Auditing the auditors

advertisement

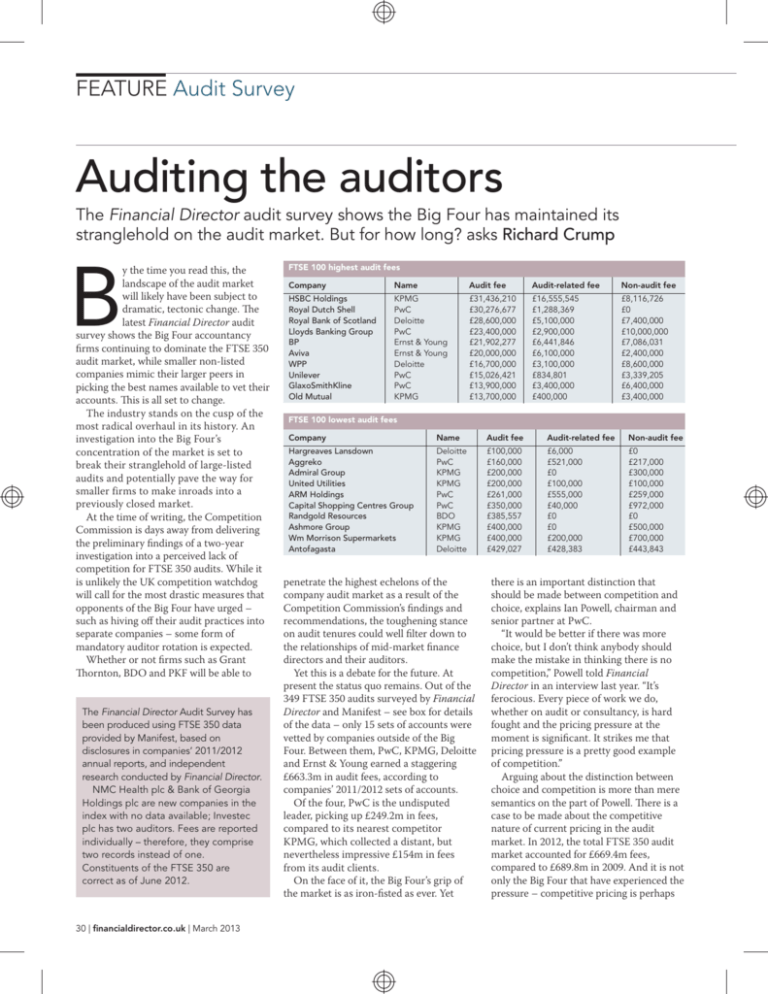

FEATURE Audit Survey Auditing the auditors The Financial Director audit survey shows the Big Four has maintained its stranglehold on the audit market. But for how long? asks Richard Crump B y the time you read this, the landscape of the audit market will likely have been subject to dramatic, tectonic change. The latest Financial Director audit survey shows the Big Four accountancy firms continuing to dominate the FTSE 350 audit market, while smaller non-listed companies mimic their larger peers in picking the best names available to vet their accounts. This is all set to change. The industry stands on the cusp of the most radical overhaul in its history. An investigation into the Big Four’s concentration of the market is set to break their stranglehold of large-listed audits and potentially pave the way for smaller firms to make inroads into a previously closed market. At the time of writing, the Competition Commission is days away from delivering the preliminary findings of a two-year investigation into a perceived lack of competition for FTSE 350 audits. While it is unlikely the UK competition watchdog will call for the most drastic measures that opponents of the Big Four have urged – such as hiving off their audit practices into separate companies – some form of mandatory auditor rotation is expected. Whether or not firms such as Grant Thornton, BDO and PKF will be able to The Financial Director Audit Survey has been produced using FTSE 350 data provided by Manifest, based on disclosures in companies’ 2011/2012 annual reports, and independent research conducted by Financial Director. NMC Health plc & Bank of Georgia Holdings plc are new companies in the index with no data available; Investec plc has two auditors. Fees are reported individually – therefore, they comprise two records instead of one. Constituents of the FTSE 350 are correct as of June 2012. 30 | financialdirector.co.uk | March 2013 FTSE 100 highest audit fees Company Name Audit fee Audit-related fee Non-audit fee HSBC Holdings Royal Dutch Shell Royal Bank of Scotland Lloyds Banking Group BP Aviva WPP Unilever GlaxoSmithKline Old Mutual KPMG PwC Deloitte PwC Ernst & Young Ernst & Young Deloitte PwC PwC KPMG £31,436,210 £30,276,677 £28,600,000 £23,400,000 £21,902,277 £20,000,000 £16,700,000 £15,026,421 £13,900,000 £13,700,000 £16,555,545 £1,288,369 £5,100,000 £2,900,000 £6,441,846 £6,100,000 £3,100,000 £834,801 £3,400,000 £400,000 £8,116,726 £0 £7,400,000 £10,000,000 £7,086,031 £2,400,000 £8,600,000 £3,339,205 £6,400,000 £3,400,000 FTSE 100 lowest audit fees Company Name Audit fee Audit-related fee Non-audit fee Hargreaves Lansdown Aggreko Admiral Group United Utilities ARM Holdings Capital Shopping Centres Group Randgold Resources Ashmore Group Wm Morrison Supermarkets Antofagasta Deloitte PwC KPMG KPMG PwC PwC BDO KPMG KPMG Deloitte £100,000 £160,000 £200,000 £200,000 £261,000 £350,000 £385,557 £400,000 £400,000 £429,027 £6,000 £521,000 £0 £100,000 £555,000 £40,000 £0 £0 £200,000 £428,383 £0 £217,000 £300,000 £100,000 £259,000 £972,000 £0 £500,000 £700,000 £443,843 penetrate the highest echelons of the company audit market as a result of the Competition Commission’s findings and recommendations, the toughening stance on audit tenures could well filter down to the relationships of mid-market finance directors and their auditors. Yet this is a debate for the future. At present the status quo remains. Out of the 349 FTSE 350 audits surveyed by Financial Director and Manifest – see box for details of the data – only 15 sets of accounts were vetted by companies outside of the Big Four. Between them, PwC, KPMG, Deloitte and Ernst & Young earned a staggering £663.3m in audit fees, according to companies’ 2011/2012 sets of accounts. Of the four, PwC is the undisputed leader, picking up £249.2m in fees, compared to its nearest competitor KPMG, which collected a distant, but nevertheless impressive £154m in fees from its audit clients. On the face of it, the Big Four’s grip of the market is as iron-fisted as ever. Yet there is an important distinction that should be made between competition and choice, explains Ian Powell, chairman and senior partner at PwC. “It