322,625 322,625 - 322,625 235,384 558,009 - 235,384 558,009 184,251 506,876 17.2 INVESTMENTS BY SEGMENTS: Federal Government Securities: -Pakistan Investment Bonds Provincial Government Securities Fully Paid up Ordinary Shares: -Listed Companies -Cooperative Institutions Total investment at cost Less: Provision for diminution in value of investment Investments (Net of Provisions) Add: Surplus on revaluation on Available-for-sale securities 17.2 Total investments at market value 184,251 506,876 2006 2007 Rupees in '000' 300,000 12,051 300,000 12,051 7,023 3,551 322,625 7,023 3,551 322,625 322,625 322,625 235,384 558,009 184,251 506,876 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 8.3 Quality of Available for Sale Securities Securities (At market value) Shares of listed companies Security Papers Limited PICIC Dawood Lawrencepur Limited PICIC Insurance Limited Shares of Cooperative Institutions Total Amount 2007 233,784 5,636 2,871 116 3,551 245,958 Rating AAA AAUnrated AUnrated Amount 2006 186,226 2,602 2,446 3,551 194,825 Rating AAA AAUnrated Unrated 8.4 Shares of Listed Companies Name of Company 2007 2006 Number of Shares Ordinary share of Rs. 10 each 2,051,641 68,644 35,007 2,314 1,578,186 62,404 31,825 - Security Papers Limited PICIC Dawood Lawrencepur Limited PICIC Insurance Limited Note 8.4.1 8.4.1 2007 2006 At Cost Rupees in '000' 6,708 315 - 6,708 315 - 7,023 7,023 8.4.1 The Bank has sold the investment in shares of PICIC during preceding years, the current share holding of PICIC represents the entitlement of bonus shares received after disposal. During the year the Bank has received shares as specie dividend of PICIC Insurance Limited from PICIC. 8.5 Share of Cooperative Institution 2007 2006 Number of shares 191,876 460 3,410 71 3,041 7,360 10 12 129 1 250 30 4 10 52 4 200 100 20 1,020 250 500 1 200 191,876 460 3,410 71 3,041 7,360 10 12 129 1 250 30 4 10 52 4 200 100 20 1,020 250 500 1 200 Face Value Name of Cooperative Institution of Shares Rupees 10 100 100 1000 100 100 100 1000 500 100 100 1000 500 100 500 100 50 100 50 100 100 100 10 50 Coop: Insurance Society of Pakistan National Coop. Supply Corporation Coop: Investment & Management Agency Oberoi Coop: Society Sialkot Shahdara Pioneer Coop: M.P. Society Lahore Central Coop: Store Jhelum Distt. Coop: Society All Pakistan Coop: Multi Purpose Society Punjab Prov. Coop: Cotton Corp. Pakistan Product Coop: Marketing Anjuman Imdad-e-Bahami M.P. Society Pioneer Coop: Leather & Rubber Society Punjab Prov. Coop: Marketing West Pakistan Coop: Consumer Society Sargodha Distt. Coop: Society Sialkot Central Coop: Multi Purpose Society Multan Distt. Coop: Multi Purpose Society Lyalpur Distt. Coop: Multi Purpose Society Lyalpur Distt. Coop: Store Montgomery Coop: Society Bahawalpur Coop: Society Arifwala Mills Society Jhang Coop: Supervising Rawalpindi Multi Purpose Union 2007 2006 At Cost Rupees in '000' 1,919 43 341 71 300 536 1 11 65 12 30 2 1 18 8 10 1 102 25 45 10 1,919 43 341 71 300 536 1 11 65 12 30 2 1 18 8 10 1 102 25 45 10 3,551 3,551 8.5.1 The comparative figures of number of shares of Cooperative Institutions have been restated due to an error made in the presentation, however, this change has no effect on the value of shares. 8.5.2 The shares of Cooperative Institutions showing nil value is due to amounts rounded off to the nearest thousand. These shares have value less than a thousand rupee. The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 8.6 Pakistan Investment Bonds are for the period of 10 years starting from December 14, 2000 with the yield 14% per annum (2006: 14% per annum). 8.7 Provincial Government securities comprise of Punjab Loan issued by the Government of Punjab on December 07, 1998 for the period of 10 years with the yield 17.5% per annum (2006: 17.5% per annum). 2007 2006 Rupees in '000' 9. ADVANCES Loans, cash credits, running finances, etc. In Pakistan Bills discounted and purchased (excluding treasury bills) Payable in Pakistan Advances - gross Provision for non-performing advances 9,453,551 7,867,167 184 9,453,735 1,443,914 184 7,867,351 1,068,548 8,009,821 6,798,803 9.1.1 In local currency 9,453,735 7,867,351 9.1.2 Short Term ( for upto one year) Long Term ( for over one year) 4,961,136 4,492,599 3,889,903 3,977,448 9,453,735 7,867,351 Advances - net of provision 9.1 Particulars of advances (Gross) 9.2 Advances include Rs. 3,254,376 (thousand) (2006 : 3,085,018 thousand) which have been placed under non-performing status as detailed below:2007 Provision Classified Advances Domestic Overseas Total Required Provision Held Category of Classification Rupees in '000' Other Assets Especially Mentioned Substandard Doubtful Loss 630,725 584,540 543,106 1,496,005 3,254,376 - 630,725 584,540 543,106 1,496,005 3,254,376 9.3 Particulars of provision against non-performing advances 2007 Specific General Total Opening balance Charge for the year 1,068,548 375,366 - Specific Rupees in '000' 1,068,548 910,939 375,366 157,609 Closing balance 1,443,914 - 1,443,914 1,068,548 9.3.1 Particulars of provisions against non-performing advances 2007 Specific General Total Specific Rupees in '000' In local currency 1,443,914 1,443,914 1,068,548 117,446 271,553 1,496,005 1,885,004 2006 General 117,446 271,553 1,054,915 1,443,914 Total - 910,939 157,609 - 1,068,548 2006 General - Total 1,068,548 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts 9.4 Year Ended June 30, 2007 PARTICULARS OF WRITE OFFs: 2007 2006 Rupees in '000' - 9.4.1 Against Provisions Directly charged to Profit & Loss account 9.4.2 Write Offs of Rs. 500,000 and above Write Offs of Below Rs. 500,000 9.5 - - DETAILS OF LOAN WRITE OFF OF Rs. 500,000/- AND