Report Builder - Target Corporation - Hoover's Online

advertisement

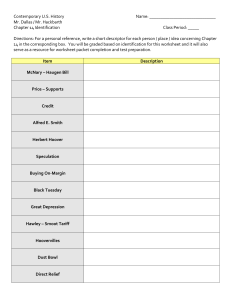

Hoover's Online Report Builder Target Corporation (NYSE: TGT) Copyright 2004, Hoover's, Inc. Report Builder − Target Corporation − Hoover's Online Table of Contents The Basics...............................................................................................................................................................................1 Key Numbers.............................................................................................................................................................1 Financial Overview....................................................................................................................................................1 Officers & Employees................................................................................................................................................2 Board Members..........................................................................................................................................................3 Industry Information..................................................................................................................................................4 SIC Codes...................................................................................................................................................................4 NAICS Codes.............................................................................................................................................................5 Top Competitors.........................................................................................................................................................5 All Competitors..........................................................................................................................................................6 Rankings.....................................................................................................................................................................6 Subsidiaries/Affiliates Covered By Hoover's Online.................................................................................................6 Biographies............................................................................................................................................................................7 Robert J. Ulrich, Age 59...........................................................................................................................................7 Gerald L. Storch, Age 46..........................................................................................................................................7 Gregg W. Steinhafel, Age 49....................................................................................................................................7 Douglas A. Scovanner, Age 47.................................................................................................................................8 James T. Hale, Age 62..............................................................................................................................................8 Todd V. Blackwell, Age 41.......................................................................................................................................9 Michael R. Francis, Age 40.......................................................................................................................................9 Bart Butzer, Age 46.................................................................................................................................................10 Paul L. Singer, Age 49............................................................................................................................................10 John D. Griffith, Age 41.........................................................................................................................................10 Stephen C. Kowalke................................................................................................................................................11 Richard J. Kuzmich.................................................................................................................................................11 Linda L. Ahlers, Age 53..........................................................................................................................................11 Diane L. Neal, Age 46.............................................................................................................................................11 Terrence J. Scully....................................................................................................................................................12 Luis A. Padilla, Age 48...........................................................................................................................................12 Maureen W. Kyer, Age 48......................................................................................................................................12 Ertugrul Tuzcu, Age 50...........................................................................................................................................13 Bernard Boudreaux.................................................................................................................................................13 Roxanne S. Austin, Age 43.....................................................................................................................................13 Calvin (Cal) Darden, Age 54..................................................................................................................................14 Roger A. Enrico, Age 58.........................................................................................................................................14 William W. George, Age 61...................................................................................................................................15 Elizabeth (Betsy) Hoffman, Age 56........................................................................................................................15 Michele J. Hooper, Age 52.....................................................................................................................................15 James A. Johnson, Age 60......................................................................................................................................16 Richard M. (Dick) Kovacevich, Age 59.................................................................................................................16 Anne M. Mulcahy, Age 51......................................................................................................................................17 Stephen W. Sanger, Age 57....................................................................................................................................17 Warren R. Staley, Age 61.......................................................................................................................................18 George W. Tamke, Age 55.....................................................................................................................................18 Solomon D. Trujillo, Age 52...................................................................................................................................19 