would be better if there was more choice, but I don’t think anybody should make the mistake in thinking there is no competition,” Powell told Financial Director in an interview last year. “It’s ferocious. Every piece of work we do, whether on audit or consultancy, is hard fought and the pricing pressure at the moment is significant. It strikes me that pricing pressure is a pretty good example of competition.” Arguing about the distinction between choice and competition is more than mere semantics on the part of Powell. There is a case to be made about the competitive nature of current pricing in the audit market. In 2012, the total FTSE 350 audit market accounted for £669.4m fees, compared to £689.8m in 2009. And it is not only the Big Four that have experienced the pressure – competitive pricing is perhaps Level of importance for FDs when assessing audit quality Ernst & Young Efficiency of audit process 3.7 Reliability of audit report 3.63 Knowledge of sector and business 4 Independence of the firm 3 Added value services 3.51 2 Knowledge of sector and business Reliability of audit report 3.5 Communication skills Ability to spot mis-statements 3.4 Project management skills 3.32 Independence of the firm 2.98 Degree of challenge by auditor 2.6 Project management skills Scepticism exhibited by auditor 2.49 Added value services 2.43 0.5 1.0 1.5 even more telling, the lower down the food chain you go. One senior audit partner at a top ten firm described the pricing environment as “brutal, just brutal”, when speaking to Financial Director’s sister title Accountancy Age. He is not alone in believing so. There have been accusations of price-cutting, lowballing and dumping business – the act of offering work below cost – with a partner at a top 20 accountancy firm telling Accountancy Age the environment is “the most challenging I have ever seen”. 2.0 Degree of challenge by auditor Communication skills Scepticism exhibited by auditor Ability to spot mis-statements Efficiency of audit process Importance of factor for an audit 2.21 Innovation 0.0 Innovation 2.5 3.0 3.5 4.0 Average Ernst & Young Average top 5 accountancy firms “A number of firms are finding it extremely difficult. We have seen margins go down across board,” she said. Big Four dominance The preponderance of the Big Four among the FTSE 350 – only BDO, Grant Thornton and PKF have any clients in the index – should come as no surprise. It has ever been thus. More interesting is the fact that they dominate the market for smaller company audits as well. According to research conducted by Financial Director, the Big Four hold a 39% FTSE 250 highest audit fees Company Name Audit fee Audit-related fee Non-audit fee Investec Balfour Beatty Man Group Phoenix Group Holdings TUI Travel ICAP Invensys Mondi Logica Rentokil Initial Ernst & Young Deloitte PwC Ernst & Young PwC PwC Ernst & Young Deloitte PwC KPMG £6,114,000 £5,100,000 £4,031,952 £4,000,000 £4,000,000 £3,400,000 £3,400,000 £2,754,844 £2,600,000 £2,600,000 £1,740,000 £500,000 £214,513 £500,000 £1,000,000 £1,100,000 £300,000 £166,960 £200,000 £400,000 £1,541,000 £800,000 £634,522 £2,200,000 £2,000,000 £500,000 £2,400,000 £500,881 £700,000 £200,000 FTSE 250 lowest audit fees Company Name Audit fee Audit-related fee Non-audit fee Personal Assets Trust Edinburgh Dragon Trust Herald Investment Trust Murray Income Trust BlueCrest AllBlue Fund Aberforth Smaller Companies Trust Fidelity European Values JPMorgan American Investment Trust Monks Investment Trust Blackrock World Mining Trusts Ernst & Young KPMG Ernst & Young Ernst & Young Ernst & Young Ernst & Young Grant Thornton Deloitte PwC Ernst & Young £14,000 £15,000 £18,000 £19,000 £19,299 £20,000 £20,000 £21,000 £22,000 £23,000 £0 £5,000 £0 £0 £0 £0 £0 £0 £0 £6,000 £12,000 £4,000 £0 £4,000 £5,824 £2,000 £1,000 £8,000 £1,000 £0 share of the overall audit market. Based on responses from 188 finance directors, financial controllers and group treasurers – 88% of whom were from non-listed companies – the five most popular auditors by response were KPMG, PwC, Grant Thornton, Deloitte and Ernst & Young. That the five largest firms in the UK fill the top five slots is to be expected. Of interest is that Grant Thornton, which vets the accounts of six FTSE 350 