Prospect Plaza Retail Market Feasibility Study

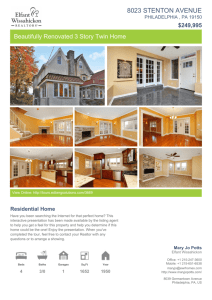

advertisement