ABOVE In terms of sub-section (3) of Section 33A of the Banking Companies Ordinance, 1962 the Statement in respect of written-off loans or any other financial relief of five hundred thousand rupees or above allowed to a person(s) during the year ended June, 2007 is NIL. 10. OPERATING FIXED ASSETS Note Capital work-in-progress (Civil Works) Property and equipment 10.1 2007 2006 Rupees in '000' 13,372 12,474 2,557,767 1,276,003 2,571,139 1,288,477 10.1 Property and equipment COST Opening Additions/ Closing Balance (Deletions)/ Balance As At As At 01-07-06 30-06-07 Free hold land Lease hold land Building on free hold land Building on lease hold land Furniture and fixture Electrical, office and computer equipments Vehicles Telephone Exchange & Conference system Arms & Ammunitions 227,758 125,223 14,342 5,915 31,486 4,199 (42,635) - 189,322 2,420 (281) - 127,362 - DEPRECIATION Opening Charge/ Closing Balance (Deletion) Balance Revaluation As At As At Surplus 01-07-06 30-06-07 Rupees in '000 2,253,637 Book value As At 30-06-07 2,442,959 Rate of depreciation % - - - - - - 41,058 2,187 43,245 - 84,117 - - - - - - - 1,194 (221) 1,090 (11) 15,315 11,039 870 11,909 - 3,406 20.00 6,994 3,018 774 3,792 - 3,202 20.00 19,023 (1,221) 49,288 21,115 4,421 (10) 25,526 - 23,762 20.00 585 - 302 20.00 76 - 18 - 854 33 887 510 93 1 94 76 1 389,263 76,816 389,263 405,672 Library 1 405,672 2007 405,672 27,960 (44,369) (16,409) 2006 392,456 13,216 75 - - 85,133 2,253,637 1 2,557,767 76,816 8,327 (10) 8,317 85,133 2,253,637 2,557,767 72,249 4,567 76,816 947,147 1,276,003 2.50-20 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts 10.2 Year Ended June 30, 2007 The land of Bank were last revalued by independent proffessional valuers in January 2007. The revaluation was carried out by M/s Unit - 3 Consultants (A valuer on approved list of the Pakistan Banks Association) on the basis of professional assesment of present market values and resulted in a surplus of Rs. 2.426 Billion. During the year revaluation surplus amounting to Rs. 172.479 million has been reversed due to sale/adjustment of land. Had there been no revaluation, the carrying amount of the land would be Rs. 189.322 million. 10.3 DETAIL OF DISPOSAL OF FIXED ASSETS Particular of Assets FREEHOLD LAND 10 kanal 11 marala at Civil Line, Khanewal 100 kanal at Thokar Niaz Baid, Lahore 31 kanal 9 1/2 marala at Jampurpur road, D.G.Khan. 1 kanal at Galla Mandi, Depalpur District Okara BUILDING ON FREE HOLD LAND Bank building & Godown at Makhdoompur Pahoran Cost Accumulated Depreciation Book Value Sales Price Profit / (Loss) Mode of Disposal Particulars of the purchasers 249 - Rupees in '000 249 16,200 42,222 - 42,222 262,355 220,133 145 - 145 30,500 30,355 Auction Mr. Azhar Mumtaz 19 - 19 3,200 3,181 Auction Mr. Muhammad Ashraf 42,635 - 42,635 312,255 269,620 15,951 Auction Mr. Muhammad Jhangir Partner Al-Faraz & Co. Negotiation M/s Metro Cash & Carry (Pvt.) Ltd. 117 - 117 11,500 11,383 Auction Malik Umer Hayat Debris of bank building at Wazirabad 32 - 32 200 168 Auction Mr. Muhammad Hafeez Bank building at Ram Din road, Jhelum 33 - 33 14,000 13,967 Auction Mr. Asif Jahangir Auction Mr. Muhammad Ashraf Debris of bank building at Harrapa 52 - 52 270 218 234 - 234 25,970 25,736 VEHICLES. Honda Civic LOX-5670 731 705 26 345 319 Auction Toyota Corolla LOU-3988 665 665 - 336 336 Auction Daily Nawa-i-Waqat Lahore Toyota Corolla LOV-9641 655 655 - 346 346 Auction Daily Nawa-i-Waqat Lahore 820 820 - 405 405 Auction Daily Nawa-i-Waqat Lahore 2,871 2,845 1,432 1,406 Toyota Corolla LOZ-2357 26 Daily Nawa-i-Waqat Lahore The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 Note 2007 2006 Rupees in '000 11 OTHER ASSETS Advances, deposits, advance rent and other prepayments Advance taxation (payments less provisions) Branch adjustment account Suspense Account Deferred Costs Dissolved bank recoverable Insurance recoverable Profit recoverable from banks Others 1,632 67,509 12,009 477 56,110 22,829 17,416 38,154 1,301 56,989 16,603 10,153 636 56,451 22,781 27,198 27,113 216,136 219,225 39,654 20,677 12,000,000 12,000,000 12,000,000 12,000,000 12,000,000 12,000,000 12 BILLS PAYABLE In Pakistan 13 BORROWINGS In Pakistan 13.1 Particulars of borrowings with respect to Currencies In local currency from State Bank of Pakistan 13.3 13.2 Details of borrowings Secured / Unsecured Secured Borrowings from State Bank of Pakistan Under agriculture credit portfolio (short term) 13.3 This loan has been sanctioned by the State Bank of Pakistan under Section 17 (6) of the State Bank of Pakistan Act, 1956 for disbursement of agricultural credit. These are secured against the Guarantee of Government of the Punjab. Mark up payable on this borrowing ranges from 7.9677% to 8.9017% per annum (2006:ranges from 2.6164% to 8.2910% per annum). 14. DEPOSITS AND OTHER ACCOUNTS Customers Fixed deposits Savings deposits Current Accounts - Non-remunerative Call Deposits Term Deposits Others 14.1 142,907 1,260,528 496,868 5,346 3,726 98,270 106,085 1,101,287 350,174 4,993 5,584 88,890 2,007,645 1,657,013 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 Note 2007 2006 Rupees in '000' 14.1 Others include staff provident fund and staff security deposits. 