businesses, garnered more responses than Deloitte and E&Y. Steve Maslin, assurance partner at Grant Thornton, has previously taken issue with claims that the mid-tier’s difficulty in tapping the market was not a sign of barriers to entry but simply reflects the will of the market. This result goes some way to bearing that out. “We will invest and deliver high-quality work and value for money where we have a realistic opportunity to win work and there are no barriers to entry. That is not currently the case in the FTSE audit market and will not be the case for the foreseeable future without regulatory intervention,” Maslin told Accountancy Age. Speaking to Financial Director about the results of the survey, Maslin adds: “Grant Thornton is the clear audit market leader on AIM and government audit and, on various measures, has come out in the past as one of the top three auditors to large, privately held businesses. These market segments already recognise the firm’s strength in quality, service and price – it is really only the FTSE 350 that has lagged behind.” March 2013 | financialdirector.co.uk | 31 FEATURE Audit Survey Grant Thornton Innovation 4 Independence of the firm Knowledge of sector and business 3 Added value services Reliability of audit report 2 Project management skills Degree of challenge by auditor Communication skills Scepticism exhibited by auditor Efficiency of audit process Ability to spot mis-statements Importance of factor for an audit Average Grant Thornton Average top 5 accountancy firms Other strong performers outside of the Big Four included BDO (4%), RSM Tenon (3%), Saffrey Champness (3%) and Baker Tilly (2%). Nevertheless, the attraction of a big-name auditor remains – whether the customer is a multinational company with complex accounts or a more simplistic mid-market business. Part of that is based on perception. Big Four names carry weight with audit committees and lenders that have been known to insert clauses into agreements requiring the borrower to use a Big Four auditor. The Big Four also prove attractive to FDs and audit committees because of their ability to deliver non-audit services in areas such as tax, compliance and transactional advice. Divinia Knowles, the finance director of Mind Candy, the company behind childrens’ game Moshi Monsters, recently explained that the company’s changing corporate structure necessitated the adoption of a Big Four auditor. The company brought in the big guns as auditors in 2011 when PwC replaced GSM & Co. Subsequently, Mind Candy moved its reporting from UK GAAP to IFRS, and saw its audit fees increase threefold. Like many FDs surveyed by Financial Director – 47% of respondents use their current auditor for tax advice - Mind Candy wanted a big name to deal with big tax issues. Despite being classed as an SME, Mind Candy’s corporate structure is relatively complex. With US employees and an increasing number of product lines, Mind Candy now operates with three US 32 | financialdirector.co.uk | March 2013 KPMG 4 Innovation Independence of the firm 3 Added value services 2 Project management skills Knowledge of sector and business Reliability of audit report Degree of challenge by auditor Communication skills Scepticism exhibited by auditor Efficiency of audit process Importance of factor for an audit Ability to spot mis-statements Average KPMG Average top 5 accountancy firms companies and two in the UK. “Our tax overhead is quite complicated, because we have all these products that attract different taxes in terms of digital products and then withholding taxes of consumer products. It got to a point where we needed PwC – they have offices everywhere,” Knowles told Financial Director. Tail wagging the dog The provision of non-audit services to audit clients remains a lucrative but thorny issue for the accountancy profession. The importance of non-audit services as a secondary revenue stream is not in doubt. FTSE 350 auditors collected £289.7m in non-audit fees last year, while for Grant Thornton and PKF it proved to be even more profitable with their pure audit business. Grant Thornton, the fifth-largest UK accountancy firm, picked up £1.7m in non-audit fees, compared to £1m from its audit work, while PKF earned £101,000 compared to £86,000. But when it comes to large company audits, particularly banks – the audits of which were largely responsible for the instigation of the Competition Commission investigation – there are questions of a conflict to answer. In a recent Lords committee hearing, Lord Lawson suggested the provision of non-audit services was a case of the “tail wagging the dog”. Grilling members of the Big Four who appeared before the Commission on Banking Standards in January, Lawson suggested that providing consultancy services to audit clients was an area of potential conflict of interest, and added that a disparity between the profitability of audit work and consulting services was a cause for concern as “we have the tail wagging the dog because audit is a critical function that is in the public interest”. However, the Big Four denied one service was inherently more profitable than the other and, in any case, there are already a number of checks and balances that govern the work auditors can do for their clients to “prevent clear conflict”. “If there was a tax judgment that was dependent on an accounting treatment where the amounts were material, we couldn’t give tax advice related to that,” said John Preston, PwC’s global tax policy leader, while Jane McCormick, head of KPMG’s tax and pensions practice in the UK, added that financial institutions have tended to limit the consulting work they give to auditors. “Very often, it is simply more trouble for a financial institution to use its auditor to give tax advice than it would be just to hire one of the competitors,” she said. Nevertheless, John Cullinane, tax partner at Deloitte, suggested that the profession would be comfortable if an “iron rule” was imposed to prevent auditors providing tax consulting to clients. However, non-audit work presents a likely entry route for nonBig Four firms into the market for FTSE 350 audits. As Maslin explains, it is difficult to make a case for being able to deliver big company audits unless the company has some What is the length of your audit tenure? 26% 44% 30% Less than five years Six to ten years More than ten years 12% 10% 9% 8% 6% 4% 3% 3% ill lar kW hit eh ss rT i lly ke Ba eC Cr ow on ne Te n mp M ha RS yC Sa ffe r ng LLP O &Y ou st BD on tte loi De Ern C tT ho rnt Pw MG 2% 2% an No less thorny for the profession, and for finance directors and audit committees, is the idea of companies being forced to a compulsory switch of auditors. It is widely expected that the Competition Commission will demand some form of mandatory auditor rotation when it delivers the preliminary findings of its investigation. Pressure is being brought to bear on this issue from all sides. A separate investigation into audit quality being conducted by the European Commission, based on proposals laid out by internal markets commissioner Michel Barnier, suggests companies should be forced to switch auditors. European policymakers remain heavily divided on the issue. British MEP Sajjad Karim, the rapporteur steering the bill through the European Parliament, published a working paper on behalf of the parliament’s legal affairs committee which suggested mandatory auditor rotation should only have to take place every 25 years. Watering rotation rules down to 25 years – the commission initially called for six years – may be seen as a sop to the Big Who is your auditor? Gr Swings and roundabouts Four, the cabal of firms most likely to lose out by the enforcement of strict rotation rules. However, Karim says it should not be seen this way. Leaving the market as it is will not be an option. “The end conclusion I came to is that neither is it a healthy situation that we deliver on a political path where we do something because we need to be seen to do so, nor is it that we maintain the status quo. I don’t want that to be seen as the eventual outcome,” he told Accountancy Age in an interview. Karim’s ideas on audit tenures have proved to be a divisive issue. Shortly after Karim produced his working paper, German MEP Jürgen Creutzmann, member of the European Parliament’s committee on industry, research and energy, produced a report that called for audit tenures to last no more than seven years as it would render “the selection process more transparent” and