WHITE

PAPER

UCITS Come to the Fore:

Opportunities and Challenges

for the Funds Industry

TABLE OF CONTENTS

[03]

Introduction

[05]

Meeting Investor and Manager Demands

Traditional Investment Managers

Hedge Funds

Limitations

[06]

UCITS IV Evolution

[07]

Anticipated Benefits

[08]

Headwinds Ahead

[08]

Investment Manager Benefits

and Challenges

Cross-border competition

Scale and efficiency

Operational complexity

[10]

Operational Keys to Success

Liquidity

Risk Management

[12]

Conclusion

[12]

About Advent

advent.com

03

Introduction

UCITS IV, due to be implemented by European Union member states

by July 2011, marks the latest iteration of what has turned into a

hugely successful fund wrapper brand.

The UCITS III amendments, which took effect in 2001, have added a

welcome dimension to the industry. By significantly broadening the

range of eligible assets in which UCITS can invest, they have opened

the way for traditional managers to launch absolute return funds

and allowed hedge funds to enter the fray with so-called “Newcits”

products.

For its part, UCITS IV will introduce an efficiency package of measures

aimed at tying up many of the loose ends left over from previous versions of the directive. As such, it has been roundly applauded by the

industry in Europe, and is the subject of growing interest in the US.

In this paper we will assess the opportunities and challenges brought

by UCITS III and IV, and examine the technology frameworks fund firms

need if they are to prosper in this changing environment.

This communication is provided by Advent

Software, Inc. for informational purposes only

and should not be construed as, and does

not constitute, legal advice on any matter

whatsoever discussed herein.

WHITE PAPER

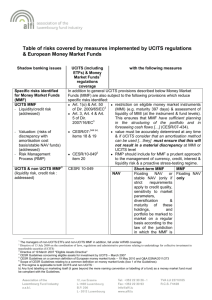

UCITS Freedoms and Requirements

UCITS must invest in liquid financial assets.

Some assets are excluded, such as unregulated hedge funds, illiquid commodities or property.

However, investing in indices of non-eligible assets such as commodities and hedge funds, as

well as in non-leveraged collateralized debt obligations, is allowed.

Units must be valued at least twice monthly.

Redemption requests must be honored within 14 days.

Investments must ensure at least 20% of assets can be redeemed.

A maximum of 10% may be invested in illiquid securities, subject to having accurate valuation

and risk management capabilities.

A maximum of 5% of NAV may be invested with a general issuer, 25% with credit institutions and

100% for government bonds, so long as there are a minimum of six securities and none exceeds

30% of the NAV.

Counterparty risk with any credit institution is capped at 10%.

UCITS can invest a 20% maximum in another supervised fund. Total investments in non-UCITS

funds limited to 30%.

Naked short sales are not allowed.

Short sales can be carried out synthetically, through the use of total return swaps, options,

futures, etc.

Cash or securities borrowings must not exceed 10% of NAV.

Leverage

Leverage through derivatives is restricted to two times assets (100% of NAV).

Risk

Management

To gauge leverage, sophisticated UCITS can use either an Absolute or Relative Value-at-Risk (VaR)

approach. They must also engage in stress testing.

Transparency

NAVs must be available twice monthly.

Funds must publish audited annual reports and financial reports, detailing their transactions and

holdings.

The key information document (KID) given to investors must describe the fund’s strategy and

risk profile.

Eligible Assets

Liquidity

Concentration

Limits

Short Sales

advent.com

05

Meeting Investor and

Manager Demands

UCITS III Fund Attractions

The freedoms instituted by UCITS III in 2001 paved the way for vehicles employing an expanded range of investment strategies to be

launched under the UCITS umbrella. As a result, there are now more

than a thousand alternative and absolute return UCITS funds in

Europe, which together total approximately $200 billion in assets.

While this still represents a relatively small portion of the overall UCITS

universe, a convergence of investor and manager interest is expected

to drive growth in these types of funds going forward.

Absolute return strategies offer

more consistent risk-adjusted performance.

Strategies and asset classes with low

correlations help manage volatility.

Vehicles provide transparency, liquidity, and safekeeping assurances.

Investors

Traditional Investment Managers

Tools to address shifting investor

demands.

Foster product differentiation.

Diversify product offerings.

Generate higher fees.