i Report Builder − Target Corporation − Hoover's Online Table of Contents Overview..............................................................................................................................................................................20 History..................................................................................................................................................................................21 Products/Operations...........................................................................................................................................................22 Other Resources Available On Hoover's Online..............................................................................................................26 Other Resources.......................................................................................................................................................26 Related Products From Our Trusted Partners..........................................................................................................26 Annual Financials................................................................................................................................................................27 Quarterly Financials...........................................................................................................................................................29 Historical Financials & Employees....................................................................................................................................32 Market Data.........................................................................................................................................................................34 Comparison Data.................................................................................................................................................................35 Competitive Landscape.......................................................................................................................................................37 ii The Basics 1000 Nicollet Mall Minneapolis, MN 55403 (Map) http://www.target.com Phone: 612−304−6073 Fax: 612−696−3731 Target stores are at the center of Target Corporation's retail empire. Formerly Dayton Hudson, Target Corporation operates about 1,550 stores in three formats: Target, a discount chain with more than 1,200 stores; 266 Mervyn's midrange department stores, found mainly in the west and south; and Marshall Field's upscale department stores in the upper Midwest. Target and its cousins, including SuperTarget and Target Greatland, account for more than 80% of Target Corporation's sales and have carved out a niche by offering more upscale, fashion−forward merchandise than rivals Wal−Mart and struggling Kmart. Target Corporation also owns catalog retailer Rivertown Trading and apparel supplier Associated Merchandising. Key Numbers Company Type Public (NYSE: TGT) Fiscal Year−End January 2004 Sales (mil.) $48,163.0 1−Year Sales Growth 9.7% 2004 Net Income (mil.) $1,841.0 1−Year Net Income Growth 11.3% 2003 Employees 306,000 1−Year Employee Growth 9.3% Auditor Ernst & Young LLP Financial Overview Last Close 16−Mar−2004 $45.29 52−Week High $45.86 52−Week Low $28.50 Basic EPS $2.01 Price/Earnings Ratio 22.53 Current Ratio 1.55 R&D Expenditures (mil.) −− Ad Expenditures (mil.) −− % Owned by Institutions 85.30% Report Builder − Target Corporation − Hoover's Online 1 Officers & Employees Title Name Age Salary Bonus Chairman and CEO, Target Corporation and Target Stores Robert J. Ulrich 59 $1,423,014 $4,600,000 Vice Chairman Gerald L. Storch 46 $794,131 $927,200 President, Target Stores Gregg W. Steinhafel 49 $895,616 $1,155,930 EVP and CFO Douglas A. Scovanner 47 $671,233 $671,951 EVP, General Counsel, and Secretary James T. Hale 62 EVP, Human Resources and Assets Protection, Target Corporation and The Associated Merchandising Corporation Todd V. Blackwell 41 EVP, Marketing Michael R. Francis 40 EVP, Stores, Target Stores Bart Butzer 46 $641,699 $835,446 SVP, Technology Services and CIO Paul L. Singer 49 SVP, Finance Jane P. Windmeier SVP, General Merchandise Manager Greg Duppler SVP, Property Development John D. Griffith SVP, Target Stores Trish Adams VP and Treasurer Stephen C. Kowalke VP, Community Relations Gail J. Dorn VP, Total Compensation Tracy Kofski VP, Events Marketing and Communication John Remington VP, Government Affairs Nathan K. Garvis VP, Investor Relations Susan D. Kahn VP, Law Timothy R. Baer VP, Media Relations Carolyn Brookter President and CEO, Associated Merchandising Corp. Richard J. Kuzmich President, Marshall Field's Linda L. Ahlers 53 $703,943 $172,583 President, Mervyn's Diane L. Neal 46 President, Target Brands Erica C. Street President, target.direct Dale Nitschke 41 Terrence J. Scully Report Builder − Target Corporation − Hoover's Online 2 President, Target Financial Services EVP, Merchandising, Marshall Field's Luis A. Padilla 48 EVP, Merchandising, Mervyn's Maureen W. Kyer 48 EVP, Store Operations, Marshall Ertugrul Tuzcu Field's VP, Merchandising, Target Stores Sandi Doyle Group Director, Target Stores Carmen Moch Director, Community Relations Laysha Ward Director, Multicultural Merchandising Roberto Madrazo Senior Manager, Community Relations Bernard Boudreaux Assistant Treasurer Jack N. Reif Assistant Treasurer Sara J. Ross Manager, Campus Recruitment Team Jen Johnson Manager, Risk Finance Reesa Baker 50 Board Members Title Name Age Chairman and CEO, Target Corporation and Target Stores Robert J. Ulrich 59 Director Roxanne S. Austin 43 Director Calvin (Cal) Darden 54 Director Roger A. Enrico 58 Director William W. George 61 Director Elizabeth (Betsy) Hoffman 56 Director Michele J. Hooper 52 Director James A. Johnson 60 Director Richard M. (Dick) Kovacevich 59 Director Anne M. Mulcahy 51 Director Stephen W. Sanger 57 Director Warren R. Staley 61 Director George W. Tamke 55 Director Solomon D. Trujillo 52 Report Builder − Target Corporation − Hoover's Online 3 Industry Information • Retail ♦ Discount & Variety Retail (primary) ◊ Warehouse Clubs & Superstores ♦ Apparel & Accessories Retail ◊ Footwear & Related Products Retail ♦ Department Stores ♦ Drug Stores & Pharmacies ♦ Grocery Retail ♦ Nonstore Retail ◊ Internet Retail • Financial Services ♦ Lending ◊ Credit Cards SIC Codes 2251 Women's hosiery, except socks 2252 Hosiery, nec 2311 Men's & boys' suits & coats 2321 Men's & boys' shirts 2322 Men's & boys' underwear & nightwear 2323 Men's & boys' neckwear 2325 Men's & boys' trousers & slacks 2329 Men's & boys' clothing, nec 2331 Women's &misses' blouses & shirts 2335 Women's, &misses' dresses 2337 Women's &misses' suits and coats 2339 Women's &misses' outerwear, necs 2341 Women's and children's underwear 2342 Bras, girdles, and allied garments 2361 Girls' & children's dresses, blouses 2369 Girls' & children's outerwear, nec 2384 Robes and dressing gowns 2385 Waterproof outerwear 2387 Apparel belts 2389 Apparel and accessories, nec 3142 House slippers 3143 Men's footwear, except athletic 3144 Women's footwear, except athletic 3171 Women's handbags and purses 3172 Personal leather goods, nec Report Builder − Target Corporation − Hoover's Online 4 3631 Household cooking equipment 3639 Household appliances, nec 3651 Household audio and video equipment 3944 Games, toys, and children's vehicles 3949 Sporting and athletic goods, nec 3961 Costume jewelry 5136 Men's and boys' clothing 5137 Women's and children's clothing 5139 Footwear 5311 Department