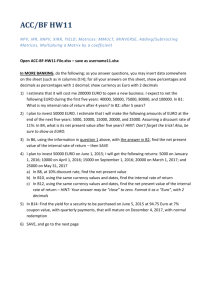

Joining the European Monetary Union

advertisement