give the audit committee more choice. Creutzmann was not the only one taking pot shots at the proposals. Ahead of the publication of Karim’s report, a collection of the largest investors in Europe ganged together to urge the EC to push ahead with tougher audit reforms. Signatories of a joint letter sent to the EC included Euroshareholders, a group of about 30 European national shareholder associations, the investment arm of Legal & General and the Universities Superannuation Scheme. High on their agenda is that auditors need to rotate every six years, although this could be extended to nine years if there are joint audits, with a cooling-off period of four years. But big questions remain over whether mandatory rotation will improve competition, or for that matter improve audit quality. Powell at PwC doesn’t think it will. “That removes competition,” Powell said. “You have immediately taken covenant out of the equation. You might have a fantastic audit team doing a fantastic job, and they have to be eliminated.” Powell’s answer is what you would expect the leader of a Big Four firm to say. Yet his views are shared by those in the mid-tier. “It is quite interesting to see mandatory rotation come up as an answer ... academic studies show it doesn’t increase competition,” James Roberts, audit partner at mid-tier firm BDO, said ahead of the KP previous experience of dealing with the firm. “Companies realise there is no point putting us on a future audit tender list unless we already have a meaningful business relationship, eg. through advisory services initially, and many are talking to us already about how best we can establish that relationship,” Maslin says. Competition Commission report. “It would have to include some form of mandated involvement of non-Big Four firms.” UK reporting regulator, the FRC, last year decided to force FTSE 350 companies to put their audits out to tender every ten years – or explain why they didn’t – while not requiring them to rotate. Maslin says the FRC rules had been helpful, but called for the commission to go further. “The FRC proposals could be bolstered with some form of backstop rotation period,” he says. Yet something needs to be done to encourage switching among the largest companies. Research carried out as part of the Competition Commission inquiry, which surveyed more than 600 CFOs, finance directors and audit committee chairs, found little desire among respondents to change auditors. According to the survey, FTSE 350 companies have used the same auditor for an average of 11.3 years, while 59% have not changed auditor for at least five years. More than a third of companies were found to have used the same Big Four auditor for more than 11 years, with 14% using the same firm for more than 20 years. However, in instances where companies had switched their auditor, more than half March 2013 | financialdirector.co.uk | 33 FEATURE Audit Survey % 47% % % 21% % 13% Improving quality Ac co un tan cy ad vic e Co mp lian ce ad vic e Co nsu ltin ga dv ice Tra nsa cti on ad vic e Tax % 10% 10% % to take the hint. Already some of the largest companies – Schroders and BG Group to name but two – have recently switched auditors, a consequence of a shift in attitude towards the hitherto cosy relationships companies enjoyed with their auditors. So maybe the market is competitive, after all. PwC certainly didn’t waste any time in claiming that to be the case on losing the BG audit to Ernst & Young. James Chalmers, PwC’s UK head of assurance, said: “We operate in a fiercely competitive market where all participants win and lose audits. We are committed to delivering high-quality audits for the benefit of our clients and their shareholders.” experienced a reduction in cost and 64% reported an improvement in audit quality. When switches have been made, the Big Four has mopped up almost all of the business on offer. According to the research, 97% of all switches made by FTSE 350 companies in the last five years have been to, or within, the Big Four. But outside of the FTSE 350 audit tenures are much shorter. According to Financial Director’s research, 44% of companies’ current auditor has had a tenure of less than five years, while 30% reported tenures of between six and ten years