stores 5331 Variety stores 5399 Misc. general merchandise stores 5499 Miscellaneous food stores 5611 Men's & boys' clothing stores 5621 Women's clothing stores 5632 Women's accessory &specialty stores 5641 Children's and infants' wear stores 5651 Family clothing stores 5912 Drug stores and proprietary stores 6141 Personal credit institutions 6153 Short−term business credit 6159 Misc. business credit institutions NAICS Codes 445110 Supermarkets and Other Grocery (except Convenience) Stores 446110 Pharmacies and Drug Stores 45211 Department Stores 452112 Discount Department Stores 452910 Warehouse Clubs and Supercenters 452990 All Other General Merchandise Stores 454111 Electronic Shopping 522210 Credit Card Issuing Top Competitors • Federated • Kmart • Wal−Mart Report Builder − Target Corporation − Hoover's Online 5 All Competitors • Albertson's • Bed Bath & Beyond • Best Buy • Costco Wholesale • CVS • Dillard's • Dollar General • eBay • Euromarket Designs • Federated • Foot Locker • Gap • Gottschalks • Home Depot • J. C. Penney • Kmart • Kohl's • Kroger • Limited Brands • Linens 'n Things • May • Neiman Marcus • Nordstrom • Ross Stores • Saks Inc. • Sears • Spiegel • SUPERVALU • TJX • Toys ''R'' Us • Walgreen • Wal−Mart • Williams−Sonoma Rankings • #25 in FORTUNE 500 • S&P 500 • #103 in FT Global 500 Subsidiaries/Affiliates Covered By Hoover's Online • Associated Merchandising Corporation • Marshall Field's • Mervyn's • Target Receivables Corporation Report Builder − Target Corporation − Hoover's Online 6 Biographies Robert J. Ulrich, Age 59 Chairman and CEO, Target Corporation and Target Stores, $1,423,014 salary, $4,600,000 bonus Other Company Affiliations Company Title YUM! Brands, Inc. Director Salary Bonus Recent Work Highlights • Target Corporation ♦ 2001: Chairman and CEO, Target Corporation and Target Stores, $1,415,311 salary, $3,700,000 bonus Biography Robert J. Ulrich is Chairman of the Board, Chief Executive Officer and Chairman of the Executive Committee of the Corporation and Chairman of the Board and Chief Executive Officer of Target Stores, a division of the Corporation. He began his retailing career as a merchandising trainee in the Corporation's department store division in 1967 and advanced through various management positions. He became Chairman and Chief Executive Officer of Target Stores in 1987 and was elected Chairman and Chief Executive Officer of the Corporation in 1994. He is also a director of Yum! Brands, Inc. (formerly known as Tricon Global Restaurants, Inc.). Source: Proxy, April 14, 2003 Gerald L. Storch, Age 46 Vice Chairman, $794,131 salary, $927,200 bonus Recent Work Highlights • Target Corporation ♦ 2001: Vice Chairman, $752,060 salary, $531,037 bonus Biography Gerald L. Storch Vice Chairman of Registrant since January 2001, President, Financial Services and New Businesses of Registrant from 1998 to 2001, President, Credit and Senior Vice President, Strategic Business Development of Registrant from 1997 to 1998 and Senior Vice President of Registrant from 1993 to 1997. Source: 10K, April 14, 2003 Gregg W. Steinhafel, Age 49 President, Target Stores, $895,616 salary, $1,155,930 bonus Report Builder − Target Corporation − Hoover's Online 7 Other Company Affiliations Company Title Salary The Toro Company Director Bonus Recent Work Highlights • Target Corporation ♦ 2001: President, Target Stores, $872,115 salary, $814,027 bonus Biography Gregg W. Steinhafel President of Target Stores since 1999 and Executive Vice President of Target Stores from 1994 to 1999. Source: 10K, April 14, 2003 Douglas A. Scovanner, Age 47 EVP and CFO, $671,233 salary, $671,951 bonus Other Company Affiliations Company Title Salary Target Receivables Corporation President and Director Bonus Recent Work Highlights • Target Corporation ♦ 2001: EVP and CFO, $647,211 salary, $446,495 bonus Biography Douglas A. Scovanner Executive Vice President and Chief Financial Officer of Registrant since February 2000 and Senior Vice President and Chief Financial Officer of Registrant from 1994 to 2000. Source: 10K, April 14, 2003 James T. Hale, Age 62 EVP, General Counsel, and Secretary Other Company Affiliations Company Title Tennant Company Director Salary Report Builder − Target Corporation − Hoover's Online Bonus 8 Biography James T. Hale Executive Vice President, General Counsel and Corporate Secretary of Registrant since March 2000 and Senior Vice President, General Counsel and Corporate Secretary of Registrant from 1981 to 2000. Source: 10K, April 14, 2003 Todd V. Blackwell, Age 41 EVP, Human Resources and Assets Protection, Target Corporation and The Associated Merchandising Corporation Other Company Affiliations Company Title Salary Associated Merchandising Corporation EVP Human Resources Bonus Recent Work Highlights • Target Corporation ♦ Title held until 2003: SVP, Human Resources Biography Todd V. Blackwell Executive Vice President, Human Resources and Assets Protection of Registrant and of The Associated Merchandising Corporation since February 2003. Senior Vice President, Human Resources of Registrant from September 2000 to February 2003. Senior Vice President, Stores of Mervyn's from December 1998 to September 2000 and Regional Vice President, Stores of Mervyn's from August 1995 to December 1998. Source: 10K, April 14, 2003 Michael R. Francis, Age 40 EVP, Marketing Other Company Affiliations Company Title Department 56, Inc. Director Piper Jaffray Companies Director Salary Bonus Recent Work Highlights • Target Corporation ♦ Title held until 2003: SVP, Marketing Report Builder − Target Corporation − Hoover's Online 9 Biography Michael R. Francis Executive Vice President, Marketing of Registrant since February 2003. Senior Vice President, Marketing of Registrant from January 2001 to February 2003. Senior Vice President, Marketing and Visual Merchandising of Marshall Field's from April 1996 to January 2001 and Senior Vice President, Marketing of Marshall Field's from January 1995 to April 1996. Source: 10K, April 14, 2003 Bart Butzer, Age 46 EVP, Stores, Target Stores, $641,699 salary, $835,446 bonus Recent Work Highlights • Target Corporation ♦ 2001: EVP, Stores, Target Stores, $622,115 salary, $598,215 bonus Biography Bart Butzer has served as Executive Vice President of Target Stores since April 2001. Butzer was President of Mervyn's from 1997 to April 2001. Prior to that he was Regional Senior Vice President of Target Stores from 1991 to 1997. Source: 10K, April 14, 2003 Paul L. Singer, Age 49 SVP, Technology Services and CIO Biography Paul L. Singer Senior Vice President, Technology Services and Chief Information Officer of Registrant since April 2000, Senior Vice President, Information Services of Registrant from February 1999 to April 2000 and Vice President, Information Services of Registrant from October 1993 to February 1999. Source: 10K, April 14, 2003 John D. Griffith, Age 41 SVP, Property Development Biography John D. Griffith Senior Vice President, Property Development of Registrant since February 2000 and Vice President, Construction of Registrant from January 1999 to February 2000. Vice President, Office Development at Ryan Companies US, Inc., a real estate development company, from 1995 to 1998. Source: 10K, April 14, 2003 Report Builder − Target Corporation − Hoover's Online 10 Stephen C. Kowalke VP and Treasurer Other Company Affiliations Company Title Salary Target Receivables Corporation VP, Treasurer, and Director Bonus Richard J. Kuzmich President and CEO, Associated Merchandising Corp. Other Company Affiliations Company Title Salary Associated Merchandising Corporation President and CEO