Traditional Investment Managers

The traditional investment management industry is faced with an

ongoing squeeze on profit margins due to the growth of passive

investment strategies, greater scrutiny on fee structures given recent

poor investment performance, and a crowded market for traditional

equity and bond products that makes fund differentiation difficult.

By offering absolute return products under the UCITS banner, traditional fund managers can leverage a broader array of tools to address

shifting investor demands for regulated products that offer an attractive risk-adjusted performance profile. In addition, alternative products

can generate higher fees to counter the margin squeeze being felt in

other parts of the industry.

Hedge Funds

According to research by PricewaterhouseCoopers, documented in a

March 2010 report,1 there are now more than 200 hedge fund-run

UCITS. And as the report noted, research by Hedge Fund Intelligence,

released in November 2009, found more than half of European hedge

fund managers have either launched or plan to launch Newcits.

For alternative investment managers, the main attraction of launching

a UCITS fund is the access it offers to an expanded investor audience.

Since many hedge funds hemorrhaged assets and investors during the

financial crisis, this opportunity to rebuild and grow their asset and

client base is appealing.

The European Union’s Alternative Investment Fund Managers Directive

(AIFMD) may also create further incentives for firms to launch Newcits.

Under the AIFMD, the ability of non-EU managers to market offshore

funds within the bloc will be restricted. Therefore Newcits may offer an

attractive alternative gateway into the EU market.

1 Future Newcits regulation?, PricewaterhouseCoopers

Hedge Funds

Access a larger investor universe.

Satisfy client demands for greater

transparency, disclosure, and liquidity.

Skirt the EU’s AIFMD restrictions.

WHITE PAPER

As the EDHEC Risk Institute noted in a recent research report,2 “60% of

alternative investment funds (AIFs) very much agree that the AIFM

directive leads to uncertainty about the distribution of funds; 65% of

AIFs plan (either “somewhat” or “very much”) to restructure their

funds as UCITS, whereas 25% do not.”

Limitations

The downside, as the EDHEC paper pointed out, is that shoe-horning

hedge funds into a UCITS structure—with the liquidity, portfolio concentration, asset eligibility, short-selling, and leverage limitations that

brings—may distort the strategies and produce diminished returns.

Similarly, there are fears that launching a parallel, watered-down UCITS

version of a firm’s regular hedge funds may erode the returns those

vehicles can achieve.

Another concern is that, despite initially meeting the qualifying

criteria, some funds may discover that in reality they do not have the

liquidity needed to weather periods of exceptional market stress.

Being unable to fulfill this key requirement of the UCITS framework

could damage the brand’s reputation.

Furthermore, not all hedge fund strategies will fit into a UCITS structure. According to the EDHEC paper, equity long/short strategies are

seen as the easiest to adapt to the UCITS framework. Event-driven and

relative-value strategies though are the hardest.

And for the time being at least, the growth in the absolute return

UCITS sector has been disappointing. Thus far, only 3% of alternative

and absolute return UCITS funds have managed to top $1 billion in

assets, with nearly 75% still short of $100 million, according to a recent

paper produced by the SEI Knowledge Partnership and Strategic

Insight.3 The paper went on to note the average absolute return fund

produced investment returns of 9% in 2009, compared to nearly

30% for the average equity fund. In addition, approximately 15% of

absolute return UCITS funds posted negative returns during 2009,

while only 2% of global equity funds did so.

UCITS IV Evolution

Alternative and absolute return UCITS may constitute a relatively small

part of the overall UCITS industry at present, but the sector remains in

the early phases of development. More important than the actual

asset numbers though is that by expanding the types of instruments

and investment techniques available, UCITS III has adapted the frame-

2 Are Hedge-Fund UCITS the Cure-All?, March 2010, EDHEC Risk Institute

3 Exotic to Mainstream: Growth of Alternative Mutual Funds in the U.S. and Europe,

the SEI Knowledge Partnership and Strategic Insight

advent.com

work to meet industry participants’ needs and goals, thereby ensuring

it remains relevant in today’s marketplace.

Yet despite the advances it brought, industry participants always

complained of the gaps UCITS III left when it came to creating a fully

functioning single market in Europe. Most notable was the absence of

a workable management passport process. As a result, a subsequent

iteration of the directive always seemed likely.

The upshot is UCITS IV, which is scheduled to come into force in July

2011. At its core is an “Efficiency Package,” comprising six headline

measures that have attracted widespread industry endorsement.