and 26% revealed that tenures has lasted more than ten years. Despite the stark figures, traction is already being made in this area. Finance directors and audit committees are starting Imposing competition for competition’s sake is not an end in itself. The aim, on which auditors and finance director both agree, is to improve audit quality. Because, while price is undoubtedly important, quality matters. But how do finance directors judge audit quality? And what elements of the audit process are more important than others? Regulators seem to think a lot of it boils down to better auditor dialogue with audit committees, and more extensive communication through the auditors’ report that accompanies annual reports. For instance, auditors will be required to warn investors about risks within the companies they audit as part of a “step change” in the way audit reports are structured, proposed by the FRC in February. In response to criticism that auditors’ reports are uninformative, the reporting watchdog has launched a consultation to extend their scope to include a commentary of the “risks of material misstatement” identified by the auditor. As part of the changes, which could force auditors to flag risks that differ from those disclosed by company directors, auditors will be FTSE 350 auditor fees Auditor Clients Audit fees Audit-related fees Non-audit fees Total BDO Deloitte Ernst & Young Grant Thornton KPMG PKF PwC Total 8 89 64 6 81 1 100 349 £1,979,480 £137,146,448 £126,000,200 £1,029,309 £153,981,748 £86,000 £249,179,185 £669,402,370 £22,000 £18,953,683 £20,708,382 £8,000 £42,130,044 £13,000 £27,609,602 £109,444,711 £793,820 £72,614,890 £46,043,577 £1,712,399 £54,456,081 £101,000 £113,978,270 £289,700,039 £2,795,300 £228,715,021 £192,752,021 £2,749,708 £250,567,873 £200,000 £390,767,057 £1,065,260,160 34 | financialdirector.co.uk | March 2013 What is the fee your company paid for its last statutory audit? 39% 18% 15% 13% 7% 6% 1% 0% 0% 1% £1 0k or les s £1 0k -£2 5k £2 5k -£5 0k £5 0k -£1 00 £1 k 00 -£2 50 £2 k 50 -£5 00 k £5 00 -£1 m £1 m£5 m £5 m£1 0m Ov er £1 0m Which of the following non-audit services do you use your current auditor for? required to explain how they applied the concept of materiality – which relates to the importance of transactions, balances and errors contained in the financial statements – and summarise how the audit scope responded to company risks. The FRC proposals build on a raft of suggestions published by the IAASB in June last year aimed at improving the auditors’ report. In addition to improving corporate reporting in a general sense, the various initiatives aim to force auditors to provide greater transparency about significant matters in the financial statements, as well as the conduct of the individual audit. The changes will no doubt make the auditor’s report more interesting as well as insightful. The one-page report has, at times, been derided for being an unremittingly dull description of how the auditor has discharged its duties which, couched in standardised wording, sheds no light on subjective matters in financial statements. David Herbinet, audit partner at Mazars, hopes that providing more information will “improve the perception and visibility of audit quality” and go some way to repairing the battered reputation of audit that was the result of failings in the audit of public FEATURE Audit Survey interest entities in the lead-up to the banking collapse of 2008. The view is shared by respondents to Financial Director’s survey, who rated the reliability of the auditor report as the second most important quality, with communication skills coming in fourth. Top of the list was efficiency of the audit process, which also garnered the most written responses from those surveyed. “An efficient and cost-effective service is key for my company and its 100-odd shareholders. We changed from a mid-tier firm six to seven years ago and the fee is still less than heretofore,” said one respondent. Respondents were less bothered by their auditors exhibiting much professional scepticism, contrary to the views of the FRC. Last year, the watchdog published a discussion paper that urged auditors to be cynical and pragmatic in their approach to audits, while auditors have been