Bonus Linda L. Ahlers, Age 53 President, Marshall Field's, $703,943 salary, $172,583 bonus Other Company Affiliations Company Title Marshall Field's President U.S. Bancorp Director Salary Bonus Biography Linda L. Ahlers President of Marshall Field's since 1996 and Executive Vice President, Merchandising of Marshall Field's from 1995 to 1996. Source: 10K, April 14, 2003 Diane L. Neal, Age 46 President, Mervyn's Other Company Affiliations Company Title Salary Mervyn's President Report Builder − Target Corporation − Hoover's Online Bonus 11 Biography Diane L. Neal President of Mervyn's since April 2001, Divisional Merchandise Manager of Target Stores from February 2001 to April 2001, Director, Merchandise Planning of Target Stores from March 1999 to February 2001, and Director, Sourcing for The Associated Merchandising Corporation, a subsidiary of Registrant, from April 1997 to March 1999. Source: 10K, April 14, 2003 Terrence J. Scully President, Target Financial Services Other Company Affiliations Company Title Target Receivables Corporation VP and Director Salary Bonus Recent Work Highlights • Target Corporation ♦ 2003 − 2003, President−Designate, Target Financial Services Luis A. Padilla, Age 48 EVP, Merchandising, Marshall Field's Other Company Affiliations Company Title Marshall Field's EVP, Merchandising Salary Bonus Biography Luis A. Padilla Executive Vice President, Merchandising of Marshall Field's since July 2001 and Senior Vice President, Merchandising, Softlines of Target Stores from July 1994 to July 2001. Source: 10K, April 14, 2003 Maureen W. Kyer, Age 48 EVP, Merchandising, Mervyn's Other Company Affiliations Company Title Salary Mervyn's EVP, Merchandising Report Builder − Target Corporation − Hoover's Online Bonus 12 Biography Maureen W. Kyer Executive Vice President, Merchandising of Mervyn's since 2001, Senior Vice President, Merchandising of Mervyn's since 1996, Vice President, General Merchandise Manager of Mervyn's in 1996 and Vice President, Merchandise Manager of Mervyn's from 1994 to 1996. Source: 10K, April 15, 2002 Ertugrul Tuzcu, Age 50 EVP, Store Operations, Marshall Field's Other Company Affiliations Company Title Marshall Field's EVP, Store Operations Salary Bonus Biography Ertugrul Tuzcu Executive Vice President, Store Operations of Marshall Field's since March 1996. Senior Vice President of Marshall Field's from August 1995 to March 1996. Source: 10K, April 14, 2003 Bernard Boudreaux Senior Manager, Community Relations Other Company Affiliations Company Title Salary Mervyn's Senior Manager, Community Relations Bonus Roxanne S. Austin, Age 43 Director Other Company Affiliations Company Title Abbott Laboratories Director DIRECTV, Inc. President and COO Salary Report Builder − Target Corporation − Hoover's Online Bonus 13 Biography Roxanne S. Austin is Executive Vice President of Hughes Electronics Corporation, a provider of digital television entertainment and technology services, and President and Chief Operating Officer of its subsidiary, DIRECTV, Inc. She joined Hughes in 1993 and has held various positions in finance. In July 1997, she was named Chief Financial Officer of Hughes. In May 2001, she was elected Executive Vice President of Hughes and June 2001, she was named President and Chief Operating Officer of DIRECTV. She is a director of Abbott Laboratories. Source: Proxy, April 14, 2003 Calvin (Cal) Darden, Age 54 Director Other Company Affiliations Company Title Coca−Cola Enterprises Inc. Director United Parcel Service, Inc. SVP US Operations and Director Salary Bonus $435,600 $184,448 Biography Calvin Darden is Senior Vice President of U.S. Operations of United Parcel Service, Inc., an express carrier and package delivery company. He joined UPS in 1971 and has held various operational and managerial positions. In December 1997, he was elected Senior Vice President of Domestic Operations and in January 2000 he was elected to his current position. He is a director of United Parcel Service, Inc. Mr. Darden joined the board of directors of Target Corporation in 2003. Source: Proxy, April 14, 2003 Roger A. Enrico, Age 58 Director Other Company Affiliations Company Title Belo Corp. Director Electronic Data Systems Corporation Director Salary Bonus Biography Roger A. Enrico is the retired Chairman of the Board and Chief Executive Officer of PepsiCo, Inc., a domestic and international beverage and food business. He joined PepsiCo in 1971. He was elected Chairman of the Board and Chief Executive Officer of PepsiCo in 1996, and became Vice Chairman in May 2001. He retired in March 2002. He is a director of Belo Corp., Electronic Data Systems Corp., PepsiCo, Inc. and The National Geographic Society. Source: Proxy, April 14, 2003 Report Builder − Target Corporation − Hoover's Online 14 William W. George, Age 61 Director Other Company Affiliations Company Title The Goldman Sachs Group, Inc. Director Salary Bonus Biography William W. George is the former Chairman of the Board and Chief Executive Officer of Medtronic, Inc., a therapeutic medical technology company. He joined Medtronic in 1989 as President and Chief Operating Officer. He was elected Chief Executive Officer in 1991 and Chairman of the Board in 1996. He retired from his position as Chief Executive Officer in April 2001 and as Chairman of the Board in April 2002. He is a director of The Goldman Sachs Group, Inc. and Novartis AG. Source: Proxy, April 14, 2003 Elizabeth (Betsy) Hoffman, Age 56 Director Other Company Affiliations Company Title University of Colorado President Salary Bonus Biography Elizabeth Hoffman is President of The University of Colorado System. In 1997, she joined the University of Illinois at Chicago as Provost and Vice Chancellor for Academic Affairs while holding concurrent academic appointments as professor of economics, history, political science, psychology and professor in The Institute of Government and Public Affairs. She held these positions until September 2000, when she was appointed to her current position. Ms. Hoffman joined the board of directors of Target Corporation in 2003. Source: Proxy, April 14, 2003 Michele J. Hooper, Age 52 Director Other Company Affiliations Company Title DaVita Inc. Director PPG Industries, Inc. Director Salary Report Builder − Target Corporation − Hoover's Online Bonus 15 Recent Work Highlights • Caremark International Inc. ♦ Last position held, VP; President, International Business Group Biography Michele J. Hooper served as President and Chief Executive Officer of Voyager Expanded Learning, an educational development company, from August 1999 to June 2000. She was Corporate Vice President, International Businesses, Caremark International, Inc., a health care company, from 1993 to July 1998. In July 1998, she became President and Chief Executive Officer of Stadtlander Drug Company, Inc., a pharmaceutical drug company, and served in that position until January 1999 when that company was acquired. She is a director of PPG Industries, Inc. Source: Proxy, April 14, 2003 James A. Johnson, Age 60 Director Other Company Affiliations Company Title Gannett Co., Inc. Director The Goldman Sachs Group, Inc. Director The John F. Kennedy Center for the Performing Arts Chairman KB Home Director Temple−Inland Inc. Director UnitedHealth Group Incorporated Director Salary Bonus Biography James A. Johnson is Vice Chairman of Perseus, LLC, a merchant banking private equity firm. From 1991 to 1998, he served as Chairman and Chief Executive Officer of Fannie Mae, a Congressionally−chartered financial services company, and from 1998 to 1999, he was the Chairman of the Executive Committee of the