14.2 Particulars of deposits In local currency 15 1,657,013 13,889 1,083 34,194 89,952 35,544 10,961 13,545 1,580 66,421 35,544 6,463 185,623 123,553 OTHER LIABILITIES Mark-up/ Return/ Interest payable in local currency Accrued expenses Branch adjustment account Sundry creditors Dissolved banks payable Others 16 2,007,645 SHARE CAPITAL 16.1 Authorized Capital 2007 2006 (Number of shares) Unlimited Unlimited Ordinary shares of Rs.100/- each Unlimited Unlimited 16.2 Issued, subscribed and paid up 17 3,927,780 375,730 3,879,600 375,730 4,303,510 4,255,330 Ordinary shares of Rs. 100/- each Fully paid in cash Issued as bonus shares 392,778 37,573 387,960 37,573 430,351 425,533 2,253,637 947,147 235,384 2,489,021 184,251 1,131,398 461 5,041 461 5,041 5,502 5,502 SURPLUS ON REVALUATION OF ASSETS 17.1 Surplus on revaluation of Fixed Assets Land 17.2 Surplus on revaluation of Available-for-sale securities Shares in Listed Companies 18 CONTINGENCIES AND COMMITMENTS 18.1 Guarantee Acceptances Show cause notices by sales tax-under appeal 18.1.1 18.1.2 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 18.1.1 Mr. Fazal-ur-Rehman deposited Rs.100,000/- & Rs.200,000/- (Total Rs.300,000/-) on 12.07.1990 & 14.07.1990 through DDs at Head Office as bid money in auction of land measuring 187(A) - 02(K)17(M) situated at Muza Nadha The & Distt. Gujranwala. Mr. Fazal-ur-Rehman did not fulfil the conditions of Landed Committee, resultantly Bank confiscated Bid Money. He filed Civil Suit No.156/1 in 1993 titled as Fazal-ur-Rehman v/s PPCBL at Gujranwala, which was decreed in favour of plaintiff. Bank filed an appeal No.RFA 243/95 in Lahore High Court, which has also decided against Bank and Lahore High Court directed Bank to furnish a guarantee No.2096/92 dated 15.09.1995 amounting to Rs.444,939/- through Main Branch and Rs.16,100/- through Head Office (Total Rs.461,039/- from NBP for the satisfaction of the Court. Now the case is pending adjudication in the Court of Civil Judge, Lahore. 18.1.2 The sales tax department has issued a show cause notice to the bank as to why the sales tax amounting to Rs. 5.041 millions has not been paid to the Government in regard to sale of machinery valuing Rs. 33,600 million of Rahwali Sugar Mills to Messers Ali Industrial and Engineering Works, Karachi without charging and depositing sales tax leviable thereon. Further the sales tax department reported that Messers Ali Industrial and Engineering Works filed written statement before Deputy Collector Audit-I, that they had paid sales tax on purchase of such machinery. The bank filed petition against the above show cause notice on the ground that bank has sold debris, scrap and non-operative machinery which were not sales tax leviable items. The case is still pending in Lahore High Court. 18.2 The Income Tax Returns for the tax years 2003, 2004, 2005 and 2006 have been filed under Self Assessment scheme whereby the Income Tax Returns filed with the I.T. department become the " deemed assessment order" unless selected for Audit. The assessment Order for Tax Year 2004 was amended by the Tax Department and challenged by the assessee in appeal before CIT(A). The case was decided in favour of the assessee by the Appellate Commissioner and the Department has preferred appeal against this order before the Learned Income Tax Appellate Tribunal ( ITAT). However , before the outcome of the Appeal & Under this present status the assessed losses for the tax year 2003 to 2006 ( after appeal effect of 2004) are Rs. 72.029 million Tax Consultant of the Bank has strong opinion that following the normal assessment procedure and history of the case, the assessing officer I.e. Income Tax department may amend the orders for the years 2003 , 2005 & 2006 and the assessments would be amended accordingly. If it is done the brought forward losses from the years 2003 to 2006 would not be available and might even be converted to Income for the years and subject to charge of income-tax. Likewise the business losses for the year 2007 would be reduced accordingly or converted into Income for the year, which would be subject to income-tax. 18.3 The appeals for the assessment year 1999-200 to 2002-2003 are pending with Income Tax appellate Tribunal (ITAT), the outcome of which is not certain 2007 2006 Rupees in '000' Commitment against construction and repair of building 24,696 1,564 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 Note 19 Mark-up/Return/Interest earned a) b) c) 20 On Loans and advances to Customers On Investments in Held to Maturity Securities On Deposits with financial institutions 578,008 44,109 407,528 1,228,805 1,029,645 31,623 515,575 36,055 217,453 547,198 253,508 9,765 296,600 1,571 16,191 23,034 8,793 3,114 902 11,063 13,629 347,161 37,501 409,398 21,677 155 31 25,864 2,162 10,301 21,548 2,878 3,082 853 820 8,327 159 10,787 17,825 14,336 396,588 21,752 234 2 22,865 2,076 9,529 12,023 2,305 1,535 659 42 7,896 159 8,868 15,809 10,169 550,203 512,511 OTHER INCOME Rent on property Gain on sale of fixed assets Profit on sale of books Bank & Service Charges. Others 22 741,527 44,108 443,170 Mark-up/Return/Interest expensed Deposits Other short term borrowings 21 2007 2006 Rupees in '000 ADMINISTRATIVE EXPENSES Salaries, allowances, etc. Charge for defined benefit plan Contribution to defined contribution plan Non-executive directors' fees, allowances and other expenses Rent, taxes, insurance, electricity, etc. Legal and professional charges Communications Repairs and maintenance Stationery and printing Advertisement and publicity Subscription 22.1 Auditors' remuneration Depreciation 10.1 Amortization General Charges Vehicles expenses Others The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 2007 2006 Rupees in '000 22.1 Auditors' remuneration Audit fee Out-of-pocket expenses 23 42 - 820 42 551 99 551 99 481 - 1,030 - 481 1,030 OTHER CHARGES Penalties imposed by State Bank of Pakistan 24 820 - TAXATION For the year Current For the prior year(s) 24.1 In view of taxable loss incurred for the year ended 30 June 2007, provision has been made only against dividend income. 