regularly pulled up by the FRC’s Audit Inspection Unit (AIU) for a distinct lack of scepticism. “More needs to be done to promote the appropriate exercise of professional scepticism, in particular in relation to the level of challenge of management’s explanations,” the AIU said in a typical report last year. Despite this, scepticism was the third least important quality expected by finance directors from their auditors. Only product innovation and the provision of value added services scored lower. Recurring gripes Not all finance directors were happy with their auditor, with one respondent going so PwC far as to say they are “an unnecessary evil and are a parasitic influence on innovation”. That response represented the most extreme view, but there were some familiar and recurring gripes that cropped up. Chiefly, auditors cutting back on the time devoted to the audit and giving audits over to junior accountants. “An overreliance on juniors, and a lack of continuity of service amount audit management makes for a frustrating relationship much of the time,” said one respondent. Another respondent mirrored this view: “The use of young audit trainees does not give a good impression. Our audit spread over many weeks with changes in personnel meaning we supplied the same information or explanation more than once.” It appears they have a point. Audit hours have become a contentious point, with the FRC warning that firms have been cutting costs by off-shoring certain audit procedures, delegating work to junior staff and using more checklists, as well as other efficiency measures. In its annual report into the profession’s performance, the FRC warned competition between firms could damage audit quality as practices try to increase the volume of audits they can perform. An example in PwC’s report said it had launched its Audit Transformation programme to improve audit quality. However, the guides issued appeared to focus on improving efficiency by reducing audit hours. The FRC’s Audit Inspection Unit warned it 4 Independence of the firm Innovation Added value services 3 Knowledge of sector and business 2 Reliability of audit report Project management skills Scepticism exhibited by auditor Efficiency of audit process Importance of factor for an audit Average top 5 accountancy firms 36 | financialdirector.co.uk | March 2013 Degree of challenge by auditor Communication skills Ability to spot mis-statements Average PwC should “ensure that there is no adverse impact on audit quality as a result of its initiatives to improve audit efficiency in the light of competitive pressures”. The most critical response came from one FD who questioned the value of the service they received from their auditor. “The field work takes a minimal amount of time and is not particularly focused. The standard of reports including financial statements is extremely poor and requires significant correction. I feel that across the audit industry standards have dropped considerably both in terms of technical advice and client service,” the respondent said. “There have been several instances where I have queried their technical advice on both accounting and disclosure (at this firm and also my previous Big Four auditors) and their advice was incorrect on fairly basic points. This does not give me the confidence that their advice would be correct on more complicated queries when I would be looking for more guidance. Auditors need to start to prove themselves as valued advisers.” With the UK regulators and European policymakers set to reform the audit industry – though the final terms are still to be set – the lesson is clear. The reforms must deliver an enhanced service and improve audit quality for finance directors, audit committees and investors. If the reforms fail to achieve this, then the past two years of arguing will have been a waste of time and effort. ■ Deloitte 4 Independence of the firm Innovation Added value services 3 Knowledge of sector and business 2 Reliability of audit report Project management skills Scepticism exhibited by auditor Efficiency of audit process Importance of factor for an audit Average top 5 accountancy firms Degree of challenge by auditor Communication skills Ability to spot mis-statements Average Deloitte