Board of Fannie Mae. From December 1999 to April 2001, he served as Chairman and Chief Executive Officer of Johnson Capital Partners. In April 2001, he was elected to his current position. He is a director of Gannett Co., Inc., The Goldman Sachs Group, Inc., KB Home, Temple−Inland Inc. and UnitedHealth Group. Source: Proxy, April 14, 2003 Richard M. (Dick) Kovacevich, Age 59 Director Other Company Affiliations Company Title Salary Report Builder − Target Corporation − Hoover's Online Bonus 16 Wells Fargo & Company Chairman, President, and CEO $995,000 $7,000,000 Recent Work Highlights • Wells Fargo & Company ♦ 2001: Chairman, President, and CEO, $995,000 salary, $2,400,000 bonus Biography Richard M. Kovacevich is Chairman of the Board and Chief Executive Officer of Wells Fargo & Co., a banking and financial services company. In 1995, he was elected Chairman of the Board and Chief Executive Officer of Norwest Corp., a banking and financial services company, and held that position until Norwest merged with Wells Fargo in 1998, when he was elected President and Chief Executive Officer. In April 2001 he was elected to his current positions. He is also a director of Cargill, Inc. Source: Proxy, April 14, 2003 Anne M. Mulcahy, Age 51 Director Other Company Affiliations Company Title Fannie Mae Director Xerox Corporation Chairman and CEO Salary Bonus $1,000,000 $1,500,000 Recent Work Highlights • Xerox Corporation ♦ 2001: Chairman and CEO, $1,000,000 salary, $1,250,000 bonus Biography Anne M. Mulcahy is Chairman of the Board and Chief Executive Officer of Xerox Corp., a document management company. She joined Xerox in 1976 and has held various management positions in marketing, human resources and operations. From 1997 to 1998, she was Vice President and Chief Staff Officer. She served as Executive Vice President; President, General Markets Operations from 1998 until May 2000, and President and Chief Operating Officer from May 2000 through July 2001. In August 2001 she was elected Chief Executive Officer and in January 2002 she was elected Chairman of the Board. She is also a director of Fannie Mae. Source: Proxy, April 14, 2003 Stephen W. Sanger, Age 57 Director Report Builder − Target Corporation − Hoover's Online 17 Other Company Affiliations Company Title Donaldson Company, Inc. Director General Mills, Inc. Chairman and CEO Wells Fargo & Company Director Salary Bonus $875,500 $1,625,147 Recent Work Highlights • General Mills, Inc. ♦ 2002: Chairman and CEO, $784,462 salary, $941,044 bonus ♦ 2001: Chairman and CEO, $696,150 salary, $1,261,100 bonus Biography Stephen W. Sanger is Chairman of the Board and Chief Executive Officer of General Mills, Inc., a consumer food products company. He joined General Mills in 1974 and held a series of positions in marketing and management across the company's consumer food businesses. In 1995, he was elected to his current positions. He is also a director of Donaldson Company, Inc. Source: Proxy, April 14, 2003 Warren R. Staley, Age 61 Director Other Company Affiliations Company Title Cargill, Incorporated Chairman and CEO U.S. Bancorp Director Salary Bonus Biography Warren R. Staley is Chairman of the Board and Chief Executive Officer of Cargill, Inc., an international marketer, processor and distributor of agricultural, food, financial and industrial products and services. He joined Cargill in 1969 and has held various merchandising, administrative and management positions. He served as President and Chief Operating Officer from February 1998 until June 1999 and as President and Chief Executive Officer from June 1999 until August 2000, when he was elected to his current positions. He is also a director of U.S. Bancorp. Source: Proxy, April 14, 2003 George W. Tamke, Age 55 Director Report Builder − Target Corporation − Hoover's Online 18 Other Company Affiliations Company Title Clayton, Dubilier & Rice, Inc. General Partner Salary Bonus Biography George W. Tamke is a Partner with Clayton, Dubilier & Rice, Inc., a private investment firm. He served as President of Emerson Electric Company, a manufacturer of electrical and electronic equipment, in 1997, as President and Chief Operating Officer from 1997 to 1999 and as Vice Chairman and Co−Chief Executive Officer from 1999 to February 2000. He assumed his current position in March 2000. He is a director of ICO Global Communications (Holdings) Ltd. and Kinko's, Inc. Source: Proxy, April 14, 2003 Solomon D. Trujillo, Age 52 Director Other Company Affiliations Company Title Salary France Telecom SA SEVP; Chairman and CEO, Orange SA Gannett Co., Inc. Director Orange SA Chairman and CEO PepsiCo, Inc. Director Bonus Recent Work Highlights • Graviton, Inc. ♦ Last position held, Chairman, President, and CEO • U S WEST, Inc. ♦ Last position held, Chairman, President and CEO Biography Solomon D. Trujillo is Chief Executive Officer and a director of Orange SA, a telecommunications company. From 1995 until June 1998, he was President and Chief Executive Officer of US WEST Communications Group, Inc., a business of US WEST, Inc., a telephone communications company which was merged with and into Qwest Corporation in June 2000. From June 1998 until November 2000, he served as Chairman, President and Chief Executive Officer of US West. In November 2000, he was elected Chairman, President and Chief Executive Officer of Graviton, Inc., a wireless communication technology company, positions he held until February 2003. He was elected to his current position in February 2003. He is also a director of Gannett Co., Inc. and PepsiCo, Inc. Source: Proxy, April 14, 2003 Report Builder − Target Corporation − Hoover's Online 19 Overview Target stores are at the center of Target Corporation's retail empire. Formerly Dayton Hudson, Target Corporation operates about 1,550 stores in three formats: Target, a discount chain with more than 1,200 stores; 266 Mervyn's midrange department stores, found mainly in the west and south; and Marshall Field's upscale department stores in the upper Midwest. Target and its cousins, including SuperTarget and Target Greatland, account for more than 80% of Target Corporation's sales and have carved out a niche by offering more upscale, fashion−forward merchandise than rivals Wal−Mart and struggling Kmart. Target Corporation also owns catalog retailer Rivertown Trading and apparel supplier Associated Merchandising. The company's namesake discount store division is expanding aggressively in the Northeast and Mid−Atlantic. It is expanding its SuperTarget format (most recently in Texas), a newer 174,000−sq.