25 EARNINGS PER SHARE - BASIC AND DILUTED Profit for the year Weighted average number of ordinary shares Basic and diluted earnings per share 26 155,033 3,336,584 46.46 715,017 5,586,775 6,301,792 409,993 6,511,008 6,921,001 CASH AND CASH EQUIVALENTS Cash and Balance with Treasury Banks Balance with other banks 27 (Numbers) (Rupees) 129,783 3,363,174 38.59 STAFF STRENGTH Permanent Temporary/ on contractual basis Daily wages Total Staff Strength (Number) 1,513 151 375 2,039 1,552 139 235 1,926 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts 28 Year Ended June 30, 2007 COMPENSATION OF DIRECTORS AND EXECUTIVES President / Chief Executive Directors 2007 2006 2007 2006 Fees Managerial remuneration Charge for defined benefit plan Contribution to defined contribution plan Rent and house maintenance Utilities Medical Conveyance Number of persons - Rupees in '000 - 1 Executives 2007 2006 1 - - - - - - 28.1 At present, the Chairman, Planning and Development, government of the Punjab is the administrator of the bank, who has full powers and duties that of a Board of Directors. 29 FAIR VALUE OF FINANCIAL INSTRUMENTS 29.1 On-balance sheet financial instruments 2007 Book value Assets Cash balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Other assets Liabilities Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Other liabilities 2006 Fair value Book value Rupees in '000 Fair value 715,017 5,586,775 558,009 8,009,821 92,040 715,017 5,586,775 558,009 8,009,821 92,040 409,993 6,511,008 506,876 6,798,803 105,597 409,993 6,511,008 506,876 6,798,803 105,597 14,961,662 14,961,662 14,332,277 14,332,277 39,654 12,000,000 2,007,645 185,623 14,232,922 39,654 12,000,000 2,007,645 185,623 14,232,922 20,677 12,000,000 1,657,013 123,553 13,801,243 20,677 12,000,000 1,657,013 123,553 13,801,243 29.2 The fair value of available for sale investments other than those classified as held to maturity is based on quoted market price. 29.3 In the opinion of the management, the fair value of the remaining financial assets and liabilities are not significantly different from their carrying values since assets and liabilities are either short term in nature or in the case of customer loans and deposits are frequently repriced. 30 RELATED PARTY TRANSACTIONS Balances outstanding 2007 2006 Rupees in '000' Loans and Advances Deposits - 14,152 4,940 Transactions during the year Loans and advances given Loans and advances adjusted/ received Mark up received on loans and advances Mark up on deposits - 11,634 11,064 1,218 32 30.1 The transactions and contracts with related parties, other than those under the terms of employment, are carried out on an Arm's length basis determined in accordance with the " Comparable Uncontrolled Price Method The Punjab Provincial Cooperative Bank Limited Notes to the Accounts 31 Year Ended June 30, 2007 CAPITAL ADEQUACY The risk weighted assets to capital ratio, calculated in accordance with the State Bank's guidelines on capital adequacy was as follows:2007 2006 Rupees in '000 Regulatory Capital Base Tier I Capital Shareholders Capital/Assigned Capital 430,351 425,533 Reserves 370,827 337,269 Unappropriated / unremitted profits (Net of Losses) 133,776 38,939 934,954 801,741 Less: Adjustments Shortfall in provisions required against classified assets (506,651) (349,787) Total Tier I Capital 428,303 451,954 Tier II Capital Subordinated Debt (upto 50% of total Tier I Capital) General Provisions subject to 1.25% of Total Risk Weighted Assets Revaluation Reserve (upto 50%) 1,244,511 1,244,511 428,303 856,606 Total Tier II Capital (restricted upto the amount of total tier I capital) Eligible Tier III Capital Total Regulatory Capital (a) Risk-Weighted Exposures 2007 295,343 6,006,449 558,009 9,453,735 2,571,139 216,136 16,802,930 Off Balance Sheet items Loan Repayment Guarantees Purchase and Resale Agreements Guarantee acceptance Revolving underwriting Commitments Stand By Letters of Credit Outstanding Foreign Exchange Contracts -Purchase -Sale 461 461 Credit risk-weighted exposures Market Risk General market risk Specific market Risk Market risk-weighted exposures Total Risk-Weighted exposures Capital Adequacy Ratio [ (a) / (b) x 100) (b) 1,201,290 245,958 6,045,209 2,571,139 148,627 10,212,223 461 461 10,212,684 565,699 565,699 451,954 903,908 2006 Rupees in '000 Book Value Risk Adjusted Value Credit Risk Balance Sheet Items:Cash and balances with treasury banks Balances with other banks Investments Advances Operating fixed assets Other Assets - Book Value 180,290 6,740,711 506,876 7,867,351 1,288,477 219,225 16,802,930 Risk Adjusted Value 1,348,142 194,825 5,288,014 1,288,477 162,236 8,281,694 461 461 461 461 8,282,155 10,212,684 8,282,155 8.39 10.91 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 32.1.1.3 Details of non-performing advances and specific provisions by class of business segment Classified Advances Agriculture, Forestry, Hunting and Fishing Mining and Quarrying Textile Chemical and Pharmaceuticals Cement Sugar Footwear and Leather garments Automobile and transportation equipment Electronics and electrical appliances Construction Power (electricity), Gas, Water, Sanitary Wholesale and Retail Trade Exports/Imports Transport, Storage and Communication Financial Insurance Services Individuals Others 3,181,099 1,595 23,192 48,490 3,254,376 2007 Rupees in '000 Specific Classified Provisions Advances Held 3,034,588 1,972 24,261 24,197 3,085,018 2006 Specific Provisions Held - 32.1.1.4 Details of non-performing advances and specific provisions by sector Public/ Government Private 32.1.1.5 GEOGRAPHICAL SEGMENT ANALYSIS Pakistan Asia Pacific (including South Asia) Europe United States of America and Canada Middle East Others 