Anticipated Benefits

The big gain UCITS IV holds out is that it will make it easier for fund

firms to generate economies of scale, and thus help rationalize costs,

noted Tom Burroughes, Group Editor at WealthBriefing, during Advent

Software EMEA’s 2010 User Conference.

The financial crisis has forced firms to review their cost-income ratios

and rethink product production policies, with a view to streamlining

fund ranges. Nevertheless, with over 36,000 UCITS now in existence

viability issues remain, with many funds duplicated across various

jurisdictions and/or of sub-optimal size.

The result, it has long been contended, is high costs and inefficiency.

For instance, a Lipper study found that total expense ratios (TERs),

when weighted by fund assets, across all actively managed equity

funds were 0.91% in the US, 1.44% in Germany, 1.63% in the United

Kingdom and 1.89% among cross-border funds.4 The simple average

TER for bond funds was 0.83% in the US, 0.88% in Germany, 1.20% in

the UK and 1.24% for cross-border funds.

Under UCITS IV, however, firms will be able to:

Leverage the MCP to reduce the number of management companies they operate across Europe, thereby cutting their cost structures and capital requirements.

Make use of the fund merger and master-feeder capabilities to

integrate small, duplicated funds into larger structures with better

economies of scale.

Use master-feeder structures located in tax favorable jurisdictions

to lower the tax drag for investors.

4 Fund Expenses: A Transatlantic Study, by Ed Moisson and Jonathan Kreider,

September 2009, http://www.lipperweb.com/docs/Research/Fiduciary/Fund_

Expenses_A_Transatlantic_Study.pdf

07

UCITS IV

Efficiency Package

i)

A full Management Company Passport (MCP) that enables companies

authorized in one member state to

manage UCITS funds domiciled in

other jurisdictions.

ii)

Introduction of new rules allowing

fund mergers.

iii) A new framework for the creation of

master-feeder structures, allowing

firms to collapse down management

structures.

iv) A revamped regulator-to-regulator

notification procedure to speed up

cross-border distribution of funds.

v)

Better supervisory cooperation

mechanisms.

vi) Introduction of a streamlined Key

Investor Document (KID).

WHITE PAPER

Foster product innovation by using the master-feeder and merger

structures to bring new ideas to market that might not otherwise

generate sufficient scale in individual jurisdictions.

Launch funds cross-border more rapidly.

The hope, therefore, is the European funds industry will be able to

reduce average TERs and bring them closer to the levels seen in the

United States, said Mr. Burroughes.

And if UCITS IV helps drive consolidation in the number of funds available in the market, that may reduce some of the product proliferation

and complexity that investors and wealth managers face at present,

and help rebuild investor trust.

Language barriers

Accurately translating the precise

descriptions of what a fund does from,

say, Spanish to Czech is a tough job.

Culture

In France, for example, there is a strong

bias toward buying enhanced cash products, which don’t sell well in the UK.

Currency

A firm running a Polish zloty bond fund

is unlikely to register it for sale in Italy.

Tax

Leveraging the Management Company

Passport, cross-border merger and

master-feeder structures may result in

multiple tax implications. For instance,

cross-border mergers may produce capital gains tax and stamp duty charges,

while the location of a master fund

brings withholding tax considerations.

Therefore, European tax harmonization

is needed if UCITS IV is to achieve its full

potential, a move that is highly unlikely.

In the meantime, the market will remain

full of tax-optimized funds designed for

specific countries, for which there is no

incentive to passport abroad.

Headwinds Ahead

UCITS IV, in tying up some of the loose ends left over from UCITS I and

UCITS III, is a welcome initiative that has the potential to bring significant benefits to managers and investors alike. Nevertheless, fund

management groups tend to act in response to investors’ demands.

And given that their needs are already being addressed for the most

part by the existing UCITS regime, it will take some time before fund

managers feel a compelling urge to revamp their businesses in the way

UCITS IV allows.

Furthermore, as Kate Hollis, Global Head, Fixed Income / Alternatives,

Standard & Poor’s, pointed out during her presentation at the Advent

conference, there are headwinds that will hamper the speed and

extent to which firms will want or be able to merge and passport their

fund ranges across Europe. Among the most important are language,

culture, currency and tax.

Investment Manager Benefits

and Challenges

Despite these headwinds, the positive changes held out by UCITS IV

will eventually permeate the industry, as those introduced with UCITS

III are gradually doing. But alongside the benefits, the existing and

upcoming UCITS regulations bring an array of challenges for industry

participants.