−ft. grocery/discount store concept that includes groceries under the Archer Farms brand. Other formats include Target Greatland (70% larger than regular Targets) and a growing online store called target.direct. Target is also testing dollar sections, called One−Stop, in some stores. The chain will also build two new import warehouses in a bid to increase direct sourcing. A 156,000−square−foot store in the Bronx is slated to open in 2004. Target has distinguished itself from rival Wal−Mart Stores and grown to become the nation's #2 discounter by employing a strategy that relies on exclusive private−label offerings from big name designers. Fashion designer Isaac Mizrahi joined the discounter's stable of in−house talent in mid−2003 offering a line of chic and affordable women's apparel and accessories. Other designers with exclusive lines at Target include Amy Coe (children's bedding and accessories), Liz Lange (maternity), Mossimo (junior fashions), and the architect Michael Graves (housewares). Target Corporation has repositioned its Hudson's and Dayton's chains all under the Marshall Field's banner and is closing or selling off under performing stores, most recently two stores in Columbus, Ohio, to rival The May Department Stores Company. It plans to lease large portions of Field's flagship State Street store in Chicago (second in size only to Macy's Herald Square location) to outside upscale vendors to boost sales per square foot. Mervyn's, meanwhile, is being squeezed by both discounters (including a newcomer to California, Kohl's) and higher−end retailers. After years of struggling to revive its Mervyn's and Marshall Field's operations, Target Corp. has hired Goldman Sachs to possibly sell one or both of the chains, whose book value is about $1.8 billion each. The nation's #2 discounter is #1 when it comes to corporate giving. Target topped the Forbes list of America's Most Philanthropic Companies in 2001, donating 2.5% of its 2000 income (nearly $86 million). By comparison Wal−Mart gave away $116.5 million in 2001, less than 1% of its income in 2000. Target plans to drop paid vacation and health insurance coverage for part−time workers at its Target stores. Report Builder − Target Corporation − Hoover's Online 20 History The panic of 1873 left Joseph Hudson bankrupt. After he paid his debts at 60 cents on the dollar, he saved enough to open a men's clothing store in Detroit in 1881. Among his innovations were merchandise−return privileges and price marking in place of bargaining. By 1891 Hudson's was the largest retailer of men's clothing in the US. Hudson repaid his creditors from 1873 in full, with interest. When Hudson died in 1912, four nephews expanded the business. Former banker George Dayton established a dry−goods store in 1902 in Minneapolis. Like Hudson, he offered return privileges and liberal credit. His store grew to a 12−story, full−line department store. After WWII both companies saw that the future lay in the suburbs. In 1954 Hudson's built Northland in Detroit, then the largest US shopping center. Dayton's built the world's first fully enclosed shopping mall in Edina, a Minneapolis suburb, in 1956. In 1962 Dayton's opened its first discount store in Roseville (naming the store Target to distinguish the discounter from its higher−end department stores). Dayton's went public in 1966, the same year it began the B. Dalton bookstore chain. Three years later it merged with the family−owned Hudson's, forming Dayton Hudson. Dayton Hudson purchased more malls and invested in such specialty areas as consumer electronics and hard goods. Target had 24 stores by 1970. The Target chain became the company's top moneymaker in 1977. The next year Dayton Hudson bought California−based Mervyn's. In the late 1970s and 1980s, it sold nine regional malls and several other businesses, including the 800−store B. Dalton chain to Barnes & Noble. The Target stores division purchased Indianapolis−based Ayr−Way (1980) and Southern California−based Fedmart stores (1983). In the late 1980s Dayton Hudson took Target to Los Angeles and the Northwest. Robert Ulrich, who began with the company as a merchandise trainee in 1967, became president and CEO of the Target stores division in 1987 and chairman and CEO of Dayton Hudson in 1994. Dayton Hudson opened the first Target Greatland store in 1990. By this time it had 420 Target stores. Also that year Dayton Hudson bought the Marshall Field's chain of 24 department stores from B.A.T Industries. Marshall Field's began as a dry−goods business that Marshall Field bought in 1865 and subsequently built into Chicago's premier upscale retailer. SuperTarget stores were introduced in 1995. The Target stores division opened stores in the Mid−Atlantic and Northeast the next year, while the department store division began selling off its Marshall Field's locations in Texas. In 1998 Dayton Hudson boosted its Internet presence by purchasing direct−marketing company Rivertown Trading; it also bought apparel supplier Associated Merchandising that year. In 2000 Dayton Hudson renamed itself Target Corporation. In early 2001 the company renamed its Dayton's and Hudson's chains Marshall Field's. Also that year Target acquired the rights to 35 former Montgomery Wards stores from the bankrupt retailer. The following year it opened 30 of them as Target stores. Net of closings, 94 Target stores opened in 2002, while neither Mervyn's nor Marshall Field's added to their store counts. In March 2003, three new SuperTarget stores opened in the Dallas/Fort Worth area. Report Builder − Target Corporation − Hoover's Online 21 Products/Operations 2003 Discount & Midrange Stores Target Mervyn's California 175 124 Texas 98 42 Florida 73 − Minnesota 62 9 Illinois 59 − Michigan 52 15 Ohio 41 − Georgia 37 − Arizona 35 15 Indiana 34 − New York 32 − Virginia 29 − Washington 29 14 Wisconsin 29 − Colorado 28 11 New Jersey 26 − Pennsylvania 26 − Missouri 24 − North Carolina 24 − Maryland 23 − Tennessee 20 − Iowa 19 − Massachusetts 15 − Oregon 15 7 Nevada 13 6 Kentucky 12 − South Carolina 12 − Kansas 11 − Nebraska 10 − Alabama 9 − Louisiana 9 6 Oklahoma 9 3 New Mexico 8 3 Utah 8 8 Montana 6 − Connecticut 5 − Idaho 5 1 North Dakota 4 − South Dakota 4 − Arkansas 3 − New Hampshire 3 − Delaware 2 − Mississippi 2 − Rhode Island 2 − West Virginia 2 − Wyoming 2 − Maine 1 − Total 1,147 264 2003 Upscale Department Stores Marshall Field's No. Michigan 21 Illinois 17 Minnesota 12 Wisconsin 5 North Dakota 3 Ohio 3 Report Builder − Target Corporation − Hoover's Online 22 Indiana South Dakota Total 2 1 64 Target Mervyn's Marshall Field's Other 2003 Sales $ mil. % of total 36,917 84 3,816 9 2,691 6 493 1 Total 43,917 100 Selected Designer Private Labels • Amy Coe (children's bedding & accessories) • Isaac Mizrahi (women's apparel & accessories) • Liz Lange (maternity) • Michael Graves (housewares) • Mossimo (junior fashions) • Sonia Kashuk (cosmetics & fragrances) • Todd Oldham (bedding & furniture) Selected Private Labels • Archer Farms (food) • Cherokee (apparel) • Furio (housewares) • Honors (apparel) • In Due Time (maternity wear) • Merona (apparel) • Utility (apparel) • Xhilaration (apparel) Store Formats • Marshall Field's (upscale department stores in the Midwest) • Mervyn's (midrange department stores, primarily in the Midwest and West) • SuperTarget (groceries and general merchandise) • Target (upscale discount stores) • Target Greatland (about 70% larger than the average Target) Other Operations • Associated Merchandising Corporation (apparel sourcing for department stores) • Rivertown Trading (catalogs and e−commerce) • Britannia (British video and gifts) • I Love A Deal (apparel, housewares, and jewelry) • Seasons (traditional) • Signals (educational) • Wireless (home electronics) Archived Charts Report Builder − Target Corporation − Hoover's Online 23 California Texas Florida Minnesota Illinois Michigan Ohio Arizona Indiana Georgia Washington Wisconsin Virginia Colorado New York North Carolina Pennsylvania Maryland New Jersey Missouri Iowa Tennessee Nevada Kentucky Oregon Massachusetts Kansas Nebraska South Carolina Utah New Mexico Oklahoma Alabama Montana Idaho Connecticut Louisiana North Dakota South Dakota New Hampshire Arkansas Delaware Mississippi Wyoming Maine Rhode Island West Virginia Total Michigan Illinois Minnesota Wisconsin North Dakota Ohio Indiana South Dakota Total 2002 Discount & Midrange Stores Target Mervyn's 159 124 95 42 69 − 59 9 53 − 50 15 38 − 34 15 34 − 33 − 28 14 28 − 26 − 25 11 25 − 24 − 23 − 22 − 21 − 20 − 19 − 19 − 12 6 12 − 11 7 11 − 10 − 10 − 10 − 8 8 8 3 8 3 7 − 6 − 5 1 5 − 4 6 4 − 4 − 3 − 2 − 2 − 2 − 2 − 1 1 − 1 − 1,053 264 2002 Upscale