3,254,376 3,254,376 - 2007 Profit before Total assets Net assets taxation employed employed Rupees in '000' 130,264 17,656,897 3,423,975 130,264 17,656,897 3,423,975 3,085,018 3,085,018 - Contingencies and commitments 30,198 30,198 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts 32.2 Year Ended June 30, 2007 Market Risk 32.2.1 Foreign Exchange Risk Assets Pakistan rupee United States dollar Great Britain pound Deutsche mark Japanese yen Euro 17,656,897 17,656,897 2007 Off-balance Net foreign sheet items currency exposure Rupees in '000 14,232,922 14,232,922 - Liabilities 32.2.2 Currency risk is the risk that the value of a financial instrument will fluctuate due to change in foreign exchange risk 32.2.3 Mismatch of Interest Rate Sensitive Assets and Liabilities Effective Total Yield/ Interest rate Upto 1 Month Over 1 to 3 Months Over 3 to 6 Months - - 2007 Exposed to Yield/ Interest risk Over 6 Over 1 Over 2 Months to 1 to 2 to 3 Year Years Years Rupees in '000' Over 3 to 5 Years Over 5 to 10 Years Above 10 Years Non-interest bearing financial instruments On-balance sheet financial instruments Assets Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Other assets Liabilities Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Other liabilities On-balance sheet gap 1.40% 9.16% 10.50% 13.50% 8.82% 3.75% 715,017 5,586,775 558,009 9,453,735 92,040 16,405,576 287,992 5,430,552 245,958 805,840 6,770,342 307,258 307,258 341,965 341,965 3,111,817 3,111,817 12,051 1,024,671 1,036,722 1,069,510 1,069,510 300,000 1,822,767 2,122,767 39,654 12,000,000 2,007,645 185,623 14,232,922 1,459,434 3,000,000 277,584 9,738 5,000,000 26,533 4,000,000 16,172 6,547 77,512 1,459,434 3,277,584 9,738 5,026,533 4,016,172 6,547 77,512 2,172,654 5,310,908 (2,970,326) (1,914,716) (2,979,450) 1,062,963 2,045,255 332,227 - - - - 816,205 816,205 - 427,025 156,223 153,403 153,403 299 92,040 675,587 - 86,973 39,654 47,152 - 86,973 185,546 272,352 66,430 403,235 816,205 Off-balance sheet financial instruments Forward Lending (including call lending, repurchase agreement lending, commitments to extend credit, etc.) - - - - - - - - - - - Forward borrowings (including call borrowing, repurchase agreement borrowing, etc.) Off-balance sheet gap - - - - - - - - - - - - - - Total Yield/Interest Risk Sensitivity Gap 2,172,654 5,310,908 (2,970,326) Cumulative Yield/Interest Risk Sensitivity Gap 2,172,654 7,483,562 4,513,236 332,227 4,845,463 Yield Risk is the risk of decline in earnings due to adverse movement of the yield curve. Interest rate risk is the risk that the value of the financial instrument will fluctuate due to changes in the market interest rates. (1,914,716) 2,930,747 - - - - - - (2,979,450) 1,062,963 2,045,255 816,205 66,430 403,235 (48,703) 1,014,260 3,059,515 3,875,720 3,942,150 4,345,385 The Punjab Provincial Cooperative Bank Limited Notes to the Accounts Year Ended June 30, 2007 32.3 Liquidity Risk Liquidity Risk is the potential for loss to an institution arising from either its inability to meet its obligations or to fund increase in assets as they fall due without incurring unacceptable cost or losses. 32.3.1 Maturities of Assets and Liabilities Total Assets Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Other assets Operating fixed assets Deferred tax assets 715,017 5,586,775 558,009 8,009,821 216,136 2,571,139 17,656,897 Liabilities Bills payable 39,654 Borrowings 12,000,000 2,007,645 Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Other liabilities 185,623 Deferred tax liabilities 14,232,922 Net assets 3,423,975 Share capital/ Head office capital account Reserves Unappropriated/ Unremitted profit Surplus/(Deficit) on revaluation of assets Upto 1 Month 715,017 5,586,775 Over 1 to 3 Months 2007 Over 6 Months to 1 Year Over 3 to 6 Months - Over 1 Over 2 to 2 to 3 Years Years Rupees in '000 - - Over 3 to 5 Years - Over 5 to 10 Years - Above 10 Years - 245,958 806,139 89,095 6,629 307,258 32,909 387 341,965 845 181 1,667,903 5,106 1,738 12,051 1,024,671 761 436 1,069,510 728 14,367 300,000 1,822,767 85,436 18,790 816,205 1,193 2,528,007 153,403 63 604 7,449,613 340,554 342,991 1,674,747 1,037,919 1,084,605 2,226,993 3,345,405 154,070 39,654 1,506,586 3,000,000 277,584 9,738 5,000,000 26,533 4,000,000 16,172 6,547 77,512 - 86,973 64,210 49,569 1 23,281 106 - 12,905 35,551 - 90,417 2,136,576 35,551 3,309,854 1,610,450 5,839,163 3,327,153 (2,986,599) 9,739 333,252 5,049,814 (3,375,067) 4,016,278 (2,978,359) 6,547 1,078,058 86,973 67,097 430,351 370,827 133,776 2,489,021 3,423,975 32.3.2 Some assets / liabilities of the bank do not have a contractual maturity date. The period in which these assets / liabilities are assumed to mature is taken as the expected date on which the assets / liabilities be realised / settled. The above maturity analysis is based on the remaining period at the balance sheet date to the contractual maturity date. 32.4 Operational Risk Operational Risk is the risk of loss resulting from inadequate or failed internal processes, people and system or from external events. 33 Messer JCR-VIS Credit Rating Company Limited has assigned the medium to long term rating of the bank at BB+ (double B plus) while short term rating is revised to B on August 09, 2007 ( Previously: BB+ / B). 34 EVENT AFTER BALANCE SHEET DATE M/s Prime Engineering Works has filed a petition in Lahore High Court against sale of 173 Kanal of land to National Logistic Cell (NLC) at Chung Panjgraeen Village, Lahore in which the petitioner has said that bargain between the Bank and NLC has been finalised for an amount much lesser than the worth of the land on July 21, 2007. Moreover the petitioner claimed that his property stood encroached upon by Bank which was the part of sold land. The petitioner has prayed to the court to direct the respondent to reverse the deal and vacate his property as soon as possible. 