Cross-border competition

With cross-border access becoming easier, firms will find it more difficult to hide in their national markets, argued David Hammond, Director with Dublin-based advisory firm Bridge Consulting at the Advent

EMEA 2010 User Conference. As a result, they will be challenged to

make their products more saleable to a broader audience.

advent.com

In this environment, organizations will have to combine international

competitiveness with the flexibility to cope with country nuances. This

means being able to:

Handle differences between tax systems.

Handle different product and service expectations between

national markets.

Offer product ranges that can appeal across borders and be available in different flavors e.g. to meet the UCITS and AIFMD rules.

Scale and efficiency

With competition for market share getting more intense, players will

need to be more niche-focused and/or able to achieve critical mass.

So as well as having the flexibility to support national market exigencies, firms will need to maximize scale and efficiency in their infrastructures wherever possible.

Operational complexity

As noted above, the freedoms introduced by UCITS III come with a

swathe of compliance requirements—for example, to provide liquidity

at least twice a month, ensure the fund remains within strict investment parameters, and adopt sophisticated risk management

approaches.

And in addition to the overarching UCITS rules, funds operating crossborder must ensure that they comply with the national idiosyncrasies

of multiple jurisdictions.

Furthermore, although UCITS III has enhanced the investment flexibility available to funds by expanding the list of eligible assets, firms

need the cross-asset class capabilities in place that allow them to

support a broader range of instruments.

Dan Waters, Director, Conduct Risk, and Asset Management Sector

Leader with the UK Financial Services Authority, underlined the operational challenges in a speech to the McKinsey Asset Management

Conference in January: “We would remind new UCITS managers that

compliance with the UCITS framework will take considerable investment in systems and controls, and while asset managers may delegate

various functions, they retain ultimate responsibility for compliance

with the quite detailed requirements of UCITS III and, even more,

under UCITS IV.”5

5 Asset management regulatory trends and priorities in the post-crisis environment:

an update from the FSA, Speech by Dan Waters, Director, Conduct Risk, and

Asset Management Sector Leader, the FSA at the McKinsey Asset Management

Conference, London, 25 January 2010, http://www.fsa.gov.uk/pages/Library/

Communication/Speeches/2010/0125_dw.shtml

09

WHITE PAPER

Operational Keys to Success

To thrive in the UCITS arena firms need a host of elements in place,

including the investing expertise to manage a range of asset classes

and alternative strategies, and an effective distribution network.

In addition, a robust, sophisticated and cost-efficient IT infrastructure

is crucial if firms are to meet the challenges highlighted.

1. Automation. As market competition intensifies in a post-UCITS IV

world, firms will need to become more efficient in order to contain

costs and provide exceptional client service.

2. Compliance. The liquidity, diversification, leverage, and reporting

stipulations laid down by the UCITS framework mean firms need

sophisticated pre- and post-trade compliance capabilities to ensure

that they remain within the strict parameters set out by the regulations, as well as those established internally. An automated infrastructure will also provide an audit trail that records each stage in

the transaction chain.

3. Risk Management. The financial crisis has propelled risk management to the forefront of investors, regulators, and fund managers’

minds. But risk in all its guises—from market and credit to counterparty, country, and operational risk—can be better monitored and

managed with an effective IT framework. Capabilities it should

comprise include:

Multi-asset class coverage—an order and portfolio management platform that supports the array of financial instruments

eligible under UCITS III, with cross-asset class risk tracking

and reporting that provides a quick and accurate view of the

manager’s firm-wide risk positions.

Monitoring fund/portfolio manager thresholds—accurate monitoring of portfolio manager thresholds and fund concentration

limits to guard against exposures that exceed the limits laid

down by UCITS III.

Intra-day VaR capability—to abide by the UCITS rules in this

area managers need the ability to measure VaR during the trading day, and support stress, correlation, and back testing for the

VaR measures.

Real-time reporting—providing management with accurate and

up-to-date information on their assets so as to monitor exposures and optimize performance.

advent.com

4. Client Service. This year’s Financial News Asset Management CEO

Snapshot survey 6 found over three-quarters of respondents plan to

increase spending on sales and marketing over the next 12 months,

as they strive to improve client servicing and rebuild their asset

bases. But alongside well-trained client-facing staff, firms can

strengthen the relationships with their investors through the deployment of effective technology. This includes having:

Performance attribution tools that conduct detailed analysis to

provide distributors and investors with transparent insights into

the performance of the firm’s funds, to foster understanding of

the products and garner trust.