Department Stores Marshall Field's No. 21 17 12 5 3 3 2 1 64 Report Builder − Target Corporation − Hoover's Online 24 2002 Sales Target Mervyn's Marshall Field's Corporate & other $ mil. 32,588 4,038 2,829 433 Total 39,888 % of total 82 10 7 1 100 Report Builder − Target Corporation − Hoover's Online 25 Other Resources Available On Hoover's Online News for Target (last 90 days) Company Press Release Archive Other Resources • Headquarters Map • SEC Filings ♦ 10−K Filings • Stock Quote • Stock Chart • Earnings Estimates • ValuEngine Analysis • Annual Report • Investor Relations • Financial Data Definitions • Market Data Definitions • Comparison Data Definitions • Historical Financials & Employees Definitions Related Products From Our Trusted Partners Buy Reports and Books Additional Research On Target • D&B Business/Credit Reports: Target Corporation • Corporate Hierarchy (D&B, Feb 1, 2004, Business Reports) • Target Corporation: Company Profile (Datamonitor, Feb 1, 2004, Business Reports) • Quantitative Report for TGT (ValuEngine, Inc., Jan 1, 2004, Business Reports) • Mortgages on Aisle Five: The Trend Toward Financial Supermarkets in the Financial Services Industry (Hoover's, Inc., Feb 1, 2004, Business Reports) • Drugs & Druggists' Sundries Wholesale Major Companies Report (Harris Industry Reports, Aug 12, 2003, Business Reports) • Credit Cards: Financial Analysis Profiles (BizMiner, Dec 23, 2003, Business Reports) • All Other General Merchandise Stores in the US (IBISWorld, Jan 28, 2004, Business Reports) • Special Package: Online Retail Strategies and Projections (Forrester Research Inc, Jan 1, 2001, Business Reports) Additional 3rd Party Libraries Report Builder − Target Corporation − Hoover's Online 26 Annual Financials All amounts in millions of US Dollars Income Statement Jan 04 (Prelim.) Jan 03 Jan 02 48,163.0 43,917.0 39,888.0 Cost of Goods Sold −− 29,260.0 27,246.0 Gross Profit −− 14,657.0 12,642.0 Gross Profit Margin −− 33.4% 31.7% SG&A Expense −− 10,181.0 8,883.0 Depreciation & Amortization −− 1,212.0 1,079.0 Operating Income −− 3,264.0 2,680.0 Operating Margin −− 7.4% 6.7% Nonoperating Income −− 0.0 0.0 Nonoperating Expenses −− 588.0 464.0 Income Before Taxes −− 2,676.0 2,216.0 Income Taxes −− 1,022.0 842.0 Net Income After Taxes −− 1,654.0 1,374.0 1,841.0 1,654.0 1,374.0 0.0 0.0 0.0 Total Operations 1,841.0 1,654.0 1,374.0 Total Net Income 1,841.0 1,654.0 1,368.0 Net Profit Margin 3.8% 3.8% 3.4% Diluted EPS from Continuing Operations ($) 2.01 1.81 1.51 Diluted EPS from Discontinued Operations ($) 0.00 0.00 0.00 Diluted EPS from Total Operations ($) 2.01 1.81 1.51 0.26 0.24 0.22 Jan 04 (Prelim.) Jan 03 Jan 02 Cash −− 758.0 499.0 Net Receivables −− 5,565.0 3,831.0 Inventories −− 4,760.0 4,449.0 Revenue Continuing Operations Discontinued Operations Diluted EPS from Total Net Income ($) Dividends per Share Balance Sheet Assets Current Assets Report Builder − Target Corporation − Hoover's Online 27 Other Current Assets −− 852.0 869.0 Total Current Assets −− 11,935.0 9,648.0 Net Fixed Assets −− 15,307.0 13,533.0 Other Noncurrent Assets −− 1,361.0 973.0 Total Assets −− 28,603.0 24,154.0 Jan 04 (Prelim.) Jan 03 Jan 02 Accounts Payable −− 4,684.0 4,160.0 Short−Term Debt −− 975.0 905.0 Other Current Liabilities −− 1,864.0 1,989.0 Total Current Liabilities −− 7,523.0 7,054.0 Long−Term Debt −− 10,186.0 8,088.0 Other Noncurrent Liabilities −− 0.0 0.0 Total Liabilities −− 19,160.0 16,294.0 Preferred Stock Equity −− 0.0 0.0 Common Stock Equity −− 9,443.0 7,860.0 Total Equity −− 9,443.0 7,860.0 911.5 909.8 902.8 Jan 04 (Prelim.) Jan 03 Jan 02 Net Operating Cash Flow −− 1,590.0 1,992.0 Net Investing Cash Flow −− (3,189.0) (3,310.0) Net Financing Cash Flow −− 1,858.0 1,461.0 Net Change in Cash −− 259.0 143.0 Depreciation & Amortization −− 1,212.0 1,079.0 Capital Expenditures −− (3,221.0) (3,163.0) Cash Dividends Paid Data Definitions −− (218.0) (203.0) Liabilities and Shareholders' Equity Current Liabilities Shareholders' Equity Shares Outstanding (mil.) Cash Flow Statement Some financial information provided by Media General Financial Services, Inc. Report Builder − Target Corporation − Hoover's Online , Richmond, Virginia 28 Quarterly Financials All amounts in millions of US Dollars except per share amounts. Income Statement Revenue Quarter Ending Jan Quarter Ending 04 (Prelim.) Oct 03 Quarter Quarter Ending Ending Jul 03 Apr 03 Quarter Ending Jan 03 15,571.0 11,286.0 10,984.0 10,322.0 14,061.0 Cost of Goods Sold −− 7,444.0 7,245.0 6,764.0 9,562.0 Gross Profit −− 3,842.0 3,739.0 3,558.0 4,499.0 Gross Profit Margin −− 34.0% 34.0% 34.5% 32.0% SG&A Expense −− 2,900.0 2,676.0 2,536.0 2,909.0 Depreciation & Amortization −− 330.0 329.0 317.0 323.0 Operating Income −− 612.0 734.0 705.0 1,267.0 Operating Margin −− 5.4% 6.7% 6.8% 9.0% Nonoperating Income −− 0.0 0.0 0.0 0.0 Nonoperating Expenses −− 131.0 156.0 142.0 154.0 Income Before Taxes −− 481.0 578.0 563.0 1,113.0 Income Taxes −− 179.0 220.0 214.0 425.0 Net Income After Taxes −− 302.0 358.0 349.0 688.0 832.0 302.0 358.0 349.0 688.0 0.0 0.0 0.0 0.0 0.0 Total Operations 832.0 302.0 358.0 349.0 688.0 Total Net Income 832.0 302.0 358.0 349.0 688.0 Net Profit Margin 5.3% 2.7% 3.3% 3.4% 4.9% Diluted EPS from Continuing Operations ($) 0.91 0.33 0.39 0.38 0.75 Diluted EPS from Discontinued Operations ($) 0.00 0.00 0.00 0.00 0.00 Diluted EPS from Total Operations ($) 0.91 0.33 0.39 0.38 0.75 0.07 0.07 0.06 0.06 0.06 Quarter Quarter Ending Ending Jul 03 Apr 03 Quarter Ending Jan 03 Continuing Operations Discontinued Operations Diluted EPS from Total Net Income ($) Dividends per Share Balance Sheet Quarter Ending Jan Quarter Ending 04 (Prelim.) Oct 03 Report Builder − Target Corporation − Hoover's Online 29 Assets Current Assets Cash −− 495.0 429.0 452.0 758.0 Net Receivables −− 5,367.0 5,343.0 5,275.0 5,565.0 Inventories −− 6,269.0 4,944.0 4,944.0 4,760.0 Other Current Assets −− 1,153.0 1,257.0 1,321.0 852.0 Total Current Assets −− 13,284.0 11,973.0 11,992.0 11,935.0 Net Fixed Assets −− 16,628.0 16,205.0 15,663.0 15,307.0 Other Noncurrent Assets −− 1,512.0 1,456.0 1,517.0 1,361.0 Total Assets −− 31,424.0 29,634.0 29,172.0 28,603.0 Quarter Quarter Ending Ending Jul 03 Apr 03 Quarter Ending Jan 03 Liabilities and Shareholders' Equity Quarter Ending Jan Quarter Ending 04 (Prelim.) Oct 03 Current Liabilities Accounts Payable −− 5,327.0 4,470.0 4,411.0 4,684.0 Short−Term Debt −− 1,475.0 767.0 713.0 975.0 Other Current Liabilities −− 1,794.0 1,724.0 1,677.0 1,864.0 Total Current Liabilities −− 8,596.0 6,961.0 6,801.0 7,523.0 Long−Term Debt −− 11,003.0 11,088.0 11,118.0 10,186.0 Other Noncurrent Liabilities −− 0.0 0.0 0.0 0.0 Total Liabilities −− 21,159.0 19,590.0 19,412.0 19,160.0 Preferred Stock Equity −− 0.0 0.0 0.0 0.0 Common Stock Equity −− 10,265.0 10,044.0 9,760.0 9,443.0 Total Equity −− 10,265.0 10,044.0 9,760.0 9,443.0 911.5 911.5 910.9 910.8 909.8 Quarter Quarter Ending Ending Jul 03 Apr 03 Quarter Ending Jan 03 Shareholders' Equity Shares Outstanding (mil.) Cumulative Cash Flow Statement Quarter Ending Jan Quarter Ending 04 (Prelim.) Oct 03 Net Operating Cash Flow −− 846.0 563.0 (245.0) 1,590.0 Net Investing Cash Flow −− (2,295.0) (1,516.0) (655.0) (3,189.0) Net Financing Cash Flow −− 1,186.0 624.0 594.0 1,858.0 Net Change in Cash −− (263.0) (329.0) (306.0) 259.0 Report Builder − Target Corporation − Hoover's Online 30 Depreciation & Amortization −− 330.0 329.0 317.0 323.0 Capital Expenditures −− (2,330.0) (1,541.0) (674.0) (3,221.0) Cash Dividends Paid −− (173.0) (109.0) (55.0) (218.0) Data Definitions Some financial information provided by Media General Financial Services, Inc. Report