35 DATE OF AUTHORIZATION FOR ISSUE These financial statements were authorized for issue on ________________ by the Administrator of the Bank. ,36 GENERAL 36.1 Figures of corresponding period have been restated where necessary for the purpose of comparison. 36.2 Figures in these statements have been rounded off to nearest thousand rupee. CH.GHULAM MUSTAFA A.SENIOR MANAGER, ACCOUNTS/STAT. MUHAMMAD ASHRAF A.CHIEF MANAGER, FINANCE RAJA ALLAH BUKHSH GENERAL MANAGER 46 46.1 46.2 46.3 46.4 GENERAL The note numbers given are for reference purposes. Further details may be given, if considered necessary, by way of additional note(s). Except for the first financial statements laid before the shareholders of the bank financial statements shall also give the corresponding figures for the immediately preceding financial year. This requirement shall, in case of banks required to prepare half yearly financial statements, be applicable to the immediately preceding corresponding period. The figures in the financial statements may be rounded off to the nearest thousand. The following shall be disclosed in the financial statements namely: i) All material information necessary to make the financial statements clear and understandable; ii) If a fundamental accounting assumption , namely, going concern, consistency and accrual is not followed in preparation of financial statement, that fact together with the reason thereof: iii) Particulars of any charge on the assets of the bank to secure the liabilities of any other person including, where practicable, the amount so secured (particulars of beneficiary along with relationship to the bank or directors). iv) Change in an accounting policy that has material effect in the current year or may have a material effect in the subsequent years together with reasons for the change and the financial effect of the change, if material. 46.5 The surplus on revaluation of fixed assets shall be treated and shown as specified in section 235 of the Companies Ordinance, 1984. Additions to, and deductions from, adjustments in or applications of the surplus on revaluation, whether resulting from disposal of the revalued asset(s) or otherwise ( detail to be provided) shall also be stated. 46.6 Where any material item shown in the financial statements or included in amounts shown therein cannot be determined with substantial accuracy, an estimated amount described as such shall be included in respect of that item together with the description of the item. 46.7 No liability shall be shown in the balance sheet or the notes thereto at a value less than the amount at which it is repayable (unless the quantum of repayment is at the option of the bank) at the date of the balance sheet or if it is not then repayable, at the amount at which it will first become so repayable thereafter, less, where appropriate, reasonable deduction for discount until that date. 46.8 If in the opinion of the directors any of the current assets have, on realization in the ordinary course of the bank's business, a value less than the amount at which they are stated in the financial statements, a disclosure of the fact that the directors are of that opinion together with their estimates of the realizable value and the reasons for assigning higher values in the balance sheet shall be required. 46.9 Terms and expressions not defined in the Banking Companies Ordinance, 1962 have the same meaning as in the Companies Ordinance, 1984 unless there is anything repugnant in the subject or context. 46.10 Wherever the words " to be specified " have been used in the Notes, it connotes that only such amounts are to be disclosed which are material. 46.11 Disclose, together with a commentary by management, the amount of significant cash and cash equivalent balances held by the bank that are not available for use by the bank. 46.12 The amount at which any asset or liability is stated in the balance sheet should not be off-set by the deduction of another liability or asset unless a legal right of set off exists and the off-setting represents the expectation as to the realization or settlement of the asset or liability. 46.13 Income and expense items should not be off-set except for those relating to hedges and to assets and liabilities which have been offset in accordance with note 46.12. 1 46.14 When income and expense items are presented on a net basis, even though the corresponding financial assets and financial liabilities on the balance sheet have not been offset, disclose the reason for that presentation if the effect is significant. 46.15 When the presentation or classification of items in the financial statements is amended and comparative amounts are reclassified, disclose the nature, amount of, and reason for any reclassification. When the presentation or classification of items in the financial statements is amended, but it is impracticable to reclassify comparative amounts, disclose the reason for not reclassifying and the nature of the changes that would have been made if amounts were reclassified. 46.16 Where any property and equipment or asset, acquired with the funds of the bank, is not held in the name of the bank or is not in the possession and control of the bank, this fact shall be stated, and the description and value of the property or asset, the person in whose name and possession or control it is held shall be disclosed. 