A market data source providing good constituent data from the

different benchmarks being used as the points of performance

comparison.

Sophisticated reporting capabilities to provide clients with accurate and useful reports on a timely basis, helping to keep them

informed and in control of their investments.

Liquidity

If there is to be a UCITS V, one area it may address is liquidity. With

memories of the redemption restrictions that occurred during the

financial crisis still fresh in investors’ minds, the majority of asset

inflows are heading for the most liquid options available. However,

although UCITS III funds are promising daily liquidity, there is concern

whether the instruments in which they invest allow them to be as liquid

as they claim.

With this in mind, the next tweak to the directive may aim to ensure

that if funds promise daily liquidity they are able to deliver it. Any

suggestion they cannot would cause a serious credibility problem for

the UCITS framework as a whole.

Risk Management

During 2009 a CESR working group launched a consultation to examine various risk management issues, in particular the use of leverage

through the commitment and VaR approaches. For while leverage is

limited to two times NAV under the regime’s rules, the VaR method

allows exposures to be above this.

The working group’s findings are due to be added to the final version

of the UCITS IV Directive. However, if the changes it proposes on the

risks that managers are able to take fail to provide adequate investor

protection, the rules may need further tightening. Should this transpire,

there will be even more focus on firms’ risk management infrastructures.

6 Asset management CEO Snapshot survey, Financial News, http://www.

efinancialnews.com/story/2010-06-21/funds-invest-in-sales-and-marketing

?ref=email_31128

11

Future Evolution: UCITS V?

The shortcomings identified in UCITS III

meant that before the directive even

came into force there was much discussion about the need for a further iteration to plug the holes it left. But with

UCITS IV now coming down the line are

there additional areas that will need

tackling with a subsequent directive?

WHITE PAPER

Conclusion

In the quarter-century since the regime’s launch, UCITS has grown into

a globally recognized brand that has attracted trillions of dollars of

investor assets. And with the combination of the investment flexibilities introduced by UCITS III and the lessons of the financial crisis, the

framework is broadening its scope to incorporate a new breed of

“hedge fund-lite” vehicles. The upcoming UCITS IV iteration, meanwhile, is broadly welcomed by industry participants as a further step

toward the goal of creating an efficient, harmonized, single European

marketplace, and by US firms as a way to expand their investor base.

But in this brave new world fund firms face intense pressures to minimize their costs and maximize the returns they can offer to clients.

More than ever they require robust and sophisticated technology

capabilities that can take the work burden off staff where possible, and

provide employees with the requisite tools in those areas where humans

are most effective: guiding investment decisions and serving clients.

Increasingly, only those firms that have invested in appropriate IT infrastructures will have the strength, speed, and flexibility to profit from

the opportunities that lie ahead.

About Advent

Advent Software, Inc., a global firm, has provided trusted solutions

to the world’s financial professionals since 1983. Firms in more than

50 countries rely on Advent technology to run their mission-critical

operations. Advent’s quality software, data, services and tools enable

financial professionals to improve service and communication to their

clients, allowing them to grow their business while controlling costs.

Advent is the only financial services software company to be awarded

the Service Capability and Performance certification for being a worldclass support and services organization. For more information on

Advent products visit http://www.advent.com/about/resources/

demos/pr.

Find out more:

www.advent.com

ADVENT

ADVENT SOFTWARE, INC.

®

[HQ]

600 Townsend St., San Francisco, CA 94103 /

[NY]

1114 Avenue of the Americas, New York, NY 10036 /

[HK]

Level 8, Two Exchange Square, 8 Connaught Place, Central, Hong Kong /

[UK]

One Bedford Avenue, London WC1B 3AU, UK /

PH

+1 800 727 0605

PH

PH

+1 212 398 1188

PH

+852 2297 2280

+44 20 7631 9240

Copyright © 2010 Advent Software, Inc. All rights reserved.

Advent, the ADVENT logo, and Advent Software are registered trademarks of Advent Software, Inc. All other products or services

mentioned herein are trademarks of their respective companies. Information subject to change without notice.

c Printed on recycled paper.

WPUCITS0810