Builder − Target Corporation − Hoover's Online , Richmond, Virginia 31 Historical Financials & Employees Income Statement Year Revenue ($ mil.) Net Income ($ mil.) Net Profit Margin Employees Jan 03 43,917.0 1,654.0 3.8% 306,000 Jan 02 39,888.0 1,368.0 3.4% 280,000 Jan 01 36,903.0 1,264.0 3.4% 254,000 Jan 00 33,702.0 1,144.0 3.4% 214,000 Jan 99 30,951.0 935.0 3.0% 244,000 Jan 98 27,757.0 751.0 2.7% 230,000 Jan 97 25,371.0 463.0 1.8% 218,000 Jan 96 23,516.0 311.0 1.3% 214,000 Jan 95 21,311.0 434.0 2.0% 194,000 Jan 94 19,233.0 375.0 1.9% 174,000 Stock History Stock Price ($) Year P/E Per Share ($) FY High FY Low FY Close High Low Earns. Div. Book Value Jan 03 46.2 24.9 28.2 25.5 13.8 1.8 0.2 10.4 Jan 02 44.4 26.0 44.4 29.4 17.2 1.5 0.2 8.7 Jan 01 39.2 21.6 38.0 28.4 15.7 1.4 0.2 7.3 Jan 00 38.5 27.1 32.9 30.3 21.4 1.2 0.2 6.4 Jan 99 32.2 15.7 31.9 31.6 15.4 1.0 0.1 6.0 Jan 98 18.6 9.4 18.0 21.9 11.1 0.8 0.2 5.1 Jan 97 10.2 6.1 9.4 20.3 12.1 0.5 0.2 4.4 Jan 96 6.7 5.3 6.2 20.3 16.0 0.3 0.2 4.0 Jan 95 7.2 5.4 5.7 15.7 11.7 0.5 0.1 3.8 Jan 94 7.1 5.2 5.5 17.7 13.0 0.4 0.1 3.3 2003 Year−End Financials Debt ratio 107.9% Return on equity 17.5% Cash ($ mil.) 758.0 Current ratio 1.59 Long−term debt ($ mil.) 10,186.0 Report Builder − Target Corporation − Hoover's Online 32 Shares Outstanding (mil.) 909.8 Dividend yield 0.9% Dividend payout 13.3% Market value ($ mil.) 25,665.5 Data Definitions Some financial information provided by Media General Financial Services, Inc. Report Builder − Target Corporation − Hoover's Online , Richmond, Virginia 33 Market Data Current Information Last Close 16−Mar−2004 $45.29 Price/Sales Ratio 0.86 52−Week High $45.86 Price/Book Ratio 4.02 52−Week Low $28.50 Price/Earnings Ratio 60−Month Beta 22.53 1.0 Price/Cash Flow Ratio Market Value (mil.) Shares Outstanding (mil.) Dividend Rate 13.77 $41,280.1 Return on Assets 5.9% 911.5 Return on Equity 17.9% 0.28 Current Ratio 1.55 Dividend Yield 0.6% Long−Term Debt/Equity −− # of Institutional Holders 1,875 % Owned by Institutions 85.3% Latest Short Interest Ratio Growth Rates Revenue Growth EPS Growth Dividend Growth 2.40 Latest Net Insider Transactions 0.00 12 Month 36 Month 60 Month 9.7% 9.4% 9.2% 11.1% 14.0% 13.8% 8.3% 7.5% 11.1% Data Definitions Some financial information provided by Media General Financial Services, Inc. Report Builder − Target Corporation − Hoover's Online , Richmond, Virginia 34 Comparison Data Company Industry1 Market2 35.60% 24.08% 48.19% Pre−Tax Profit Margin 5.68% 5.05% 6.72% Net Profit Margin 3.82% 3.18% 3.78% Return on Equity 17.9% 18.8% 7.4% Return on Assets 5.9% 7.8% 1.2% Return on Invested Capital 8.7% 12.5% 3.7% Company Industry1 Market2 0.86 0.91 1.39 22.53 28.96 36.25 4.02 5.36 2.71 13.77 18.96 13.91 Company Industry1 Market2 40.12 7.90 59.16 Inventory Turnover 5.2 7.1 7.6 Days Cost of Goods Sold in Inventory 69 50 48 Asset Turnover 1.6 2.5 0.3 Net Receivables Turnover Flow 9.4 45.9 6.2 38.0% 35.9% 42.4% Company Industry1 Market2 1.55 1.16 1.41 0.7 0.3 1.0 Leverage Ratio 3.06 2.40 5.95 Total Debt/Equity 1.22 0.61 1.40 Interest Coverage 5.70 11.20 2.20 Company Industry1 Market2 52.84 52.06 19.86 Fully Diluted Earnings Per Share from Total Operations 2.01 1.63 0.76 Dividends Per Share 0.26 0.25 0.43 Cash Flow Per Share 3.29 2.49 1.98 Working Capital Per Share 5.14 1.09 2.22 Long−Term Debt Per Share 12.07 4.43 10.29 Book Value Per Share 11.26 8.80 10.15 Profitability Gross Profit Margin Valuation Price/Sales Ratio Price/Earnings Ratio Price/Book Ratio Price/Cash Flow Ratio Operations Days of Sales Outstanding Effective Tax Rate Financial Current Ratio Quick Ratio Per Share Data ($) Revenue Per Share Report Builder − Target Corporation − Hoover's Online 35 Total Assets Per Share 34.48 21.09 60.41 Company Industry1 Market2 9.7% 2.1% 6.1% 12−Month Net Income Growth 11.3% 1.6% 129.0% 12−Month EPS Growth 11.1% 1.2% 137.5% 12−Month Dividend Growth 8.3% 4.2% 4.9% 36−Month Revenue Growth 9.4% 4.9% 2.3% 36−Month Net Income Growth 14.1% 13.8% (11.4%) 36−Month EPS Growth 14.0% 16.9% (12.0%) 7.5% 8.6% 2.2% Growth 12−Month Revenue Growth 36−Month Dividend Growth 1Industry: Discount, Variety Stores Industry classifications are from Media General Financial Services, Inc. 2 . Public companies trading on the New York Stock Exchange, the American Stock Exchange, and the NASDAQ National Market. Data Definitions Some financial information provided by Media General Financial Services, Inc. Report Builder − Target Corporation − Hoover's Online , Richmond, Virginia 36 Competitive Landscape KEY: Best of Group. Companies listed are Top Competitors. Target Federated Kmart 1 Wal−Mart 48,163.0 15,264.0 30,762.0 256,329.0 −− −− 212,000 −− 41,280.1 9,316.1 −− 250,894.2 Profitability Target Federated Kmart 1 Wal−Mart Industry2 Market3 Gross Profit Margin 35.60% 44.83% −− 24.72% 24.08% 48.19% Pre−Tax Profit Margin 5.68% 6.23% −− 5.33% 5.05% 6.72% Net Profit Margin 3.82% 4.54% −− 3.53% 3.18% 3.78% Return on Equity 17.9% 12.5% −− 21.5% 18.8% 7.4% Return on Assets 5.9% 4.7% −− 8.6% 7.8% 1.2% Return on Invested Capital 8.7% 8.0% −− 14.6% 12.5% 3.7% Target Federated 1 Wal−Mart 2 Market3 0.86 0.61 −− 0.98 0.91 1.39 22.53 13.89 −− 28.00 28.96 36.25 4.02 1.68 −− 5.95 5.36 2.71 13.77 7.25 −− 19.78 18.96 13.91 Target Federated Kmart 1 Wal−Mart Industry2 Market3 40.12 68.54 −− 1.56 7.90 59.16 Inventory Turnover 5.2 1.9 −− 6.3 7.1 7.6 Days Cost of Goods Sold in Inventory 69 193 −− 57 50 48 Asset Turnover 1.6 1.0 −− 2.6 2.5 0.3 Net Receivables Turnover Flow 9.4 5.4 −− 168.2 45.9 6.2 38.0% 39.6% −− 35.1% 35.9% 42.4% Target Federated Kmart 1 Wal−Mart Industry2 Market3 1.55 1.75 −− 0.94 1.16 1.41 0.7 0.7 −− 0.1 0.3 1.0 Leverage Ratio 3.06 2.66 −− 2.49 2.40 5.95 Total Debt/Equity 1.22 0.72 −− 0.66 0.61 1.40 Interest Coverage 5.70 4.40 −− 14.50 11.20 2.20 Target Federated 1 Wal−Mart 2 Market3 52.84 84.43 −− 59.23 52.06 19.86 2.01 3.71 −− 2.07 1.63 0.76 Key Numbers Annual Sales ($mil.) Employees Market Value ($mil.) Valuation Price/Sales Ratio Price/Earnings Ratio Price/Book Ratio Price/Cash Flow Ratio Operations Days of Sales Outstanding Effective Tax Rate Financial Current Ratio Quick Ratio Per Share Data ($) Revenue Per Share Fully Diluted Earnings Per Share from Total Operations Kmart Kmart Report Builder − Target Corporation − Hoover's Online Industry Industry 37 Dividends Per Share 0.26 0.38 −− 0.36 0.25 0.43 Cash Flow Per Share 3.29 7.11 −− 2.93 2.49 1.98 Working Capital Per Share 5.14 18.23 −− (0.56) 1.09 2.22 Long−Term Debt Per Share 12.07 17.43 −− 4.61 4.43 10.29 Book Value Per Share 11.26 30.70 −− 9.74 8.80 10.15 Total Assets Per Share 34.48 81.59 −− 24.22 21.09 60.41 Target Federated Kmart 1 Wal−Mart Industry2 Market3 9.7% (1.1%) −− 4.8% 2.1% 6.1% 12−Month Net Income Growth 11.3% (15.3%) −− 12.6% 1.6% 129.0% 12−Month EPS Growth 11.1% (10.0%) −− 14.4% 1.2% 137.5% 12−Month Dividend Growth 8.3% −− −− 20.0% 4.2% 4.9% 36−Month Revenue Growth 9.4% (5.6%) −− 10.4% 4.9% 2.3% 36−Month Net Income Growth 14.1% −− −− 13.6% 13.8% (11.4%) 36−Month EPS Growth 14.0% −− −− 14.7% 16.9% (12.0%) 7.5% −− −− 13.7% 8.6% 2.2% Growth 12−Month Revenue Growth 36−Month Dividend Growth 1 Data unavailable. Industry: Discount, Variety Stores Industry classifications are from Media General Financial Services, Inc. . 3 Public companies trading on the New York Stock Exchange, the American Stock Exchange, and the NASDAQ National Market. 2 Data Definitions Some financial information provided by Media General Financial Services, Inc. Report Builder − Target Corporation − Hoover's Online , Richmond, Virginia 38 Copyright 2004, Hoover's, Inc. Report Builder − Target Corporation − Hoover's Online 39