46.17 Where information is required about the extent and nature, including significant terms and conditions that may affect the amount, timing and certainty of future cash flows, terms and conditions that may warrant disclosure include: a) the principal, stated, face or other similar amount which, for some derivative instruments, may be the amount (referred to as the notional amount) on which future payments are based; b) the date of maturity, expiry or execution; c) early settlement options held by either party to the instrument, including the period in which, of date at which, the options may be exercised and the exercise price or range of prices; d) options held by either party to the instrument to convert the instrument into, or exchange it for, another financial instrument or some other asset or liability, including the period in which, or date at which, the options may be exercised and the conversion or exchange ratio(s); e) the amount and timing of scheduled future cash receipts or payments of the principal amount of the instrument, including installment repayments and any sinking fund or similar requirements; f) stated rate or amount of interest/mark-up, dividend or other periodical return on principal and the timing of payments; g) collateral held, in the case of a financial asset, or pledged, in the case of a financial liability; h) in the case of an instrument for which cash flows are denominated in a currency other than the bank's reporting currency, the currency in which receipts or payments are required; i) in the case of an instrument that provides for an exchange, information described in items (a) to (h) for the instrument to be acquired in the exchange; and j) any condition of the instrument or an associated covenant that, if contravened, would significantly alter any of the other terms (for example, a maximum debt-to-equity ratio in a bond covenant that, if contravened, would make the full principal amount of the bond due and payable immediately). 46.18 Any information required to be given in respect of any of the items in the financial statements shall, if it cannot be included in such statements, be furnished in a separate note, schedule or statement to be attached to, and which shall be deemed to form an integral part of the financial statements. 46.19 All banks operating in Pakistan (whether incorporated in Pakistan or outside Pakistan and whether listed or not) shall prepare their accounts in accordance with the directives issued by the State Bank of Pakistan from time to time, the Banking Companies Ordinance 1962, the International Accounting Standards and International Financial Reporting Standards as notified in the official Gazette by the Securities and Exchange Commission of Pakistan for listed companies under section 234(3)(i) of the Companies Ordinance 1984. 1 46.20 Captions in respect of which no amounts exist may not be reproduced in the financial statements except in case of Balance Sheet and Profit & Loss account. 46.21 Banks are encouraged to disclose financial highlights of recent periods. Banks will decide the periods for disclosing the past financial highlights. They may also consider disclosing trends in key financial ratios from investors perspective and transparency in disclosure. 46.21 Following notes will be applicable when Basel II is implemented Note Title 44.1 Capital Assessment and Adequacy Basel II Specific (will replace Note 44) 45.1.2 Credit Risk-General Disclosures Basel II Specific 45.2 Equity Position risk in the banking book Basel II Specific 45.3.4 Yield/Interest Rate Risk in the Banking Book (IRRBB)-Basel II Specific 45.5.1 Operational Risk-Disclosures Basel II Specific 1 Annexure - 1 STATEMENT SHOWING WRITTEN-OFF LOANS OR ANY OTHER FINANCIAL RELIEF OF FIVE HUNDRED THOUSAND RUPEES OR ABOVE PROVIDED DURING THE YEAR ENDED __________________ S. Name and Name of individuals/ Father's/ Outstanding Liabilities at beginning of year Principal Interest/ Other finTotal written-off Mark-up ancial relief No. address of the partners/ directors Husband's Principal Interest/ Others borrower (with NIC No.) name Mark-up written-off provided 1 2 3 4 TOTAL: Please disclose reconciliation 5 6 7 8 9 Rupees in '000 10 11 Total (9+10+11) 12 Annexure - 2 ISLAMIC BANKING BUSINESS The bank is operating ___ Islamic banking branches at the end of current year as compared to ___ Islamic banking branches at the end of Prior year. 2006 2007 Rupees in '000 ASSETS Cash and balances with treasury banks Balances with and Due from Financial Institutions Investments Financing and Receivables -Murahaba -Ijara -Musharaka -Diminishing Musharaka -Salam -Other Islamic Modes (Please specify) Other assets Total Assets LIABILITIES Bills payable Due to Financial Institutions Deposits and other accounts -Current Accounts -Saving Accounts -Term Deposits -Others -Deposit from Financial Institutions -Remunerative -Deposits from Financial Institutions-Non-Remunerative Due to Head Office Other liabilities NET ASSETS REPRESENTED BY Islamic Banking Fund Reserves Unappropriated/ Unremitted profit Surplus/ (Deficit) on revaluation of assets Remuneration to Shariah Advisor/Board CHARITY FUND Opening Balance Additions during the period Payments/Utilization during the period Closing Balance xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx (xxxxxx) xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx (xxxxxx) xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx (xxxxxx) xxxxxx xxxxxx xxxxxx (xxxxxx) xxxxxx Annexure - 3 Guidelines for mapping of Business Lines Level 1 Corporate Finance Trading & Sales Level 2 Corporate Finance Municipal/Government Finance Merchant Banking Advisory Services Sales Market Making Proprietary Positions Treasury Retail Banking Retail Banking Private Banking Card Services Commercial Banking Payment and Settlement1 Agency Services Asset Management Retail Brokerage Commercial Banking External Clients Custody Corporate Agency Corporate Trust Discretionary Fund Management Non-Discretionary Fund Management Retail Brokerage Activity Groups Mergers and acquisitions, underwriting, privatisations, securitisation, research, debt (government, high yield), equity, syndications, IPO, secondary private placements Fixed income, equity, foreign exchanges, commodities, credit, funding, own position securities, lending and repos, brokerage debt, prime brokerage Retail lending and deposits, banking services, trust and estates Private lending and deposits, banking services, trust and estates, investment advice Merchant/commercial/corporate cards, private labels and retail Project finance, real estate, export finance, trade finance, factoring, leasing, lending, guarantees, bills of exchange Payments and collections, funds transfer, clearing and settlement Escrow, depository receipts, securities lending (customers) corporate actions Issuer and paying agents Pooled, segregated, retail, institutional, closed, open, private equity Pooled, segregated, retail, institutional, closed, open Execution and full service 1 Payment and settlement losses related to a bank’s own activities would be incorporated in the loss experience of the affected business line 41 Principles for business line mapping1 (a) All activities must be mapped into the eight level 1 business lines in a mutually exclusive and jointly exhaustive manner. (b) Any banking or non-banking activity which cannot be readily mapped into the business line framework, but which represents an ancillary function to an activity included in the framework, must be allocated to the business line it supports. If more than one business line is supported through the ancillary activity, an objective mapping criteria must be used. (c) When mapping gross income, if an activity cannot be mapped into a particular business line then the business line yielding the highest charge must be used. The same business line equally applies to any associated ancillary activity. (d) Banks may use internal pricing methods to allocate gross income between business lines provided that total gross income for the bank (as would be recorded under the Basic Indicator Approach) still equals the sum of gross income for the eight business lines. (e) The mapping of activities into business lines for operational risk capital purposes must be consistent with the definitions of business lines used for regulatory capital calculations in other risk categories, i.e. credit and market risk. Any deviations from this principle must be clearly motivated and documented. (f) The mapping process used must be clearly documented. In particular, written business line definitions must be clear and detailed enough to allow third parties to replicate the business line mapping. Documentation must, among other things, clearly motivate any exceptions or overrides and be kept on record. 1 Supplementary business line mapping guidance There are a variety of valid approaches that banks can use to map their activities to the eight business lines, provided the approach used meets the business line mapping principles. Following is an example of one possible approach that could be used by a bank to map its gross income: Gross income for retail banking consists of net interest income on loans and advances to retail customers and SMEs treated as retail, plus fees related to traditional retail activities, net income from swaps and derivatives held to hedge the retail banking book, and income on purchased retail receivables. To calculate net interest income for retail banking, a bank takes the interest earned on its loans and advances to retail customers less the weighted average cost of funding of the loans (from whatever source - retail or other deposits). Similarly, gross income for commercial banking consists of the net interest income on loans and advances to corporate (plus SMEs treated as corporate), interbank and sovereign customers and income on purchased corporate receivables, plus fees related to traditional commercial banking activities including commitments, guarantees, bills of exchange, net income (e.g. from coupons and dividends) on securities held in the banking book, and profits/losses on swaps and derivatives held to hedge the commercial banking book. Again, the calculation of net interest income is based on interest earned on loans and advances to corporate, interbank and sovereign customers less the weighted average cost of funding for these loans (from whatever source). For trading and sales, gross income consists of profits/losses on instruments held for trading purposes (i.e. in the markto-market book), net of funding cost, plus fees from wholesale broking. For the other five business lines, gross income consists primarily of the net fees/commissions earned in each of these businesses. Payment and settlement consists of fees to cover provision of payment/settlement facilities for wholesale counterparties. Asset management is management of assets on behalf of others. 42 (g) Processes must be in place to define the mapping of any new activities or products replicate the business line mapping. Documentation must, among other things, clearly motivate any exceptions or overrides and be kept on record. (h) Processes must be in place to define the mapping of any new activities or products. (i) Senior management is responsible for the mapping policy (which is subject to the approval by the board of directors). (j) The mapping process to business lines must be subject to independent review. 43